[ad_1]

Buyers have lots to be glad about as we collect this yr to rejoice Thanksgiving.

Optimism that the Federal Reserve is all executed elevating rates of interest has helped enhance urge for food for equities.

As such, every of those 5 shares affords a purpose to be grateful, not only for their previous efficiency, however for his or her potential sooner or later.

Searching for extra actionable commerce concepts to navigate the present market volatility? Members of InvestingPro get unique concepts and steering to navigate any local weather. Be taught Extra »

Safe your Black Friday positive factors with InvestingPro’s as much as 55% low cost!

With simply 25 buying and selling days left in 2023, U.S. shares are on observe to document one in all their greatest annual performances in recent times, boosted by indicators of cooling which have fueled hopes that the Federal Reserve is completed elevating rates of interest.

The benchmark index is up 18.7% year-to-date and now stands simply 5% away from its January 2022 intraday document excessive.

The rally on Wall Road has been fueled by shares of the mega-cap tech firms, with Nvidia (NASDAQ:), and Meta Platforms (NASDAQ:) each posting triple-digit positive factors, whereas Tesla (NASDAQ:), Amazon (NASDAQ:), Alphabet (NASDAQ:), Microsoft (NASDAQ:), and Apple (NASDAQ:) are additionally up solidly on the yr.

Apart from the ‘Magnificent 7’ group of shares, there are many different thriving firms within the S&P 500 that buyers needs to be extraordinarily grateful for this Thanksgiving.

