[ad_1]

Wall Road’s main averages are on monitor to shut out 2023 close to their all-time highs.

It’s been an unimaginable yr for shares, with many corporations recording blowout year-to-date positive factors.

On this article, I have a look at among the yr’s greatest winners and look at their prospects on whether or not they can proceed hovering in 2024.

Seeking to beat the market in 2024? Let our AI-powered ProPicks do the leg be just right for you, and by no means miss one other bull market once more. Study Extra »

With Wall Road closing the curtains on a outstanding yr, the 5 shares mentioned on this article have skilled a powerful surge of their worth as traders turned bullish on their prospects.

These shares’ substantial rise in 2023 was propelled by particular catalysts, and a more in-depth look reveals compelling the reason why these shares are poised for additional positive factors in 2024.

Wanting forward, the drivers that fueled their rise stay robust, setting the stage for continued development in 2024.

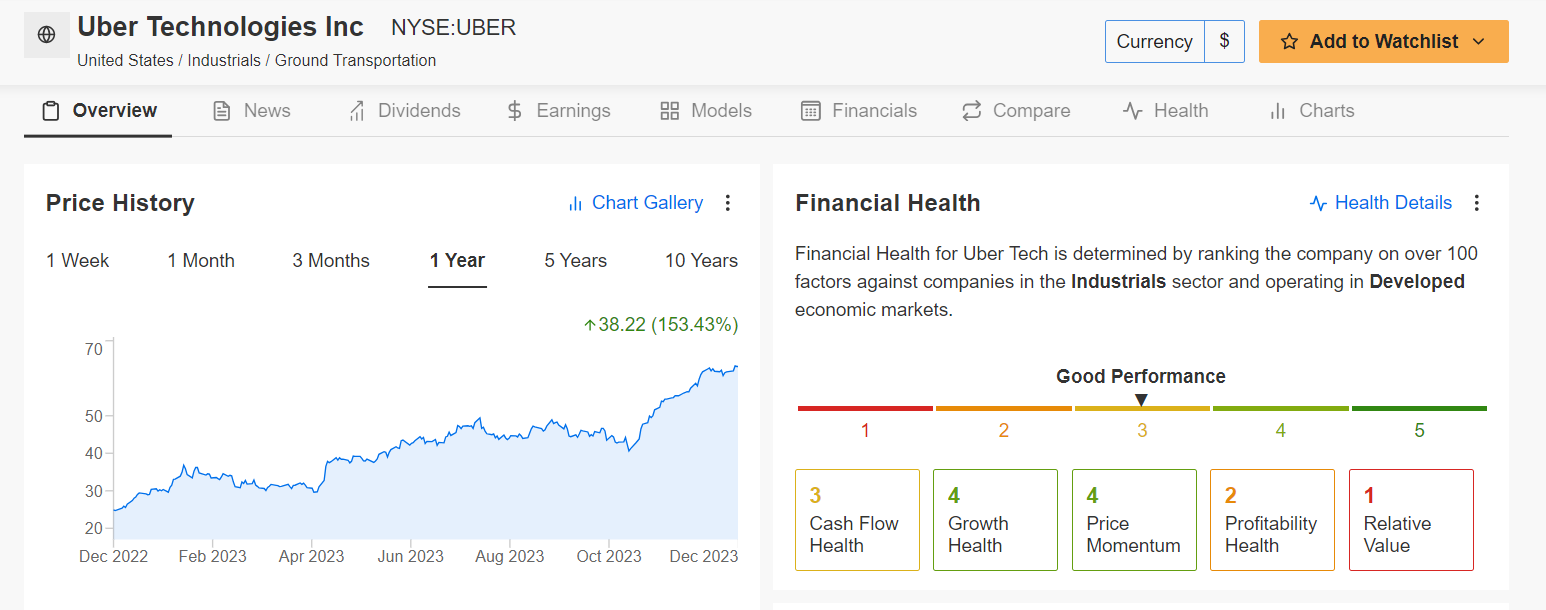

1. Uber

2023 12 months-To-Date Acquire: +155.3%

Market Cap: $129.9 Billion

2023 Surge: Uber (NYSE:)’s ascent in 2023 was fueled by a number of components. The mobility-as-a-service firm’s diversification past ride-hailing companies into meals supply and freight logistics contributed considerably to income development.

