[ad_1]

USD/CAD PRICE, CHARTS AND ANALYSIS:

Hawkish BoC Fails to Encourage CAD Bulls.A Rebound in Oil At present has Didn’t Spark USDCAD into life, Will Fedspeak do the Trick?Having a look on the IG consumer Sentiment Information and we will see that Retail Merchants are At the moment Web-SHORT with 72% of Merchants Holding Quick Positions.To Be taught Extra About Value Motion,Chart PatternsandTransferring Averages, Take a look at theDailyFX Training Sequence.

Learn Extra: The Financial institution of Canada: A Dealer’s Information

USDCAD has continued to rally after discovering assist across the 1.3650 mark on Monday. Since then, it has rallied near 200 pips because the US Greenback Index inched larger as nicely and Oil costs continued to slip.

Really useful by Zain Vawda

Get Your Free Prime Buying and selling Alternatives Forecast

BANK OF CANADA

The Financial institution of Canada Deputy Governor Carolyn Rodgers has been vocal this week following the discharge of the abstract of deliberations. The Deputy Governor warned that the interval of super-low rates of interest is probably going over and that each companies and shoppers must adapt. Rodgers acknowledged that persons are already feeling a pressure of current debt as delinquency charges on bank cards, automotive loans and unsecured traces of credit score have returned to or have barely surpassed their pre-pandemic ranges.

The Abstract of Deliberations confirmed that some members felt that it was extra possible than not that the coverage charge would wish to extend additional to return inflation to focus on. Curiously sufficient this was an identical message which we heard from Jerome Powell yesterday in his handle on the IMF which sparked a little bit of life into the US Greenback. Judging by the place of Central Banks now is likely to be an excellent time to focus a bit extra on the technical.