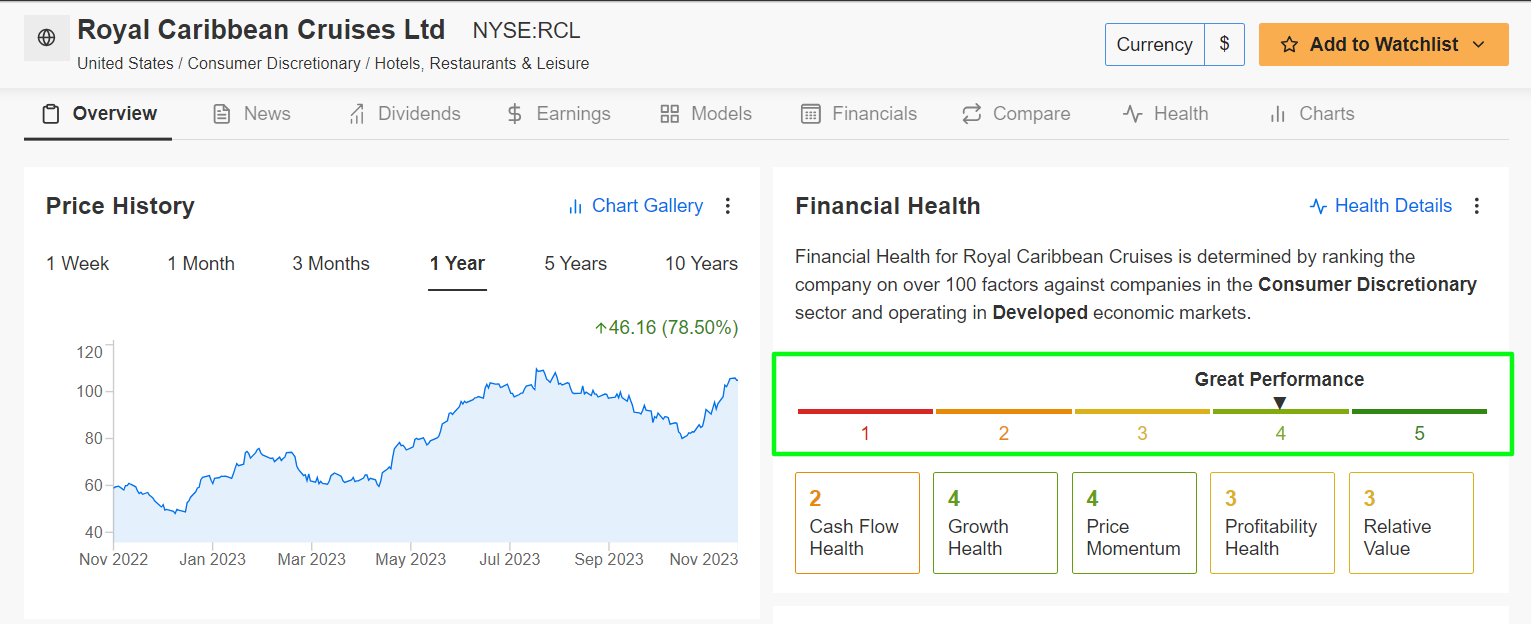

1. Royal Caribbean Cruises

Yr-To-Date Efficiency: +112.3%

Market Cap: $26.9 Billion

In a testomony to recovering journey and tourism tendencies, Royal Caribbean (NYSE:) Cruises, which is the world’s largest cruise operator, has given shareholders loads of causes to be grateful this Thanksgiving.

The Miami-based cruise big has seen a resurgence this yr because the journey trade continues to rebound from the damaging impression of the Covid pandemic.

Royal Caribbean’s methods to reinforce security measures, revamp the cruise expertise, and capitalize on the continuing enchancment in journey demand have contributed to its strong year-to-date efficiency.

RCL inventory – which started buying and selling at $50.54 on January 3 and rose all the best way to a 2023 peak of $112.95 on July 28 – has gained 112.3% in 2023, making it the third-best performer on the S&P 500 this yr, trailing solely Nvidia, and Meta Platforms.

Supply: InvestingPro

All issues thought of, Royal Caribbean shares ought to proceed appreciating because the journey firm is poised to develop its earnings due to bettering profitability tendencies.

It’s price mentioning that RCL at present has an above-average InvestingPro ‘Monetary Well being’ rating of three.2/5.0 on account of sturdy earnings and gross sales progress prospects.

