[ad_1]

Goldman Sachs stated the economic system and investing panorama is returning to a pre-2008 surroundings.

Strategists stated the worldwide economic system has outperformed expectations in 2023, and disinflation ought to stick with it.

Circumstances are normalizing because the period of ultra-low charges ends.

Goldman Sachs sees a 15% recession likelihood for the yr forward, and the financial institution expects a handful of tailwinds to assist international development and investments because the macro panorama reverts to pre-2008 circumstances.

In a word to shoppers this week titled, “The Arduous Half Is Over,” Goldman strategists led by Jan Hatzius highlighted that economies world wide have outperformed even optimistic expectations via 2023.

“2024 ought to cement the notion that the worldwide economic system has escaped the post-GFC surroundings of low inflation, zero coverage charges and adverse actual yields,” Hatzius stated. “The interval for the reason that GFC has typically felt like an inexorable transfer in the direction of decrease international yields and low inflation — ‘liquidity lure’ and ‘secular stagnation’ have been the last decade’s buzzwords.”

Policymakers have put an finish to the easy-money period, and the transition to greater charges has to this point been rocky, as illustrated by excessive volatility within the inventory market, the speedy tightening of economic circumstances, and the rising variety of “zombie” firms going stomach up.

“The large query is whether or not a return to the pre-GFC price backdrop is an equilibrium,” based on the strategists. “The reply is extra more likely to be sure within the US than elsewhere, particularly in Europe the place sovereign stress may reemerge.”

The Fed pulled rates of interest to near-zero within the aftermath of the Nice Monetary Disaster, however a return to a high-rate surroundings may spell bother for closely indebted corporations and broader enterprise circumstances.

Different Wall Avenue forecasters, too, have cautioned {that a} wave of distressed debt and troubled steadiness sheets will come to the floor within the coming months as tighter monetary circumstances chunk. Charles Schwab has estimated that defaults will peak someday between now and the primary quarter of 2024.

Story continues

Upside for markets

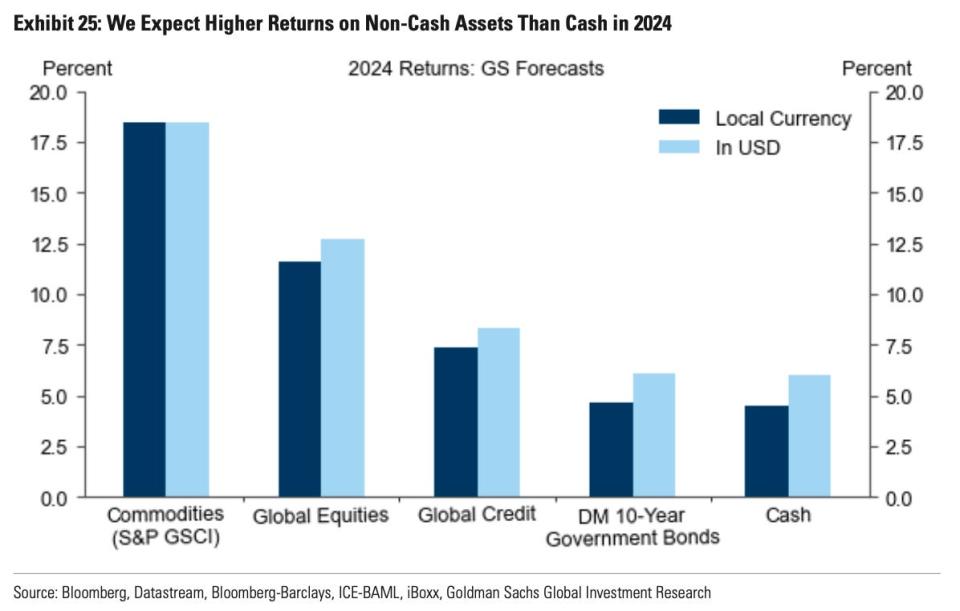

Goldman expects returns in charges, credit score, equities and commodities to exceed money in 2024.

“The transition [from the easy money era] has been bumpy, however the upside of this ‘Nice Escape’ is that the investing surroundings now appears extra regular than it has at any level for the reason that pre-GFC period, and actual anticipated returns now look firmly constructive,” Hatzius stated.

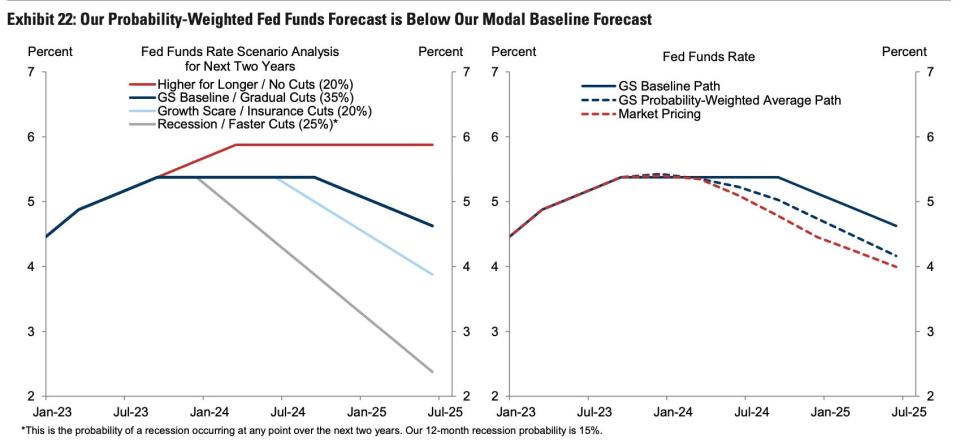

Inflation ought to proceed to say no in 2024, actual family revenue development ought to develop, manufacturing exercise will bounce again, and central banks led by the Federal Reserve ought to change into more and more prepared to chop charges, within the agency’s view.

“We do not suppose the final mile of disinflation will likely be significantly laborious,” Hatzius stated. “First, though the advance within the supply-demand steadiness within the items sector — measured for instance by provider supply lags — is now largely full, the affect on core items disinflation remains to be unfolding and can seemingly proceed via most of 2024.”

Regardless of their relative optimism, Goldman strategists stated they see “higher-than-normal dangers” for 2024.

Even when disinflation continues at a gradual clip, it is attainable that the Fed and different central banks nonetheless preserve rates of interest excessive for longer than anticipated.

There are additionally draw back dangers round development, the financial institution stated. A restoration in international manufacturing may very well be delayed, significantly if excessive charges push corporations to normalize stock ranges relative to gross sales under 2019 ranges.

Learn the unique article on Enterprise Insider

[ad_2]

Source link