[ad_1]

Shares have been on the rise this yr, with the Nasdaq Composite index up 8% because the begin of 2024. The expansion is a pattern that has continued from final yr when pleasure over tech shares brought about the identical index to soar greater than 43%.

Advances in budding sectors like synthetic intelligence (AI) have rallied buyers as elevated demand for such providers has boosted all the tech market. AI development will probably proceed fueling shares throughout the business in 2024, with dozens of firms and associated markets benefiting from its tailwinds.

Because the previous saying goes, “The most effective time to plant a tree was 20 years in the past, and the following finest time is now.” And the identical goes for investing.

Listed below are three shares that may assist you get richer in 2024.

1. Superior Micro Gadgets

As a number one chipmaker, Superior Micro Gadgets (NASDAQ: AMD) has an thrilling outlook this yr and properly into the long run. The corporate provides its {hardware} to firms throughout tech, with its chips powering a variety of gadgets from cloud platforms to online game consoles, AI fashions, custom-built PCs, laptops, and extra.

AMD’s success within the business has seen its income soar by 240% during the last 5 years, with its free money move up by 306%.

In the meantime, the corporate is investing closely in AI. Final December, AMD unveiled its MI300X AI graphics processing unit (GPU). The chip was designed to compete instantly with Nvidia’s choices and has already caught the eye of a few of tech’s most outstanding gamers, signing on Microsoft and Meta Platforms as purchasers.

AMD’s earnings have but to mirror its funding in AI. Nevertheless, its latest quarterly outcomes counsel it is shifting in the correct path. In its fourth quarter of 2023, AMD’s income rose 10% yr over yr to $6 billion, beating analysts’ expectations by about $60 million. The corporate’s AI-focused knowledge heart phase posted 38% income development.

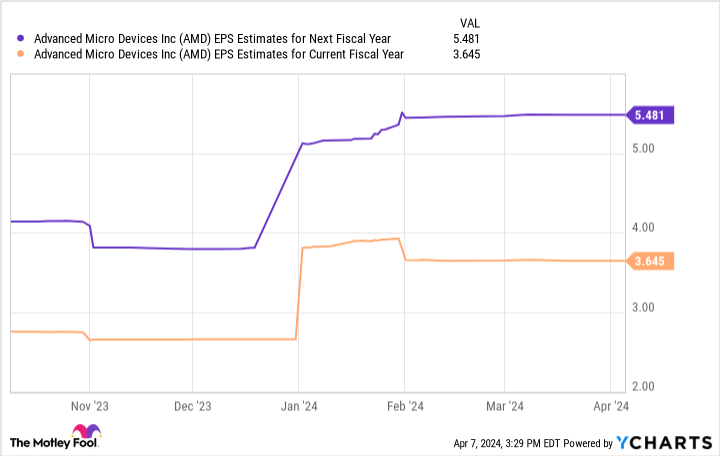

This chart reveals AMD’s earnings might hit simply over $5 per share by 2025. Multiplying that determine by the corporate’s ahead price-to-earnings (P/E) ratio of 47 yields a share worth of $257, projecting inventory development of 51% by subsequent yr.

Story continues

Because of this, AMD is a screaming purchase in 2024 because it expands its enterprise and advantages from AI development.

2. Intel

Chip demand throughout tech is skyrocketing, suggesting you may’t have too many chip shares in your portfolio, and Intel (NASDAQ: INTC) is one other enticing possibility.

The corporate has hit quite a lot of roadblocks in recent times. Its inventory is down about 41% over the previous three years after decreased market share in central processing items (CPUs) and ending a greater than decade-long partnership with Apple

Nevertheless, the autumn from grace has seemingly lit a hearth below Intel once more, and it has been making strikes to come back again sturdy within the coming years. Final June, Intel introduced a “basic shift” to its enterprise, adopting an inner foundry mannequin that it believes will assist it save $10 billion by 2025.

Furthermore, Intel is shifting into AI. In December 2023, the corporate debuted a spread of AI chips, together with Gaudi3, a GPU designed to problem comparable choices from market chief Nvidia. Intel additionally confirmed off new Core Extremely processors and Xeon server chips, which embrace neural processing items for working AI packages extra effectively.

