[ad_1]

On late November 13, the XRP worth skilled a major surge, momentarily leaping by 16% following a purported exchange-traded fund (ETF) submitting by BlackRock, which shortly turned out to be faux.

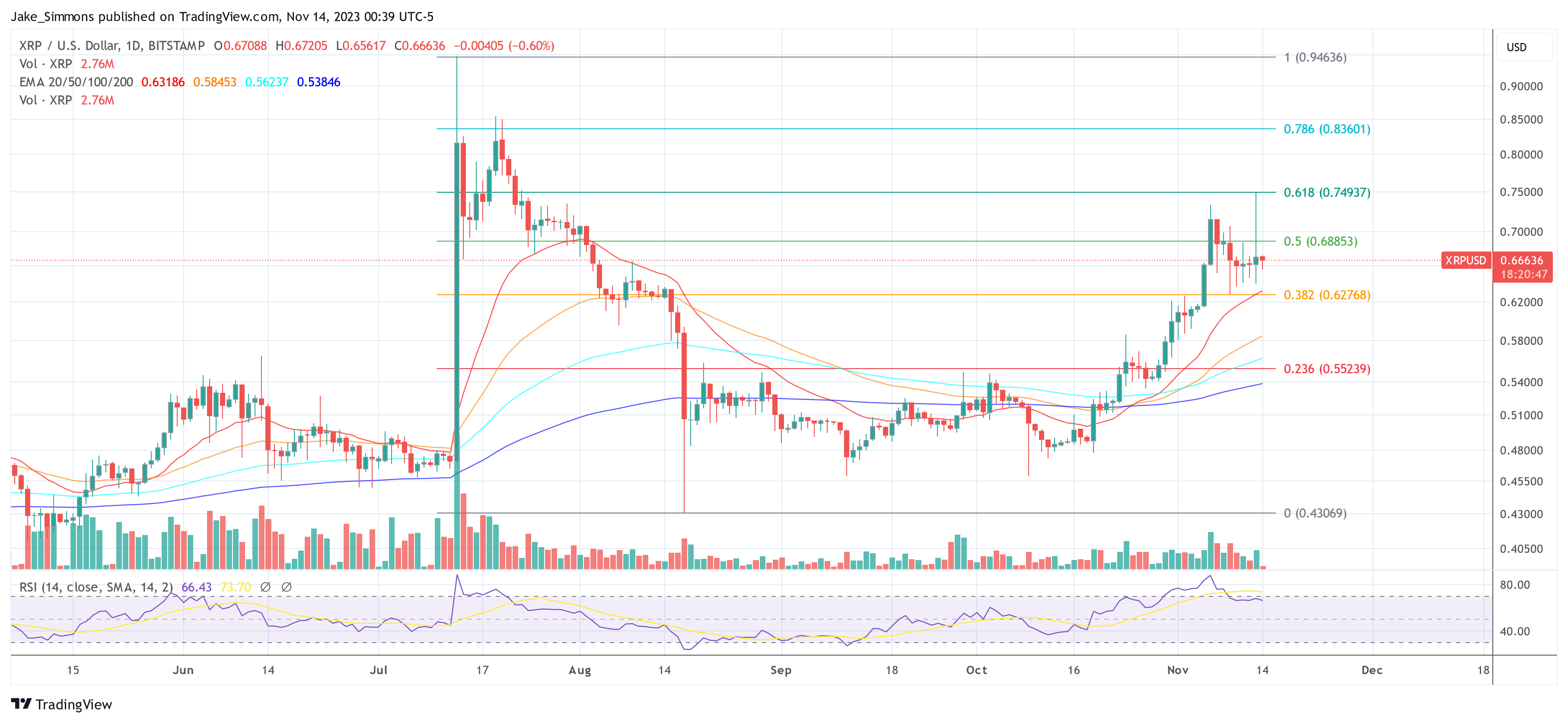

The incident started when X (previously Twitter) customers shared a submitting in Delaware suggesting that BlackRock, the worldwide asset administration big, had registered the “iShares XRP Belief”. This motion is often a precursor to launching an ETF. Consequently, the XRP worth soared to $0.75, a 16% improve, inside simply 25 minutes of the information breaking.

Nonetheless, the thrill was short-lived. Bloomberg ETF analyst Eric Balchunas confirmed the submitting as faux after direct communication with BlackRock representatives. Balchunas indicated that the XRP belief had been falsely listed on the Delaware web site utilizing the identify of Daniel Schwieger, a managing director at BlackRock.

In a X submit, Balchunas acknowledged, “That is false! Confirmed by BlackRock by me. Some whacko will need to have added utilizing BlackRock government identify and so forth. Cmon man. […] Some ppl questioning whether or not BlackRock truly confirmed to me that is false. They did. A spokesperson confirmed. If that’s not sufficient and you’re nonetheless raging, then please search medical assist.”

Including to this, Bloomberg’s James Seyffart remarked on the fast worth fluctuation: “Spherical journey to under the place it was earlier than the faux pump. […] That was a fast […] Whoever did this higher have lined their tracks as a result of the feds will probably be wanting into them I believe.” Seyffart additionally clarified that whereas the XRP belief submitting was faux, the Ethereum ETF submitting is official and confirmed.

Why The Odds Of A XRP ETF By BlackRock Have been Slim

Scott Johnson, finance lawyer at Davis Polk elucidated why the XRP ETF by BlackRock had little probability to be true: “Would symbolize an aggressive posture from Blackrock given there’s presently no clear path for XRP to get 19b-4 approval right here and not using a CME futures market / SSA. To not say it may’t be completed, however would require forging a brand new path.”

Jeremy Hogan, a famend lawyer from the group, defined the simplicity of spoofing the formation of an ETF, highlighting its fraudulent nature and the convenience of execution. Hogan elaborated that “it’s truly very simple and simply prices $500. You solely must file two paperwork (connected), pay the cash, and also you get a ‘placeholder’ on the state web site. ”

He additionally speculated that the perpetrator might have doubtlessly capitalized on the value surge. “Legal noticed what occurred with the ETH belief submitting, information the XRP belief ‘submitting,’ buys $100k XRP on leverage, sells at 74 cents, and pockets 2-3 million {dollars},” Hogan speculated.

At press time, XRP traded at $0.6636 after briefly touching the 0.618 Fibonacci retracement stage.

Featured picture from Markus Winkler / Unsplash, chart from TradingView.com

[ad_2]

Source link