Furthermore, the gradual restoration from pandemic-induced restrictions boosted demand for its transportation and meals supply companies.

UBER inventory – which started buying and selling at $25.37 on January 3 and rose all the best way to a 2023 peak of $63.53 on December 15 – has gained 155.3% in 2023.

Supply: InvestingPro

2024 Potential: Uber’s growth into new markets and continued innovation in companies, together with its concentrate on electrical automobiles and autonomous driving know-how, positions it favorably for development.

Moreover, the ride-hailing and supply specialist’s relentless concentrate on reaching profitability via cost-cutting measures and strategic acquisitions units the stage for an additional robust efficiency in 2024.

It’s price mentioning that Uber at present has an above-average InvestingPro ‘Monetary Well being’ rating on account of robust earnings and gross sales development prospects.

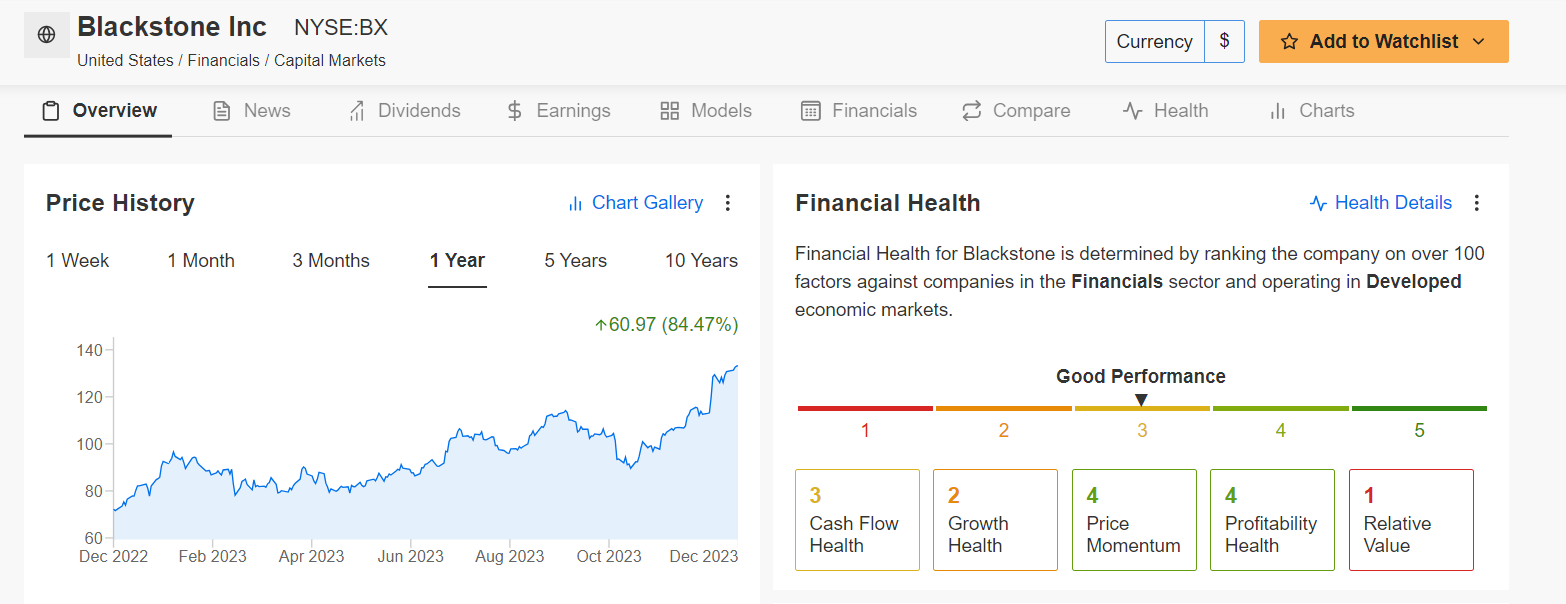

2. Blackstone

2023 12 months-To-Date Acquire: +79.4%

Market Cap: $155.8 Billion

2023 Surge: Blackstone (NYSE:)’s stellar efficiency in 2023 was underpinned by the power of its various asset administration enterprise amid a strong funding panorama.

The monetary companies agency capitalized on robust market circumstances, driving substantial positive factors in non-public fairness, actual property, and credit score segments.

BX inventory, which rose to a 2023 excessive of $133.52 on Thursday after beginning the yr at $76.80, is up 79.4% year-to-date.

Supply: InvestingPro

2024 Potential: Given the persistent demand for various investments, Blackstone stays poised to learn from a continued urge for food for its choices.

Its strategic investments throughout know-how, infrastructure, and sustainable ventures place it favorably for sustained development in 2024, leveraging rising alternatives in evolving markets.

As InvestingPro factors out, Blackstone is in nice monetary well being situation, due to strong earnings prospects, and a wholesome profitability outlook. Moreover, it must be famous that the corporate has raised its dividend payout for 17 consecutive years.

