[ad_1]

Time for an additional longstanding Inventory Gumshoe custom — each Thanksgiving, for 16 years in a row now, now we have regarded again over our teaser monitoring spreadsheets and known as out one horrible choose because the Turkey of the 12 months. That’s the teaser pitch that offered us with the worst-performing, most-overhyped, or in any other case simply the goofiest gobbler of the previous twelve months. We attempt to keep away from those who have been simply dangerous luck or dangerous timing, however, like creating an important Thanksgiving dinner, it’s not precisely science.

This honor will not be bestowed evenly — to be named Turkey of the 12 months in Gumshoedom, you should have been a very terrible inventory thought, chosen throughout the final twelve months, and, ideally, it is best to stand for all that’s entertaining (and deceptive) in inventory e-newsletter teaser advertisements.

Most years, we’ve received loads of candidates… over-promised expertise names, failed biotech trials and puffed-up mining shares are likely to fill out the underside of the Teaser Monitoring spreadsheets right here at Inventory Gumshoe in any given yr, with the occasional smattering of frauds and bankruptcies, so who’re probably the most promising nominees for our annual prize?

The timeframe we work on is “a few yr”… nevertheless it doesn’t really feel truthful to name out a Turkey only a month or two after it’s teased, so we really often use the September-to-September interval to discover a qualifying chook.

And I ought to begin with the usual caveats — we don’t subscribe to all these newsletters, we simply evaluation their promotional supplies, so we don’t often know after they first suggest a inventory to their subscribers, whether or not their commentary to subscribers is extra nuanced than their promotional supplies (God, you’d should hope so), or if or after they may suggest promoting it… all we all know is when and the way they dangled hints a few suggestion as bait to recruit new subscribers.

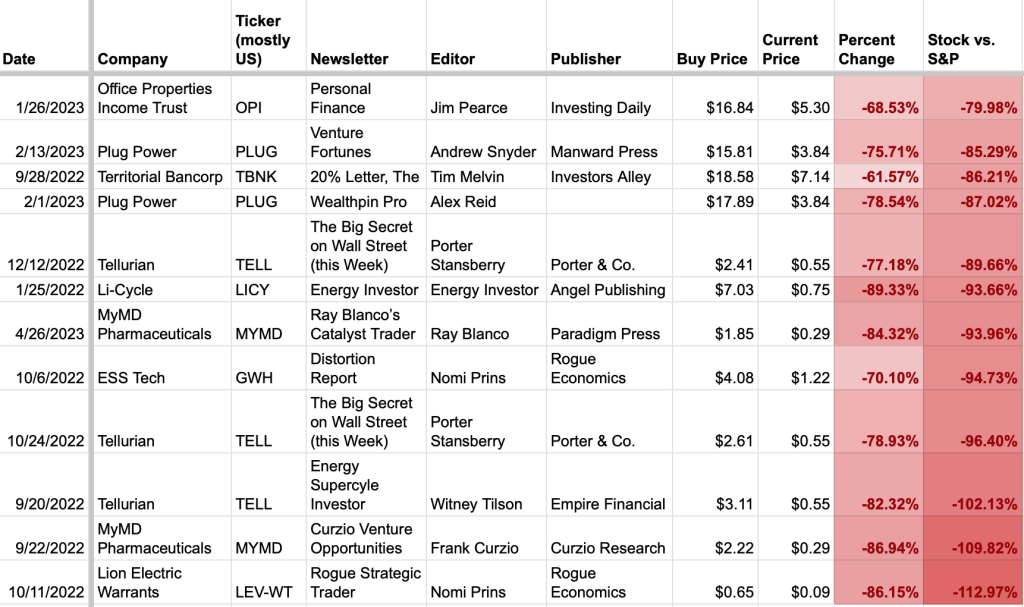

So who’re the candidates? That is your soiled dozen of the worst teaser picks from September 2022 to September 2023… with the info pulled at Friday’s shut final week.

What stands out once we look by means of that listing? Effectively, we monitor these relative to the S&P 500, to make it a bit extra truthful, and the market has really executed fairly nicely for the reason that fourth quarter of 2022… however a number of these picks have been made round that point, in the previous couple of months of final yr. Often we see the really horrible market picks made at a peak of investor enthusiasm, not close to a trough available in the market, in order that’s slightly uncommon.