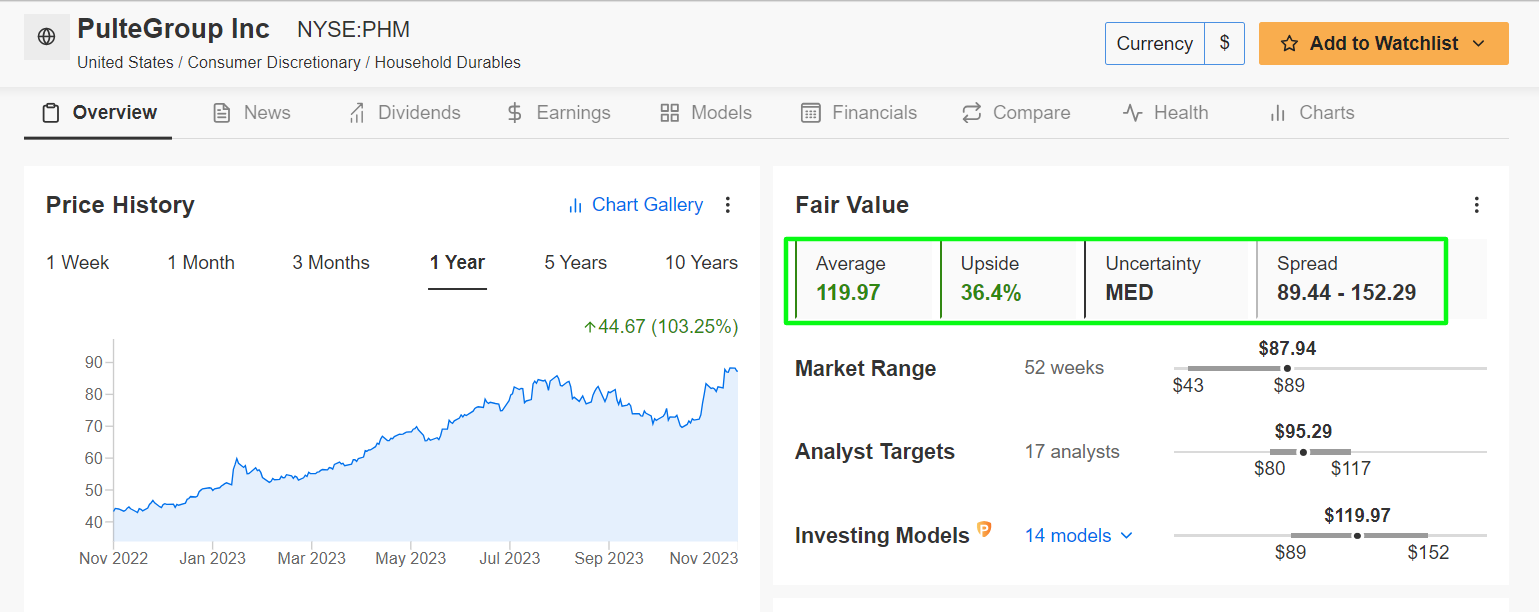

2. PulteGroup

Yr-To-Date Efficiency: +93.2%

Market Cap: $19 Billion

PulteGroup (NYSE:), the third largest house building firm in the USA, has been on a tear this yr because it capitalizes on sturdy housing demand, largely pushed by favorable provide and demand tendencies.

The Atlanta-based homebuilder, which primarily sells single-family houses, has demonstrated the next backlog, wholesome earnings, and strong gross sales progress due to thriving demand for brand spanking new houses.

Its strategic land acquisition, aggressive share buybacks, and growing annual dividend depict a powerful outlook. Thus, this Thanksgiving, buyers in PulteGroup have causes to be optimistic.

PHM inventory, which rose to a document excessive of $89.10 on Wednesday after beginning the yr at $46.40, is up 93.2% year-to-date, making it the fourth greatest performer on the S&P 500.

Supply: InvestingPro

Wanting forward, PulteGroup appears set for additional capital appreciation, because the homebuilding firm’s high and backside traces are anticipated to develop significantly, courtesy of upper revenues and margin enchancment.

It needs to be famous that even after the inventory has almost doubled for the reason that begin of the yr, PHM stays undervalued in the mean time in keeping with InvestingPro, and will see a rise of 36.4% from the present market worth.

