[ad_1]

Revealed on November twenty second, 2023 by Nikolaos Sismanis

Based in 2003, Scion Asset Administration, LLC is a personal funding agency led by investing guru Dr. Michael J. Burry.

Scion Asset Administration has change into more and more common resulting from Dr. Burry’s means to determine undervalued funding alternatives all over the world. The fund solely has 4 shoppers. It costs an asset-based administration payment that may be as excessive as 2% per yr, whereas it could additionally take as much as 20% of the worth of the appreciation from every shopper’s account.

Buyers following the corporate’s 13F filings during the last 3 years (from mid-November 2020 by means of mid-November 2023) would have generated annualized complete returns of 28.4%. For comparability, the S&P 500 ETF (SPY) generated annualized complete returns of 11.0% over the identical time interval.

Word: 13F submitting efficiency is completely different than fund efficiency. See how we calculate 13F submitting efficiency right here.

You possibly can obtain an Excel spreadsheet with metrics that matter of Scion Asset Administration’s present 13F fairness holdings beneath:

Hold studying this text to study extra about Scion Asset Administration.

Desk Of Contents

Scion Asset Administration’s Fund Supervisor, Michael Burry

Michael J. Burry is understood by most because the “Large Quick” investor because of the eponymous film revolving round himself and his story in the course of the days of the Nice Monetary Disaster, a task performed by Christian Bale. Nevertheless, Dr. Burry has a much wider observe report within the investing world.

After attending medical college, Dr. Burry left to begin his personal hedge fund in 2000. He had already constructed a repute as an investor on the time by exhibiting success in worth investing. Particularly, his picks had been revealed on message boards on the inventory dialogue website Silicon Investor again in 1996, with their returns being excellent! In actual fact, Dr. Burry had showcased such nice stock-picking abilities that he drew the curiosity of firms comparable to Vanguard, White Mountains Insurance coverage Group, and famend traders comparable to Joel Greenblatt.

However, it’s Dr. Burry’s legendary performs previous to the Nice Monetary Disaster, and the large returns that adopted that pushed his identify into the worldwide highlight. Significantly, in 2005, Dr. Burry began to focus on the subprime market. Based mostly on his evaluation of mortgage lending practices utilized in 2003 and 2004, he precisely forecasted that the actual property bubble would come tumbling by 2007.

His evaluation resulted in him shorting the market by convincing Goldman Sachs and different funding companies to promote him credit score default swaps towards subprime offers he noticed as weak. Curiously sufficient, when Dr. Burry needed to pay for the credit score default swaps, he skilled an investor revolt, as some traders in his fund feared his prophecy was inaccurate, requesting to withdraw their funds. In the end, Burry’s evaluation proved proper. Not solely did he make a private revenue of $100 million, however his remaining traders earned greater than $700 million.

For instance how profitable Dr. Burry’s picks had been from the origins of Scion Asset Administration to the Nice Monetary Disaster, the hedge fund recorded returns of 489.34% (web of charges and bills) between its inception in November 2000 to June 2008. Compared, the S&P 500 returned slightly below 3%, together with dividends, over the identical interval.

Michael Burry’s Funding Philosophy & Technique

The idea of “Worth Investing can sum up Michael Burry’s complete funding philosophy”. He has said greater than as soon as that his funding type is predicated on Benjamin Graham and David Dodd’s 1934 guide Safety Evaluation. In his phrases: “All my inventory selecting is 100% based mostly on the idea of a margin of security.”

Dr. Burry doesn’t differentiate between small-caps, mid-caps, tech shares, or non-tech shares. He solely seems to be for his or her undervalued components, no matter their sector and sophistication. Exactly as a result of he doesn’t concentrate on a selected trade and since the essence of economic metrics shifts by trade and every firm’s place within the financial cycle, Dr. Burry makes use of the ratio of enterprise worth (EV) to EBITDA when researching funding concepts.

