[ad_1]

Jair Ferreira Belafacce/iStock through Getty Photos

Funding Thesis

Inexperienced Plains Companions LP (NASDAQ: NASDAQ:GPP) warrants a purchase score for its excessive dividend yield and sustainability. Regardless of a excessive payout ratio, the corporate’s dividend funds seem like secure because of forecasted business progress, GPP’s constant unlevered money circulate, and its management over debt. Downsides to GPP are the corporate’s share worth efficiency in addition to unremarkable progress. Regardless of these drawbacks, GPP is price shopping for for dividend revenue seekers.

Firm Overview and Rivals

Inexperienced Plains Companions was based in 2005 and is an organization that develops, shops, and transports biofuels equivalent to ethanol. Ethanol is an additive to gasoline and has quite a few different purposes together with medical makes use of and alcoholic drinks. The corporate owns or leases 27 storage tanks along with 19 vehicles and tankers for transportation. GPP’s mother or father firm is Inexperienced Plains Inc. (GPRE) which owns an nearly 49% stake within the firm and has a number of industrial agreements that vastly profit GPP. For comparability functions, peer rivals examined are StealthGas Inc. (GASS), Martin Midstream Companions L.P. (MMLP), Plains All American Pipeline, L.P. (PAA), and International Companions LP (GLP).

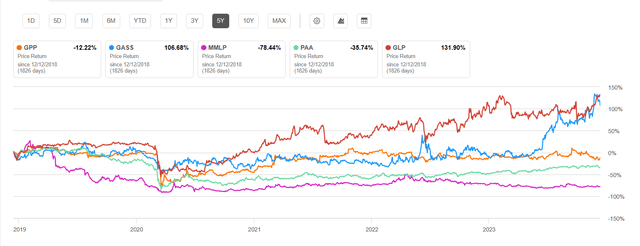

GPP and Peer Competitor 5-12 months Worth Return (Looking for Alpha)

Traditionally, GPP’s share worth has seen a slight CAGR decline. Even going again to 2015, GPP traded at just below $15 per share. On the time of this text GPP is at $13.65 per share. Nevertheless, as I’ll cowl later, GPP affords a substantial dividend yield. Due to this fact, whereas not a inventory for progress buyers, it is vitally interesting for revenue seekers which can be keen to simply accept primarily a flat share worth in alternate for prime dividend yield.

Outlook for Trade

The ethanol market is anticipated to see a 4.6% CAGR between 2023 and 2033. The U.S. is the world’s largest ethanol producer in 2021 at 53% of the world’s provide. Total demand for ethanol will seemingly have a direct influence on GPP because it beneficial properties income from the storage and transportation of biofuels.

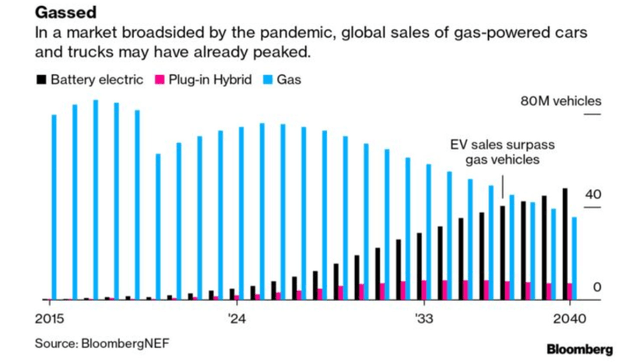

The important thing dampener on future demand will seemingly be electrical autos taking a bigger portion of the general automobile and truck market. As a result of gasoline takes a portion of ethanol market share, it will have an effect on GPP. Nevertheless, gas-powered vehicles and vehicles are anticipated to see a rise till mid-2020s after which a gradual decline. This development will proceed till EV gross sales surpass fuel autos in late 2030s.