And it in all probability goes with out saying that these firms have been shrinking, that’s often what’s occurring when your inventory worth goes down dramatically… however additionally they all began out fairly small. The most important of those has a market cap of solely about $2.5 billion now — that will be Plug Energy (PLUG), ~$2 billion nonetheless places it within the “small cap” class, relying on who’s doing the categorizing — however most of them at the moment are $200-400 million firms, which implies they have been all very small even earlier than they misplaced 60-80% of their worth.

Nonetheless, most of those are usually not true “microcap” concepts ($50-100 million or much less), which is a little bit of a change — final yr at the moment, like most years, there have been a bunch of really teensy speculative junk shares on the backside (you realize the type… failed biotechs, dry-hole oil explorers, pre-revenue expertise “concepts” that appear borne extra of entrepreneurs than engineers, and, often, a couple of pathalogically optimistic prospectors who didn’t discover their gold).

Although to be truthful, it may simply be that “junk shares” received a bit greater throughout these previous few years of manic free cash. And there was one actual stinker in that “tiny” class, MyMD Prescription drugs (MYMD), which was teased by each Ray Blanco and Frank Curzio within the Fall of 2022 (Blanco had began earlier, his authentic pitches for MYMD have been in early August of 2022, in order that didn’t make the lower for this “Turkey Desk,” however that will tally up because the worst absolute performer among the many teaser shares of the previous two years, it has misplaced about 94% of its worth).

A shock for me? No bankruptcies but. We often have one or two firms that truly go to zero… or at the least, we did within the previous days, earlier than COVID rescues and near-zero rates of interest saved so many zombie firms alive. I believed we would have seen a few of the teased picks go underneath by now as they face rising rates of interest, however not but.

Glad information? Effectively, should you’ll let me wax egocentric a bit for a second, it’s that I didn’t spend money on any of those firms — which hasn’t at all times been the case. I’ve gotten sucked right into a story or two previously, as longtime readers are in all probability all too conscious, and the final two Turkeys have been shares that additionally stained my Actual Cash Portfolio, at the least for a short time. I’m glad we didn’t make it three in a row this yr.

However who wins? Effectively, that is difficult considerably by the truth that a number of of the “soiled dozen” worst picks over the previous yr have been in heavy rotation for a very long time… they have been promoted at these costs at the least as soon as inside our timeframe, however a few of them have been repeatedly promoted all year long, and in a couple of circumstances are nonetheless actively being touted immediately, so that they have been breathlessly pitched at decrease and lower cost because the shares declined. Tilson and Stansberry have each continued to pitch Tellurian extra lately, for instance, so Tilson’s February pitch of TELL at about $1.50 would additionally nearly make the lower to be on that desk, regardless that by then the inventory worth had fallen ~60% since his preliminary suggestion six months earlier.

And it’s additional difficult by the truth that there are a couple of duplicates, too — it’s not simply that Whitney Tilson and Porter Stansberry each touted LNG hopeful Tellurian within the second half of 2022, and saved doing so all through 2023… we additionally noticed perennial self-promoter Plug Energy touted by each Andy Snyder and Alex Reid again in February, throughout one other wave of “hydrogen will save us all” enthusiasm, in addition to Curzio and Blanco each falling into the MYMD lure.

That’s commonplace for each good and dangerous picks, there are sometimes folks piling on to no matter story is best to promote to traders — generally that’s a very good factor, like the handfuls of newsletters who’ve promoted the massive tech shares over the previous few years, generally it’s a foul factor when there are scientific trial failures or frauds or no matter else causes a scorching “story inventory” to break down.

Nevertheless it means now we have a little bit of a judgement name to make — and which means the tenor of the gross sales pitch comes into play slightly bit. Which of those advertisements was stuffed with probably the most bluster and promise?