Accordingly, he disregards price-to-earnings ratios to dodge being deceived by an organization’s said metrics. Firm metrics from anybody time interval will be deceptive based mostly on the underlying state of the economic system and macros which will profit or hurt the corporate at a given cut-off date. Reasonably, he pays consideration to off-balance sheet metrics and, naturally, free money stream.

Scion Asset Administration’s Noteworthy Portfolio Adjustments

Throughout its newest 13F submitting, Scion Asset Administration executed the next notable portfolio changes:

Noteworthy new Buys:

Alibaba Group Holding Ltd ADR (BABA)

JD.com Inc ADR (JD)

Noteworthy new Sells:

iHeartMedia Inc (IHRT)

Liberty Latin America Ltd Class C (LILAK)

Very important Vitality Inc. (VTLE)

Costamare Inc (CMRE)

Generac Holdlings Inc (GNRC)

Constitution Communications Inc (CHTR)

New York Neighborhood Bancorp (NYCB)

Hanesbrands, Inc. (HBI)

Cigna Holding Co (CI)

Signet Jewelers Ltd (SIG)

GEO Group, Inc. (The) (GEO)

MGM Resorts Worldwide, Inc. (MGM)

Comstock Assets Inc. (CRK)

Scion Asset Administration’s Portfolio – All 11 Public Fairness Investments

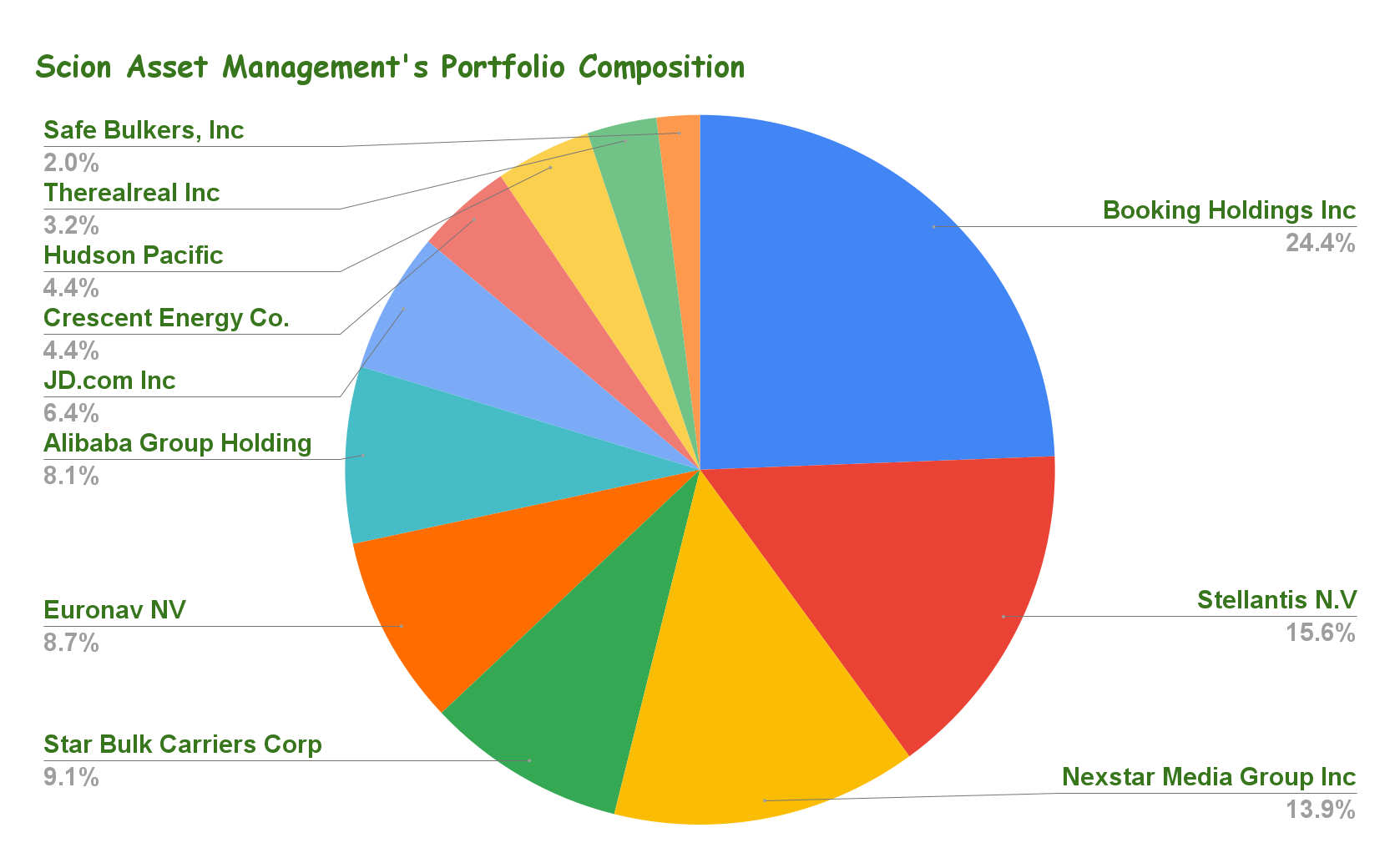

Excluding Michael Burry’s lengthy and brief possibility performs, the core fairness portfolio numbers solely 11 names, with Reserving Holdings accounting for twenty-four.4% of its holdings. The fund’s high 5 holdings, which we analyze beneath, account for 72% of its complete public fairness publicity.

Supply: 13F submitting, Creator

Reserving Holdings

Reserving Holdings is a number one on-line journey firm working a portfolio of well-known manufacturers within the journey and lodging trade. Its most outstanding ones are Reserving.com, Priceline, Agoda, Kayak, and OpenTable. The corporate facilitates the reserving of inns, flights, rental automobiles, and restaurant reservations by means of these portals, catering to a various vary of vacationers.

Again in 2021, Reserving Holdings confronted large challenges because of the COVID-19 pandemic impacting international journey. Nevertheless, the corporate tailored its technique on the time, and at present, it’s as soon as once more thriving!

Revenues have reached a brand new report of $20.6 billion over the previous 12 months, sustaining a really spectacular development pattern.

Reserving Holdings is Scion’s largest holding, accounting for twenty-four.4% of its fairness holdings.

