[ad_1]

-Antonio-

The iShares iBoxx $ Excessive Yield Company Bond ETF (HYG) is the most important high-yield bond ETF out there, with $19.2 billion in AUM. It is usually one of the crucial costly ones, with a 0.49% expense ratio. HYG does not likely have any important benefits over its friends, together with the SPDR Portfolio Excessive Yield Bond ETF (SPHY) and the iShares Broad USD Excessive Yield Company Bond ETF (USHY), however is rather more costly. Mentioned bills have led to underperformance up to now and can, I consider, result in additional underperformance sooner or later. As such, I might promote HYG, and put money into both SPHY or USHY.

HYG – Fundamentals

Sponsor: Funding Supervisor Underlying Index: Markit iBoxx USD Liquid Excessive Yield Index Expense Ratio: 0.49% Dividend Yield: 5.76% Complete Returns 10Y: 3.11%

HYG – Overview and Evaluation

Index and Holdings

HYG is an easy high-yield company bond ETF, monitoring the Markit iBoxx USD Liquid Excessive Yield Index. It’s a comparatively easy index, together with all bonds with the next traits:

fixed-rate developed market company issuer greenback denominated non-investment grade credit standing, BB or decrease

As with most different indexes, there are particular different primary inclusion and exclusion standards centered on liquidity, measurement, and the like.

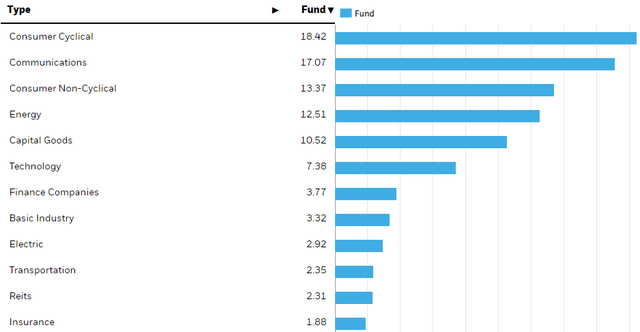

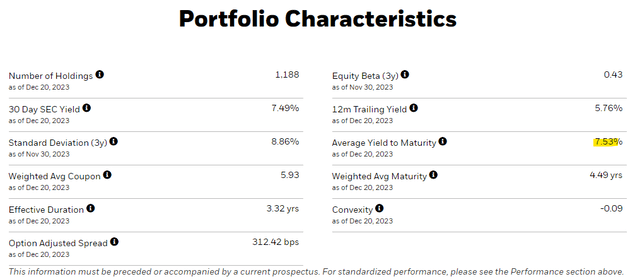

HYG gives buyers with diversified publicity to high-yield bonds, with investments in 1,188 bonds from all related business segments.

HYG

Focus is kind of low too, with most issuers accounting for lower than 1.0% of the fund’s portfolio, none for greater than 3.0%.

HYG’s diversification reduces threat, volatility, and potential losses from anyone particular person default. These are all vital advantages, and of explicit significance for a high-yield bond fund.

Moreover the above, nothing actually stands out about HYG or its underlying index. It’s a broad high-yield company bond index ETF, with an inexpensive index, and with holdings reflective of the identical.

Importantly, the fund’s index and portfolio doesn’t markedly differ from a number of of its friends, together with SPHY and USHY. There are some variations, with each SPHY and USHY having considerably laxer inclusion standards and extra diversified portfolios, however these are small variations, all issues thought of.

Credit score Threat

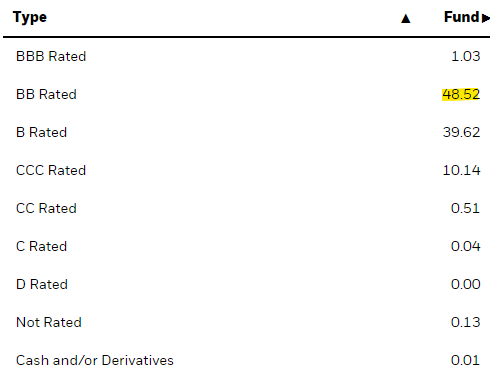

HYG focuses on non-investment grade bonds, with a mean credit standing of BB.

