[ad_1]

USD/CAD ANLAYSIS & TALKING POINTS

BoC assembly minutes recommend much less aggressive stance from the central financial institution.Canadian earnings & retail gross sales in focus alongside US GDP.Will USD/CAD respect trendline assist as soon as once more?

Need to keep up to date with essentially the most related buying and selling info? Join our bi-weekly e-newsletter and maintain abreast of the most recent market transferring occasions!

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX crew

Subscribe to E-newsletter

CANADIAN DOLLAR FUNDAMENTAL BACKDROP

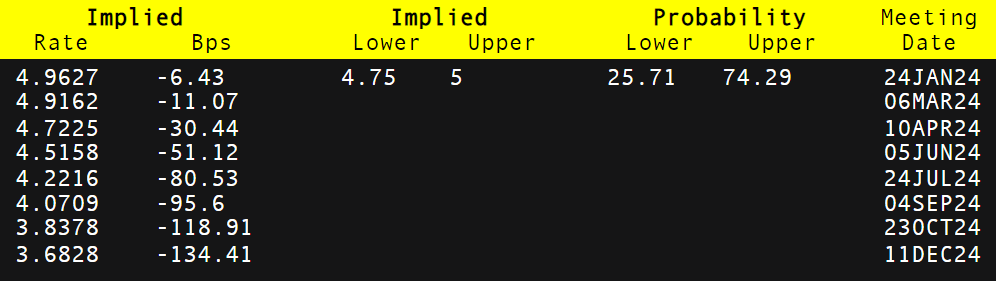

The Canadian greenback restoration could also be fading after final nights Financial institution of Canada (BoC) abstract of deliberations that highlighted the progress being made on the inflationary entrance. Regardless of Tuesday’s marginal beat on each core and headline metrics, there was no upside shift that’s trigger for concern at this level. Consequently, we’ve got seen a rise in cumulative rate of interest cuts (consult with desk under) for 2024 as markets now anticipate this to be the height of the cycle for the BoC.

BANK OF CANADA INTEREST RATE PROBABILITIES

Supply: Refinitiv

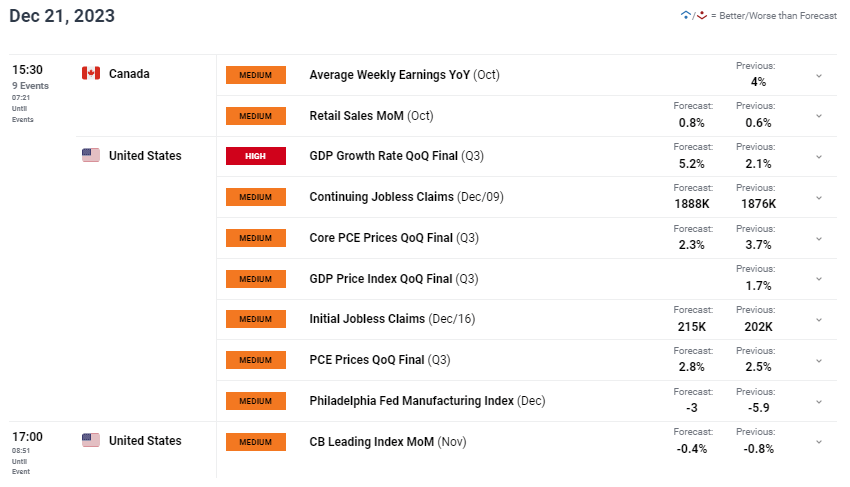

The financial calendar at the moment holds some necessary information for Canada together with common weekly earnings and retail gross sales information. Earnings has been sticky and will likely be welcomed by the BoC ought to we see a transfer decrease. Retail gross sales has additionally been cussed of latest no matter restrictive financial coverage and it is going to be attention-grabbing to see how shopper demand has been impacted for October.

From a USD perspective, US GDP , jobless claims and core PCE figures are scheduled later at the moment. GDP is anticipated to maneuver sharply increased which may stabilize the weakening buck. The Fed’s Harker yesterday pushed again in opposition to slicing charges too early and should nicely gai traction with different Fed officers.

