[ad_1]

Up to date on November twenty ninth, 2023

Charlie Munger died on November twenty eighth, 2023 on the age of 99. He was Warren Buffett’s enterprise companion and vice-chairman of Berkshire Hathaway (BRK.B), one of many largest and most properly regarded U.S. firms.

As a result of management of Munger and Buffett, Berkshire’s historic investing observe file is second-to-none. There may be loads for traders to be taught from finding out Berkshire’s inventory holdings. You’ll be able to obtain Berkshire Hathaway’s inventory portfolio under.

Warren Buffett tends to get a lot of the consideration on the subject of the dialogue of Berkshire’s exceptional efficiency over the previous a number of many years. However Munger performed an important position in Berkshire’s development.

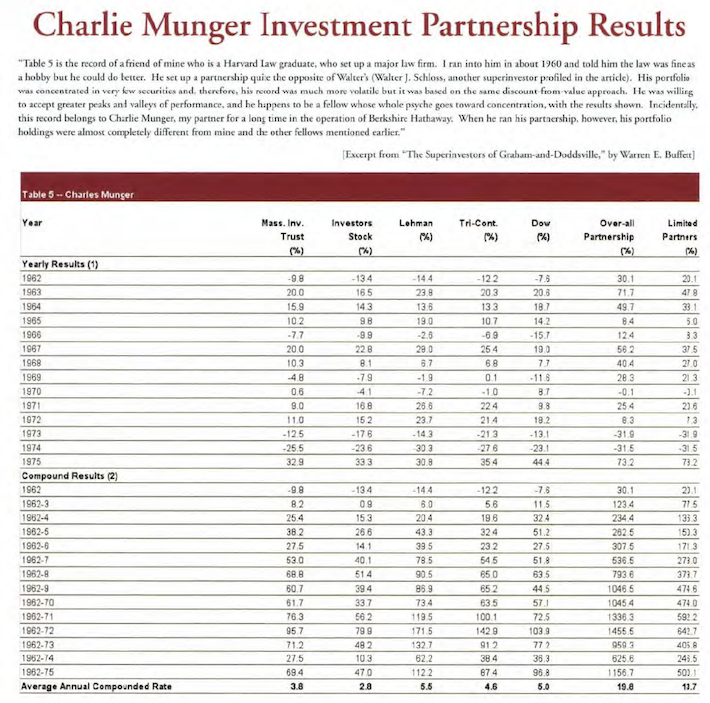

Munger really managed his personal funding partnership earlier than teaming up with Buffett at Berkshire Hathaway. Munger’s personal partnership averaged returns of 19.8% a yr from 1962 to 1975 versus simply 5% a yr for the Dow Jones Industrial Common over the identical interval.

This text supplies an outline of Munger’s most fascinating quotes. Buyers can be taught from his actionable insights and incorporate them in each enterprise and life.

Desk of Contents

You’ll be able to bounce to a selected part of this text with the hyperlinks under:

Charlie Munger’s Life & Funding Partnership Outcomes

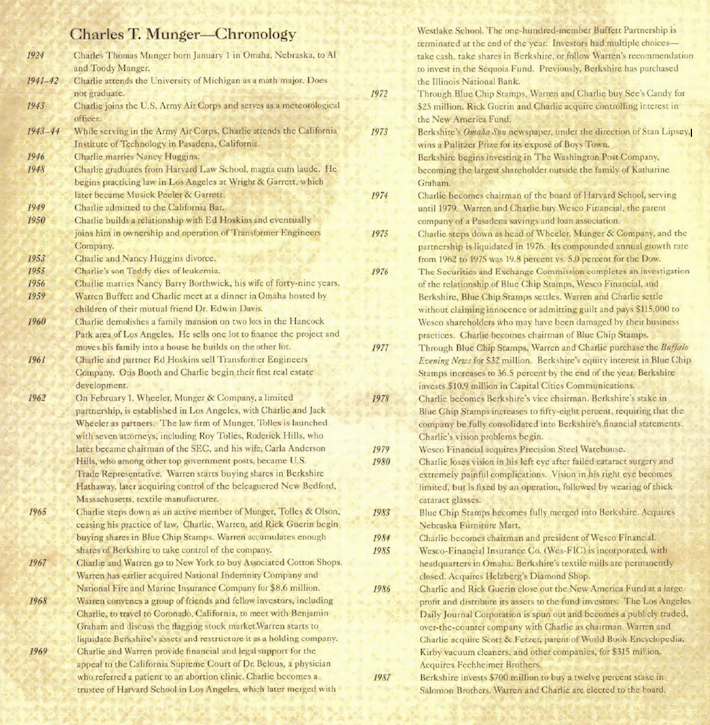

Charlie Munger had an extended life, dwelling till virtually 100. His life might be finest summarized with the next from the acclaimed e book Poor Charlie’s Almanack:

Supply: Poor Charlie’s Almanack

As talked about, he beforehand ran his personal investing partnership. his exceptional observe file might help us to grasp why we’d be capable of be taught from this implausible investor. The observe file of the Charlie Munger investing partnership is proven under.

