[ad_1]

batuhanozdel/iStock by way of Getty Photographs

Empire State Realty Belief, Inc. (NYSE:ESRT) has had a stellar 12 months in opposition to wider doom calls from bears concerning the finish of city US workplace actual property. The REIT is up 44% year-to-date to cap a shocking restoration from a Fed-induced selloff. While there are considerations about whether or not or not the rally has overextended itself, the near-term outlook for the REIT is robust with headline CPI persevering with to say no to set the backdrop for rate of interest cuts within the first half of 2024. REITs have optimistic length threat and have been near-toxic investments because the Fed launched into its battle with inflation. Whether or not to construct a place in ESRT in opposition to what’s now a 9.7x value to annualized 2023 third-quarter FFO a number of will rely upon the path of what is presently bullish macroeconomic indicators. US GDP is rising, inflation is falling, and the Fed has indicated not less than 3 rate of interest cuts subsequent 12 months. That is the Goldilocks situation for bulls and the worst-case situation for REIT bears.

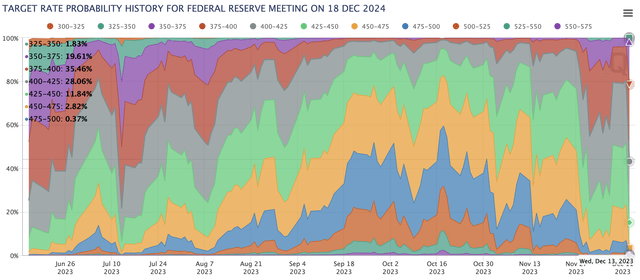

CME FedWatch Device

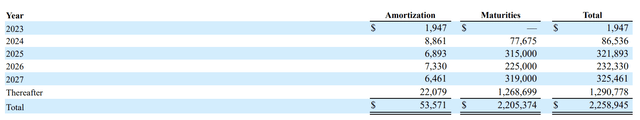

The chance of rates of interest being at their current 5.25% to five.50% on the finish of 2024 is actually zero with the market as per the CME FedWatch Device pricing within the probability of charges having been reduce by 150 foundation factors to three.75% to 4.00% as the bottom situation for subsequent 12 months. ESRT held a complete debt stability of $2.24 billion on the finish of its third quarter with roughly 3.86% of this stability, round $86.54 million, coming due subsequent 12 months. Critically, rate of interest cuts will set the backdrop for the favorable refinancing of debt with ESRT dealing with extra materials principal funds from 2025. It is onerous to see the bearish base remaining by means of 2024.

Empire State Realty Belief Fiscal 2023 Third Quarter Type 10-Q

Occupancy Positive factors And NOI Progress

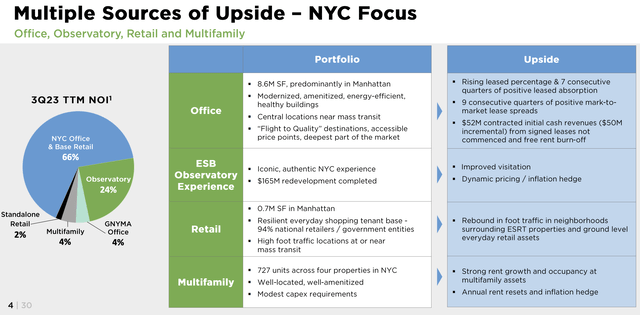

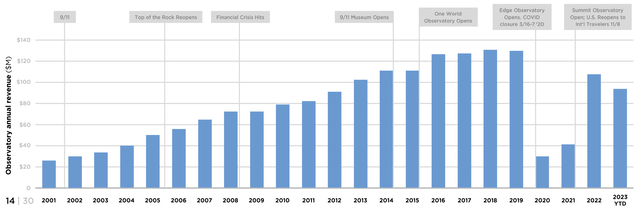

To be clear, ESRT held complete money, investments, and restricted money of $447 million on the finish of its third quarter. That is greater than sufficient liquidity to deal with its maturities up till 2026. Therefore, the REIT doesn’t within the medium time period face any default threat as implied by doom evaluation concerning the trajectory of workplace actual property. ESRT’s portfolio can also be fairly diversified and on the finish of the third quarter was comprised of 8.6 million sq. ft of Manhattan workplace house, one other 700,000 of retail house, 4 multifamily properties with 727 items, and the Empire State Constructing Observatory expertise on the 102nd and 86th flooring of New York’s hottest constructing.

