[ad_1]

Ethan Miller

This text is a part of a collection that gives an ongoing evaluation of the adjustments made to David Einhorn’s Greenlight Capital 13F portfolio on a quarterly foundation. It’s primarily based on Einhorn’s regulatory 13F Kind filed on 11/14/2023. Please go to our Monitoring David Einhorn’s Greenlight Capital Holdings article collection for an thought on his funding philosophy and our earlier replace for the fund’s strikes throughout Q2 2023.

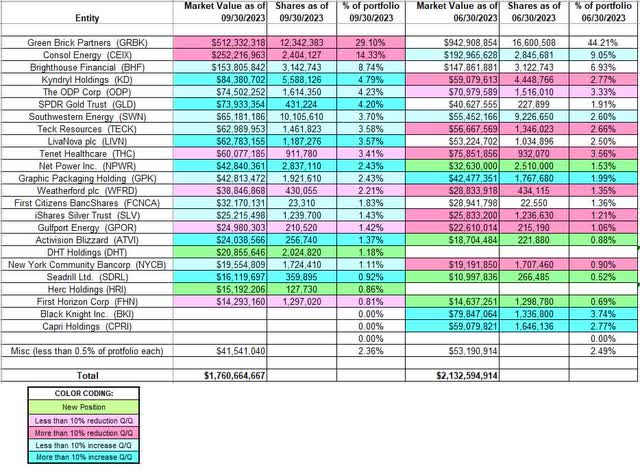

Greenlight Capital’s 13F portfolio worth stood at $1.76B this quarter. It’s down ~17% in comparison with $2.13B as of final quarter. Einhorn’s Q3 2023 letter reported that the fund returned 27.7% YTD by way of Q3 2023 vs 13.1% for the S&P 500 Index. Since 1996 inception, Greenlight has returned ~13% annualized vs 9.4% annualized for S&P 500 index. Along with accomplice stakes, the fund additionally invests the float of Greenlight Capital RE (NASDAQ:GLRE). To study David Einhorn and the perils of shorting, check-out his “Fooling Among the Folks All the Time, A Lengthy Brief (and Now Full) Story“.

New Stakes:

DHT Holdings (DHT) and Herc Holdings (HRI): The small 1.18% DHT place was established at costs between $8.15 and $10.30. The inventory at the moment trades at $9.79. HRI is a really small 0.86% stake established at costs between ~$119 and ~$147 and it now goes for ~$123.

Stake Disposals:

Black Knight Inc.: Black Knight was a merger-arbitrage stake established throughout Q1 2023 at a cost-basis of $60.59. Intercontinental Trade (ICE) acquired them for a $75 per share cash-and-stock deal that closed in August thereby eliminating this place.

Capri Holdings (CPRI): The two.77% CPRI place was bought in 2021 at costs between ~$40.50 and ~$67. Q1 2022 noticed a ~12% trimming whereas subsequent quarter there was a ~20% stake improve. That was adopted by a ~75% improve within the final two quarters at costs between ~$34 and ~$68. They bought the place this quarter instantly after Tapestry’s (TPR) $57 per share money supply. The inventory is now at $48.21.

Stake Will increase:

Brighthouse Monetary (BHF): BHF is a big (prime three) stake at ~9% of the portfolio. The place was established in Q3 2017 and elevated by ~60% within the following quarter at an general cost-basis of $57.92. There was a ~70% promoting in This autumn 2018 at costs between $29 and $46.50. The inventory is at the moment at $52.49. This quarter noticed a marginal improve.

Notice: BHF is a by-product of MetLife’s (MET) U.S. Retail enterprise (annuities and life insurance coverage) that began buying and selling in July 2017.

Kyndryl Holdings (KD): KD is a 4.79% of the portfolio place constructed over the 5 quarters by way of This autumn 2022 at costs between ~$8.25 and ~$41 and the inventory is now at $18.32. There was a ~50% promoting final quarter at costs between ~$11.50 and ~$15 whereas this quarter there was a ~25% improve at costs between $12.22 and $16.92.

The ODP Corp. (ODP): ODP is a 4.23% of the portfolio place primarily constructed over the three quarters by way of This autumn 2021 at costs between ~$36 and ~$50. The inventory at the moment trades at $46.57. There was a ~20% stake improve in Q2 2022 at costs between ~$29 and ~$46. The final three quarters noticed minor trimming whereas this quarter noticed a ~7% improve.

Notice: Greenlight’s cost-basis is ~$44.

SPDR Gold Belief (GLD): The 4.20% GLD stake was inbuilt Q3 2020 at costs between $167 and $194. Q1 2021 noticed a ~70% promoting at costs between ~$158 and ~$183. H1 2022 had seen a ~140% stake improve at costs between ~$167 and ~$192. The subsequent two quarters noticed a ~24% discount at costs between ~$151 and ~$170. This quarter noticed the place rebuilt at costs between ~$172 and ~$184. It at the moment trades at ~$188.

Southwestern Vitality (SWN): SWN is a 3.70% of the portfolio stake established in Q1 2022 at a median worth of $6.58. The inventory at the moment trades at $6.27. There was a ~48% stake improve throughout Q3 2022 at costs between ~$5.60 and ~$8.10. That was adopted by the same improve within the subsequent quarter at costs between ~$5.50 and ~$7.25. This quarter additionally noticed a ~10% stake improve.