Stellantis N.V

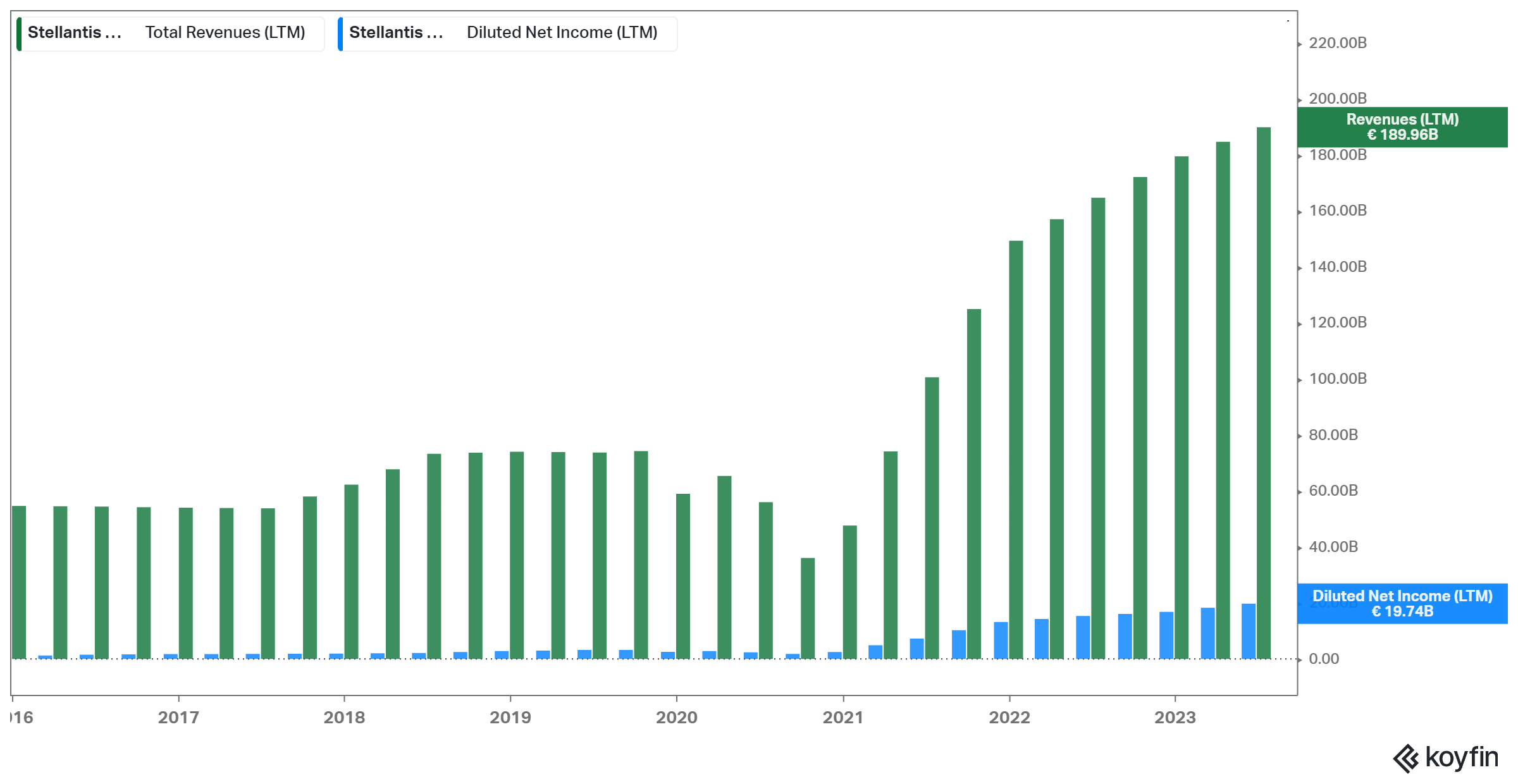

Stellantis N.V. is a multinational automotive producer fashioned in 2021 by means of the merger of Fiat Chrysler Vehicles (FCA) and PSA Group. Headquartered in Amsterdam, Stellantis is now one of many world’s largest automotive firms, bringing collectively a various portfolio of iconic manufacturers.

The corporate encompasses a variety of manufacturers, together with Fiat, Chrysler, Jeep, Dodge, Ram, Peugeot, Citroën, Opel, Vauxhall, Alfa Romeo, and Maserati, amongst others. Stellantis operates throughout numerous segments, producing vehicles, industrial autos, and elements.

The merger aimed to create synergies, improve effectivity, and strengthen Stellantis’ aggressive place within the international automotive market. By combining the strengths and assets of FCA and PSA Group, Stellantis seeks to navigate trade challenges, together with the transition to electrical and autonomous autos.

Following the merger, income development has picked up, with last-twelve-month gross sales amounting to almost €190 million. The corporate’s earnings have additionally been rising.

Stellantis is Scion’s second-largest holding, accounting for 15.6% of its fairness holdings.