HYG

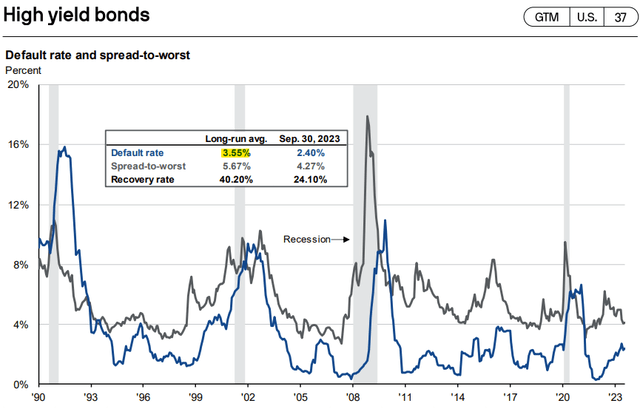

HYG’s credit score rankings are indicative of relative weak issuers, with subpar financials and steadiness sheets. Nonetheless, these corporations can typically meet their monetary obligations, with long-term common default charges of three.6%.

JPMorgan Information to the Markets

However, default charges are considerably depending on financial and business circumstances, with many non-investment grade issuers defaulting throughout recessions, downturns, or related environments.

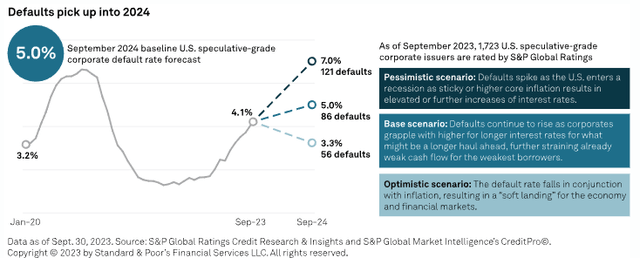

Proper now, increased rates of interest have make it troublesome and prohibitively costly for among the riskier issuers to roll-over their debt. Default charges have elevated to round 4.1%, barely increased than common. Defaults might proceed to extend if charges stay increased for longer, particularly as older bonds, issued with decrease charges, proceed to mature.

S&P

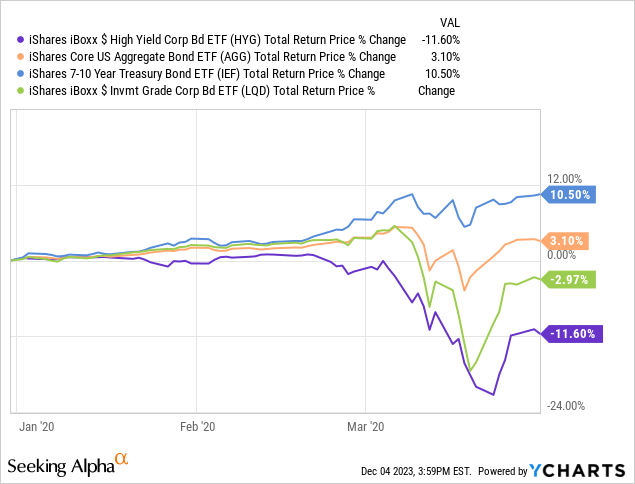

Default charges additionally spike throughout recessions and downturns, one can see the influence of the pandemic within the graph above. Excessive-yield bond costs are inclined to comply with go well with, resulting in losses and underperformance throughout these. For example, HYG noticed double-digit losses throughout 1Q2020, the onset of the coronavirus pandemic. Losses had been a lot increased than these of most bonds and bond sub-asset lessons.

Information by YCharts

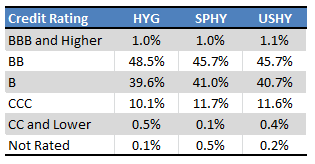

HYG’s credit score high quality could be very barely increased than that of most high-yield company bond ETFs, as a consequence of barely stricter inclusion standards. Variations are small, nonetheless.

Fund Filings – Chart by Writer

Dangers and drawdowns appear comparable. Losses had been barely increased throughout 1Q2020, however recovered barely sooner throughout 2Q2020 too. Variations right here appear small, and principally as a consequence of volatility, nonetheless.