USD/CAD ECONOMIC CALENDAR (GMT +02:00)

Supply: DailyFX Financial Calendar

TECHNICAL ANALYSIS

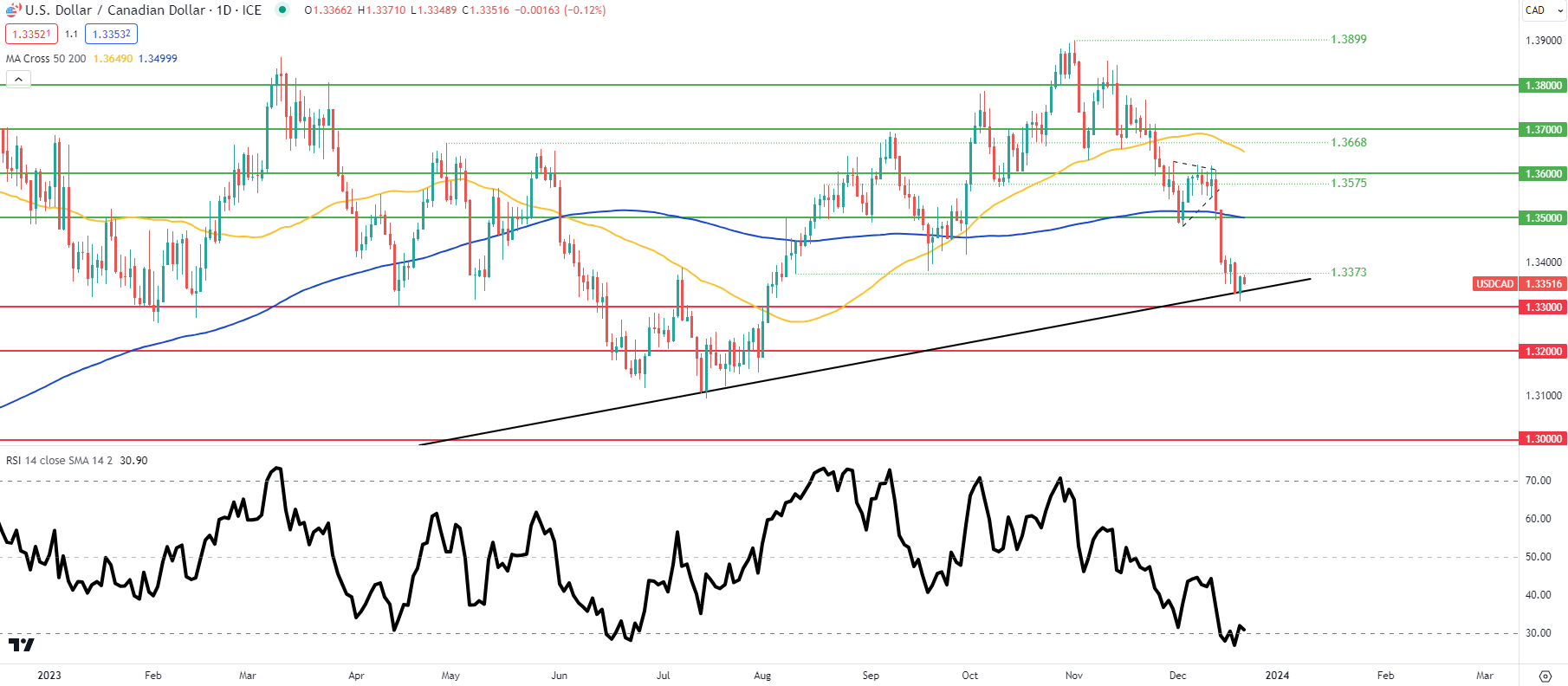

USD/CAD DAILY CHART

Chart ready by Warren Venketas, IG

Every day USD/CAD value motion above has bears testing the long-term trendline assist zone (black) which has held agency since June 2021. Whereas the Relative Energy Index (RSI) reveals momentum pushing out of oversold territory, a break under trendline assist can’t be dominated out. Bulls could also be on the lookout for a reversal however ought to train sound danger administration as a assist break might catalyze a major drop in direction of 1.3200 psychological stage.

Key resistance ranges:

Key assist ranges:

Trendline support1.33001.3200

IG CLIENT SENTIMENT DATA: MIXED

IGCS reveals retail merchants are presently web LONG on USD/CAD, with 76% of merchants presently holding lengthy positions (as of this writing).

Curious to find out how market positioning can have an effect on asset costs? Our sentiment information holds the insights—obtain it now!

Change in

Longs

Shorts

OI

Every day

-5%

-4%

-5%

Weekly

42%

-15%

18%

Contact and followWarrenon Twitter:@WVenketas

factor contained in the factor. That is in all probability not what you meant to do!

Load your utility’s JavaScript bundle contained in the factor as a substitute.

[ad_2]

Source link