[ad_1]

J Studios/DigitalVision by way of Getty Photographs

Funding Thesis

In my opinion, AppLovin (NASDAQ:APP) is the poster youngster of ‘having struck a pot of gold’. The corporate has seen phenomenal development in its enterprise as soon as once more because it used its backend know-how to pivot to the quicker rising digital advert enterprise normally, permitting it some publicity to the quickly increasing CTV advert market and diversifying away from its unstable cell advert market.

Administration made all the fitting strikes a few years in the past and infused their development outlook with the fitting elements to show their enterprise round and navigate the corporate by means of a pivotal 2023.

The inventory is already up 88% for the yr, however I nonetheless consider there’s upside remaining for the yr since I consider the catalysts for its FY24 development are rising. Therefore, I fee this as a Purchase.

Summarizing AppLovin’s Enterprise Updates

Be aware: I’ve added extra element on this part for a few causes. One, I consider that is required due to the monumental transition the corporate has gone by means of since FY22. Two, the digital advert market might not be understood effectively sufficient, so I consider a few of my explanations under will profit customers on SA.

AppLovin has undergone a big evolution in its enterprise for the reason that firm went public in early 2021. The corporate began off as an app development and monetization platform to assist app builders develop their apps within the cell ecosystem.

Nevertheless, with the overall droop in advert spending a yr later, the corporate developed right into a broad-based advertising know-how platform, driving monetization throughout digital channels. Now, the corporate primarily operates underneath two most important segments, with its Software program Platform enterprise driving over half of the corporate’s complete income whereas its Apps Monetization enterprise, which was once the breadwinner, three years in the past, is now plateaued.

Its Software program Platform operates by way of 4 key merchandise:

AppDiscovery: The cornerstone of AppLovin’s Software program Platform which offers advertisers with performance-based advert instruments. This product is powered by the corporate’s in-house Axon 2.0 AI algorithms, which I’ll elaborate on additional later.

Max: AppLovin’s in-house bidding algorithms are offered without cost to publishers, however the firm costs a ~5% take fee from advertisers who bid by means of Max.

Regulate: the corporate’s measurement and analytics advertising platform for advertisers & entrepreneurs

Wurl: the namesake acquisition by AppLovin, which is the corporate’s Linked TV (CTV) advert product, permitting advertisers to promote on streaming video channels.

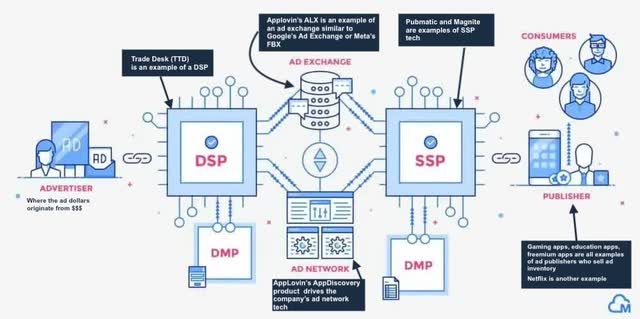

I’ve added a chart under that explains how AppLovin’s merchandise match within the total digital advert area. That is necessary as a result of many corporations on this area are inclined to work with each other, forging partnerships whereas additionally competing with each other on the similar time.

In AppLovin’s case, the corporate competes with Google (GOOG) and Fb (META) as an advert community whereas additionally utilizing the Google Cloud Platform for its backend merchandise and having advert partnerships with Google. The digital advert ecosystem I’ve added right here could be implied throughout most different channels, equivalent to cell, net, social media, CTV, and many others.

How AppLovin integrates itself with the bigger digital advert ecosystem (Writer’s illustration)

AppLovin can also be targeted on growing their publicity to channels aside from cell, and many others. They acquired Wurl in FY22 to enter the CTV advert area and are within the means of increasing product testing this yr on CTV.

