[ad_1]

Up to date on December 14th, 2023 by Bob Ciura

The ebook publishing trade is present process speedy adjustments. The enterprise mannequin that remained comparatively unchanged for many years is quickly transferring towards new applied sciences reminiscent of e-books, whereas conventional books lose market share. The distribution channels via which the publishers promote books are shifting as properly.

Amazon (AMZN), which began out as a web-based ebook retailer and expanded into many different product classes since, is the biggest on-line ebook vendor. Amazon will not be solely promoting books, it has additionally moved into publishing books itself, which places some strain on conventional publishers.

These challenges had been as soon as once more illustrated in 2023. Unit gross sales of print books fell 4.1% within the first 9 months of the 12 months.

On this article, we are going to take a look at the three greatest publicly traded ebook publishing shares: Scholastic (SCHL), John-Wiley & Sons (WLY), and Pearson plc (PSO). All three of those firms pay dividends to shareholders, and are included in our checklist of all client discretionary shares.

A technique for traders to seek out nice dividend shares is to deal with these with the longest histories of elevating dividends. With this in thoughts, we created a downloadable checklist of all 150 Dividend Champions.

You possibly can obtain your free copy of the Dividend Champions checklist, together with related monetary metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the hyperlink under:

The three shares are ranked by estimated whole annual returns over the approaching 5 years. Extra information on every firm is on the market via the Positive Evaluation Analysis Database.