A few of that reveals up most simply whenever you’re two teaser pitches for a similar inventory — Tilson’s spiel for Tellurian was relentlessly optimistic, and included a video he filmed on the web site of a (totally different) LNG plant, and it began simply earlier than Tellurian introduced how disastrously their newest try at debt financing had gone, so I’d say it’s extra of a “turkey” than Porter’s ongoing pitch of the identical firm… partly as a result of Porter was at instances slightly clearer in regards to the danger in his tease, in noting that they’re buying and selling at a low worth as a result of they’re going through a problem getting financing, although he did additionally promise the potential for excellent issues in saying he thinks it would go from a $2 billion market cap to $100 billion over the following decade (if that’s the case, it will be evermore dramatic now — step one over this previous yr was going from $2 billion right down to $350 million). My impression is that Tilson was much less clear in regards to the dangers, and Porter was extra formidable in regards to the upside, so I’d give Tilson the sting for selecting extra of a Turkey this day trip. Once more, judgement name.

And equally, Frank Curzio actually used some hyperbole in speaking up the potential of MYMD’s drug, which was in Part 2 trials on the time, saying it may very well be higher than Humira… and he had additionally even touted the inventory on TV, and was a purchaser personally throughout one among their earlier personal placements… however nonetheless, it’s arduous to outdo Ray Blanco with regards to relentlessly overdoing a inventory promotion, when his efficiency in a video presentation features a disingenuous reveal of the key patent that simply simply been rewarded for this coming success, or says an upcoming catalyst is not going to simply result in a worthwhile inventory choose, however will shock the world and signify the top of a illness. And Blanco saved doubling down on the thought, form of like Porter and Whitney did with Tellurian, however selling particular days when large information would come out and ship the inventory hovering… with, in fact, excellent amnesia about how mistaken he had been for the earlier six months.

So is it higher to personal the inventory your self, market it on TV, and likewise make huge guarantees about it beating out Humira to develop into the best-selling drug of all time? Or is it higher to placed on a present and maintain re-promoting the inventory with a distinct “this time it would change the world” catalyst, with out ever mentioning the numerous instances you’ve been mistaken in that very same assertion over the previous yr? Once more, judgement name, however I discovered Blanco’s pitch extra excessive and ridiculous, and barely extra deserving of the Turkey of the 12 months award than Curzio’s tout.

And people shares which have been touted by a number of pundits actually catch the attention extra simply, however we shouldn’t neglect how horrible Nomi Prins’ pitch was for the Lion Electrical warrants (LEV/WS), significantly since she’s additionally the one pundit to have two totally different teaser picks within the soiled dozen (she was teasing a speculative battery firm, ESS Tech (GWH), at about the identical time, with outcomes nearly as dangerous).

If there’s not a transparent winner within the “most hype” class, may it make a distinction which pundit was making an attempt to cost probably the most? There once more we’re actually splitting hairs, the underside three performers have been all teased by “improve” newsletters which have excessive costs and no-refund insurance policies — Tilson’s Vitality Supercycle Investor was pitched at $2,000/yr, Curzio’s Enterprise Alternatives at $2,500/yr, and Prins’ Rogue Strategic Dealer at $1,750. No $49 throwaway letters right here, which ought to come as no shock — typically the promotional hype is most excessive for these publications, as a result of these high-priced, no-refunds letters are the place most publishers actually make their cash (given the relentless prices of promoting this closely, many newsletters lose cash or break even on bringing in new subscribers to their “entry stage” publications that price $49 or $99/yr, solely getting cash if these subscribers renew for a couple of years or may be satisfied to improve… it typically seems that the actual goal of these cheaper publications, which in all probability have significantly better general efficiency, on common, as a result of they suggest extra mainstream investments, is to domesticate an inventory of subscribers who may be “upsold” on lifetime packages or upgrades to pricier letters).

And none of these people have seen one among their picks win the Turkey of the 12 months previously, so there’s no breaking the tie that manner (although Tellurian got here near successful a couple of years again, when Kent Moors was touting it early on).

So the place will we come down? Effectively, as your pleasant dictator right here at Inventory Gumshoe, I get to make the decision… and whereas I’m tempted to award the Turkey of the 12 months to both Whitney Tilson or Ray Blanco due to the final vibes I received from these teaser advertisements, amplifying the horrible efficiency, I often lean on the maths in these circumstances — when there are a number of cheap candidates, I feel I ought to in all probability simply defer to the numbers.

The Winner!