Gasoline, Electrical, and Hybrid Automobile Demand Forecast (BloombergNEF)

Regardless of the discount in gas-powered autos, general demand for ethanol will stay substantial. GPP is postured to help that progress with low debt, excessive money circulate, and its environment friendly partnership with its mother or father firm. Due to this fact, an investor can moderately count on a sustainable dividend given the general ethanol market. Nevertheless, to additional validate this declare, we should take a look at GPP’s financials extra carefully.

Dividend Sustainability

GPP gives a excessive dividend yield of 13.96% with a mean four-year yield of 12.23%. The corporate has additionally been offering dividend funds for 8 years and has seen two years of consecutive progress. With such a excessive dividend yield, the important thing query in my thoughts is relating to its sustainability. To find out dividend sustainability, the obvious metric to me is GPP’s payout ratio. Whereas trending downward, GPP has a dividend payout ratio of higher than 100%. That is usually a purple flag to me since theoretically greater than 100% of the corporate’s revenue goes to the shareholder. However we should dive deeper to find out if its sustainable.

Inexperienced Plains Companions Dividend Payout Metrics (2022 This fall via 2023 Q3)

Dividend Payout Metric

2022 This fall

2023 Q1

2023 Q2

2023 Q3

Payout Ratio

166.60%

108.88%

115.49%

114.79%

Dividend per share

$0.46

$0.46

$0.46

$0.46

Frequent Dividends Paid

$15.7M

$10.6M

$10.6M

$10.6M

Click on to enlarge

Supply: Looking for Alpha, 14 Dec 23

Regardless of a excessive payout ratio, GPP has been in a position to preserve a constant asset to legal responsibility ratio. Moreover, its money place is greater than the earlier two quarters. Lastly, the corporate has web debt that’s controllable. These metrics match with what GPP reviews in its annual report that it may obtain sustainable money flows via the agreements it has established. In these agreements, there are minimal commitments in its rail, storage, and transportation providers that present constant money circulate.

GPP Belongings and Liabilities Metrics (2022 This fall via 2023 Q3)

2022 This fall

2023 Q1

2023 Q2

2023 Q3

Whole Belongings

$121.4M

$137.8M

$127.5M

$120.3M

Whole Liabilities

$120.7M

$137.8M

$129.0M

$121.4M

Internet Debt

$86.7M

$101.7M

$98.4M

$87.0M

Money and Equivalents

$20.2M

$18.1M

$15.6M

$19.1M

Click on to enlarge

Supply: Looking for Alpha, 14 Dec 23

Due to this fact, whereas GPP has a excessive payout ratio, I conclude that it has a number of indications for being sustainable. To discover one other side of its dividend sustainability we should take a look at the corporate’s progress and profitability. As one may count on, an organization with such a excessive dividend yield has little to reinvest into its personal progress.

Progress and Profitability

Any firm may very well be offering a excessive dividend yield solely to be dropping precipitously in share worth because of growing debt and declining money reserves. Nevertheless, this has not been the case with GPP. The corporate has demonstrated constant income and web revenue in addition to a excessive web revenue margin of 45.54%.

Progress and Profitability Metrics for GPP

2022 This fall

2023 Q1

2023 Q2

2023 Q3

Revenues

$20.9M

$20.8M

$20.5M

$20.1M

Internet revenue

$9.4M

$9.7M

$9.2M

$9.2M

YoY Income Progress

9.70%

8.77%

4.42%

0.39%

Click on to enlarge

Supply: Looking for Alpha, 14 Dec 23

Whereas GPP has maintained constant income and web revenue, my solely space for concern is its YoY income progress over the past 4 quarters. Nevertheless, this isn’t out of the unusual for high-dividend corporations. As a result of GPP is just not using its earnings for increasing storage amenities and autos, muted income progress is pretty anticipated.

Firm Outlook and Valuation

With a present share worth of $13.65 on the time of this text, GPP is at present in roughly the center of its 52-week vary ($11.72 to $16.25). Inexperienced Plains has demonstrated a YTD worth return of virtually 6% however has traditionally been primarily flat. This isn’t stunning contemplating a lot of the corporate’s revenue are returned to shareholders within the type of dividends versus funding for future progress.