Information by YCharts

Dividends and Dividend Development Evaluation

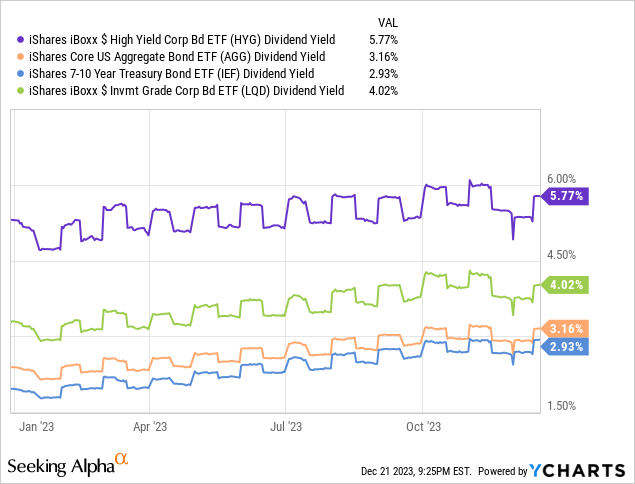

HYG focuses on non-investment grade bonds, with excessive credit score threat and yields. HYG itself yields 5.8%, a considerably good yield, and better than that of most bonds and bond sub-asset lessons.

Though HYG’s 5.8% dividend yield is correct, it doesn’t totally consider latest Fed hikes. The fund’s 8.3% yield to maturity is a extra forward-looking yield metric, and rather more indicative of the dividends and returns that buyers ought to anticipate shifting ahead. For my part not less than.

HYG

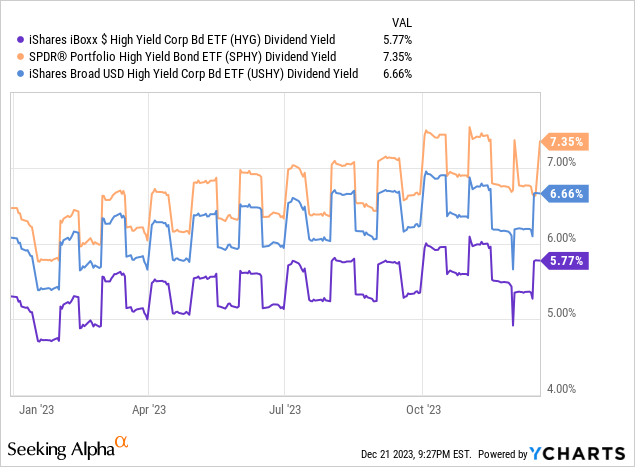

However, HYG’s dividends examine considerably unfavorably to these of USHY and SPHY. Each funds have increased dividend yields:

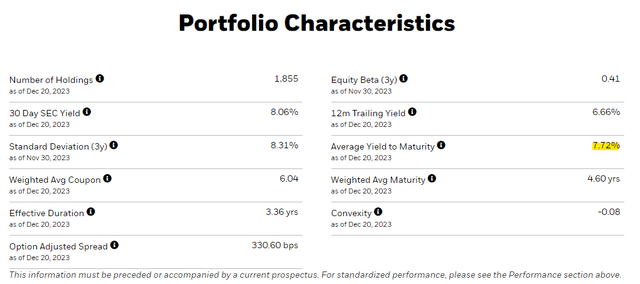

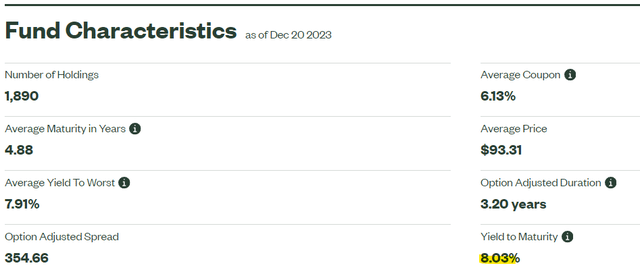

However extra comparable yield to maturities:

USHY SPHY

HYG’s decrease dividend yield is not less than partly the results of its a lot increased expense ratio. HYG has bills of 0.49%, whereas USHY is cheaper at 0.15%, SPHY even cheaper at 0.05%. Dividends are internet of charges, so increased bills instantly cut back fund dividends.

On a extra unfavourable be aware, if the Federal Reserve had been to chop charges within the coming years, as appears exceedingly doubtless, dividends for these funds would all doubtless lower. The magnitude and timing of those (potential) dividend cuts would rely upon the magnitude and timing of any potential price cuts, nonetheless.

