[ad_1]

Powell’s newest speech was music to the ears of inventory traders worldwide

As a consequence, the Dow Jones hit a brand new closing excessive, showcasing the breadth of the present bullish development

S&P 500’s historic outperformance in low inflation years, US greenback weakening signifies markets may very well be in for one more bullish 12 months in 2024

Due to probably the most aggressive price hike cycle in recent times, the central financial institution has managed to include with out inflicting a recession – to this point.

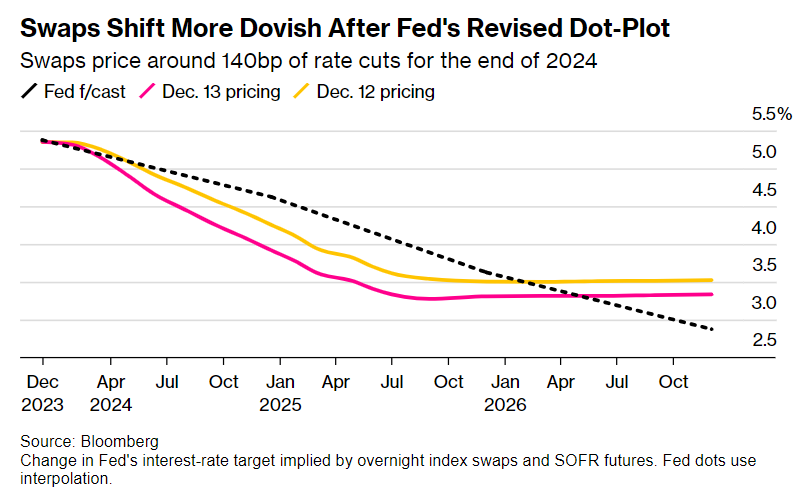

Now, in a stunning flip of occasions, Fed officers have made clear their intentions of implementing a sequence of cuts in 2024, totaling 75 foundation factors (extra easing than indicated in September).

This comes after Powell, just a few weeks in the past, declared it was untimely to speak in regards to the timing of price cuts again then.

In the meantime, they count on additional price cuts by 2025 to three.6 p.c, and Fed funds are discounting 6 price cuts by the Fed in 2024. The , in keeping with the Fed’s decisions, has additionally determined to not enhance tightening.

Thus, rates of interest on foremost refinancing operations, marginal lending operations, and deposits with the ECB will stay unchanged at 4.50 p.c, 4.75 p.c, and 4.00 p.c, respectively.

In line with the info proven by Eurosystem consultants, eurozone inflation is predicted to say no steadily over the following 12 months after which method the two p.c goal in 2025.

What Now?

Taking the Common, we will see the way it has reached new all-time highs, and in addition extra shares have recorded new 52-week highs.

Through the bull market that has persevered for over a 12 months, some people have spent your entire 12 months trying to find causes to undertake a bearish stance and place themselves towards the fairness development.

The query stays: Are you continue to not satisfied? The inventory market continues to exhibit a broadly outlined bullish development.

Maybe it is time to shift our focus to observing the market’s precise conduct as an alternative of getting entangled in varied concerns.

Even with superior information of stories, predicting market reactions stays difficult as a result of myriad variables at play.

Whereas sure variables maintain extra significance than others—realizing future inflation charges, as an example—navigating market dynamics includes grappling with a large number of unpredictable elements.

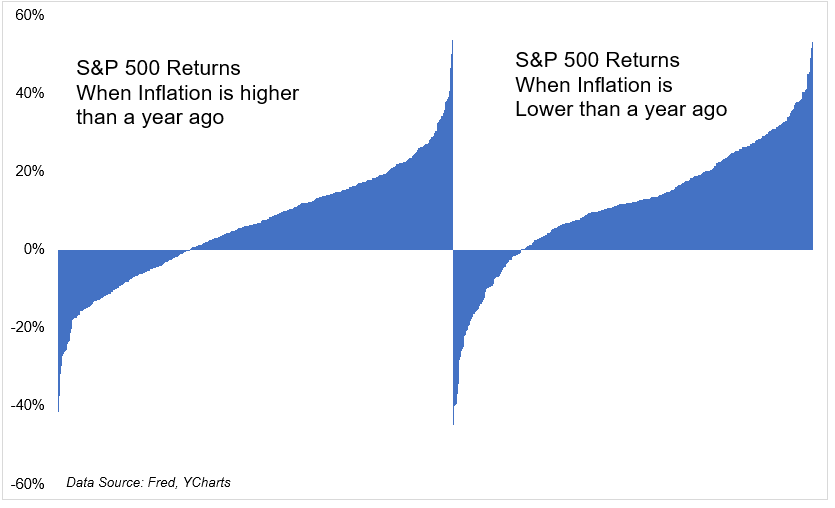

The chart above would possibly look the identical, however the has a mean annual return of 6.3% when inflation is larger than within the earlier 12 months and 11.8% when it’s decrease.

As well as, the variety of adverse years, and thus sharp declines, is way more current with excessive inflation (33%), which within the coming years, projections in hand, shouldn’t be there.