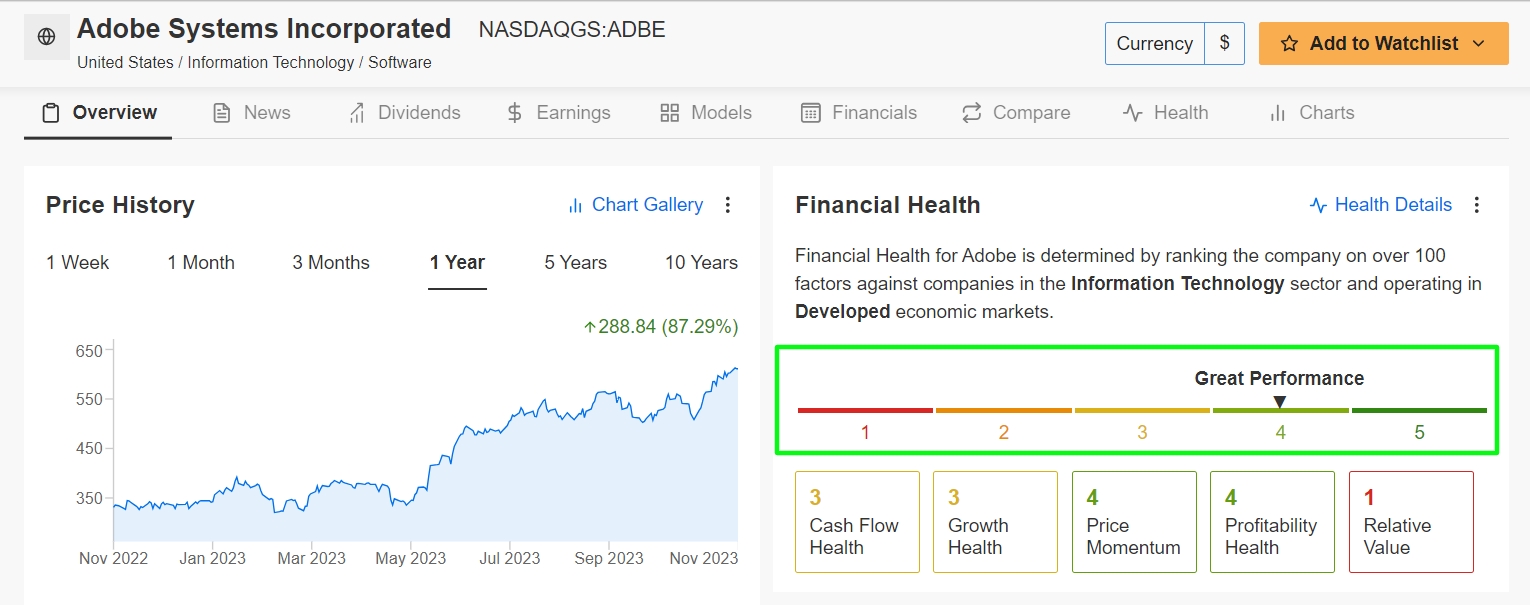

3. Adobe

Yr-To-Date Efficiency: +84.2%

Market Cap: $282.2 Billion

Adobe (NASDAQ:)’s revolutionary software program options and a powerful foothold in inventive and digital advertising instruments have secured its place as one of many high performers within the S&P 500 this yr.

The San Jose, California-based software-as-a-service powerhouse has continued to innovate and supply precious instruments within the digital house due to its rising involvement in synthetic intelligence.

Adobe’s dedication to enhancing its suite of software program, leveraging increasing digital transformation tendencies, and delivering constant buyer worth makes it a inventory for its holders to be glad about this Thanksgiving.

Supply: InvestingPro

ADBE started the yr at $340.16 and closed at an all-time excessive of $619.73 final night time, representing a year-to-date acquire of 84.2%.

Adobe appears poised for additional positive factors in 2024 as the present working surroundings fuels demand for its big selection of subscription-based digital media and advertising software program instruments.

As Investing Professional factors out, the tech titan at present enjoys a ‘Monetary Well being’ rating of 4/5, due to sturdy earnings prospects, and a wholesome profitability outlook.