Efficiency Evaluation

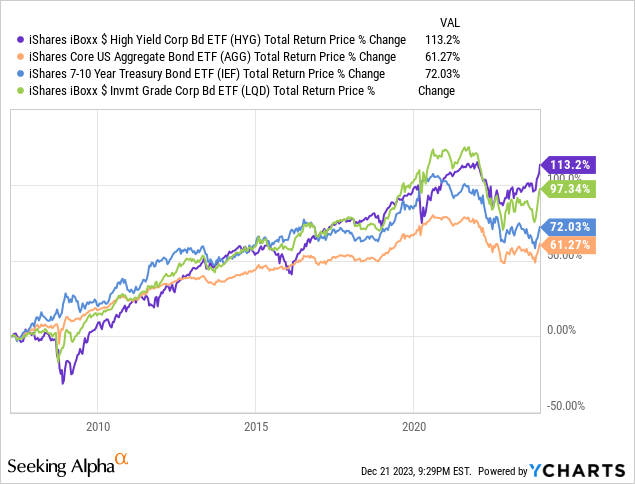

Bonds are earnings autos, whose long-term returns are nearly fully depending on earnings. On account of this, HYG ought to outperform relative to most bonds and bond sub-asset lessons long-term, as has been the case since inception:

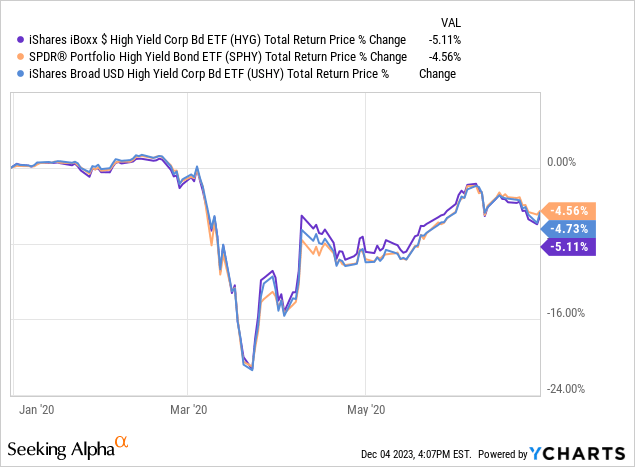

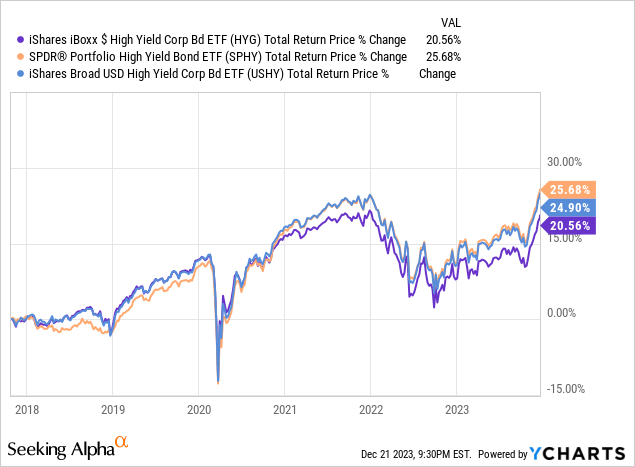

However, because the fund yields than comparable high-yield bond ETFs, it ought to underperform relative to those long-term, as has been the case since inception:

HYG is a little more costly than SPHY and USHY, and so has a decrease yield and complete returns. This is a crucial unfavourable for the fund. Importantly, HYG doesn’t considerably differ from these two funds in any other case, with comparable indexes, credit score rankings, drawdowns and threat. The one vital distinction between these funds is HYG’s increased bills, which implies there is kind of no cause to anticipate HYG to ever outperform, or to purchase the fund. SPHY and USHY appear strictly higher, for my part not less than.

Conclusion

HYG is an easy high-yield company bond ETF. Though there’s nothing considerably incorrect with the fund, it’s considerably costlier than its friends, resulting in decrease dividends and weaker efficiency. Because the fund does not likely have any important benefits over its friends, I might not put money into the fund.

[ad_2]

Source link