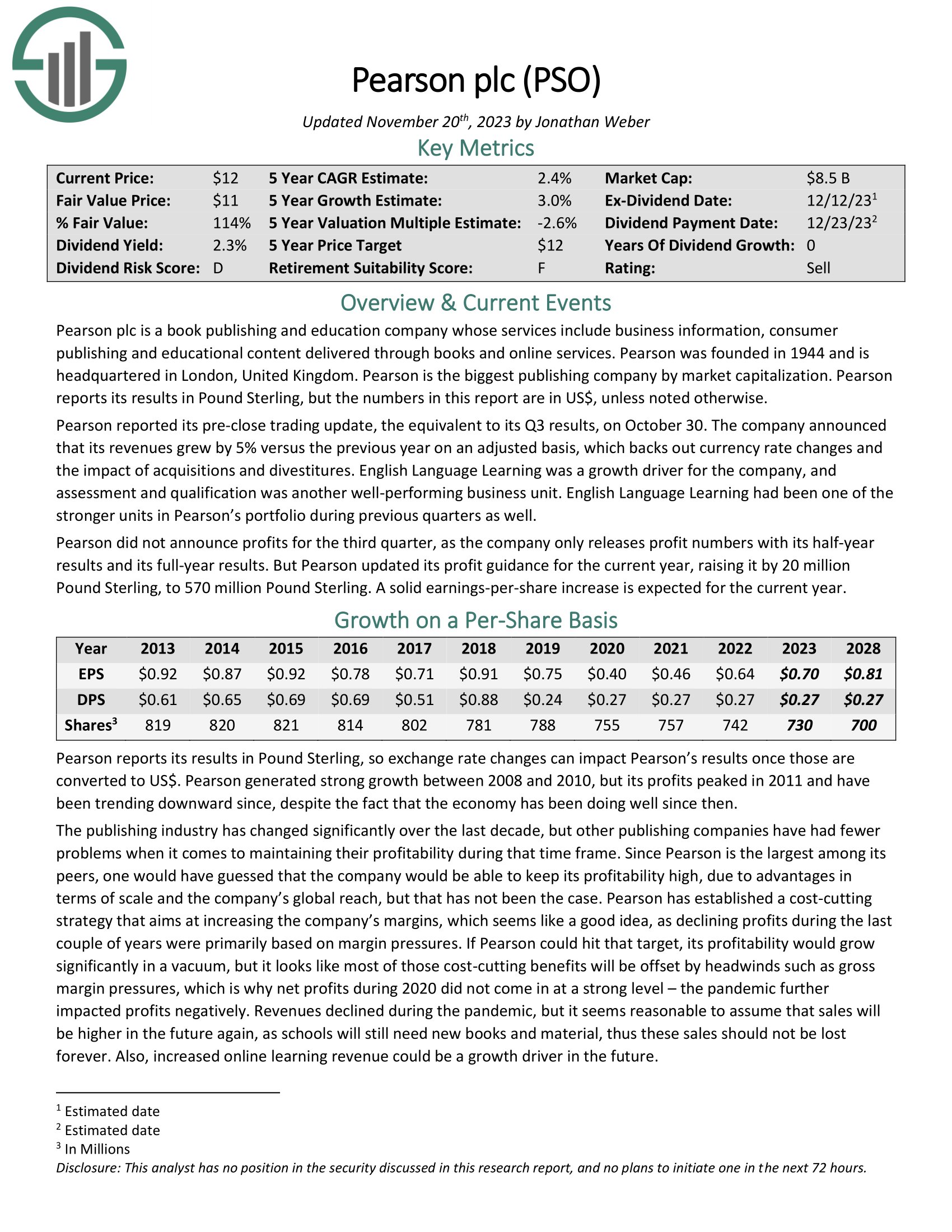

Guide Publishing Inventory #3: Pearson plc (PSO)

5-year anticipated annual returns: 3.1%

Pearson plc is the largest ebook publishing firm on the planet, with annual gross sales of ~$3.4 billion and a market capitalization above $8 billion. Pearson is headquartered within the U.Ok., and the corporate was based in 1944.

Pearson is lively in client publishing, schooling content material, and enterprise info markets.

Pearson reported its pre-close buying and selling replace, the equal to its Q3 outcomes, on October 30. The corporate introduced that its revenues grew by 5% versus the earlier 12 months on an adjusted foundation, which backs out foreign money fee adjustments and the affect of acquisitions and divestitures.

English Language Studying was a development driver for the corporate, and evaluation and qualification was one other well-performing enterprise unit.

Click on right here to obtain our most up-to-date Positive Evaluation report on Pearson (preview of web page 1 of three proven under):

