[ad_1]

by Fintechnews Switzerland

December 11, 2023

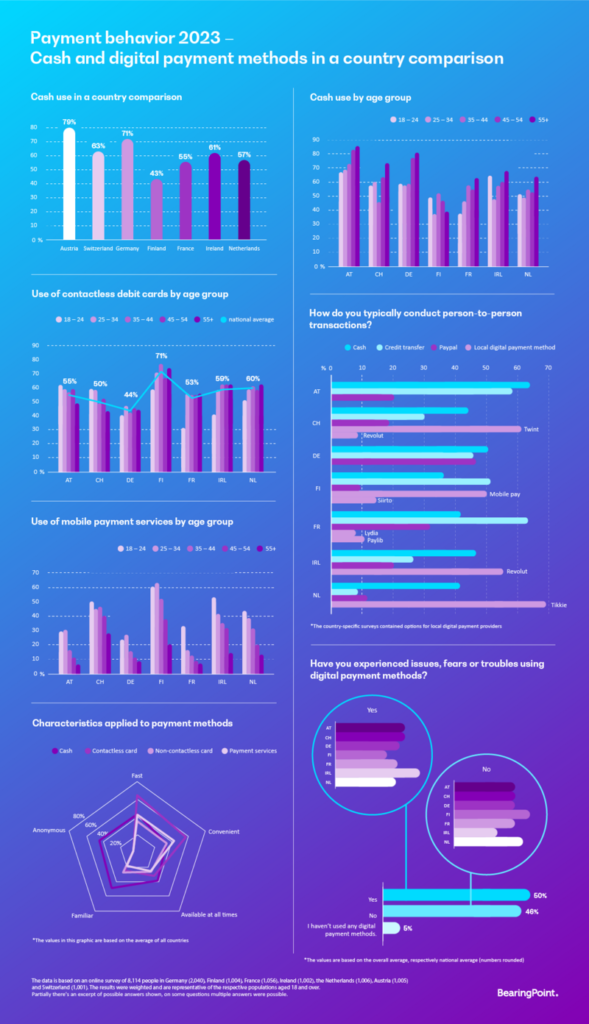

Money is the first type of cost throughout Europe, being most steadily utilized in Austria and Germany and least steadily utilized in Finland.

Nevertheless, the frequency of cost methodology utilization varies significantly between international locations and age teams. The attribute of anonymity is simply attributed to money, whereas the traits of pace and comfort are attributed to digital cost strategies similar to card funds and cost companies.

Money is king in German-speaking international locations

Money use is considerably increased in Austria (79%) and Germany (71%) than in different European international locations. Respondents from Switzerland (63%), Eire (61%), the Netherlands (57%), and France (55%) additionally present a comparatively excessive stage of money use however are properly behind Germany and Austria. Finland has a considerably decrease frequency of money utilization at 43%.

Money utilization additionally assorted throughout the surveyed age teams. Essentially the most frequent use of money is seen within the 55+ age group in Austria, at 86%, whereas Finland has the bottom frequency on this age group at 39%. Typically, the 55+ age group makes use of money most steadily, besides in Finland, the place the 35-44 age group makes use of money most steadily at 51%. Within the 18-24 age group, Austria once more tops different international locations at 68%, whereas France has the bottom frequency of money utilization on this age group at 37%.

Contactless debit card most steadily used cost methodology in Finland

In Finland, the contactless debit card is essentially the most steadily used cost methodology throughout all age teams at 71%, which is considerably increased than money use. On common, the contactless debit card is the second most steadily used cost methodology within the international locations surveyed at 56%. Money and contactless debit playing cards are used virtually equally frequent in France, Eire, and the Netherlands. In comparison with the opposite international locations, the frequency of use of non-contactless debit playing cards is lowest in Finland at 17%, which is properly under the typical of 33% for the international locations surveyed.

Folks in France nonetheless steadily use cheques as a cost methodology

For France, it may be seen within the 18-24 age group that no cost methodology is most popular for frequent use. At a comparatively low stage, there’s a very homogeneous frequency of use of money, card funds, cell cost companies and on-line cost companies and digital wallets within the vary between 24% and 37%. Cheques, alternatively, are clearly lagging behind at 6%, whereas the frequency of use in France is steadily rising throughout the age teams and is highest for the 55+ age group at 41%. Cheques are virtually not used as a cost methodology within the different international locations.

Cell cost companies used primarily by youthful folks in Eire and France

In most international locations, contactless debit playing cards are used evenly throughout all surveyed age teams. The exceptions are France and Eire, the place the 18-24 age group differs considerably in comparison with the nationwide common, with the bottom frequency of contactless debit card use on this age group at 31% in France, intently adopted by Eire at 40%. In distinction, cell cost companies are used considerably extra steadily within the 18-24 age group in France at 33% and Eire at 54% than the nationwide common for the opposite age teams.

Christian Bruck

It’s attention-grabbing to see that money is quite common throughout all age teams and is clearly primary amongst respondents. It is usually noteworthy that within the 18-24 age group, money is used extra steadily on common than cell cost companies. From my standpoint, the contactless debit card has skilled extra intensive use in the course of the pandemic and established itself as a closely used digital cost methodology in Europe.

Christian Bruck, Associate and funds professional at BearingPoint

Anonymity is simply attributed to money

43% of respondents attribute the attribute of anonymity to money, whereas card funds and cost companies will not be assigned this attribute. With 56% of respondents, Austria is the chief within the nation comparability for the anonymity attribute of money. Contactless playing cards are rated as quick by 64% and as handy by 57% of respondents on common, placing them above the opposite cost strategies surveyed. There are clear variations between international locations. Concerning contactless playing cards, 74% of respondents in Finland agree with the attribute of quick, and 69% agree that they’re handy, whereas in Germany, solely 54% agree with quick, and 42% agree that they’re handy.

For funds between non-public people, country-specific digital cost strategies are used

Austria and France stay loyal to the normal cost strategies of money and financial institution switch, with money being essentially the most steadily used cost methodology for funds amongst non-public people in Austria at 64% and financial institution switch at 64% in France.

Particular person digital cost suppliers are the primary port of name for funds amongst non-public people within the Netherlands (69%), Switzerland (62%) and Eire (55%).

One in two had skilled issues or considerations with digital cost strategies

Round one in two respondents had issues or considerations when utilizing digital cost strategies. In Eire, most respondents (63%) said they’d skilled issues or considerations, whereas in Finland, solely 38% had skilled both.

Featured picture credit score: edited from freepik

[ad_2]

Source link