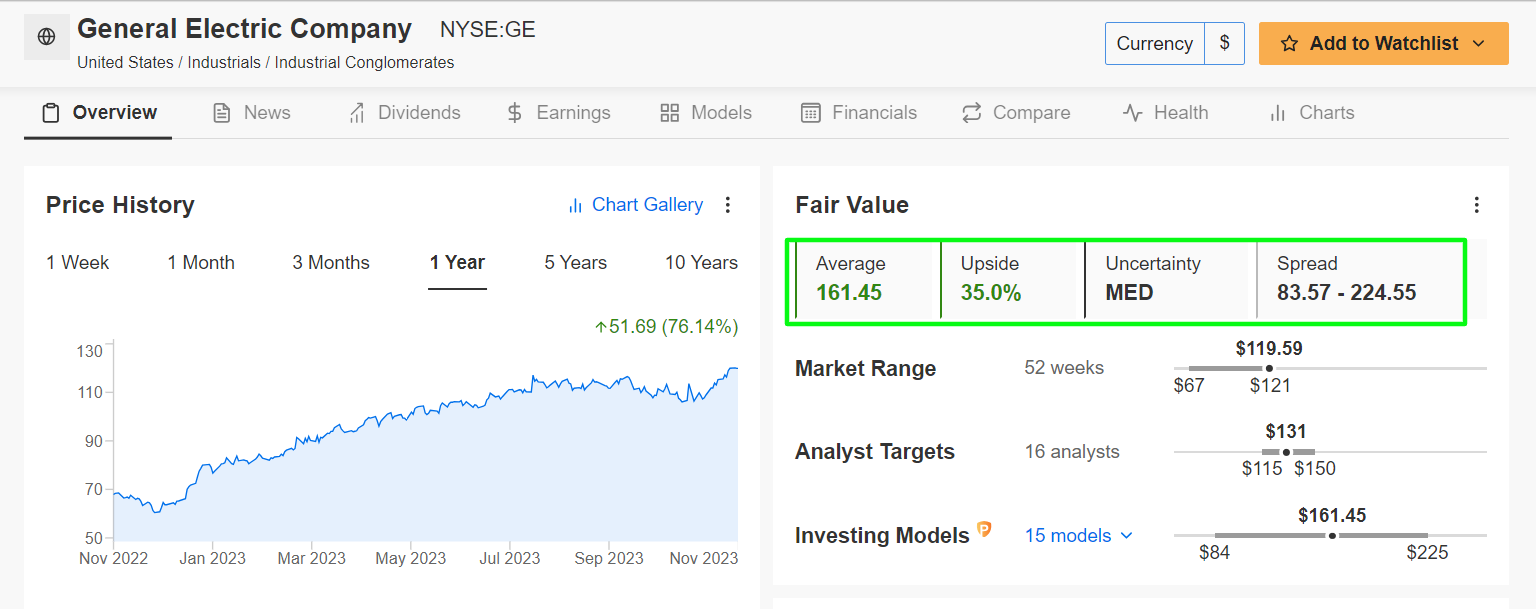

4. Normal Electrical

Yr-To-Date Efficiency: +83%

Market Cap: $130.2 Billion

Normal Electrical (NYSE:) has emerged as one of many high performers within the S&P 500 this yr, which makes GE a inventory to be particularly grateful for this Thanksgiving.

The multinational conglomerate has thrived on account of its diversification throughout varied sectors like aviation, healthcare, and renewable power. The Boston-based firm, which was based in 1892, beat Wall Road’s revenue and gross sales estimates in each quarter this yr because it reaps the advantages of its diversified portfolio, strategic initiatives, in addition to cost-cutting measures.

Supply: InvestingPro

Normal Electrical has been on a significant uptrend all through a lot of the yr, with shares hovering 83% in 2023. The inventory – which started buying and selling at $65.59 on January 3 – ended at $119.66 yesterday, the best closing worth since November 2017.

Even with the latest upswing, GE stays undervalued and will see a rise of 35%, in keeping with InvestingPro, bringing shares nearer to their ‘Truthful Worth’ of $161.45.

Demonstrating the energy and resilience of its enterprise, Normal Electrical sports activities a near-perfect Investing Professional ‘Monetary Well being’ rating of 4 out of 5.

5. Arista Networks

Yr-To-Date Efficiency: +79.4%

Market Cap: $67 Billion

Arista Networks (NYSE:), a key participant within the networking expertise sector, has carved a distinct segment with its revolutionary options and has been profitable in grabbing market share from chief rivals Cisco Methods (NASDAQ:) and Juniper Networks (NYSE:).

The Santa Clara, California-based networking-infrastructure firm’s deal with cloud networking, knowledge middle options, and its position in advancing community infrastructure has made it a standout performer, incomes loads of gratitude from stockholders this yr.