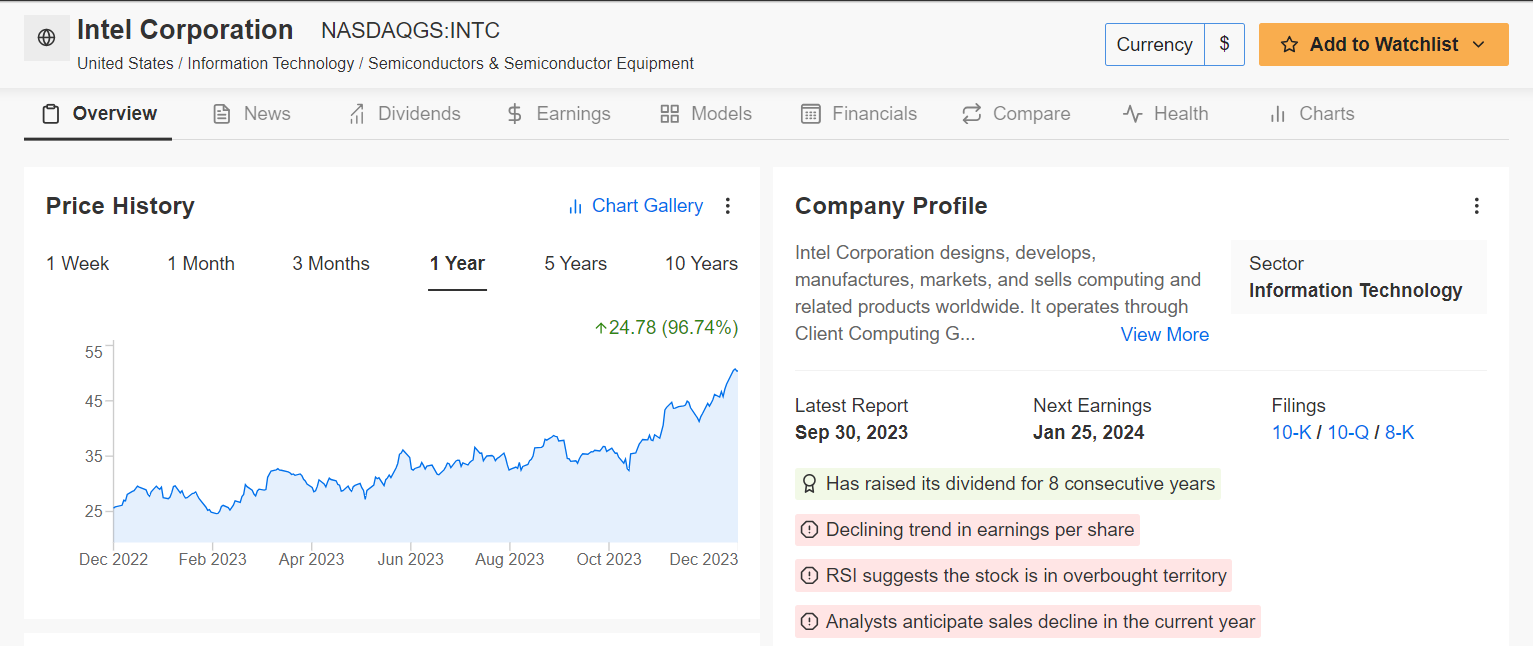

3. Intel

2023 12 months-To-Date Acquire: +90.6%

Market Cap: $212.4 Billion

2023 Surge: Intel (NASDAQ:)’s resurgence in 2023 was fueled by the market’s optimistic reception to its new product launches and developments in semiconductor know-how and synthetic intelligence initiatives.

The worldwide semiconductor scarcity additional propelled demand for its merchandise, contributing to its spectacular efficiency.

INTC started the yr at $27.05 and closed at a 2023 excessive of $50.39 final evening, representing a year-to-date achieve of 90.6%.

Supply: InvestingPro

2024 Potential: Intel’s strategic emphasis on increasing its manufacturing capabilities, coupled with ongoing technological developments in chip manufacturing units the stage for continued development.

The Santa Clara, California-based chipmaker’s investments in areas resembling AI, 5G know-how, and high-performance computing place it as a key participant in an more and more digital world, promising additional positive factors in 2024.

In accordance with insights from InvestingPro, the chipmaking large can be a high quality dividend inventory. INTC at present gives a quarterly payout of $0.125 per share, which means an annualized dividend of $0.50 at a yield of 1.31%.

