[ad_1]

nycshooter

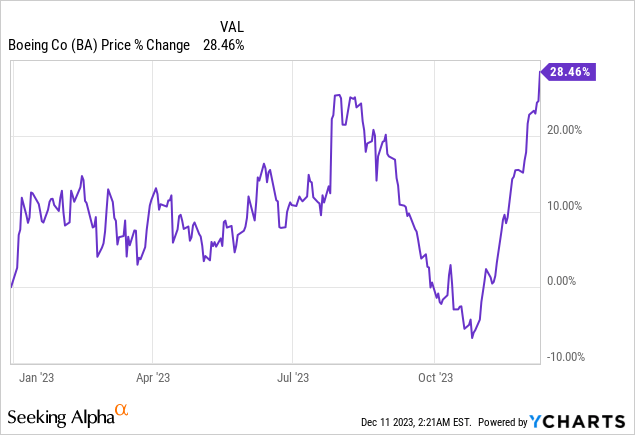

The Boeing Firm (NYSE:BA)’s shares went into an enormous new up-leg after the corporate introduced earnings for its third fiscal quarter on the finish of October and the present rally has sufficient steam to final properly into 2024, in my view. The plane producer’s order books are full and the U.S. economic system is performing properly, suggesting that Boeing is getting into the 2024 monetary 12 months on an upswing. Passenger air journey is about for a brand new file subsequent 12 months as properly, which may entice new plane manufacturing orders and assist Boeing obtain optimistic core working margins. Though shares have develop into rather more costly since I final labored on the plane producer, I imagine the chance profile remains to be favorable!

Earlier score

I beforehand rated shares of Boeing as a purchase once they had been in a buy-the-drop variety of scenario in September. Since then, a serious revaluation has taken place, which was pushed by an honest earnings report for the third-quarter and a confirmed outlook for FY 2023 free money stream. Nonetheless, I imagine that Boeing nonetheless has upside potential because it strikes nearer to optimistic core working revenue in FY 2024. The business plane division particularly is about to learn from a positive financial local weather and if the U.S. economic system avoids a recession, Boeing’s shares could proceed to revalue larger.

2 catalysts for FY 2024: A file 12 months for air journey and optimistic working revenue margins

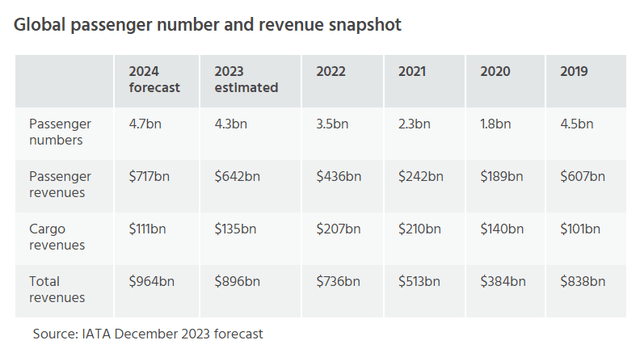

Based on the Worldwide Air Transport Affiliation, the trade group expects passenger journey to hit new information in 2024… that are projected to surpass the 2019 excessive in air passenger journey. For 2024, the Worldwide Air Transport Affiliation expects 4.7B vacationers utilizing airline providers which might replicate a 9% development charge in comparison with 2023 and a 4% development charge relative to 2019… which marked the earlier file for world passenger volumes, simply earlier than the COVID-19 pandemic decimated the airline trade. The trade group additional initiatives about 8% income development for the airline trade and a mixed $25.7B in airline income (Supply).

IATA

The U.S. economic system additionally stays in good situation and grew at a 4.9% charge within the third-quarter, offering extra tailwinds. Sturdy financial development and file passenger journey volumes point out that airways could also be prepared to position new plane orders with producers like Boeing. A good macro image is why I imagine the plane producer is about so as to add to its order backlog and slowly, however steadily transfer in the direction of optimistic core working margins in FY 2024… which within the third-quarter had been nonetheless damaging. Boeing’s plane order backlog was valued at $392B and with air journey set for a file 12 months, the U.S. plane producer could entice new big-ticket orders for airways all over the world.

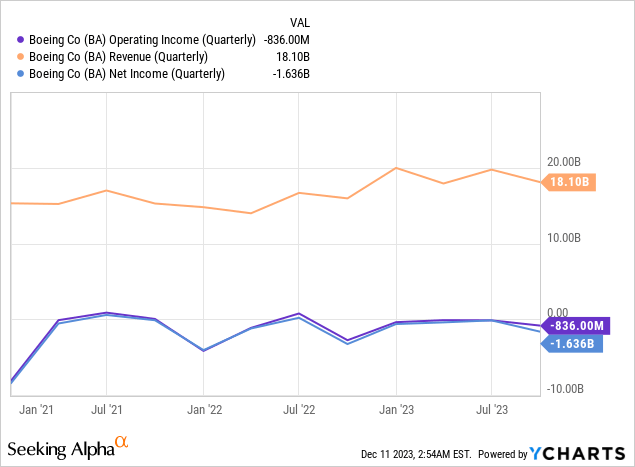

The business plane division particularly has seen renewed momentum after the pandemic with many airways putting new orders with Boeing. Nonetheless, Boeing’s business plane division is just not but worthwhile, partially because of excessive prices. The corporate achieved a damaging 8.6% working margin on $7.9B in revenues within the third-quarter, however the scenario is bettering and Boeing might even see optimistic working revenue subsequent 12 months.