Supply: Poor Charlie’s Almanack

Munger’s restricted companions realized 19.8% annualized returns in the course of the lifetime of the partnership (earlier than charges), evaluating very favorably to the 5.0% return realized by the Dow Jones Industrial Common in the identical time interval. Clearly, we’ve got rather a lot to be taught from this nice investor.

Munger, Buffett, & Investing

Charlie Munger closely influenced Warren Buffett’s funding fashion. Munger believed in holding a hyper-concentrated portfolio of extraordinarily high-quality companies. Munger eschewed diversification – he was comfy holding as few as 3 securities at a time.

Munger’s philosophy of shopping for and holding high-quality companies for the long-run clearly rubbed off on Buffett. Earlier than Munger, Buffett was far more of a conventional worth investor. After Munger, Buffett targeted on high-quality companies buying and selling at honest or higher costs.

One of many fundamental differentiators between Warren Buffett and Charlie Munger was Munger’s insistence on pondering by way of “psychological fashions”, which we clarify under.

Psychological Fashions

Charlie Munger’s pursuits went far past investing. He was a generalist with broad data throughout a number of fields. Munger was maybe finest identified for his ‘psychological fashions’ method to fixing issues.

Warren Buffett says Munger had “the perfect 30 second thoughts on the earth. He goes from A to Z in a single transfer. He sees the essence of every thing earlier than you even end the sentence“.

Munger suggested you perceive the ‘large concepts’ from a variety of topics – from philosophy, science, physics, investing, and so forth. This ‘latticework’ of psychological fashions will assist you come to appropriate conclusions by viewing the issue from a number of vantage factors.

Charlie Munger’s psychological fashions lifestyle gave him a singular perspective. The rest of this text is devoted to presenting and analyzing quotes from Charlie Munger as they apply to enterprise, investing, and dwelling a satisfying life.

On Studying

Munger was maybe best-known as a loyal life-long learner in a large variety of disciplines. Munger thought that universities ought to embrace a category referred to as “Remedial Worldly Knowledge” that taught all of the ideas that college students ought to have discovered previous to enrolling.

Due to Munger’s popularity as a passionate learner, it’s helpful to grasp his definition of knowledge:

“What’s elementary, worldly knowledge? Nicely, the primary rule is that you would be able to’t actually know something should you simply keep in mind remoted info and try to bang ’em again. If the info don’t dangle collectively on a latticework of idea, you don’t have them in a usable kind.

You’ve bought to have fashions in your head. And also you’ve bought to array your expertise – each vicarious and direct – on this latticework of fashions. You could have observed college students who simply attempt to keep in mind and pound again what’s remembered. Nicely, they fail at school and fail in life. You’ve bought to hold expertise on a latticework of fashions in your head.”

As this quote suggests, Munger relied closely on psychological fashions in his pursuit to grasp the world round him. Munger thought it was vital to grasp the “large concepts” from the “large disciplines,” and generalize from there:

“It’s essential to know the large concepts within the large disciplines and use them routinely – all of them, not only a few. Most individuals are skilled in a single mannequin – economics, for instance – and attempt to resolve all issues in a method. You understand the previous saying: To the person with a hammer, the world seems like a nail. It is a dumb approach of dealing with issues.”

If psychological fashions are so vital, this begs the query – how does one be taught them?

Munger believed that one of the best ways to be taught is by mastering the perfect that different folks have found out:

“I consider within the self-discipline of mastering the perfect that different folks have ever found out. I don’t consider in simply sitting down and attempting to dream all of it up your self. No one’s that sensible…”

Munger additionally believed it’s crucial to be taught from others’ previous errors:

“We acknowledged early on that very sensible folks do very dumb issues, and we needed to know why and who, in order that we might keep away from them.”

To be taught from others, Munger’s favourite medium was studying.

Supply: Poor Charlie’s Almanack

Studying and understanding the nice concepts in philosophy, economics, science, and different disciplines slowly opens your thoughts to totally different potentialities in a approach that staying in a single slim discipline alone won’t ever be capable of accomplish.

It’s additionally vital to have the inborn temperament to at all times be taught extra. Munger described how some folks have an inner disposition for studying within the following passage:

“How do some folks get wiser than different folks? Partly it’s inborn temperament. Some folks would not have temperament for investing. They’re too fretful; they fear an excessive amount of. However should you’ve bought temperament, which mainly means being very affected person, but mix that with an unlimited aggression when sufficient to do one thing, then you definately simply progressively be taught the sport, partly by doing, partly by finding out. Clearly, the extra arduous classes you’ll be able to be taught vicariously, as an alternative of from your individual horrible experiences, the higher off you can be. I don’t know anybody who did it with nice rapidity. Warren Buffett has develop into one hell of rather a lot higher investor because the day I met him, and so have I. If we had been frozen at any given stage, with the data hand we had, the file would have been a lot worse than it’s. so the sport is to continue learning, and I don’t suppose individuals are going to continue learning who don’t like the educational course of.”

