[ad_1]

Billionaire Charlie Munger, the investing sage who made a fortune even earlier than he turned Warren Buffett’s right-hand man at Berkshire Hathaway, has died at age 99.

Munger died Tuesday, in line with a press launch from Berkshire Hathaway. The conglomerate mentioned it was suggested by members of Munger’s household that he peacefully died this morning at a California hospital. He would have turned 100 on New Yr’s Day.

“Berkshire Hathaway couldn’t have been constructed to its current standing with out Charlie’s inspiration, knowledge and participation,” Buffett mentioned in a press release.

Along with being Berkshire vice chairman, Munger was an actual property lawyer, chairman and writer of the Every day Journal Corp., a member of the Costco board, a philanthropist and an architect.

In early 2023, his fortune was estimated at $2.3 billion — a jaw-dropping quantity for many individuals however vastly smaller than Buffett’s unfathomable fortune, which is estimated at greater than $100 billion.

Throughout Berkshire’s 2021 annual shareholder assembly, the then-97-year-old Munger apparently inadvertently revealed a well-guarded secret: that Vice Chairman Greg Abel “will preserve the tradition” after the Buffett period.

Munger, who wore thick glasses, had misplaced his left eye after issues from cataract surgical procedure in 1980.

Munger was chairman and CEO of Wesco Monetary from 1984 to 2011, when Buffett’s Berkshire bought the remaining shares of the Pasadena, California-based insurance coverage and funding firm it didn’t personal.

Buffett credited Munger with broadening his funding technique from favoring troubled corporations at low costs in hopes of getting a revenue to specializing in higher-quality however underpriced corporations.

An early instance of the shift was illustrated in 1972 by Munger’s potential to influence Buffett to log out on Berkshire’s buy of See’s Candies for $25 million although the California sweet maker had annual pretax earnings of solely about $4 million. It has since produced greater than $2 billion in gross sales for Berkshire.

“He weaned me away from the thought of shopping for very so-so corporations at very low cost costs, figuring out that there was some small revenue in it, and in search of some actually fantastic companies that we may purchase in truthful costs,” Buffett instructed CNBC in Might 2016.

Or as Munger put it on the 1998 Berkshire shareholder assembly: “It is not that a lot enjoyable to purchase a enterprise the place you actually hope this sucker liquidates earlier than it goes broke.”

Munger was usually the straight man to Buffett’s jovial commentaries. “I’ve nothing so as to add,” he would say after one in all Buffett’s loquacious responses to questions at Berkshire annual conferences in Omaha, Nebraska. However like his good friend and colleague, Munger was a font of knowledge in investing, and in life. And like one in all his heroes, Benjamin Franklin, Munger’s perception did not lack humor.

“I’ve a good friend who says the primary rule of fishing is to fish the place the fish are. The second rule of fishing is to always remember the primary rule. We have gotten good at fishing the place the fish are,” the then-93-year-old Munger instructed the hundreds of individuals at Berkshire’s 2017 assembly.

He believed in what he known as the “lollapalooza impact,” wherein a confluence of things merged to drive funding psychology.

A son of the heartland

Charles Thomas Munger was born in Omaha on Jan. 1, 1924. His father, Alfred, was a lawyer, and his mom, Florence “Toody,” was from an prosperous household. Like Warren, Munger labored at Buffett’s grandfather’s grocery retailer as a youth, however the two future joined-at-the-hip companions did not meet till years later.

At 17, Munger left Omaha for the College of Michigan. Two years later, in 1943, he enlisted within the Military Air Corps, in line with Janet Lowe’s 2003 biography “Rattling Proper!”

The navy despatched him to the California Institute of Expertise in Pasadena to check meteorology. In California, he fell in love along with his sister’s roommate at Scripps Faculty, Nancy Huggins, and married her in 1945. Though he by no means accomplished his undergraduate diploma, Munger graduated magna cum laude from Harvard Regulation Faculty in 1948, and the couple moved again to California, the place he practiced actual property legislation. He based the legislation agency Munger, Tolles & Olson in 1962 and targeted on managing investments on the hedge fund Wheeler, Munger & Co., which he additionally based that yr.

“I am pleased with being an Omaha boy,” Munger mentioned in a 2017 interview with Dean Scott Derue of the Michigan Ross Enterprise Faculty. “I generally use the outdated saying, ‘They bought the boy out of Omaha however they by no means bought Omaha out of the boy.’ All these old style values — household comes first; be able so that you could assist others when troubles come; prudent, smart; ethical responsibility to be affordable [is] extra essential than the rest — extra essential than being wealthy, extra essential than being essential — an absolute ethical responsibility.”

In California, he partnered with Franklin Otis Sales space, a member of the founding household of the Los Angeles Occasions, in actual property. One in all their early developments turned out to be a profitable rental challenge on Sales space’s grandfather’s property in Pasadena. (Sales space, who died in 2008, had been launched to Buffett by Munger in 1963 and have become one in all Berkshire’s largest buyers.)

“I had 5 actual property initiatives,” Munger instructed Derue. “I did each aspect by aspect for a number of years, and in a only a few years, I had $3 million — $4 million.”

Munger closed the hedge fund in 1975. Three years later, he turned vice chairman of Berkshire Hathaway.