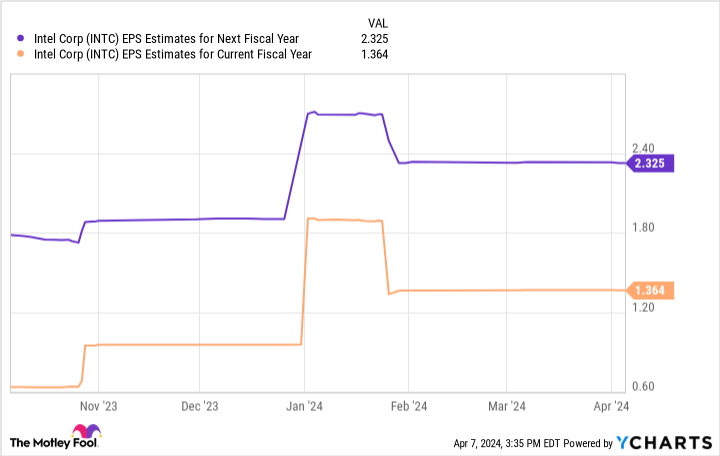

Intel’s earnings are projected to achieve simply over $2 per share over the following yr. While you multiply that determine by the corporate’s ahead P/E of 28, you get a share worth of $65.

Contemplating its present place, these projections would see Intel’s inventory soar 67% by fiscal 2025, making it a must-buy proper now.

3. Amazon

Amazon’s (NASDAQ: AMZN) inventory has climbed 81% during the last yr, making loads of folks richer alongside the way in which.

The corporate’s enterprise has soared during the last decade because it has change into a frontrunner in e-commerce and the cloud market, with its annual income and working revenue up 546% and 20,000% since 2014.

Nevertheless, all eyes have been on Amazon’s AI efforts this yr. Because the operator of the world’s largest cloud service, Amazon Net Companies (AWS), the corporate has the potential to leverage its huge cloud knowledge facilities and steer the generative AI market. In 2023, AWS responded to elevated demand for AI providers by introducing quite a lot of new instruments, which might result in a serious increase to earnings within the coming years.

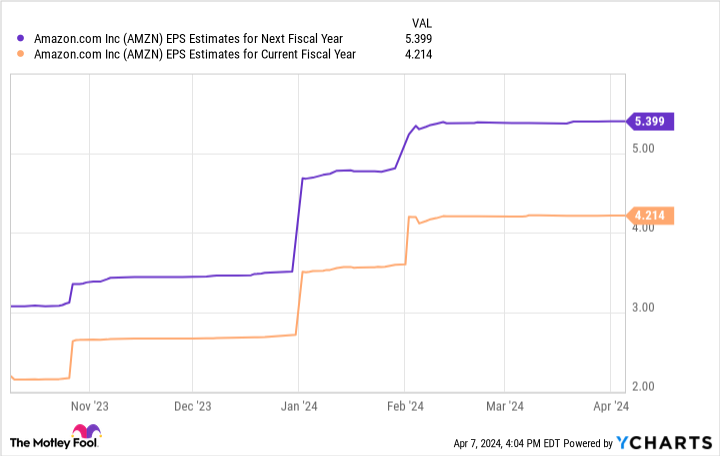

In keeping with the desk above, Amazon’s earnings might obtain $5 per share over the following two fiscal years. In an analogous calculation to AMD and Intel, multiplying that determine by Amazon’s ahead P/E of 44 yields a inventory worth of $237, which might see its inventory rise 28% by fiscal 2025.

This projected development may not be as vital as AMD and Intel, however it could nonetheless exceed the S&P 500’s 26% rise during the last yr. Because of this, Amazon is price contemplating proper now and is a inventory that would make you richer in 2024.

Do you have to make investments $1,000 in Superior Micro Gadgets proper now?

Before you purchase inventory in Superior Micro Gadgets, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Superior Micro Gadgets wasn’t one in every of them. The ten shares that made the minimize might produce monster returns within the coming years.

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of April 8, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Dani Cook dinner has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2023 $57.50 calls on Intel, lengthy January 2025 $45 calls on Intel, lengthy January 2026 $395 calls on Microsoft, brief January 2026 $405 calls on Microsoft, and brief Could 2024 $47 calls on Intel. The Motley Idiot has a disclosure coverage.

3 Shares That Can Assist You Get Richer in 2024 was initially revealed by The Motley Idiot

[ad_2]

Source link