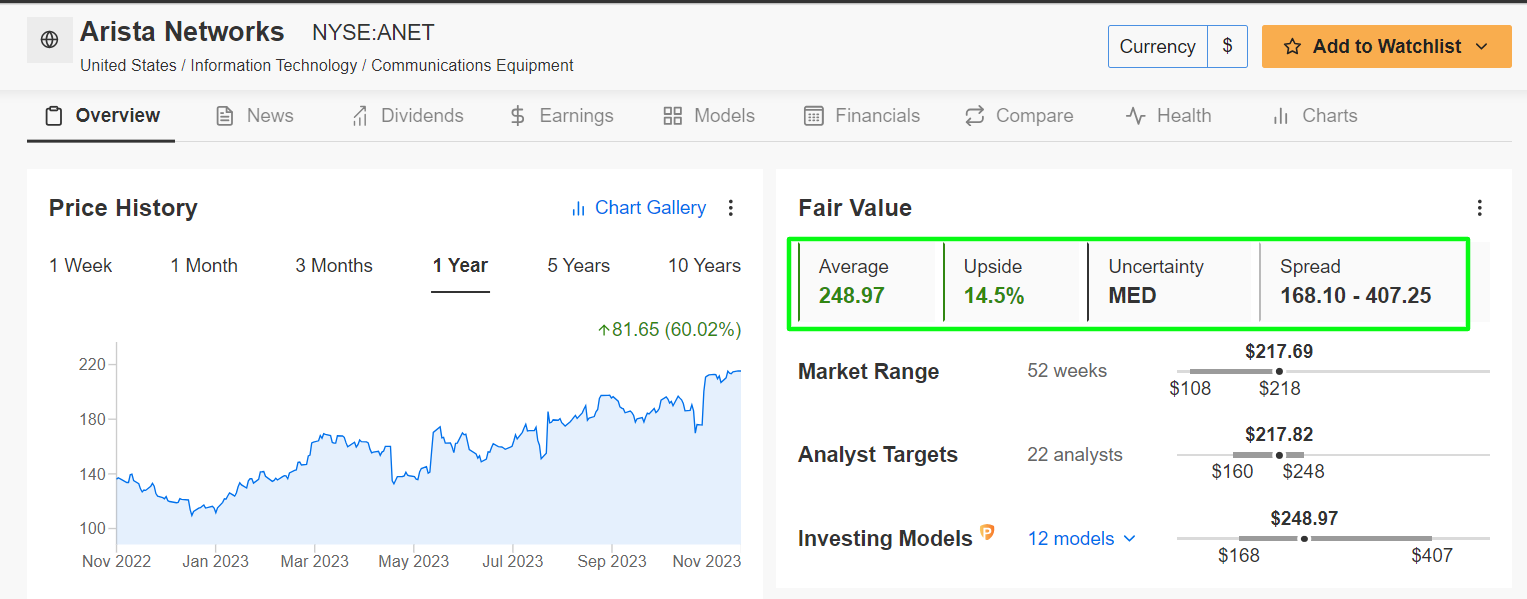

Supply: InvestingPro

ANET inventory closed at a brand new document peak of $217.69 on Wednesday, incomes the corporate a valuation of $67 billion.

Shares have scored a acquire of virtually 80% in 2023, making it the eleventh greatest performer on the S&P 500 this yr.

Not surprisingly, Arista Community’s inventory is considerably undervalued in keeping with the quantitative fashions in Investing Professional: with a ‘Truthful Worth’ worth goal of round $249, ANET shares might see an upside of 14.4% from present ranges.

Make sure to try InvestingPro to remain in sync with the market pattern and what it means on your buying and selling. As with all funding, it is essential to analysis extensively earlier than making any choices.

InvestingPro empowers buyers to make knowledgeable choices by offering a complete evaluation of undervalued shares with the potential for important upside out there.

***

Purchase or Promote? Get the reply with InvestingPro for Half of the Worth This Black Friday!

Well timed insights and knowledgeable choices are the keys to maximizing revenue potential. This Black Friday, make the neatest funding choice out there and save as much as 55% on InvestingPro subscription plans.

Whether or not you are a seasoned dealer or simply beginning your funding journey, this provide is designed to equip you with the knowledge wanted for extra clever and worthwhile buying and selling.

Black Friday Sale – Declare Your Low cost Now!

Disclosure: On the time of writing, I’m lengthy on the S&P 500, and the by way of the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Belief ETF (QQQ). I’m additionally lengthy on the Expertise Choose Sector SPDR ETF (NYSE:).

I recurrently rebalance my portfolio of particular person shares and ETFs based mostly on ongoing danger evaluation of each the macroeconomic surroundings and firms’ financials.

The views mentioned on this article are solely the opinion of the creator and shouldn’t be taken as funding recommendation.

[ad_2]

Source link