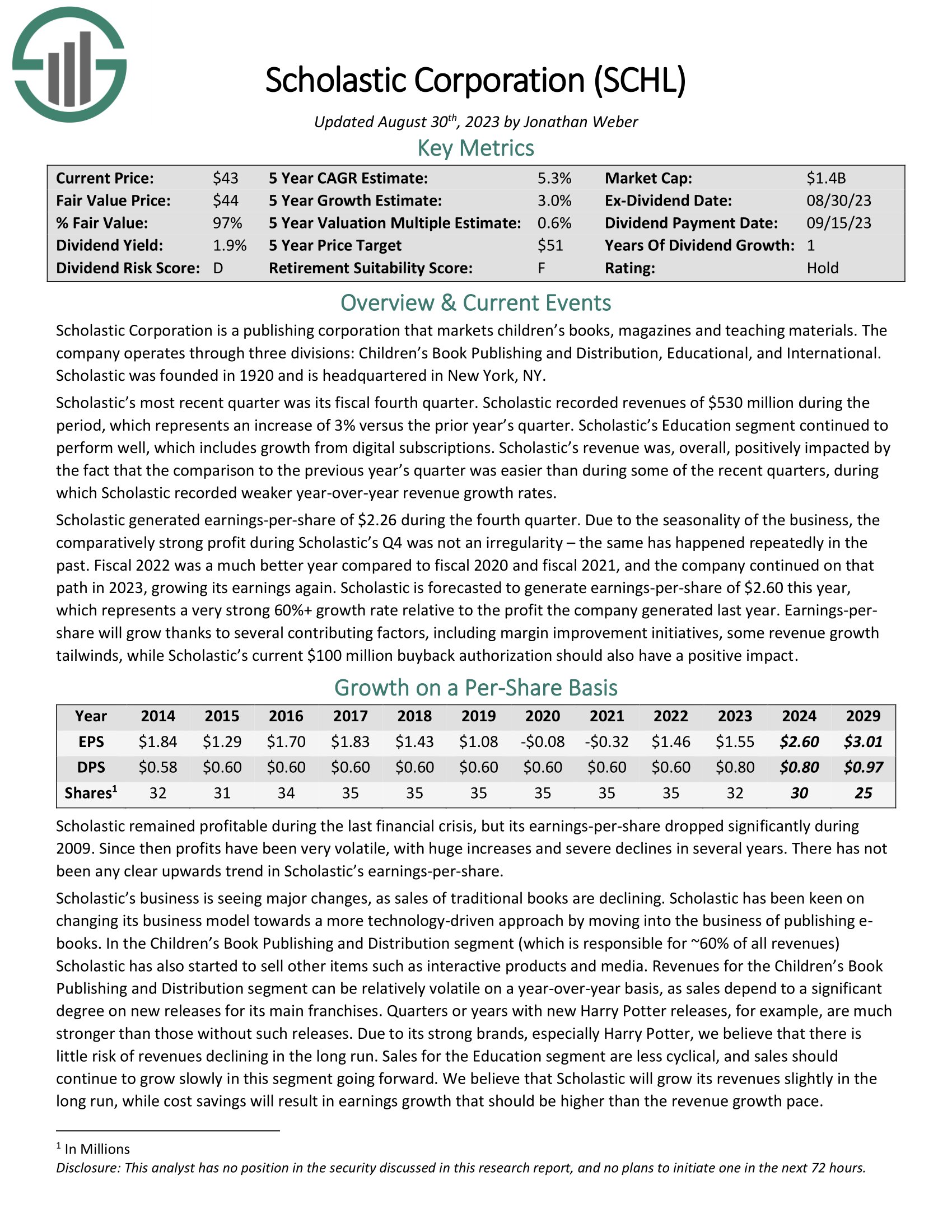

Guide Publishing Inventory #2: Scholastic (SCHL)

5-year anticipated annual returns: 6.8%

Scholastic Company is a publishing company that markets youngsters’s books, magazines, and educating supplies. The firm operates via three divisions: Youngsters’s Guide Publishing and Distribution, Academic, and Worldwide.

In the latest quarter, income of $530 million elevated 3% from the identical quarter final 12 months. Earnings-per-share got here to $2.26 for the quarter. The corporate forecasts earnings-per-share of $2.60 this 12 months, which represents a really robust 60%+ development fee from the earlier 12 months. EPS development can be derived from a number of elements, together with margin growth, income development, and a lift from the present $100 million share buyback authorization.

Click on right here to obtain our most up-to-date Positive Evaluation report on Scholastic (preview of web page 1 of three proven under):