The worst general performer, and our 2023 Turkey of the 12 months, was Rogue Strategic Dealer’s “Tiny Agency Saving Amazon” teaser goal, Lion Electrical (LEV), largely as a result of, as has typically been the case for this explicit e-newsletter, Nomi Prins touted the warrants on Lion Electrical, not the inventory, as a result of that permit her promise that you possibly can “play” for underneath a greenback. She wouldn’t have fairly made the lower in pitching LEV as a inventory, for the reason that shares solely fell from about $2.50 to $1.70 over the previous yr, however in pitching the $11.50 SPAC warrants on Lion Electrical, which appeared like unnecessarily irresponsible leverage even on the time, she created a relative lack of nicely over 100% (that 112% relative loss simply acknowledges what the real-life expertise would have been — the S&P 500 is up greater than 20% since Prins pitched these warrants, so you probably did’t simply lose 86% by shopping for the warrants and watching the worth collapse, you additionally missed out on what you’ll have made should you had simply purchased an index fund).

And this won’t even be a inventory choose from Nomi Prins herself, frankly — this Rogue Strategic Dealer letter at all times appeared to be largely a technique to tie the massive image “struggle the Federal Reserve” character that Nomi Prins has created together with her books and non-investing punditry, with a political slant that appeals to many e-newsletter prospects who lean libertarian or prefer to yell at politicians, to the inventory picks made by her writer’s cousins at Casey Analysis, significantly Dave Forest’s pitches for Casey Strategic Dealer, and Forest equally touted Lion Electrical as a technique to get “Amazon warrants” manner again in 2021 (his efficiency would have been even worse, he pitched the warrants at about $4 so that they’ve now misplaced nearly 99% in two years). Nomi Prins, like Jim Rickards and another pundits who publishers can promote utilizing their political stance, area of interest superstar, or disaster outlook, might nicely depend on the minions whose names are under the fold to do the work of truly making and monitoring inventory picks… which might be generally good and generally dangerous. (I’m simply speculating right here, by the way in which, I don’t know the way it works behind the scenes at these newsletters — possibly Rickards and Prins are very concerned in selecting the shares that they promote).

How is Lion doing now? Effectively, my first impression is “about the identical,” although traders are much less affected person with the “save the long run” EV firms than they have been a yr or two in the past. They’re nonetheless making and promoting electrical vehicles and buses, they usually’re nonetheless dropping fairly some huge cash on each, with hopes of profitability persevering with to recede out to the horizon as every quarter passes. It seems like they’re beginning to run a bit low on money as nicely — they burn by means of a median of $30-40 million in money every quarter, it seems, they usually have been right down to $35 million or so in money as of September, however they do have some accounts receivable, they usually have been capable of borrow cash lately because of their order circulate, so I don’t know in the event that they’ll hit a disaster level or not. Analysts have regularly been bumping their “goal costs” down because the inventory has declined, no one foresees profitability till at the least 2026, however they do have a bunch of orders and they’re rising income, so they could make it by means of.

However there you have got it, we’ll accept “worst loser” as our Turkey of the 12 months, and which means the Lion Electrical warrants go into the books because the 2023 Turkey of the 12 months. And since this was one of many many disastrous SPAC offers over the previous few years that tempted folks, both as shares or warrants, it feels applicable to at the least get one SPAC washout into the lengthy listing of Turkeys (there could also be extra, we’ll see what the long run holds).

How has 2023 shaken out general?

Effectively, with regards to relative efficiency for these hype-selling pundits, 2021 picks ended up being horrible… 2022 was slightly bit higher, and 2023 up to now has been a little bit of an enchancment once more. Should you purchased all the shares teased in equal quantities on the time they have been pitched by a e-newsletter promo in 2021, you’ll have “underperformed” the S&P 500 by about 38%, 2022 picks, measured a yr in the past, would have solely executed about 13% worse than should you had simply purchased the index on every of these days as a substitute (although that has gotten worse over the previous yr, 2022 picks at the moment are on common 27% behind the index)… and 2023, up to now, is fairly good. Inventory picks teased in 2023, yr so far, at the moment are coming in about 7% worse than the index. 10-12% underperformance is extra typical of teaser shares usually over a yr or two, so on that entrance 2023 is shaping up as barely above common. To this point.

Turkey Historical past

Should you’re newer to Inventory Gumshoe, we’ve been monitoring closely promoted teaser shares since 2007, and named our first Turkey of the 12 months in 2008 — and you’ll go all the way in which again to see how these 15 earlier Turkeys matured or recovered.