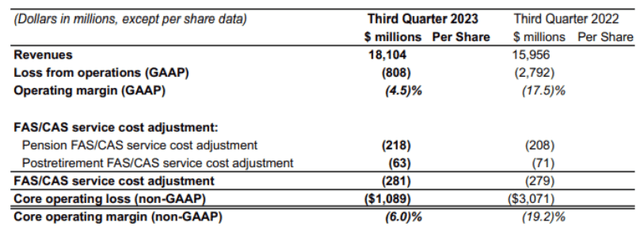

Apart from the continuous anticipated power in airline journey, I see a possible return to optimistic core working margins as a possible catalyst for Boeing’s shares. Boeing reported a 6.0% damaging core working margin in Q3’23, however the agency has seen a cloth enchancment in its margin image because of a stronger order scenario (Boeing added 398 planes to its order backlog in Q3), an escalating tempo of deliveries following the tip of the pandemic and decrease working prices. A return to optimistic (core) working margins can be a serious optimistic catalyst for Boeing and sure additionally precipitate a brand new spherical of EPS upward revisions.

Boeing

Boeing’s valuation, EPS revision potential

Boeing is just not low-cost, not less than not anymore. Nonetheless, that doesn’t imply traders ought to ignore the plane producer.

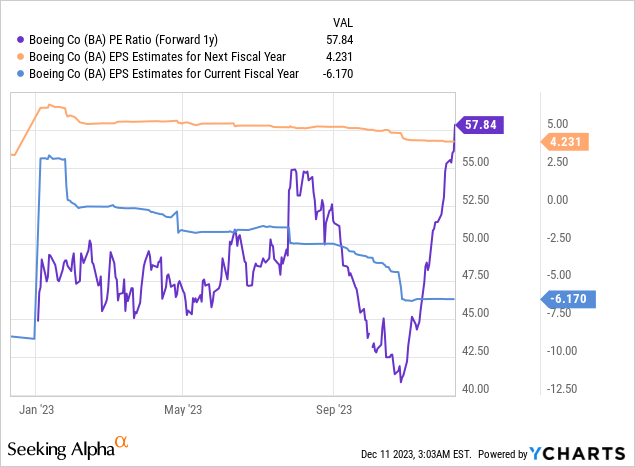

Boeing is projected to see $(6.17) per-share in earnings this 12 months, but additionally anticipated to publish optimistic earnings in 2024 as the corporate lastly digs itself out of the pandemic gap. I additionally imagine that Boeing has appreciable EPS shock potential, particularly if the U.S. economic system retains performing as properly and if the airline trade approaches new passenger journey information in 2024.

Boeing is presently valued at a 58X P/E ratio (primarily based off of FY 2024 earnings), however this P/E ratio drops to 30X primarily based off of FY 2025 earnings. With EPS estimates set to reset larger, traders might even see the P/E ratio drop additional subsequent 12 months. Given the basically optimistic macro tailwinds, I imagine Boeing may commerce at ~35-36X FY 2025 earnings, assuming that its achieves optimistic working margins, implying a good worth vary of $284-294.

Dangers with Boeing

Boeing depends on the expansion trendline within the U.S. economic system and a positive financial outlook since airline corporations are extra prepared to position plane orders with producers once they count on the economic system, and their trade, to do properly. Subsequently, I see the macro image — the efficiency of the U.S. economic system — as the most important danger issue for Boeing. What would change my thoughts about Boeing is that if the corporate failed to attain optimistic core working margins subsequent 12 months.

Closing ideas

Boeing has seen some main positive factors because it introduced its third-quarter earnings card through which the plane producer confirmed its outlook for FY 2023. Nonetheless, I imagine the macro image nonetheless helps an funding in Boeing as the corporate may add to its backlog of plane orders subsequent 12 months because the journey trade is projected to surpass the 2019 passenger journey quantity file (the primary catalyst). Boeing additionally has the chance to maneuver nearer to posting optimistic core working margins (the second catalyst), particularly if the business plane division retains attracting new contracts from airways. Whereas shares of Boeing commerce at a comparatively excessive 55X P/E ratio, the P/E ratio is predicted to drop drastically subsequent 12 months and the corporate additionally has appreciable EPS revision potential. Given the favorable macroeconomic profile, I nonetheless see shares of Boeing as a purchase heading into 2024!

[ad_2]

Source link