When it got here to studying, Munger notably emphasised the arduous sciences. He studied arithmetic as an undergraduate pupil (although he by no means accomplished that diploma), and maintained his bias towards quantitative topics for the remainder of his life.

“If you don’t get this elementary, however mildly unnatural, arithmetic of elementary chance into your repertoire, then you undergo an extended life like a one–legged man in an ass–okayicking contest. You’re giving a big benefit to all people else.”

Munger believed that permutations and combos (which come from the sector of math often known as combinatorics that helps reply questions like “what number of methods are there to order a gaggle of numbers?”) had been particularly helpful.

“And the nice helpful mannequin, after compound curiosity, is the elementary math of permutations and combos.”

Munger was clearly an unorthodox learner. Given this information, it’s unsurprising that he thinks the present post-secondary training system is damaged:

“There’s rather a lot improper [with American universities]. I’d take away three-fourths of the school – every thing however the arduous sciences. However no person’s going to try this, so we’ll must stay with the defects. It’s wonderful how wrongheaded [the teaching is]. There may be deadly disconnectedness. You might have these squirrelly folks in every division who don’t see the large image.”

This poor educating is particularly current within the discipline of investing, as the next quotes illustrate:

“Beta and trendy portfolio idea and the like – none of it makes any sense to me. We’re attempting to purchase companies with sustainable aggressive benefits at a low, or perhaps a honest, value.”

“How can professors unfold this [nonsense that a stock’s volatility is a masure of risk]? I’ve been ready for this craziness to finish for many years. It’s been dented, nevertheless it’s nonetheless on the market.”

“Warren as soon as mentioned to me, “I’m most likely misjudging academia typically [in thinking so poorly of it] as a result of the folks that work together with me have bonkers theories.”

To Munger, studying was the most effective methods to enhance in enterprise, investing, and in life.

“Those that continue learning, will maintain rising in life.”

And, serving to others to be taught will be simply as beneficial:

“One of the best factor a human being can do is to assist one other human being know extra.”

Munger’s potential and willingness to be taught had been among the many causes he grew to become such a fantastic investor. One more reason was his affected person temperament. Munger’s ideas on the significance of psychology in life and investing are mentioned under.

On Psychology

Charlie Munger liked psychology. In a speech referred to as The Psychology of Human Misjudgment that Munger delivered to Caltech college students in 1995, he outlined his perspective on the 25 cognitive biases which have the best potential to impair human decision-making.

The 25 biases are:

Reward and Punishment Superresponse Tendency

Liking/Loving Tendency

Disliking/Hating Tendency

Doubt-Avoidance Tendency

Inconsistency-Avoidance Tendency

Curiosity Tendency

Kantian Equity Tendency

Envy/Jealousy Tendency

Reciprocation Tendency

Affect-from-Mere-Affiliation Tendency

Easy, Ache-Avoiding Psychology Denial

Extreme Self-Regard Tendency

Overoptimism Tendency

Deprival-Superreaction Tendency

Social-Proof Tendency

Distinction-Misreaction Tendency

Stress-Affect Tendency

Availability-Misweighting Tendency

Use-It-or-Lose-It Tendency

Drug-Misinfluence Tendency

Senescence-Misinfluence Tendency

Authority-Misinfluence Tendency

Twaddle Tendency

Purpose-Respecting Tendency

Lollapalooza Tendency – The Tendency to Get Excessive Penalties From Confluences of Psychology Tendencies Performing in Favor of a Explicit Final result

Every of those concepts is exterior the scope of this text. In the event you’re fascinated with studying extra about them, we advocate studying Poor Charlie’s Almanack. With this mentioned, you’ll seemingly discover Munger’s emphasis on psychology all through the remainder of this text, as we discover how extra of his quotes apply to different areas of enterprise and life.

On When To Purchase

As we noticed earlier, Munger ran his personal funding partnership that beat the market over a significant time frame. He additionally has a robust affect on Berkshire Hathaway’s funding choices to this present day. Accordingly, his ideas on when to purchase shares are price discussing.

Munger’s funding technique was very boring. Protecting a cool head and investing in high-quality companies with lengthy histories of rewarding shareholders is probably not as thrilling, however it’ll generate strong returns over time with much less threat than investing in ‘the subsequent large factor’. When the gang strikes on, massive losses usually comply with massive positive factors. Munger sought alternative that’s engaging when adjusted for threat. In different phrases, he appeared for mispriced gambles.

“You’re on the lookout for a mispriced gamble. That’s what investing is. And you must know sufficient to know whether or not the gamble is mispriced. That’s worth investing.”