How AI is a recreation changer for AppLovin’s Income Progress

As a part of their transition plan introduced within the deadly Q1 FY22 earnings name, administration introduced the transition to the Software program Platform enterprise by leveraging their Axon ad-tech engine. The corporate transitioned their complete Axon platform onto Google Cloud in 2022 and additional upgraded the backend know-how early final yr, with Google Cloud’s AI capabilities rechristening it Axon 2.0. I consider that is presumably one of many the reason why the corporate noticed a lift in its income efficiency within the Q2 quarter final yr, when income rose 21.2% in that quarter. The tailwinds initiated by the backend know-how improve and transition into its Software program Platform enterprise continued to propel AppLovin by means of the yr, as the corporate recorded stellar top-line and bottom-line numbers for the yr.

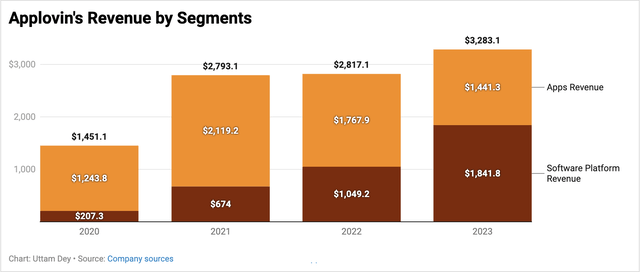

AppLovin’s Income per yr by income segments (Firm sources)

As could be seen within the chart above, AppLovin’s income has grown at a compounded development fee of 31% since FY20. A lot of that development has come from its Software program Platform income which has grown at breakneck pace, rising 107% on a compounded foundation. On a y/y foundation, Software program Platform income grew an enormous 76% since FY22. Administration attributed the explanations for fulfillment primarily to the corporate’s AppDiscovery product, which is powered by the AI-enabled Axon 2.0 that I had touched upon earlier. Whereas reviewing AppLovin’s 10-Ok, I discovered that improved AppDiscovery advert efficiency led to app installations rising 17% y/y and web income per set up rising 35% y/y. Whereas these numbers have barely receded from the earlier yr’s development efficiency, they’re very sturdy numbers for promoting efficiency metrics, which might incentivize advertisers to spend extra on AppLovin’s platforms.

Bettering Macro Outlook for Adverts has additionally helped. CTV is a bonus

The optimism in retail spending in addition to enterprise spending final yr has additionally aided the enhance in spending on AppLovin’s platform, in my view. The sturdy present in advert income from Meta Platforms and Amazon will also be mirrored in AppLovin’s income development, as enhancing macro forces had some hand to play within the income development for AppLovin, in line with my observations. Furthermore, these traits are anticipated to proceed because the outlook will get higher in FY24, as seen under.

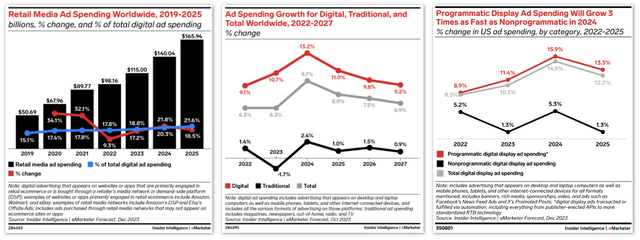

Digital advert greenback spending is anticipated to extend in FY24 (eMarketer)

As per a research by eMarketer, the general advert spend greenback is anticipated to develop 9.7% in FY24, powered by a 13.2% projected improve in digital advert spending, whereas programmatic advert spend can also be anticipated to extend 16% y/y. Furthermore, advert spend for CTV can also be anticipated to extend by 22.3%.

These are all areas the place AppLovin has its merchandise progressively being adopted and used, equivalent to its AppDiscovery platform or its personal ad-exchange platform for programmatic shopping for, together with CTV advert stock. I consider the numerous enchancment within the macro outlook is placing AppLovin in pole place to outperform for the yr.