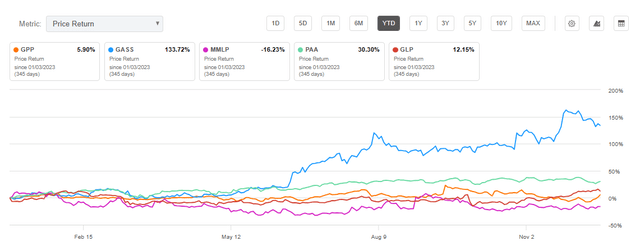

YTD Worth Return: GPP and Peer Rivals (Looking for Alpha)

In comparison with the peer rivals analyzed, GPP is priced a bit on the upper facet as seen in its worth/gross sales and worth/money circulate. Nevertheless, given its excessive dividend yield and stability, one can moderately count on GPP’s share worth to not see any main beneficial properties or losses. That’s, until a serious danger issue unfolds like recession or different influence to the ethanol business.

Valuation Metrics for GPP and Peer Rivals

GPP

GASS

MMLP

PAA

GLP

EV/EBITDA FWD

7.44

3.45

6.06

9.07

8.28

Worth/Gross sales TTM

3.51

1.57

0.11

0.21

0.08

Worth/Money Movement TTM

6.28

2.95

0.70

5.07

5.24

P/E GAAP TTM

7.72

4.79

N/A

11.05

9.76

Click on to enlarge

Supply: Looking for Alpha, 14 Dec 23

Maybe extra necessary than its share worth progress is its anticipated dividend. Whereas I don’t count on GPP to extend its dividend, I consider it’s secure via 2024 as a result of a number of elementary components already coated on this article. Due to this fact, GPP is a stable selection, notably for dividend buyers.

Volatility and Dangers to Buyers

There are a number of dangers to GPP’s share worth and dividend sustainability. The primary is financial recession. As a result of ethanol is utilized in gasoline, any recession-induced decline in gasoline demand will influence the ethanol business. In April 2020, in the course of the COVID-19 pandemic, demand for gasoline fell 37% under its April 2019 stage resulting in a 53% decline within the worth index for gasoline.

The second main danger is electrical automobile manufacturing changing fuel autos. That is extra a certainty than a danger as already coated. Nevertheless, the shift from gasoline-powered autos is just not a fast change, however gradual shift spanning many years. Moreover, as mentioned, gasoline solely represents a portion of general ethanol demand.

The third main danger lies with the crops that produce ethanol. Gasoline ethanol is predominantly produced by the sugar of grains like corn, sorghum, and barley. Whereas the corn business, for instance, is powerful, impacts to the crop will seemingly have a direct influence on ethanol provide.

Even when certainly one of these danger components turns into actuality, GPP has steady fundamentals that point out low volatility. GPP additionally has a comparatively low 60-month beta worth of 0.71, indicating low volatility in comparison with the market general. This beta worth is decrease than all 4 peer rivals analyzed. Due to this fact, whereas GPP might lower its dividend within the occasion of declining income, I discover it extremely unlikely that the corporate would get rid of the dividend totally.

Concluding Abstract

GPP warrants a purchase score for me because of its excessive dividend yield that seems to be secure given the businesses regular revenue, managed debt, and constant money circulate. The corporate’s inventory is just not appropriate for progress buyers because of its sluggish decline in share worth traditionally. Nevertheless, given the dividend progress CAGR and relative security, GPP needs to be thought of by income-seeking buyers.

Given GPP’s industrial agreements with its mother or father firm, International Plains Inc., the corporate seems effectively suited to make the most of the 4.6% anticipated CAGR for the ethanol business. Whereas gasoline-powered autos will finally decline compared to electrical autos, quite a few purposes for ethanol will live on.

[ad_2]

Source link