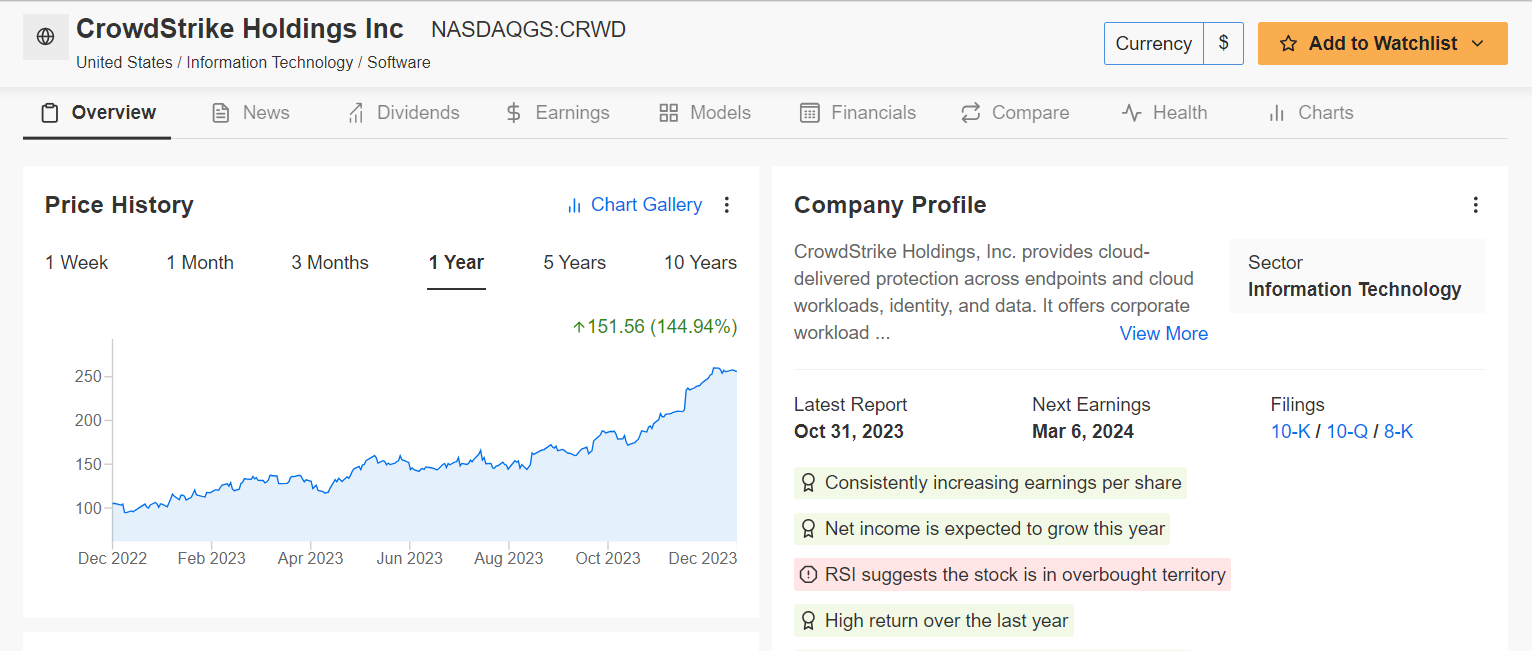

4. Crowdstrike

2023 12 months-To-Date Acquire: +143.2%

Market Cap: $61.5 Billion

2023 Surge: CrowdStrike’s (NASDAQ:) outstanding efficiency in 2023 stemmed from the rising significance of cybersecurity amid escalating cyber threats globally.

The knowledge safety specialist’s modern cloud-native safety options and a surge in cyber spending from firms and governments around the globe bolstered its efficiency because it responded to rising digital safety threats.

CRWD inventory is up 143.2% year-to-date, reflecting the endpoint safety chief’s robust fundamentals and long-term development prospects.

Supply: InvestingPro

2024 Potential: As cybersecurity stays a prime precedence for companies worldwide, Crowdstrike’s cutting-edge know-how and strong development trajectory are prone to persist amid the unsure geopolitical local weather.

Its constant concentrate on analysis and improvement, buyer acquisition, and the growth of its cybersecurity suite positions it nicely for ongoing success in 2024 amid favorable cybersecurity demand developments.

InvestingPro additionally highlights a number of further tailwinds Crowdstrike has going for it, together with a strong earnings outlook, wholesome profitability, and stable money move development.

