[ad_1]

On this article, we are going to be taught in regards to the ‘I Dream of Dividends’ technique, tailor-made to pick corporations with substantial dividends, excessive return on invested capital, and environment friendly capital utilization.

This technique employs particular standards corresponding to dividend yield, return on invested capital, P/E ratio, and earnings to determine corporations appropriate for traders throughout financial downturns.

InvestingPro presents a classy platform for conducting complete basic analyses of corporations worldwide. Amongst its array of capabilities, the inventory scanner stands out, permitting customers to pick corporations utilizing all kinds of economic indicators.

Moreover, the platform supplies pre-designed methods tailor-made to cater to the varied wants of traders. One such technique is the “I Dream of Dividends,” designed to determine corporations providing each substantial dividends and a comparatively excessive stage of earnings and return on invested capital.

This specific choice strategy typically results in the inclusion of sturdy and well-established defensive manufacturers available in the market. These corporations can function worthwhile additions to traders’ portfolios throughout financial downturns, probably providing alternatives in a market characterised by inventory worth reductions.

Here is how one can harness the facility of the technique on InvestingPro:

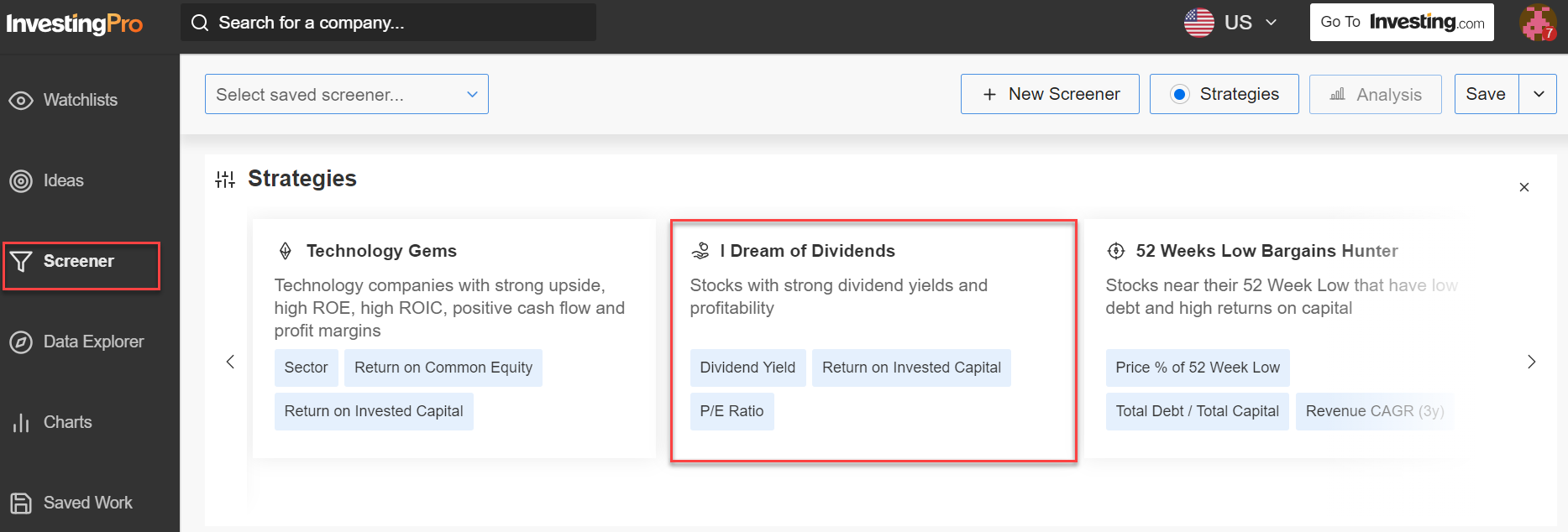

Find the ‘I Dream of Dividends’ technique on InvestingPro

Merely go to the scanner part, then scroll inside the out there methods and choose the ‘I Dream of Dividends’ technique we mentioned on this article.

Supply: InvestingPro

What precisely Is the ‘I Dream of Dividends’ technique?

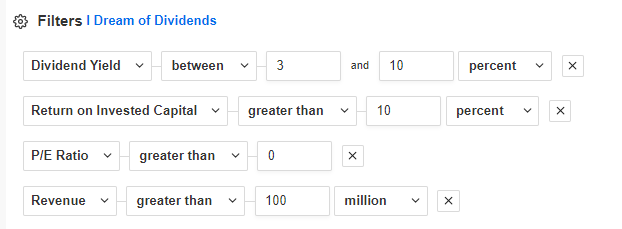

The described “I Dream of Dividends” technique depends on 4 key standards for choosing particular corporations:

Dividend Yield: This basic indicator targets corporations with a dividend yield starting from 3% to 10%. The dividend yield ratio is calculated by dividing the worth of dividends paid per share by the share worth. A better yield is favored because it signifies larger potential income for shareholders, demonstrating the corporate’s dedication to sharing earnings.

Return on Invested Capital (ROIC): Effectivity in producing returns on invested capital is essential. A ROIC criterion of over 10% is utilized to determine corporations able to attaining funding yields increased than the sector common. That is particularly vital for bigger, capital-intensive companies, significantly these within the manufacturing sector.