A go to with previous Turkey of the 12 months winners will shortly flip right into a cautionary story in regards to the risks of backside fishing — final yr’s Turkey was Voyager Digital (VOYG.TO again when it was listed), the cryptocurrency brokerage, they usually had already gone into chapter 11 earlier than the prize was awarded, so there wasn’t actually a “purchase the beaten-down Turkey” alternative for anybody with any sanity, however generally folks do get tempted (the inventory nonetheless trades over-the-counter at VYVGQ, with that dreaded “Q” appended — Q on the finish of an OTC-traded ticker is nice shorthand for “Give up this, dummy”).

Again in 2021, although, it was Intrusion (INTZ) that walked dwelling with the prize, and there was form of an actual enterprise nonetheless hiding underneath the over-promotion the corporate had executed, so in some methods it was arduous, on the time, to think about their story getting so much worse… nevertheless it did, the inventory is down one other 90% or so within the final two years. (Sure, these are the 2 Turkeys that I at the least speculated on at one level, although fortunately I didn’t journey both ship right down to the underside of the ocean).

The 2020 winner LimeLight Networks later modified names (it’s now Edgio (EGIO)), however has continued to fall, down one other 90% or so because it was named the thirteenth Turkey of the 12 months three years in the past.

You get the thought. Many of the older ones have continued to disappoint as nicely, and lots of of them don’t actually exist anymore — 2019 marijuana pretender Crop Infrastructure (CRXPF) merged with Vert Infrastructure, then went into receivership a yr or so later and has wafted into nonexistence like a smoke ring.

Others have been by means of one other hype cycle or two within the intervening years however nonetheless fallen over time, like 2017 winner Aqua Metals (AQMS)… the one one which has ever actually meaningfully recovered has been 2018 winner Indivior (INDV.l, INVVY), teased by Chris Mayer, and that hasn’t been an important funding, it’s actually only a standout for being a survivor. Coincidentally, I feel Chris Mayer is the one winner of this prize that has left the e-newsletter enterprise (he now manages a non-public fund, managing a few of e-newsletter pioneer Invoice Bonner’s cash, amongst others).

For posterity’s sake, listed here are the opposite earlier winners… most of them are gone now, both reverse break up to infinity or shedding shareholders by means of a chapter or two. A few the names nonetheless exist in some kind, however I’m fairly positive that every one of them ended up being 100% losses for traders who purchased anyplace close to after they have been initially teased and held by means of to the bitter finish:

SunEdison in 2016 (Kent Moors’ Vitality Benefit)CT Companions in 2015 (Louis Navellier)Solazyme in 2014 (Jimmy Mengel and the Motley Idiot each pitched this oneHRT Participa in 2013 (Byron King, who nowadays I feel serves as ‘geologist’ for Jim Rickards, in all probability selecting his gold shares)Gasfrac in 2012 (Sean Brodrick and Keith Kohl) (even the corporate that purchased Gasfrac’s belongings out of chapter a number of years later, STEP Vitality (STEP.TO), has misplaced most of its worth since)Tengion in 2011 (Steve Christ)SuperMedia in 2010 (Hilary Kramer) (that one recovered briefly when merging with Dex One, and the ashes persist as Thryv Holdings (THRY), however within the meantime it went by means of at the least one investor-destroying chapter)Raser Applied sciences in 2009 (Nancy Zambell and the Oxford Membership each teased this one)Potash North in 2008 (Andrew Mickey).

Just a few caveats for this entire train, simply to be clear:

As I famous above, we don’t know what the particular recommendation was from any of those newsletters — possibly they doubled down on the inventory when it dropped, possibly they stopped out or modified their minds the day after we coated the tease, we don’t subscribe so we don’t know… as a result of all we find out about a inventory is when it was teased as a world-beater, we set our monitoring to only assume that you just purchased the inventory on the day the e-newsletter teased it and held it endlessly.

