[ad_1]

Willis Towers Watson is Bauopost’s third-largest place, occupying about 9.9% of its fairness holdings.

Constancy Nationwide Data Providers, Inc. (FIS)

Constancy Nationwide Data Providers, Inc. is a supplier of economic know-how providers for retailers, banks, and capital markets companies. The corporate was based in 1968 and is headquartered in Jacksonville, Florida. FIS gives know-how options for retail and institutional banking, funds, asset and wealth administration, danger and compliance, fee processing, consulting, and outsourcing.

Shares of Constancy have plummeted currently following the banking disaster that regional banks have been experiencing. However, the corporate ought to be one of many extra resilient gamers within the area and is anticipated to stay worthwhile this 12 months.

Constancy Nationwide Data Providers is Baupost’s fifth-largest holding. The fund elevated its place by 2.7% through the quarter.

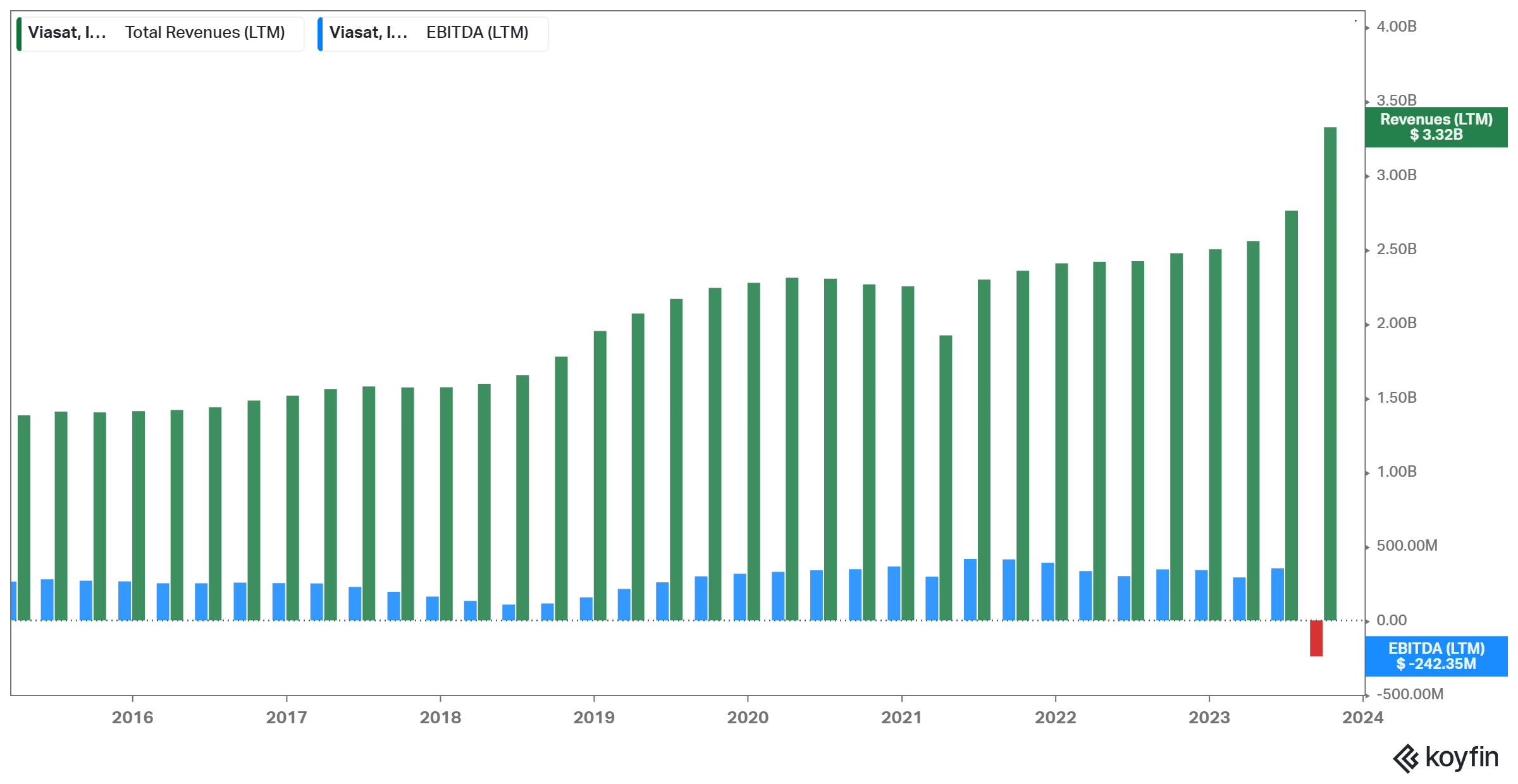

Viasat, Inc. (VSAT)

Media conglomerate Viasat is Baupost’s third largest holding, accounting for roughly 7.8% of its portfolio. Within the present panorama, legacy media conglomerates have been in hassle as content material creation is changing into more and more decentralized.

Corporations equivalent to Netflix (NFLX), Amazon (AMZN), and even Apple (AAPL) have began producing their very own content material, whereas the information shops have moved principally on-line, producing gross sales via advertisements or a subscription charge.

In our view, Baupost holds a stake in Viasat as an activist investor because of the fund holding about 13% of its complete excellent shares. This means the likelihood that Baupost desires to have an energetic affect on how the corporate is run, with a possible goal in direction of modernizing.

For retail buyers, the place may very well be a dangerous long-term guess, although an admittedly attractively priced one.

Warner Bros. Discovery, Inc. (WBD)

Warner Bros. Discovery is a global mass media firm and one of many largest within the area globally. The inventory has now declined to the identical ranges it was buying and selling 15 years in the past, because the mixed firm has had a tough time integrating its belongings and having them produce strong money circulate. On the one hand, Warner Bros. Discovery already achieved $750 million in incremental synergies final 12 months, whereas this 12 months, these synergies are anticipated to ramp up notably to $2.75 billion and $3.5 billion in 2024+. However such enhancements stay unsure.

The fund left its place unchanged through the quarter. Warner Bros. Discovery is now Baupost’s sixth-largest holding, and the fund owns 1% of the corporate’s complete excellent shares.

Clarivate Plc (CLVT)

Clarivate is a outstanding international info providers firm famend for its dedication to advancing innovation via insights and analytics. With a multifaceted method, Clarivate caters to various industries, together with life sciences, healthcare, academia, and mental property.

On the core of Clarivate’s choices is the ‘Net of Science,’ a complete analysis database offering entry to an intensive assortment of scholarly articles and analysis papers. This platform serves as a significant useful resource for researchers, lecturers, and professionals searching for the newest developments of their respective fields.

The corporate’s revenues and EBITDA have been strong in recent times, although progress has been considerably weak.

Clarivate is a wholly new holding for Baupost. The inventory makes up round 3.8% and is now the fund’s 7-largest place.

SS&C Applied sciences Holdings, Inc. (SSNC)

Based in 1986, SS&C has grown through the years via a mixture of natural progress and acquisitions. The corporate has acquired quite a few different monetary know-how and software program companies to increase its product choices and market attain. This technique has allowed SS&C to develop into a outstanding participant within the monetary know-how sector.

SS&C serves a various shopper base that features funding managers, asset homeowners, insurance coverage firms, banks, hedge funds, and different monetary establishments. Their software program options goal to streamline operations, improve decision-making, enhance effectivity, and allow compliance with trade laws.

Baupost initially invested in SS&C in Q2-2022. It’s the fund’s eighth-largest place, making up round 3.2% of its portfolio.

[ad_2]

Source link