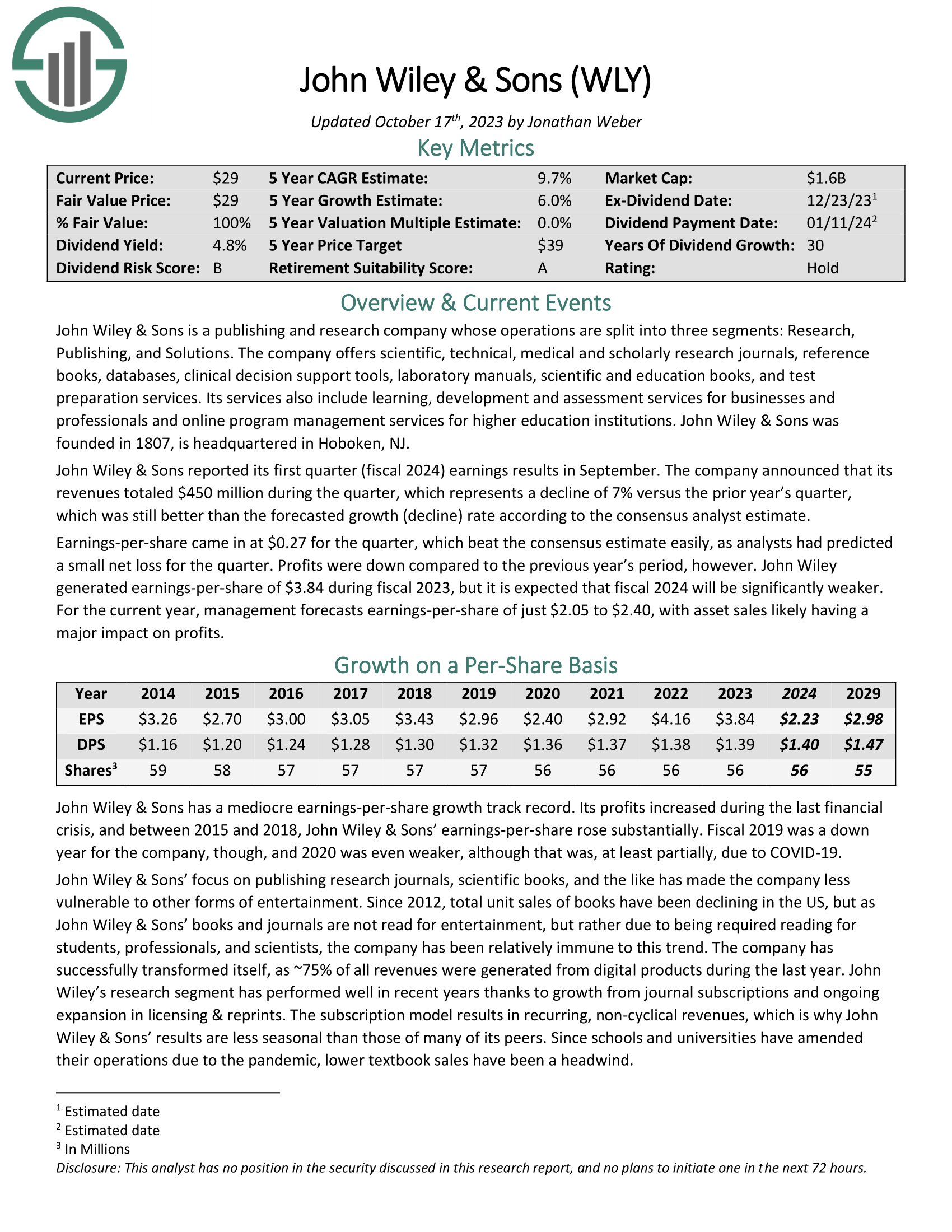

Guide Publishing Inventory #1: John Wiley & Sons (WLY)

5-year anticipated annual returns: 7.4%

John Wiley & Sons is a publishing firm with a powerful deal with the skilled and scientific group. Its merchandise embody analysis journals (scientific, technical, medical and scholarly), reference books, manuals, databases, scientific and schooling books, take a look at preparation companies, and extra.

The corporate additionally gives companies reminiscent of improvement and evaluation companies for companies and companies for increased schooling establishments. John Wiley & Sons was based in 1807.

John Wiley & Sons reported its first quarter (fiscal 2024) earnings leads to September. Quarterly revenues totaled $450 million through the quarter, which represented a decline of seven% versus the identical quarter final 12 months. Earnings-per-share got here in at $0.27 for the quarter, which beat the consensus estimate simply, as analysts had predicted a small internet loss for the quarter.

For the present 12 months, administration forecasts earnings-per-share of $2.05 to $2.40. John Wiley has elevated its dividend for 30 consecutive years. It’s a Dividend Champion.

Click on right here to obtain our most up-to-date Positive Evaluation report on John Wiley & Sons (preview of web page 1 of three proven under):

Last Ideas

Guide publishing shares have skilled various challenges lately. Not solely did the trade undergo from the coronavirus pandemic, nevertheless it was already coping with the rise of e-readers and on-line schooling. Guide publishing shares have needed to adapt to those challenges, with various ranges of success to date.

As a result of the trade stays in a challenged state heading into 2023, traders ought to be selective relating to ebook publishing shares.

Because of the firm’s earnings development outlook, stable dividend yield, and cheap valuation, we view John Wiley & Sons as the highest ebook publishing inventory right this moment. That mentioned, WLY inventory earns a maintain advice as its anticipated annual returns are under 10%.

The next articles comprise shares with very lengthy dividend or company histories, ripe for choice for dividend development traders:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.

[ad_2]

Source link