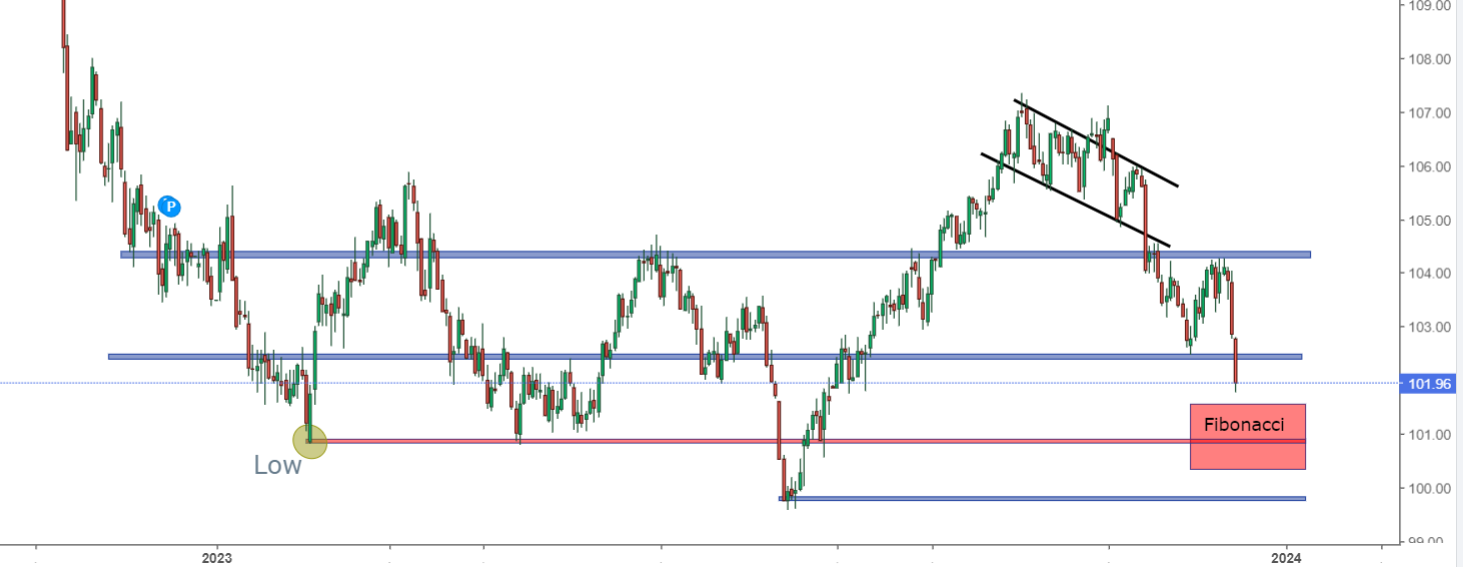

In the meantime, these anticipating rises in December as properly are hoping for a weaker greenback. And December, up to now 40 years, has been the worst month of the 12 months for the .

The buck has been falling since October; a break of 102.5 suggests additional weak point towards the February lows, contained in the Fibonacci retracement space.

A drop to the earlier lows would undoubtedly convey a tailwind to equities and a subsequent space of focus going to the July low at 99.5.

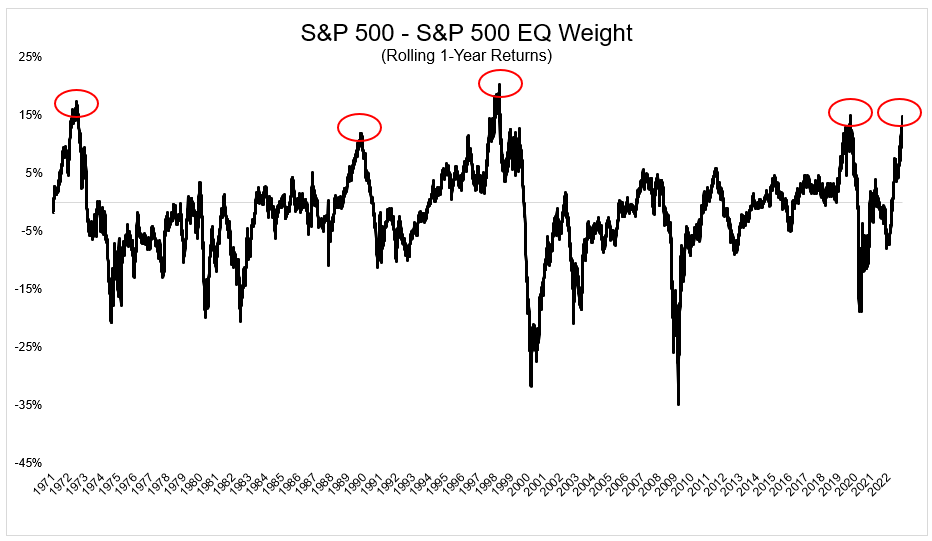

Whereas we had been to contemplate a historic statistic, among the many many current, the chart under exhibits durations of utmost outperformance of the S&P 500 market-cap weighted over .

4 examples: 1973, 1990, 1999, and 2020 excluding this 12 months the place it exhibits that slim management, reminiscent of that of the Magnificent 7, is commonly adopted by dangerous years.

Is 2024 destined to be simply one other unexceptional 12 months? Maybe it is time to focus on the value development to seek out out.

***

You possibly can simply decide whether or not an organization is appropriate in your danger profile by conducting an in depth basic evaluation on InvestingPro in accordance with your standards. This manner, you’ll get extremely skilled assist in shaping your portfolio.

As well as, you’ll be able to join InvestingPro, one of the crucial complete platforms out there for portfolio administration and basic evaluation, less expensive with the largest low cost of the 12 months (as much as 60%), by profiting from our prolonged Cyber Monday deal.

Declare Your Low cost Immediately!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, or suggestion to speculate as such it’s not meant to incentivize the acquisition of belongings in any method. I want to remind you that any kind of asset, is evaluated from a number of factors of view and is extremely dangerous and subsequently, any funding determination and the related danger stays with the investor.

[ad_2]

Source link