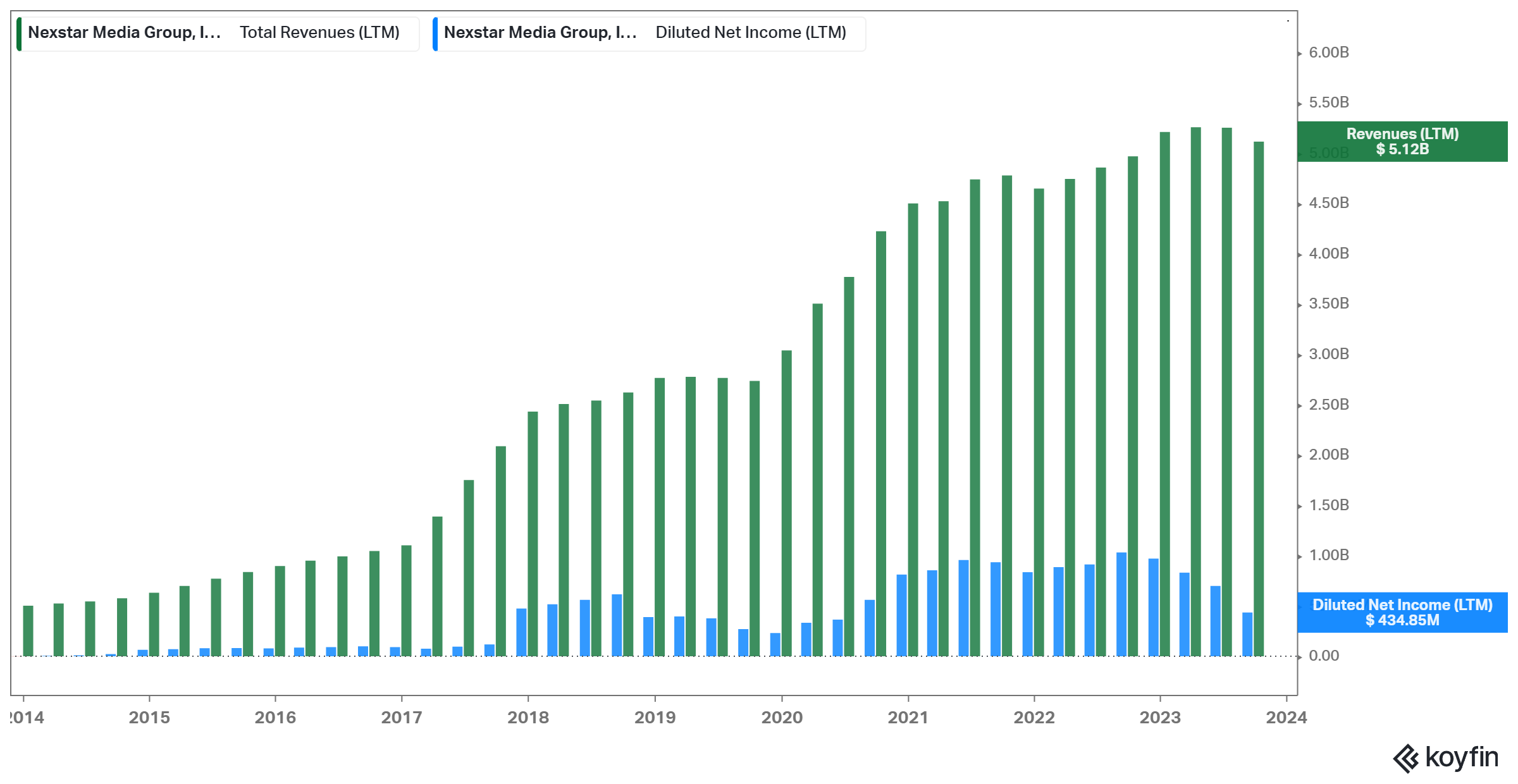

Nexstar Media Group Inc

Based mostly in Irving, Texas, Nexstar owns and operates tv stations throughout the USA, reaching a big viewers by means of its community of associates. The corporate’s portfolio contains stations affiliated with main broadcast networks comparable to NBC, CBS, ABC, and Fox.