Empire State Realty Belief 2023 October Investor Presentation

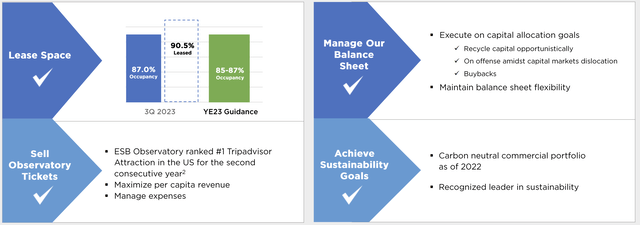

ESRT derived round 24% of its third-quarter internet working revenue from its Observatory with the biggest share of NOI at 66% derived from its workplace properties. The REIT generated income of $191.53 million through the third quarter, up 4.3% over its year-ago comp and beating consensus estimates by $6.14 million. Third-quarter core funds from operations at $0.25 per share was up 4 cents from the year-ago interval, pushed by same-store property money NOI which grew by a terrific 8.8% over its year-ago comp. Additional, the workplace part of the portfolio noticed its leased charge end the third quarter at 91.9%, a 30 foundation factors sequential enhance and a good bigger 250 development from its year-ago interval. The overall industrial portfolio was 90.5% leased on the finish of the third quarter.

Empire State Realty Belief 2023 October Investor Presentation

ESRT is focusing on rising its industrial portfolio occupancy by 200 foundation factors by the top of 2023, up from 85% on the finish of the third quarter. That is up 460 foundation factors because the finish of 2021 with the REIT realizing 7 consecutive quarters of optimistic leased share absorption. The REIT’s 100% carbon-neutral industrial portfolio is a plus on the subject of corporates discovering new workplace house while pushing to satisfy sustainability objectives. The REIT achieved an 11% optimistic mark to market on workplace leasing spreads within the third quarter, highlighting the energy of its portfolio.

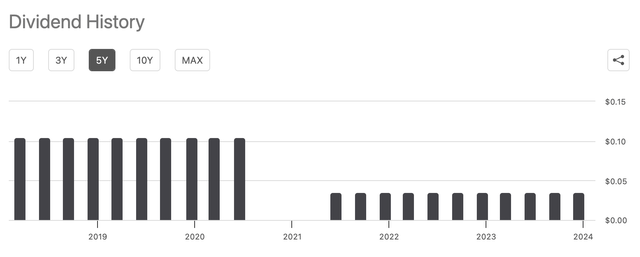

Doable Dividend Hike Helps Units Backdrop For 2024

In search of Alpha

The internally managed REIT final paid out a quarterly money dividend of $0.035 per share, unchanged from prior for what’s presently a 1.45% annualized ahead dividend yield. It is paid out 14% of its FFO for the third quarter as a dividend. Critically, the distribution nonetheless sits far under the $0.1050 per share paid out earlier than the pandemic. ESRT was at all times a high-profile sufferer of the pandemic, however the restoration is nicely underway with NYC tourism numbers ticking up and nicely on monitor to surpass their pre-pandemic ranges. The observatory has vital upside potential with income on the up. It will proceed to drive FFO development for the REIT.

Empire State Realty Belief 2023 October Investor Presentation

ESRT Is now guiding for core FFO to come back in at $0.85 to $0.87 per share for the complete 12 months 2023, a rise from prior steering of core FFO of $0.83 to $0.86 per share. Therefore, we might see fairly substantial dividend hikes particularly as a response to Fed charge cuts delivering a pathway for cheaper debt. The REIT is a maintain for 2024 with a attainable dividend hike, continued NOI development, and occupancy good points set to drive additional shareholder worth creation.

[ad_2]

Source link