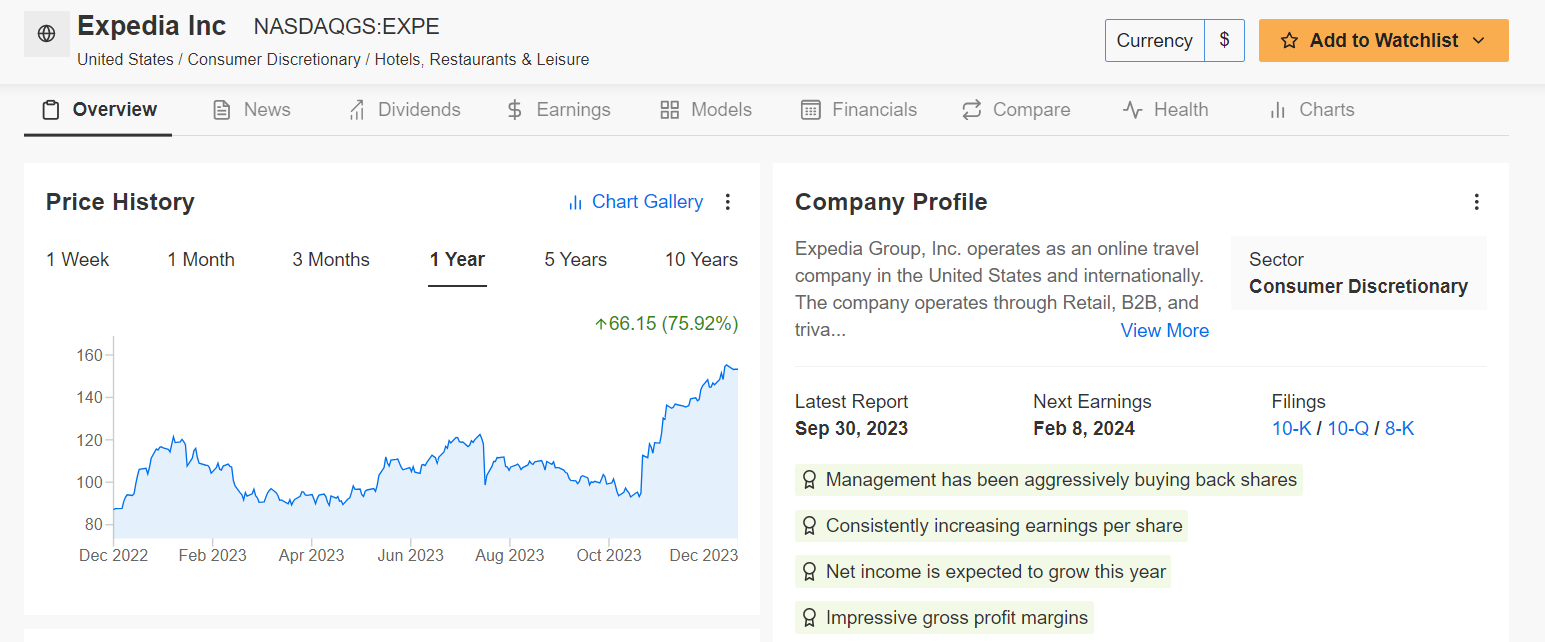

5. Expedia

2023 12 months-To-Date Acquire: +75%

Market Cap: $21.3 Billion

2023 Surge: Expedia (NASDAQ:)’s resurgence in 2023 was pushed by the gradual restoration within the journey business as pandemic-related restrictions eased.

The pent-up demand for journey and leisure actions considerably boosted bookings and income for the net journey firm regardless of fears of a world financial slowdown which have sparked considerations about shopper spending.

EXPE inventory has been on a tear in 2023, scoring a year-to-date achieve of 75% to simply outperform the broader market over the identical timeframe.

Supply: InvestingPro

2024 Potential: Because the journey business continues its restoration, Expedia stands to learn from elevated shopper confidence and a revival in journey demand.

The web trip reserving platform operator’s ongoing digital improvements, enhanced buyer experiences, and strategic partnerships place it for additional development in 2024.

Demonstrating the power and resilience of its enterprise, Expedia sports activities a near-perfect InvestingPro ‘Monetary Well being’ rating of 4 out of 5 and administration has been aggressively shopping for again shares.

***

Be sure you take a look at InvestingPro to remain in sync with the market pattern and what it means in your buying and selling. As with all funding, it is essential to analysis extensively earlier than making any choices.

InvestingPro empowers traders to make knowledgeable choices by offering a complete evaluation of undervalued shares with the potential for vital upside out there.

Be a part of now for as much as 50% off on our Professional and Professional+ subscription plans and by no means miss one other bull market by not realizing which shares to purchase!

Declare Your Low cost Right this moment!

Disclosure: On the time of writing, I’m lengthy on the S&P 500, and the through the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Belief ETF (QQQ). I’m additionally lengthy on the Expertise Choose Sector SPDR ETF (NYSE:). I usually rebalance my portfolio of particular person shares and ETFs based mostly on ongoing danger evaluation of each the macroeconomic surroundings and corporations’ financials. The views mentioned on this article are solely the opinion of the writer and shouldn’t be taken as funding recommendation.

[ad_2]

Source link