Nexstar focuses on native information, leisure, and sports activities programming, delivering content material to viewers in each massive and mid-sized markets. The corporate’s stations play an important function in offering information and data to their respective communities.

Along with its tv broadcasting operations, Nexstar has expanded its presence within the digital media area. The corporate engages in digital publishing, providing content material by means of web sites and cellular apps. This multi-platform method permits Nexstar to achieve audiences by means of conventional broadcasts and on-line channels.

Whereas the inventory has produced noteworthy returns over time, with he firm being persistently worthwhile, its bottom-line margins have been suppressed notably these days.

Nexstar is Scion’s third-largest holding, accounting for 13.9% of its fairness holdings.

Star Bulk Carriers

Star Bulk Carriers Corp. is a world main international delivery firm that owns and operates a contemporary and numerous fleet of dry bulk vessels. Particularly, the corporate owns 124 high-quality vessels on a completely delivered foundation with a mean age of round 11.7 years and a dwt (deadweight ton) capability of 13.5 million metric tons.

The vessels are utilized to move a broad vary of main and minor bulk commodities, together with iron ore, minerals, grain, bauxite, fertilizers, and metal merchandise, alongside worldwide delivery routes. Star Bulk Carriers generated $1.44 billion in revenues final yr and is predicated in Marousi, Greece.

The dry bulk delivery trade is wildly cyclical in nature. Dry bulk charges remained fairly depressed over the previous decade for a lot of elements, together with a excessive order guide, which led to an oversupply of dry bulk vessels relative to the underlying demand.

Following the provision chain disaster attributable to the pandemic, TCE charges skyrocketed, permitting Star Bulk to report large earnings in 2020 and 2021. Charges plummeted in 2022 and nonetheless stay fairly smooth to this present day. That mentioned, Star Bulk enjoys the perfect supply-side dynamics in many years with slowing fleet development (order guide at 25+ yr lows as a share of the worldwide fleet).

Star Bulk Carriers is Scion’s fourth-largest holding, accounting for 9.1% of its fairness holdings.

Euronav NV

Euronav stands because the world’s premier impartial publicly traded tanker firm, devoted to the worldwide conveyance and storage of crude oil.

Headquartered within the vibrant metropolis of Antwerp, Belgium, with a widespread presence throughout Europe and Asia, the corporate has grown from its familial roots with 17 vessels to emerge as a formidable worldwide participant.

Euronav’s forward-looking method is encapsulated in its long-term technique, centered on reaching through-cycle profitability. This entails a dynamic adjustment of its steadiness sheet leverage and liquidity place, aligning with the varied sources of its revenues.

These revenues, whether or not mounted (long-term FSO revenue and/or TC portfolio) or floating (pool and spot), drive Euronav’s resilience and success in navigating the complexities of the worldwide delivery market.

The corporate’s efficiency is very cyclical because of the cyclical nature of tankers. Nevertheless, present market situations are fairly favorable, evident by the continued rise in revenues and earnings.

Euronav is Scion’s fifth-largest holding, accounting for 8.7% of its fairness holdings.

Remaining Ideas

Following the large triumph he skilled by efficiently predicting the subprime mortgage disaster of 2007-2008, Dr. Michael Burry has grown right into a dwelling legend on the earth of finance. His solemn investing philosophy has resulted in outsized market returns over the previous few years, beating the S&P 500 by a large margin.

Whereas Scion Asset Administration’s portfolio lacks diversification, its holdings include traits that replicate Dr. Burry’s ideas. However, most fund shares appear to bear their justifiable share of dangers. Thus, be conscious and conduct your individual analysis earlier than allocating your hard-earned cash to any of those names.

Further Assets

See the articles beneath for evaluation on different main funding companies/asset managers/gurus:

If you’re desirous about discovering extra high-quality dividend development shares appropriate for long-term funding, the next Positive Dividend databases might be helpful:

The key home inventory market indices are one other strong useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.

[ad_2]

Source link