Normally, this entailed shopping for companies under their intrinsic worth. Shopping for companies under their honest worth requires you may have an concept of what honest worth is. When the gang turns into overly pessimistic they give attention to damaging potentialities and low cost optimistic potentialities. Having a greater estimate of the true chances provides an investor a sizeable edge that may be exploited.

Sadly, severely ‘mispriced gambles’ don’t come alongside usually. Munger beneficial ready for the perfect alternatives to return round. After they do, transfer rapidly and decisively.

“In the event you took our prime fifteen choices out, we’d have a fairly common file. It wasn’t hyperactivity, however a hell of loads of endurance. You caught to your ideas and when alternatives got here alongside, you pounced on them with vigor.”

The alternatives Munger appeared for are nice companies buying and selling at a reduction to their honest worth.

“A terrific enterprise at a good value is superior to a good enterprise at a fantastic value.”

So what defines a fantastic enterprise? Munger thought {that a} key attribute of enterprise was one which required minimal reinvestment. Stated in another way, Munger appreciated the flexibility to withdraw money from a robust performing enterprise.

On the floor, it would seem to be that is at all times the case. The next passage explains why this isn’t true in observe:

“There are two varieties of companies: The primary earns twelve %, and you’ll take the income out on the finish of the yr. The second earns twelve %, however all the surplus money have to be reinvested – there’s by no means any money. It jogs my memory of the man who sells building tools – he seems at his used machines, taken in as prospects purchased new ones, and says “There’s all of my revenue, rusting within the yard.” We hate that form of enterprise.”

Munger additionally favored enterprise fashions that had been simple to grasp, and extra importantly, simple to handle. Buyers can’t management who will get appointed to guide the businesses they spend money on, so it is very important give attention to companies that don’t require a genius to be run successfully.

“Put money into a enterprise any idiot can run, as a result of sometime a idiot will. If it gained’t stand a bit of mismanagement, it’s not a lot of a enterprise. We’re not on the lookout for mismanagement, even when we are able to stand up to it.”

As soon as an investor finds a fantastic enterprise, it’s vital to be prepared to offer it time. To Charlie Munger, endurance was a advantage:

“The massive cash shouldn’t be within the shopping for or the promoting, however within the ready.”

Munger used the financial idea of alternative value to filter by way of funding alternatives.

“Alternative value is a large filter in life. In the event you’ve bought two suitors who’re actually wanting to have you ever and one is approach the hell higher than the opposite, you would not have to spend a lot time with the opposite. And that’s the way in which we filter out shopping for alternatives.”

Certainly, it’s arduous to overstate the significance of alternative value in Munger’s funding philosophy. The Berkshire funding managers eschew educational funding evaluation methods like weighted common value of capital (WACC), as an alternative preferring the far-simpler alternative value. The next change between Warren Buffett and Charlie Munger at a Berkshire Hathaway annual assembly illustrated this:

Buffett: Charlie and I don’t know our value of capital. It’s taught at enterprise faculties, however we’re skeptical. We simply look to do essentially the most clever factor we are able to with the capital that we’ve got. We measured something in opposition to our alternate options. I’ve by no means seen a cost-of-capital calculation that made sense to me. Have you ever, Charlie?

Munger: By no means. In the event you take the perfect textual content in economics by Mankiw, he says clever folks make choices primarily based on alternative prices – in different phrases, it’s your alternate options that matter. That’s how we make all of our choices. The remainder of the world has gone off on some kick – there’s even a price of fairness capital. A wonderfully wonderful psychological malfunction.

Munger additionally believed {that a} compelling aggressive benefit was one motive to be fascinated with a inventory. What stands out about Munger’s evaluation of aggressive benefits is how he associated them to disciplines exterior of the world of investing. For instance, Munger associated geometry to scale-based aggressive benefits (usually referred to as economies of scale) within the following passage.

“Let’s undergo a listing – albeit an incomplete one – of attainable benefits of scale. Some come from simple geometry. If you’re building a fantastic circular tank, clearly, as you construct it larger, the quantity of metal you use in the floor goes up with the sq. and the cubic quantity goes up with the dice. In order you improve the scale, you’ll be able to hold a lot extra volume per unit space of metal.

And there are all varieties of issues like that the place the simple geometry- the easy reality- gives you a bonus of scale.”

It’s additionally price mentioning that Munger (and, by extension, Berkshire Hathaway) didn’t make funding choices primarily based on macroeconomics. In response to the query “What macro statistics do you commonly monitor or discover helpful in your try to grasp the broader financial panorama?” Munger mentioned:

“None. I discover by staying abreast of our Berkshire subsidiaries and by commonly studying enterprise newspapers and magazines, I’m uncovered to an unlimited quantity of fabric on the micro stage. I discover that what I see happening there just about informs me of what’s occurring on the macro stage.”