And as a corollary to that, this isn’t essentially a mirrored image on the e-newsletter pundit who promoted the Turkey — sure, we must always use this second to remind ourselves that the advertising and marketing pablum skews our notion and needs to be actively ignored, however generally the e-newsletter editors don’t even actually have something to do with the teaser pitches their writer makes use of… and the general efficiency of a e-newsletter’s portfolio is presumably typically totally different from the efficiency of their most actively touted “teaser” shares. Shares which are teased aren’t essentially actually the “greatest thought” of the e-newsletter pundit, generally they’re simply the inventory whose story is best to promote.

This isn’t essentially meant as a criticism of these explicit newsletters — I consider the annual Turkey Award as being a bit extra light-hearted than that, since all of us do dumb issues generally, but additionally as a cause to be cautious about thrilling tales. One of the simplest ways to try this is by mentioning, at the least every year, a couple of of these moments when the emperor, at the least on reflection, wasn’t sporting any garments.

Previous Turkey of the 12 months winners have received for plenty of totally different causes — generally they ended up being precise frauds or scams, with administration who lied… generally they simply borrowed an excessive amount of cash on the mistaken time. Usually they have been offered as a narrative however hadn’t but gotten previous the primary chapter and turned that story into an actual working enterprise, and sometimes they have been bets on an enormous occasion that failed (like a hoped-for oil discovery, or a drug trial).

What’s lacking? There has (very) often been slightly little bit of income development behind a Turkey finalist, and a couple of times one among them even reported a revenue, however the winner has by no means been an organization with any sort of historical past of secure working outcomes… not to mention rising revenues or rising earnings. Lion Electrical may find yourself being an exception to that rule, since they at the least have rising income… however we’ll see the way it shakes out over time.

So what’s the lesson? Identical because it ever was… tales disappear extra simply than {dollars}.

Should you persist with firms who’ve confirmed their promise to a point, with proof of precise development or significant profitability of their monetary outcomes, not simply of their future daydreams and their investor shows or within the minds of optimistic pundits, possibly you may keep away from bringing a Turkey dwelling.

No person’s excellent, although — as I mentioned, the final two Turkey of the 12 months winners have been each shares that I personally speculated on for at the least a short time. The world continues to be unpredictable, and I think about we’ll all make extra errors than we’d like.

What’s my greatest blunder of a purchase over the previous yr? We’d have to return barely greater than a yr to search out my final actual bottom-of-the-barrel stinker, although I actually personal many shares (or have offered them, in a couple of circumstances) that carried out poorly over the previous 12-15 months — the worst single commerce has in all probability been my buy of Stem (STEM) again in August of 2022, a blow which was solely partially cushioned by the truth that I paired it with a extra established and profitable firm in that very same vitality space for storing, Fluence (FLNC), although the 20% achieve at FLNC hasn’t come near erasing the near-80% loss that STEM has proven at this level. I posted an replace on that sector for the Irregulars again in September, and nonetheless personal each, although I’ve by no means added to them they usually stay tiny positions.

In order that’s it for this yr’s roasting of the Turkeys…. Glad Thanksgiving, everybody! I’m grateful to your continued readership and your help of Inventory Gumshoe, and delighted that you just proceed to make this the best spot in our on-line world. We might be closed for the vacation, so get pleasure from your break from my blather — no Friday File this week, and I’ll be again to dazzle you with extra tales of promise and peril subsequent week… thanks for studying!

P.S.: In case you’re questioning, we could have an optimistic model of this look-back as nicely… proper across the finish of the yr, often between Christmas and New 12 months’s Day, we’ll spotlight the BEST teaser shares picked over the past yr. And, in fact you may at all times peruse the Monitoring Spreadsheets to see which winners… or turkeys… is perhaps your favourite.

P.P.S. Have a Turkey of your personal to get off your chest? It may be good for the soul to acknowledge it and transfer on, and we’re able to pay attention. Suppose I ought to have picked anyone else? Have an unpleasant Turkey from the investing world that by no means graced the pages of Inventory Gumshoe? Be at liberty to share with a remark under.

Disclosure: Of the businesses talked about above, I personal shares of Amazon, Fluence and Stem. I can’t commerce in any coated inventory for at the least three days after publication, per Inventory Gumshoe’s buying and selling guidelines.

Irregulars Fast Take

Paid members get a fast abstract of the shares teased and our ideas right here.

Be a part of as a Inventory Gumshoe Irregular immediately (already a member? Log in)

[ad_2]

Source link