[ad_1]

AzmanL

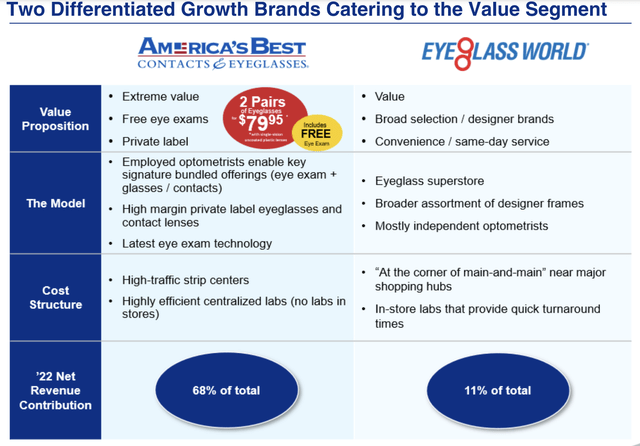

If producing sturdy returns from investing was as simple as shopping for low cost shares, all people might be like Warren Buffett. There are a lot of instances the place simply shopping for a agency on a budget does pay out nicely. However generally, altering situations can alter a agency and the alternatives that it gives. One actually good instance of this may be seen by taking a look at Nationwide Imaginative and prescient Holdings (NASDAQ:EYE), an optical retailer that has not solely its personal standalone shops, but additionally that boasts in retailer partnerships. In the event you put on glasses, there is a good likelihood that you understand of its two key manufacturers. Essentially the most well-known of those is America’s Greatest Contacts & Eyeglasses, which is an excessive value-oriented supplier of optical options that generated 68% of the corporate’s income final yr. The opposite is Eyeglass World, which was chargeable for one other 11% of gross sales.

Nationwide Imaginative and prescient Holdings

In the long term, the imaginative and prescient area is one that ought to do fairly nicely. On high of this, shares of the establishment look attractively priced. However since I final wrote concerning the agency in a bullish article in Might of this yr, some moderately dangerous information has come on to the scene. Close to the tip of July, information broke that Walmart (WMT) had determined to finish its partnership with Nationwide Imaginative and prescient Holdings in 2024. This, mixed with some combined monetary efficiency up to now this yr, has resulted in shares dropping 22.2% for the reason that publication of that article at a time when the S&P 500 is up 10.7%. In truth, that is painful to see. However when you think about how less expensive the inventory has change into and take a look at administration’s plan for recouping these losses, I might argue that the agency nonetheless gives upside from right here.

A take a look at current ache

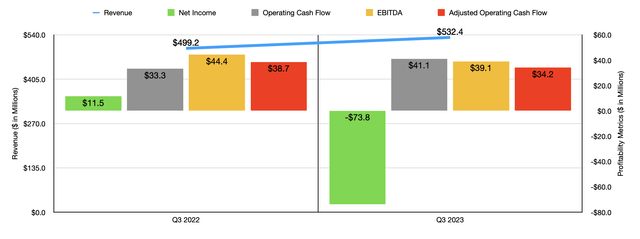

Current monetary efficiency achieved by Nationwide Imaginative and prescient Holdings has been considerably combined. If we take a look at the newest quarter, which might be the third quarter of the 2023 fiscal yr, we might see that income for the corporate has are available in at $532.4 million. That is 6.7% increased than the $499.2 million the corporate generated one yr earlier. A rise within the variety of shops in operation from 1,332 within the third quarter of final yr to 1,402 the identical time this yr was chargeable for a very good portion of this enhance. Nevertheless, the corporate additionally benefited from will increase in comparable retailer gross sales for a few of its manufacturers. America’s Greatest, for example, noticed a 5.7% rise in comparable retailer gross sales, whereas the navy income generated by the corporate elevated 3.8% on a comparable foundation. There have been some areas of weak spot, comparable to a 1.2% drop for Eyeglass World and a 3.7% decline related to Fred Meyer. However on the entire, adjusted comparable retailer gross sales progress elevated by 4.3%.