We’ve seen that Munger favored to purchase nice companies with sustainable aggressive benefits once they commerce at honest or higher costs. The subsequent part discusses his ideas on portfolio diversification.

On Diversification

As talked about earlier on this article, Charlie Munger ignored diversification within the conventional sense. Munger was comfy proudly owning as few as three shares.

Munger’s concentrated method to investing flows from the concept of utilizing your capital in your finest concepts. The price of diversifying is forgoing placing extra capital to work in your finest concept. Considered on this method, a concentrated portfolio is logical – when you have a excessive conviction your forecasts are correct.

“The thought of extreme diversification is insanity.”

Munger believed that taking cash you can spend money on your finest concept and placing it into your a centesimal finest concept doesn’t make sense. The larger diploma of certainty you may have in your investing talent, the less securities it’s essential personal in your portfolio.

Furthermore, much less diversification means a larger give attention to the few particularly vital alternatives that come round in somebody’s lifetime.

“Our expertise tends to substantiate a long-held notion that being ready, on a couple of events in a lifetime, to behave promptly in scale, in performing some easy and logical factor, will usually dramatically enhance the monetary outcomes of that lifetime.

A couple of main alternatives, clearly acknowledged as such, will often come to at least one who constantly searches and waits, with a curious thoughts that loves analysis involving a number of variables.

After which all that’s required is a willingness to wager closely when the percentages are extraordinarily favorable, utilizing sources out there on account of prudence and endurance prior to now. “

Munger’s habits with respect to diversification was extremely uncommon. His choices on when to promote shares are equally atypical and mentioned within the subsequent part of this text.

On When To Promote

Charlie Munger was a notoriously long-term investor. This was as a result of there are a variety of serious advantages that come from proudly owning nice companies for lengthy intervals of time. Munger’s ideas on long-term investing will be seen under.

“We’re a fan of placing out massive quantities of cash the place we gained’t must make one other resolution. In the event you purchase one thing as a result of it’s undervalued, then you must take into consideration promoting it when it approaches your calculation of its intrinsic worth. That’s arduous. However should you purchase a couple of nice firms, then you’ll be able to sit in your ass. That’s factor.”

Munger held for the long-term partially as a result of his conservative, low-risk funding technique labored finest when utilized for very lengthy intervals of time. His investments had been slow-and-steady choices that, in combination, outperformed rivals with extra irrational threat tolerance. This naturally brings the tortoise-and-the-hare analogy to thoughts:

“It’s sometimes attainable for a tortoise, content material to assimilate confirmed insights of his finest predecessors, to outrun hares that search originality or don’t want to be omitted of some crowd folly that ignores the perfect work of the previous. This occurs because the tortoise stumbles on some notably efficient solution to apply the perfect earlier work, or just avoids customary calamities. We attempt extra to revenue from at all times remembering the apparent than from greedy the esoteric. It’s exceptional how a lot long-term benefit folks like us have gotten by attempting to be constantly not silly, as an alternative of attempting to be very clever.”

As implied above, Munger’s threat tolerance was very conservative. The subsequent part discusses Munger’s threat tolerance intimately.

On Danger

Munger had little threat tolerance and was a really conservative investor. With that mentioned, he acknowledged that there’s some threat inherent in any funding, and anybody who says this isn’t true needs to be averted.

“When any man provides you an opportunity to earn a number of cash with out threat, don’t hearken to the remainder of his sentence. Observe this, and also you’ll save your self loads of distress.”

Munger realized that there are far too many individuals trying to benefit from much less knowledgeable traders. There are additionally many individuals who imply properly however don’t perceive the chance they’re taking. If one thing appears too good to be true, it most likely is.

This actually holds on the subject of derivatives and different sophisticated monetary devices. Munger mentioned the next on derivatives:

“It’s simple to see [the dangers] whenever you discuss [what happened with] the vitality derivatives – they went kerflooey. When [the companies] reached for the belongings that had been on their books, the cash wasn’t there. On the subject of monetary belongings, we haven’t had any such denouement, and the accounting hasn’t modified, so the denouement is forward of us.”

Munger’s aversion to utilizing derivatives got here from a lack of understanding about their intrinsic worth. Whereas the Black-Scholes mannequin is usually used to worth inventory choices for accounting functions, this mannequin is flawed. Munger defined this under:

“Black-Scholes is a know-nothing system. If nothing about worth – solely value – then Black-Scholes is a fairly good guess at what a ninety-day choice could be price. However the minute you get into longer intervals of time, it’s loopy to get into Black-Scholes.”

Individually, Munger mentioned:

“For instance, at Costco we issued inventory choices with strike costs of $30 and $60, and Black-Scholes valued the $60 ones increased. That is insane.”

Notice: Charlie Munger is a long-time member of Costco’s Board of Administrators.

Munger’s risk-aversion was a key part of his funding philosophy, and translated to his opinion on present accounting schemes – mentioned under.