‘We expect a lot alike that it is spooky’

In 1959, at age 35, Munger returned to Omaha to shut his late father’s authorized observe. That is when he was launched to the then-29-year-old Buffett by one in all Buffett’s investor purchasers. The 2 hit it off and stayed involved regardless of dwelling half a continent away from one another.

“We expect a lot alike that it is spooky,” Buffett recalled in an interview with the Omaha World-Herald in 1977. “He is as sensible and as high-grade a man as I’ve ever run into.”

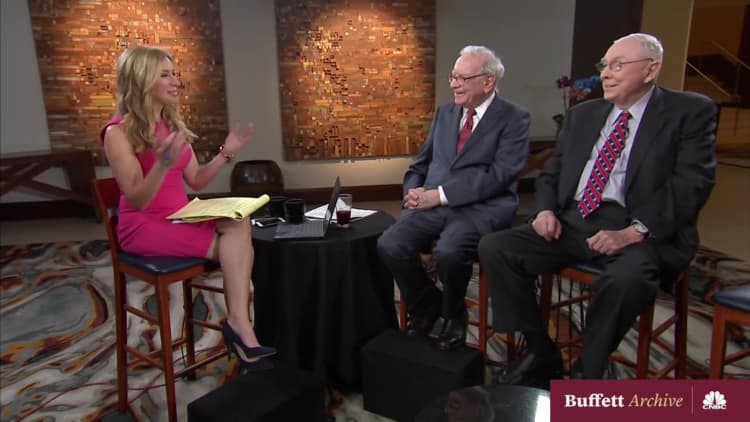

“We by no means had an argument in your entire time we have recognized one another, which is sort of 60 years now,” Buffett instructed CNBC’s Becky Fast in 2018. “Charlie has given me the final word reward that an individual may give to any person else. He is made me a greater individual than I might have in any other case been. … He is given me a whole lot of good recommendation over time. … I’ve lived a greater life due to Charlie.”

The melding of the minds targeted on worth investing, wherein shares are picked as a result of their value seems to be undervalued based mostly on the corporate’s long-term fundamentals.

“All clever investing is worth investing — buying greater than you’re paying for,” Munger as soon as mentioned. “You should worth the enterprise with a purpose to worth the inventory.”

Warren Buffett (L), CEO of Berkshire Hathaway, and vice chairman Charlie Munger attend the 2019 annual shareholders assembly in Omaha, Nebraska, Might 3, 2019.

Johannes Eisele | AFP | Getty Pictures

However in the course of the coronavirus outbreak in early 2020, when Berkshire suffered an enormous $50 billion loss within the first quarter, Munger and Buffett had been extra conservative than they had been in the course of the Nice Recession, once they invested in U.S. airways and financials like Financial institution of America and Goldman Sachs hit exhausting by that downturn.

“Nicely, I might say principally we’re just like the captain of a ship when the worst storm that is ever occurred comes,” Munger instructed The Wall Avenue Journal in April 2020. “We simply need to get via the storm, and we might fairly come out of it with an entire lot of liquidity. We’re not taking part in, ‘Oh goody, goody, the whole lot’s going to hell, let’s plunge 100% of the reserves’ [into buying businesses].”

The philanthropist/architect

Munger donated lots of of tens of millions of {dollars} to instructional establishments, together with the College of Michigan, Stanford College and Harvard Regulation Faculty, usually with the stipulation that the varsity settle for his constructing designs, although he was not formally educated as an architect.

At Los Angeles’ Harvard-Westlake prep college, the place Munger had been a board member for many years, he ensured that the women bogs had been bigger than the boys room in the course of the development of the science middle within the Nineties.

“Any time you go to a soccer sport or a perform there’s an enormous line outdoors the ladies’s rest room. Who would not know that they pee another way than the lads?” Munger instructed The Wall Avenue Journal in 2019. “What sort of fool would make the lads’s rest room and the ladies’s rest room the identical dimension? The reply is, a standard architect!”

Munger and his spouse had three youngsters, daughters Wendy and Molly, and son Teddy, who died of leukemia at age 9. The Mungers divorced in 1953.

Two years later, he married Nancy Barry, whom he met on a blind date at a rooster dinner restaurant. The couple had 4 youngsters, Charles Jr., Emilie, Barry and Philip. He additionally was the stepfather to her two different sons, William Harold Borthwick and David Borthwick. The Mungers, who had been married 54 years till her demise in 2010, contributed $43.5 million to Stanford College to assist construct the Munger Graduate Residence, which homes 600 legislation and graduate college students.

Requested by CNBC’s Fast in a February 2019 “Squawk Field” interview concerning the secret to an extended and pleased life, Munger mentioned the reply “is straightforward, as a result of it is so easy.”

“You do not have a whole lot of envy, you do not have a whole lot of resentment, you do not overspend your revenue, you keep cheerful despite your troubles. You cope with dependable individuals and also you do what you are presupposed to do. And all these easy guidelines work so nicely to make your life higher. And so they’re so trite,” he mentioned.

“And staying cheerful … as a result of it is a clever factor to do. Is that so exhausting? And might you be cheerful once you’re completely mired in deep hatred and resentment? After all you’ll be able to’t. So why would you’re taking it on?”

— CNBC’s Yun Li contributed reporting.

[ad_2]

Source link