Writer – SEC EDGAR Knowledge

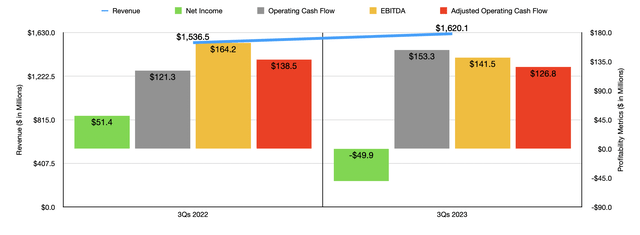

Regardless of this enhance in income, income for the establishment took a beating. The corporate went from producing a web revenue of $11.5 million within the third quarter of 2022 to producing a web lack of $73.8 million the identical time this yr. Nevertheless, a whole lot of this needed to do with an $80.8 million asset impairment cost that the corporate booked within the third quarter. Money move knowledge appears considerably higher. Working money move, for example, went from $33.3 million final yr to $41.1 million this yr. But when we regulate for modifications in working capital, it might have fallen from $38.7 million to $34.2 million. In the meantime, EBITDA for the corporate additionally dropped, declining from $44.4 million to $39.1 million. As you’ll be able to see within the chart beneath, monetary efficiency for the primary 9 months of this yr relative to the identical time final yr appears similar to the third quarter by itself. Clearly, this isn’t a terrific yr for the enterprise.

Writer – SEC EDGAR Knowledge

The Walmart downside

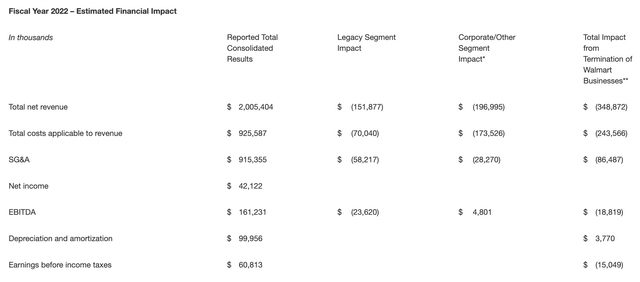

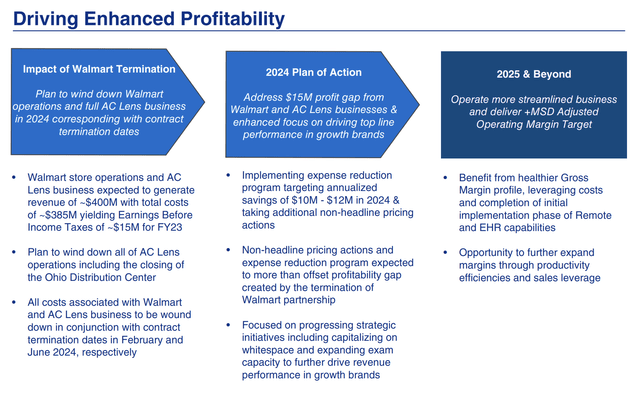

To make issues worse, in July of this yr, administration introduced that its partnership with Walmart could be ending subsequent yr. At first look, this appears completely terrible. I say this as a result of, utilizing knowledge for 2022, Walmart was chargeable for about $348.9 million of the corporate’s income. That is 17.4% of total gross sales. For 2023, Walmart is predicted to account for roughly $385 million price of the corporate’s income. So it is a large hit from a gross sales perspective.

Nationwide Imaginative and prescient Holdings

The excellent news for buyers is that the underside line shouldn’t be so dangerous. The huge partnership it had with the world’s largest retailer solely introduced in earnings, earlier than taxes, of round $15 million. Admittedly, that’s round 25% of the corporate’s pre-tax income for 2022. The excellent news for buyers, nonetheless, is that administration already has a plan to make up for a very good portion of this decline in income. The agency’s present expense discount program is concentrating on annualized financial savings of between $10 million and $12 million subsequent yr. Along with this, the corporate is taking different pricing actions that it hopes will enhance its backside line. Actually, whereas administration has not supplied specifics on the matter, they did say that the mixture of those efforts will greater than offset the profitability hole created by the termination of this partnership.