On Accounting

Munger discovered the inventive accounting employed by many company managers to be extremely distasteful. A proof of this (within the context of the Enron accounting fraud) is proven under.

“Inventive Accounting is an absolute curse to a civilization. One might argue that double-entry bookkeeping was considered one of historical past’s nice advances. Utilizing accounting for fraud and folly is a shame. In a democracy, it usually takes a scandal to set off reform. Enron was the obvious instance of a enterprise tradition gone improper in an extended, very long time.”

Munger particularly disliked EBITDA as a proxy for company earnings:

“I believe that, each time you see the phrase EBITDA, you must substitute the phrases “bullsh*t earnings.”

If there may be something that Munger disliked greater than inventive accounting, it’s excessive investing charges. We focus on Munger’s stance on investing charges under.

On Investing Charges

In Poor Charlie’s Almanack, there are many passages that describe Munger’s stance on excessive investing charges. Specifically, Munger disliked the funding administration enterprise as a result of he believed that it doesn’t add something to society in combination. He additionally believed that the chance {that a} consumer is being harmed by their funding supervisor is commensurate with the charges they’re paying.

“In every single place there’s a massive fee, there’s a excessive chance of a rip-off.”

Outperforming the market could be very troublesome. When traders pay massive charges, it turns into just about unattainable. The decrease your investing prices, the more cash you’ll be able to put to work within the inventory marketplace for your self. ‘Simply’ 1% or 2% a yr provides as much as an amazing quantity of misplaced cash over the course of an investing lifetime.

Munger believed that one of the best ways to reduce funding charges was to take a position for the long-term. Munger succinctly summarized the associated fee advantages of long-term investing:

“You’re paying much less to brokers, you’re listening to much less nonsense, and if it really works, the tax system provides you an additional, one, two, or three share factors each year.”

Thus, Munger’s dislike of investing charges and his long-term investing fashion are linked.

So far, we’ve got targeted on discussing Munger’s knowledge because it pertains to enterprise and investing. The rest of this text will give attention to Munger’s knowledge because it pertains to private life.

On Dwelling A Virtuous and Fulfilling Life

Charlie Munger believed the important thing to non-public {and professional} success is straightforward. Dedicate your life to one thing you might be keen about, and good at.

“You’ll do higher when you have ardour for one thing wherein you may have aptitude. If Warren had gone into ballet, nobody would have heard of him.”

Munger and his enterprise companion Warren Buffett stand out amongst profitable businessmen due to their character, honesty, and integrity. We’ll focus on the character-related ideas of Charlie Munger’s life step-by-step on this part.

Munger believed that avoiding envy is an integral part of dwelling a contented and affluent life. When it got here to constructing wealth, he warned in opposition to the jealousy that will come from different folks outperforming you.

“Somebody will at all times be getting richer sooner than you. This isn’t a tragedy.”

There’ll at all times be a subsector of the economic system that’s ‘on fireplace’. The traders who occur to be on this subsector will present phenomenal outcomes – for a time.

A terrific enterprise at a good value compounds investor wealth yr after yr. A good enterprise at a fantastic value solely provides the potential to compound investor returns when it reaches honest worth – then it have to be bought. A terrific enterprise doubtlessly by no means must be bought.

One other part of Munger’s persona was a robust perception that folks needs to be dependable. In different phrases, folks ought to do what they are saying they’re going to do. The next quote, written by Munger in Poor Charlie’s Almanack, illustrates this level properly:

“Certainly, I have usually made myself unpopular on elite faculty campuses pushing this reliability theme. What I say is that McDonald’s is considered one of our most admirable establishments. Then, as indicators of shock come to surrounding faces, I explain that McDonald’s, providing first jobs to hundreds of thousands of youngsters, many troubled, over the years, has efficiently taught most of them the one lesson they most want: to present up reliably for responsible work. Then I often go on to say that if the elite campuses had been as profitable as McDonald’s in educateing sensibly, we’d have a greater world.”

To Charlie Munger, being unreliable was not simply an undesirable high quality, nevertheless it might additionally maintain an individual again of their life:

“What do you wish to keep away from? Such a simple reply: sloth and unreliability. In the event you’re unreliable, it doesn’t matter what your virtues are. You’re going to crater instantly. Doing what you may have faithfully engaged to do needs to be an automated a part of your conduct. You wish to keep away from sloth and unreliability.”

Munger additionally believed that honesty is without doubt one of the most vital traits a person can have.

“I believe observe information are essential. In the event you begin early attempting to have an ideal one in some easy factor like honesty, you’re properly on you solution to success on this world.”

This extends to his habits as a steward of shareholder capital at Berkshire Hathaway. Munger would reasonably actually underperform than report dishonest monetary outcomes that please his traders.

“Immediately, it appears to be thought to be the responsibility of CEOs to make the inventory go up. This results in all kinds of silly habits. We wish to inform it like it’s.”