P/E Ratio: To filter out corporations, this technique makes use of the price-to-earnings (P/E) ratio. It’s supposed to exclude corporations with destructive P/E ratios. Whereas a decrease P/E ratio can counsel comparatively enticing share costs, it could additionally point out troubled corporations dealing with downward inventory tendencies. To keep away from overvalued shares, an higher restrict filter primarily based on sector averages will also be added.

Earnings: This criterion is used to exclude smaller corporations that will not have a constant observe report of long-term dividend funds in comparison with bigger, extra capitalized corporations. Moreover, the period of steady dividend funds by an organization is taken into account. Longer observe information improve the probability of dividend funds persevering with sooner or later.

Filters

Supply: InvestingPro

For potential modifications or extra standards, you can take into account indicators like internet earnings, market capitalization, or price-to-book (P/B) worth. Nonetheless, it is important to strike a steadiness when including standards.

Being overly restrictive can restrict the pool of eligible corporations, so cautious consideration needs to be given to how extra standards could have an effect on the choice course of.

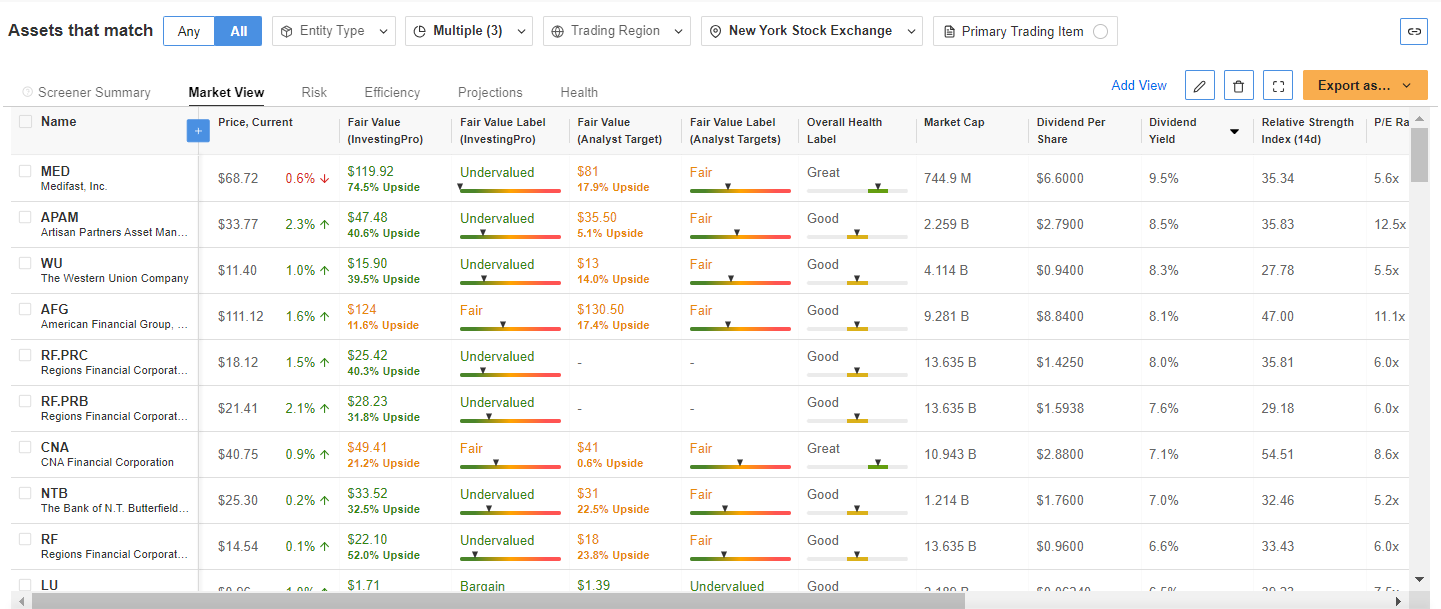

InvestingPro’s crystal clear knowledge presentation to select your winners

As soon as the choice course of is accomplished, the InvestingPro device presents the chosen corporations in a tabular format, itemizing people who meet the established standards inside the specified geographic area.

Supply: InvestingPro

Notably, one standout indicator among the many many out there is the “honest worth.” This metric, decided by way of a mixture of numerous monetary fashions and analyst suggestions, presents insights into whether or not an organization is overvalued or undervalued, typically with a selected goal worth supplied.

Furthermore, to simplify the method and accommodate customers of all ranges, the scanner categorizes the huge quantity of information into six basic classes, as illustrated beneath:

Knowledge Class

This user-friendly breakdown ensures that even novice merchants can readily interact in basic evaluation, leveraging the capabilities supplied by the InvestingPro device.

***

With InvestingPro, you’ll be able to conveniently entry a single-page view of full and complete details about completely different corporations multi functional place, eliminating the necessity to collect knowledge from a number of sources and saving you effort and time.

Begin your free trial immediately!

Discover All of the Data You Want on InvestingPro!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation or advice to take a position as such and is on no account supposed to encourage the acquisition of belongings. I want to remind you that any sort of asset, is evaluated from a number of factors of view and is very dangerous and subsequently, any funding choice and related danger stays with the investor.

[ad_2]

Source link