Nationwide Imaginative and prescient Holdings

From that time on, administration might be targeted on enhancing margins additional, although we do not know what that can appear to be from a income or revenue perspective. We additionally do not know all that’s included on this. Nevertheless, simply final month, the corporate did transfer ahead with the repurchase of $100 million of convertible notes which can be due in 2025. They paid $99.25 million for the notes in a maneuver that can save the corporate about $2.5 million per yr in curiosity.

Nationwide Imaginative and prescient Holdings

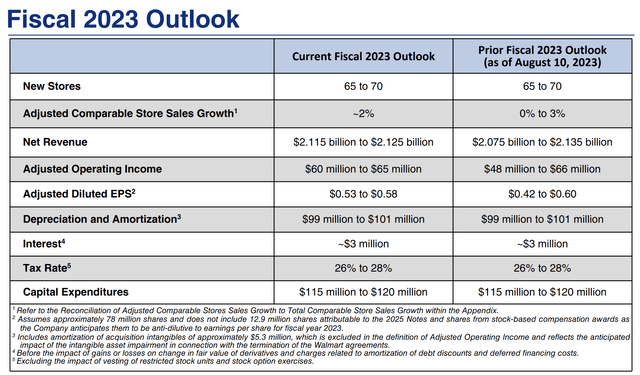

On condition that administration is forecasting offsetting this loss in income, it is cheap for my part to nonetheless worth the corporate based mostly on estimates for 2023. For 2023, the corporate is forecasting income of between $2.115 billion and $2.125 billion. Earnings per share, on the midpoint, ought to translate to web income of about $43.3 million. Primarily based by myself estimates, adjusted working money move needs to be round $143.5 million, whereas EBITDA ought to are available in someplace round $162.5 million.

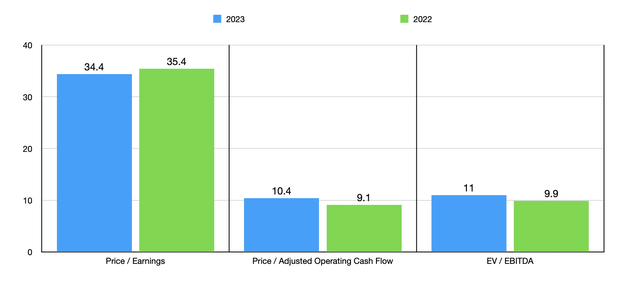

Writer – SEC EDGAR Knowledge

Primarily based on these figures, I used to be capable of create the desk above. In it, you’ll be able to see how shares are priced utilizing estimates for 2023 and precise outcomes for 2022. Clearly, the inventory does look dearer on a ahead foundation. However all the identical, at the least from a money move perspective, shares do look low cost. As a part of my evaluation, I then in contrast the corporate to 5 related companies as proven within the desk beneath. On a worth to earnings foundation, it’s fairly a bit pricier, with three of the 5 corporations cheaper than it. However in terms of the value to working money move foundation and the EV to EBITDA foundation, solely one of many corporations that had optimistic outcomes was cheaper than it.

Firm Worth / Earnings Worth / Working Money Movement EV / EBITDA Nationwide Imaginative and prescient Holdings 34.4 10.4 11.0 Alcon (ALC) 72.1 28.8 36.4 The Cooper Firm (COO) 335.1 29.6 22.7 Bausch & Lomb Company (BLCO) 15.1 41.7 20.3 Olaplex Holdings (OLPX) 2.5 8.4 10.1 Warby Parker (WRBY) 11.0 17.9 N/A Click on to enlarge

Takeaway

Proper now, Nationwide Imaginative and prescient Holdings goes by means of some points. The excellent news is that these are not insurmountable. Had I identified that the corporate was going to have this termination with Walmart, I in all probability would have rated it a ‘maintain’. However given how low cost the inventory is on a money move foundation now that the inventory has fallen and given administration’s plan to deal with that matter, I might argue that the ‘purchase’ score I assigned the inventory is smart right this moment.

[ad_2]

Source link