The job of a CEO is to maximise long-term worth for shareholders. Usually, long-term worth maximization comes on the expense of short-term income.

CEOs who search to spice up the inventory value in any respect prices will repurchase shares on the worst attainable instances and pursue short-term income above all else, destroying shareholder worth within the course of. It additionally harms the supervisor’s popularity.

“Do not forget that popularity and integrity are your most precious belongings – and will be misplaced in a heartbeat.”

Within the short-run, folks and companies can get richer sooner by being dishonest. In the long term, honesty and integrity construct a popularity that’s price greater than the fast positive factors that come from trickery. Being trustworthy and appearing with integrity makes it simple to sleep at night time.

“Our concepts are so easy that folks maintain asking us for mysteries when all we’ve got are essentially the most elementary concepts.”

Along with honesty and integrity, Munger advocated humility as properly. In Munger’s view, extreme ego can get traders and enterprise leaders in hassle.

“In the event you suppose your IQ is 160 nevertheless it’s 150, you’re a catastrophe. It’s significantly better to have a 130 IQ and suppose it’s 120.”

Like different nice traders, Charlie Munger advocated simplicity. Protecting issues easy vastly reduces errors. The extra sophisticated an concept or funding thesis, the extra seemingly it’s to be improper. It is because there are just too many transferring elements and too many estimates which are all vulnerable to error.

Munger and Buffett lengthy steered away from companies that had been too sophisticated to grasp:

“Now we have three baskets for investing: sure, no, and too robust to grasp.”

Lastly, Munger additionally had some beneficial profession recommendation:

“I’ve three fundamental guidelines. Assembly all three is almost unattainable, however you must attempt anyway:

Don’t promote something you wouldn’t purchase your self.

Don’t work for anybody you don’t respect and admire.

Work solely with folks you take pleasure in.I’ve been extremely lucky in my life: with Warren I had all three.”

Charlie Munger on Warren Buffett

Munger is usually cited as having had a profound affect on Warren Buffett’s funding technique. With that mentioned, Munger usually acknowledged that he receives an excessive amount of credit score for this.

“I believe these authors give me extra credit score than I deserve. It’s true that Warren had a contact of mind block from working beneath Ben Graham and making a ton of cash – it’s arduous to change from one thing that’s labored so properly. But when Charlie Munger had by no means lived, the Buffett file will nonetheless be just about what it’s.”

“I believe there’s some mythology in the concept that I’ve been this nice enlightener of Warren. He hasn’t wanted a lot enlightenment. However we all know extra now than 5 years in the past.”

Munger additionally believed that Buffett’s distinctive competency implies that his successor seemingly is not going to be as clever. To be honest, Buffett’s successor may have massive sneakers to fill.

“I believe the highest man gained’t be as sensible as Warren. But it surely’s foolish to complain: “What sort of world is that this that provides me Warren Buffett for forty years, after which some bastard comes alongside who’s worse?”

Quotes from Berkshire Hathaway’s 2022 Annual Report

Berkshire’s annual reviews are usually written by Warren Buffett. The 2022 annual report had a number of inciteful quotes from Charlie Munger.

“You must continue learning if you wish to develop into a fantastic investor. When the world modifications, you should change.”

The above quote highlights the significance of lifelong studying in investing. It’s essential to continue learning and bettering because the world modifications.

“There is no such thing as a such factor as a 100% certain factor when investing. Thus, the usage of leverage is harmful. A string of great numbers instances zero will at all times equal zero. Don’t rely on getting wealthy twice.”

Leverage can lead whole capital impairment. Shedding all of it means you begin at nothing; properly nothing however a worse popularity. Being conservative with investing could imply slower wealth accumulation within the brief run, nevertheless it additionally usually means a better chance of compounding wealth over the long term.

“Warren and I don’t give attention to the froth of the market. We search out good long-term investments and stubbornly maintain them for a very long time.”

&

“The world is filled with silly gamblers, and they won’t do in addition to the affected person investor.”

Munger and Buffett’s investing fashion was to hunt out prime quality companies and maintain them for the long term. They averted ‘market froth’ and should not ‘silly traders’. As a substitute they had been ‘affected person traders’ who ‘search out good long-term investments’.

What Different Folks Have To Say About Charlie Munger

Charlie Munger is adored by many different members of the skilled funding neighborhood. The next set of quotes illustrates the wonderful popularity that Munger has crafted over the many years whereas additionally offering extra perception into his persona and funding philosophy.

“I used to be in New York Metropolis with Charlie to attend a Salomon Brothers board assembly. We had come out of the constructing and had been standing on the sidewalk, discussing what had transpired on the assembly. At least, that‘s what I assumed we had been doing, for all of a sudden I spotted that I had been speaking to myself for some time. I appeared round for Charlie, solely to see him climbing into the again of a taxicab, headed off to the airport. No goodbye, no nothing.