Teck Assets (TECK): TECK is a 3.58% of the portfolio place bought in Q2 2020 at costs between $7 and $12.25. There was a ~40% stake improve in This autumn 2020 at costs between ~$12.25 and ~$18.85 whereas subsequent quarter there was a ~25% promoting at costs between ~$18 and ~$23.75 The 2 quarters by way of Q3 2021 had seen a stake doubling at costs between ~$19.50 and ~$26.80. There was ~55% promoting over the following three quarters at costs between ~$26 and ~$46. The three quarters by way of Q1 2023 noticed a ~25% improve at costs between ~$26 and ~$44. The final quarter noticed a ~45% discount at costs between ~$36.50 and ~$49. The inventory at the moment trades at $37.27. There was a ~9% stake improve this quarter.

LivaNova plc (LIVN): The three.57% of the portfolio stake in LIVN was constructed over the six quarters by way of Q3 2022 at costs between ~$44 and ~$92. The inventory is now close to the underside of that vary at $45.07. There was a ~23% stake improve throughout Q1 2023 at costs between ~$41 and ~$58. That was adopted by a ~15% improve this quarter at costs between ~$50 and ~$59.

NET Energy Inc. (NPWR): NPWR is a 2.43% of the portfolio place bought final quarter at a cost-basis of $10.10 per share. The inventory at the moment trades at $9.42. This quarter noticed a ~13% stake improve.

Graphic Packaging Holding (GPK): The two.43% stake in GPK noticed a two-thirds improve final quarter at costs between ~$23.50 and ~$27. The inventory at the moment trades at $23.43. This quarter additionally noticed a ~9% improve.

First Residents BancShares (FCNCA): FCNCA is a small 1.83% of the portfolio place bought throughout Q1 2023 at costs between ~$509 and ~$973 and the inventory at the moment trades properly above that vary at ~$1429. There was a minor ~3% improve this quarter.

iShares Silver Belief (SLV): SLV is a 1.43% of the portfolio place established in Q3 2021 at costs between ~$20 and ~$24.50 and the inventory at the moment trades at $21.79. There was a ~17% trimming final quarter and a marginal improve this quarter.

New York Group Bancorp (NYCB): The 1.11% NYCB stake was established throughout Q1 2023 at costs between ~$6.40 and ~$10.40. It was bought down by ~25% final quarter at costs between ~$8.50 and ~$11. The inventory is now at $9.82. There was a marginal improve this quarter.

Activision Blizzard, and Seadrill Ltd. (SDRL): These two small (lower than ~1.5% of the portfolio every) stakes had been elevated throughout the quarter. Microsoft acquired Activision Blizzard in a $95 money deal that closed in October.

Stake Decreases:

Inexperienced Brick Companions (GRBK): GRBK is at the moment the most important place at ~29% of the 13F portfolio. The stake was acquired on account of BioFuel Vitality’s JGBL Builder Finance acquisition and rename transaction. The deal closed (October 2014) with Greenlight proudly owning 49% of the enterprise. David Einhorn was appointed Chairman of the Board following the transaction. Q1 2021 noticed a ~28% promoting at ~$20.50 per share by way of an underwritten providing. This quarter noticed the same discount at costs between $41.51 and $58.51. The discount was primarily on account of in-kind distributions to redeeming shareholders relatively than precise gross sales within the open market. The inventory at the moment trades at $50.62.

Notice: They’ve a ~27% possession stake within the enterprise.

CONSOL Vitality (CEIX): CEIX is a big (prime three) 14.33% of the portfolio place that happened on account of the merger with Consol Coal Assets that closed in December 2020. Phrases known as for 0.73 shares of CONSOL Vitality for every share of Consol Coal held. Greenlight had a place in Consol Coal for which they acquired these shares. There was a ~30% discount in Q1 2021 at costs between ~$6.75 and ~$12.20. That was adopted with a ~25% promoting in Q2 2021 at costs between ~$8.75 and ~$18.70. The three quarters by way of This autumn 2022 noticed a ~23% web improve at costs between ~$35.50 and ~$77.50. There was one other ~50% improve throughout Q1 2023 at costs between ~$51 and ~$64. This quarter noticed a ~16% promoting at costs between ~$63 and ~$105. CEIX at the moment trades at ~$104.

Tenet Healthcare (THC): THC is a 3.41% of the portfolio place bought throughout This autumn 2022 at a cost-basis of $48.61. The inventory at the moment trades at $68.94. There was a ~117% stake improve throughout Q1 2023 at costs between ~$49 and ~$62. The final quarter noticed a one-third discount at costs between ~$58 and ~$82. There was a ~2% trimming this quarter.

Weatherford plc (WFRD): The two.21% of the portfolio place in WFRD was bought in Q1 2022 at a median worth of $32.27 and it’s now at $85.03. This autumn 2022 noticed a ~22% discount at costs between ~$32 and ~$51. That was adopted by comparable promoting final quarter at costs between ~$56 and ~$66. There have been marginal trimming this quarter.

Gulfport Vitality (GPOR): GPOR is a 1.42% of the portfolio stake constructed within the two quarters by way of Q1 2023 at costs between ~$61 and ~$97. There was a ~25% promoting final quarter at costs between ~$76 and ~$108. It’s now at ~$134. This quarter noticed a minor ~2% trimming.

First Horizon Corp. (FHN): The very small 0.81% stake in FHN noticed marginal trimming this quarter.

The spreadsheet beneath highlights adjustments to Greenlight’s 13F inventory holdings in Q3 2023:

David Einhorn – Greenlight Capital’s Q3 2023 13F Report Q/Q Comparability (John Vincent (creator))

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please concentrate on the dangers related to these shares.

[ad_2]

Source link