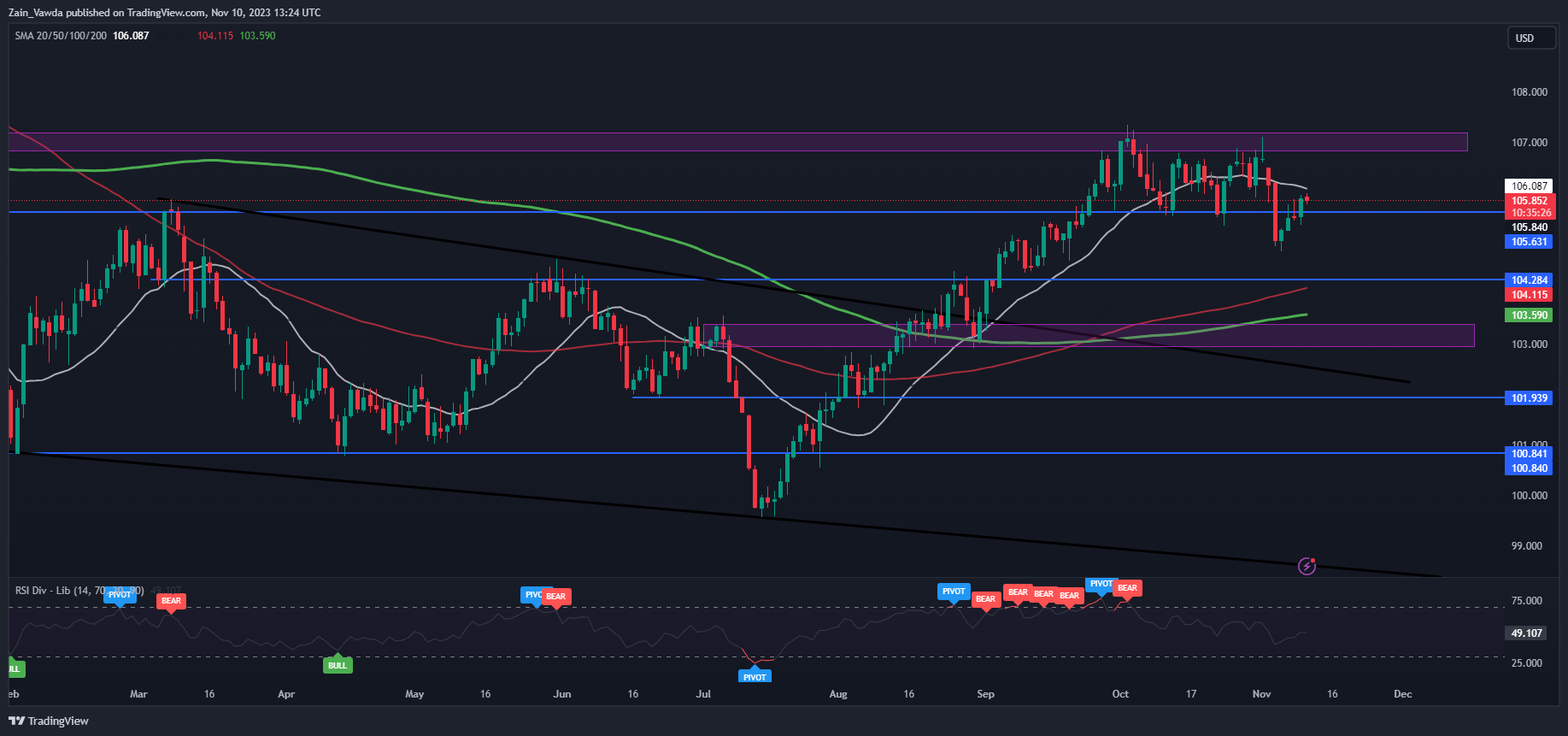

US Greenback Index (DXY) Each day Chart

Supply: TradingView

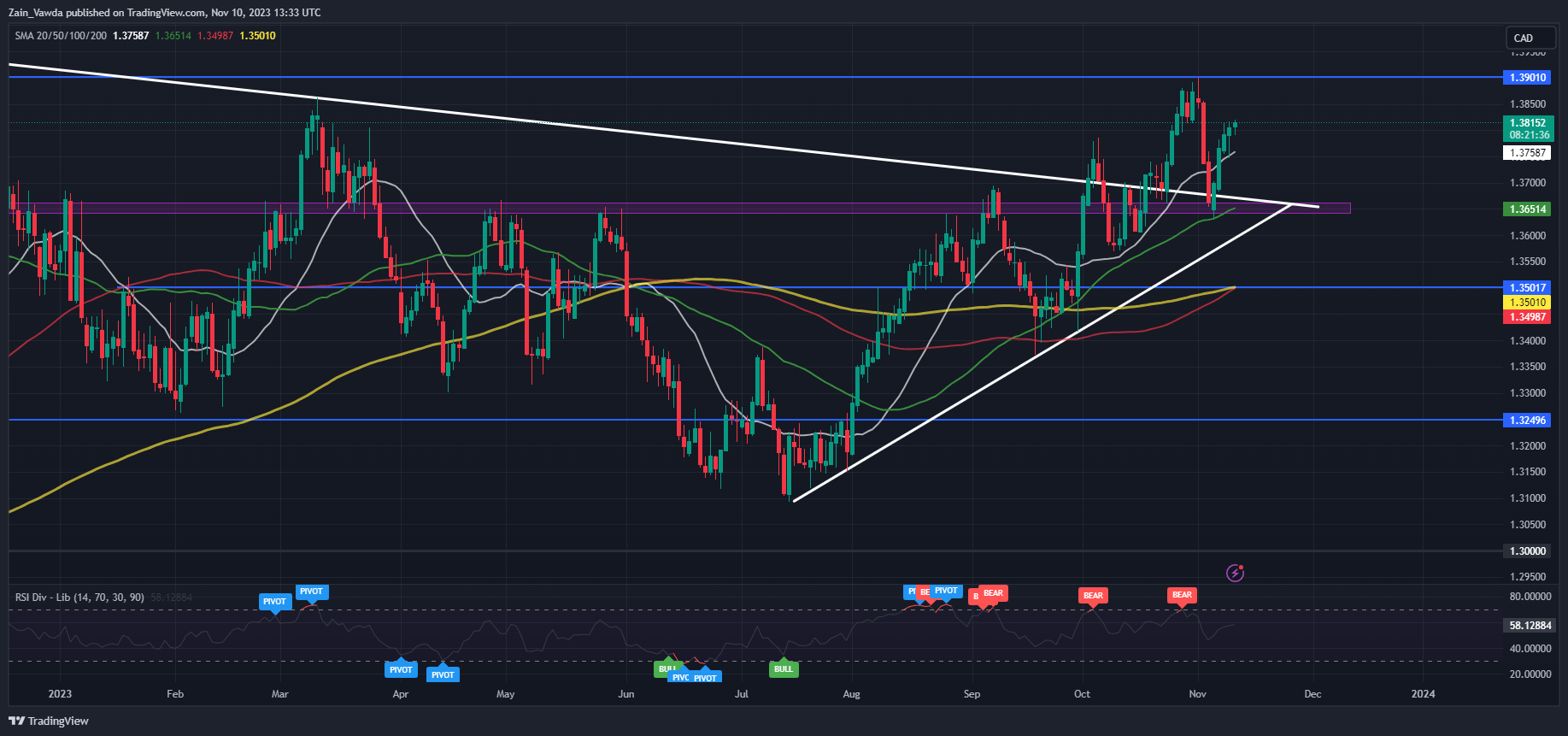

TECHNICAL ANALYSIS USD/CAD

USDCAD failed on the 1.3900 resistance stage two weeks in the past earlier than a selloff of some 270 pips earlier than discovering assist on the 1.3650 assist space. This space additionally had the 50-day MA which supplied an additional confluence and has seen USDCAD rise to commerce simply above the 1.3800 deal with on the time of writing.

USDCAD is nonetheless flashing blended indicators with the every day candle shut on Friday November 3 breaking the general bullish construction because it closed beneath the earlier larger low swing level round 1.3660. his would trace at a brand new decrease excessive, shy of the earlier excessive at 1.3900 earlier than pushing to print a brand new decrease low and break by assist on the 1.3650 deal with. In distinction to his improvement, we even have simply seen a golden cross sample develop because the 100-day MA crosses above the 200-day MA in an indication that the bullish momentum could but proceed. These are two utterly completely different indicators with regards to the following temper for USDCAD and type of displays the rationale indecisive nature of markets as a complete.

I for one nonetheless desire a little bit of a correction to the draw back with a possible retest of the 100 and 200-day MAs earlier than a push to doubtlessly break the 1.3900 deal with. This in fact is only a intestine feeling however i’ll little question be monitoring the pair with curiosity within the coming days.

Key Ranges to Maintain an Eye On:

Help ranges:

Resistance ranges:

USD/CAD Each day Chart

Supply: TradingView, ready by Zain Vawda

IG CLIENT SENTIMENT

Having a look on the IG consumer sentiment knowledge and we will see that retail merchants are at the moment internet SHORT with 72% of Merchants holding quick positions. Given the contrarian view adopted right here at DailyFX towards consumer sentiment, Is USDCAD Destined to rise additional and break the 1.3900 resistance stage?

For Ideas and Methods on The best way to use Shopper Sentiment Information, Get Your Free Information Under

Change in

Longs

Shorts

OI

Each day

-8%

-5%

-6%

Weekly

-29%

54%

20%

— Written by Zain Vawda for DailyFX.com

Contact and comply with Zain on Twitter: @zvawda

component contained in the component. That is most likely not what you meant to do!

Load your utility’s JavaScript bundle contained in the component as an alternative.

[ad_2]

Source link