Folks suppose it‘s Charlie’s eyes that trigger him to overlook seeing issues (Charlie misplaced his imaginative and prescient in one eye many years in the past due to issues from cataract surgical procedure). BUT IT’S NOT HIS EYES, IT’S HIS HEAD! I as soon as sat by way of three units of visitors lights, and loads of honking behind us, as Charlie mentioned some complicated drawback at an intersection.”

“I’d say every thing about Charlie is uncommon. I’ve been on the lookout for the standard now for forty years, and I’ve but to seek out it. Charlie marches to his personal music, and it’s music like just about nobody else is listening to. So, I’d say that to try to typecast Charlie when it comes to every other human that I can consider, nobody would match. He’s bought his personal mildew.” – Warren Buffett, CEO and Chairman of Berkshire Hathaway

I can attest that Chalie has a mix of traits that I’ve by no means seen in every other single particular person. He has a unprecedented and deep intelligence throughout a broad vary of pursuits, and he by no means appears to neglect something, regardless of how arcane or trivial. On prime of those attributes is his absolute dedication to honesty, ethics, and integrity – Charlie by no means “grabs” for himself and will be trusted with out reservation. If that’s not sufficient, he has a temperament towards investing that may solely be described as perfect: unyielding endurance, self-discipline, and self-control – Charlie simply doesn’t crack or compromise on his ideas, regardless of how disturbing the state of affairs.” – Louis A. Simpson, President and CEO, Capital Operations, GEICO Company

When Charlie is in deep thought, he usually loses observe of a lot of what’s happening round him, together with social niceties. I do not forget that after we had been negotiating with CenFed to have them take over our financial savings and mortgage enterprise, Charlie and I went over to their workplaces to fulfill with their CEO, Ted Lowrey. We had a perfectly great assembly – Charlie can put on the churt if he places his thoughts to it – and we had been winding issues up very satisfactorily.

“Ted walked us to the elevator. Simply as we bought there, the elevator door opened, and Charlie walked instantly inside. He by no means said goodbye, by no means shook fingers, nothing. Tad and I had been left standing there, smiling and speechless.” – Bob Chook, President, Wesco Monetary. Additionally Munger’s buddy and enterprise asscoiate since 1969.

“When it comes to being curious and targeted, when Charlie will get interested in one thing, he REALLY will get fascinated with it. I keep in mind three talks he ready and offered to our regulation agency on a few of what he known as ‘the eminent lifeless‘ he had encountered by way of his in depth studying: Isaac Newton, Albert Einstein, and Simon Marks. Specifically, I keep in mind the central message of the discuss on Simon Marks (of retailer Marks and Spencer): ‘Discover out what you’re finest at and maintain pounding away at it.’ This, after all, has at all times been Charlie’s fundamental method to life.” – Dick Esbenshade, Munger’s buddy and enterprise affiliate since 1956.

“For years, I’d see Charlie at our Southern California seaside home. I keep in mind having ‘conversations’ that had been basically one-sided, feeling like I ought to have a dictionary at my facet to search for all of the phrases I didn’t perceive. I keep in mind not saying a lot, being scared to ask a query and showing silly. He’s so darned sensible, like my father, within the stratosphere.” – Howard Buffet, Warren Buffett’s son.

“Charlie had a want to grasp precisely what makes issues occur. He desires to unravel every thing, whether or not it’s one thing of great curiosity to him or not. Something that involves his consideration, he desires to know extra about it and perceive it and determine what makes it tick.” – Roy Tolles, co-founder of Munger’s unique regulation agency.

“He is aware of the way to take all of his brains and all of his vitality and all of his thought and focus precisely on a single drawback, to the exclusion of the rest. Folks will come into the room and pat him on the again or provide him one other cup of espresso or one thing, and he gained’t even acknowledge their presence as a result of he’s utilizing 100% of his big mind.” – Glen Mitchel, Munger’s buddy since 1957.

Remaining Ideas

Charlie Munger died on November twenty eighth at age 99. Charlie Munger’s psychological fashions method to investing produced phenomenal success for Munger himself and for Berkshire Hathaway. His distinctive perspective was a mix of the knowledge of a number of fields. At its core, Charlie Munger’s method was much like Warren Buffett’s – spend money on high-quality companies that generate above-average returns.

Companies that generate above-average returns will need to have a aggressive benefit that prohibits rivals from undercutting the corporate. Patents, sturdy model names, and economies of scale can all end in above common returns.

The Dividend Aristocrats Listing is a superb place to search for high-quality companies. To develop into a Dividend Aristocrat, a enterprise should pay rising dividends for 25 or extra consecutive years in a row. In some methods, that is unsurprising; the Dividend Aristocrats have many traits that might make Munger smile.

Different Dividend Lists

The next lists include many extra high quality dividend shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.

[ad_2]

Source link