Valuation suggests upside

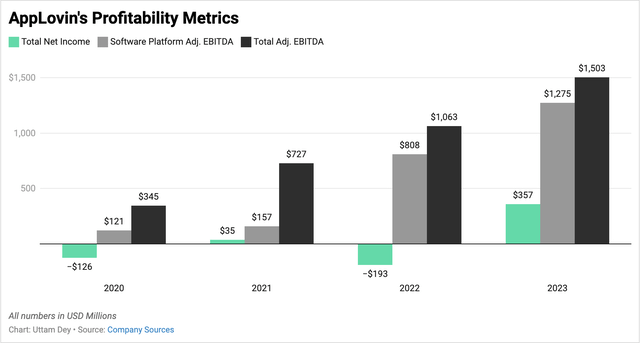

Earlier than I transfer on to evaluating AppLovin’s goal value, I do wish to additionally make a point out of the numerous impression the corporate’s Software program Platform enterprise is having on its total efficiency. AppLovin’s Software program Platform is a high-margin enterprise with adjusted EBITDA rising considerably quicker than the income phase’s high line development at 119% CAGR since FY20. This has been one of many key drivers for the corporate to be worthwhile on a GAAP-basis and register $357 million in FY23, as could be seen under.

AppLovin’s EBITDA has surged by a CAGR of 119% since FY20 (Firm sources)

This has allowed the corporate to attain a forty five.8% adj. EBITDA margin in FY23, and administration expects to sequentially enhance this in Q1 FY24 by projecting adj. EBITDA margins of a mouth-watering 50.3% on the again of income to be rising 35% y/y to $965 million (all administration projections are taken on the midpoint of their steering vary).

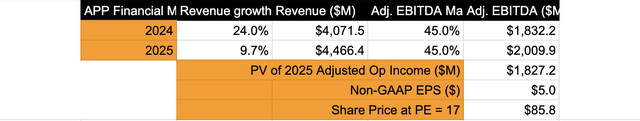

Now, the corporate doesn’t have an official long-term working plan, nor did they information for the total fiscal yr of FY24. So I’ll use consensus estimates for the following two years to worth the corporate’s inventory. I may even be factoring in a ten% low cost fee primarily based on these assumptions, which I consider are necessary when valuing AppLovin’s inventory.

Regardless of administration’s pleasant steering for Q1, their lack of full-year steering makes me wish to be cautious in my expectation of their adj. EBITDA development, so I’ve truly assumed their EBITDA margins to be comparatively flat for the following two years.

Utilizing a reduction fee of 10% and 362 million quantity shares excellent, my mannequin suggests upside (Writer’s Valuation Mannequin)

From the mannequin above, I can see that each AppLovin’s income and adj. EBITDA are estimated to rise ~16% in keeping with each other. For these development charges, I consider a ahead PE of ~17 is completely honest right here. My mannequin implies 14% upside from present ranges.

Dangers & Different Elements to contemplate

Digital promoting has change into more and more advanced and aggressive on the similar time over time. The complexity arises from the speedy evolution of applied sciences underpinning the digital advert panorama and the privateness adjustments occurring on numerous platforms. Google’s cookie deprecation and Apple’s elevated App Retailer crackdowns on privateness and advert fingerprinting have made it advanced for some advert platforms to ship larger advert efficiency. Nevertheless, I consider the mixing of AI is enabling AppLovin to empower advertisers with higher advert concentrating on, and this may be seen within the elevate in income.

Competitors is an enormous danger right here too, however as I discussed earlier, AppLovin usually enters partnerships with a few of its rivals and friends. For instance, the corporate had partnered with Commerce Desk (TTD) on an ad-inventory shopping for deal a pair years in the past. I additionally consider AppLovin’s progressive methods and its embrace of AI ought to insulate the corporate from aggressive strain as long as it retains on innovating.

Thus far, its Apps Income phase has stalled, rising solely 5% on a compounded development foundation since FY20, as seen from an earlier chart. However with total digital advert spend development anticipated, this may occasionally add an additional enhance to AppLovin’s income, which I’ve not accounted for in my mannequin but for the aim of being cautious.

Conclusion

In conclusion, AppLovin appears to have gotten itself again heading in the right direction by scoring an enormous win with its outperformance in its Software program Efficiency income phase in FY23. I count on these tailwinds to proceed in 2024, coupled with the enhancing macro outlook for normal advert spending, which ought to act as catalysts to spice up AppLovin’s prospects in FY24.

I fee this as a Purchase.

[ad_2]

Source link