[ad_1]

metamorworks

You’ll be able to sway a thousand males by interesting to their prejudices faster than you’ll be able to persuade one man by logic.”― Robert A. Heinlein.

At this time, we take our first take a look at ResMed Inc. (NYSE:RMD). The corporate has been within the information these days, as ResMed introduced a slew of administration adjustments on November ninth once they disclosed their President and Chief Working Officer was stepping down. As well as, the corporate additionally appointed a Chief Advertising and marketing Officer, a Chief Product Officer and a Chief Income Officer. These adjustments had been made as a part of the corporate’s new working mannequin geared toward boosting long-term development.

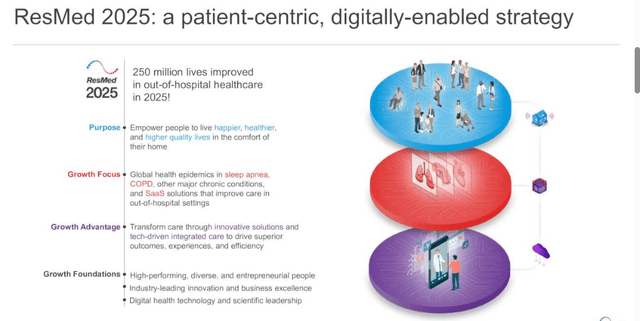

August Firm Presentation

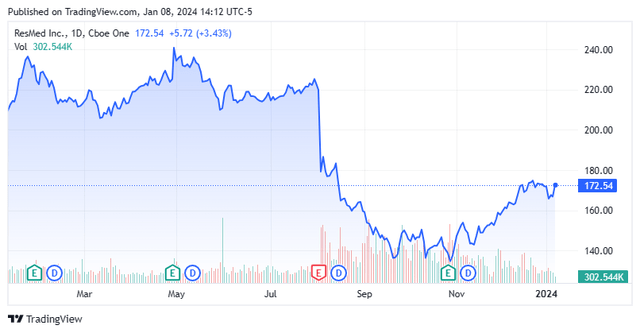

Six weeks later, the corporate despatched out an alert round certainly one of its merchandise. After a steep decline over the summer season, the inventory has began to rebound since late October throughout the total market rise. Can the rally proceed in 2024? An evaluation follows beneath.

Searching for Alpha

Firm Overview:

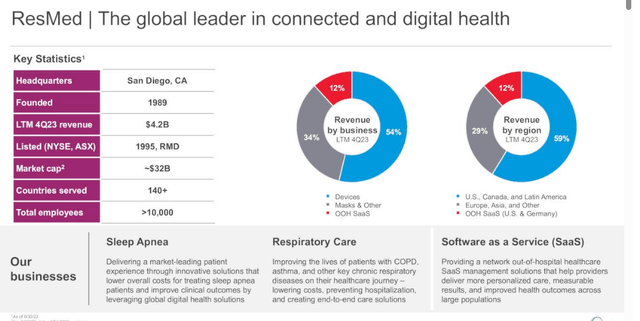

This San Diego-headquartered concern has two major enterprise segments: Sleep and Respiratory Care, and Software program as a Service. The previous unit provides air flow units, diagnostic merchandise, masks techniques and different merchandise to be used within the hospital and residential. These medical units and merchandise are designed to makes sleeping and air flow simpler. The Software program as a Service enterprise, which can be referred to as SaaS on this article, supplies a number of merchandise and purposes akin to AirView, which is a cloud-based system that permits distant monitoring and altering of sufferers’ machine settings. ResMed now has 16 billion nights of de-identified medical information within the cloud and over 22.5 million 100% cloud connectable medical units, based on its most up-to-date earnings name transcript.

The inventory presently trades simply north of $170.00 a share and sports activities an approximate market capitalization of roughly $25 billion. The corporate operates via a fiscal yr that begins on July 1st.

August Firm Presentation

The corporate is addressing a really massive market. Over 2 billion individuals worldwide undergo from sleep apnea, continual obstructive pulmonary illness, respiratory insufficiency resulting from neuromuscular illness, and insomnia based on administration. Whereas there are some considerations, the brand new GLP-1 medicine will decrease that inhabitants considerably over time, that but stays to be seen.

First Quarter Outcomes:

The corporate posted its fiscal Q1 2024 numbers on October twenty sixth. The corporate delivered non-GAAP earnings per share of $1.64 a share, barely above the consensus. Internet earnings was up 9 p.c from the identical interval a yr in the past on a non-GAAP foundation. Revenues rose 16% on a year-over-year foundation to $1.1 billion, $10 million south of expectations.

Revenues from ResMed’s SaaS enterprise grew 32% on year-over-year foundation. These outcomes had been assist enormously by the corporate’s acquisition of MEDIFOX DAN in Germany that was accomplished late in 2022. Natural income development was up seven p.c, equating for that buy. The corporate received 10% total income development from the USA, Canada, and Latin America area, and 18% from Europe and Asia in fixed foreign money phrases.

Gross margins fell 250bps from Q1 2023 to 54.5%. Administration blamed the autumn in margins totally on “a discipline security notification on its Astral ventilators, together with increased element and manufacturing prices.”

Analyst Commentary & Stability Sheet:

Since first quarter outcomes got here out, three analyst companies together with JPMorgan have reissued Purchase rankings on the inventory. Worth targets proffered ranged from $160 to $175 a share. Each Jefferies ($158 value goal) and Jefferies ($200 value goal) maintained Maintain rankings

Roughly 4 p.c of the excellent float within the shares is presently held brief. A number of insiders had been frequent and constant sellers of the fairness all through 2023. Within the fourth quarter of final yr, they disposed of simply over $2.1 million price of fairness collectively. ResMed ended the third quarter with almost $210 million price money and marketable securities on its steadiness sheet based on ResMed’s third quarter 10-Q. The corporate listed long-term debt of $1.351 billion. ResMed produced working money circulate for the quarter was $286.3 million within the third quarter, and it paid out $72 million price of dividend payouts.

Verdict:

The corporate made $6.44 a share in FY2023 on gross sales of $4.22 billion. The present analyst agency consensus has income rising to $7.18 a share in FY2024 as revenues develop by some $400 million. The projected earnings are for $7.96 a share in FY2025 on gross sales development of six p.c.

August Firm Presentation

With the current run increased within the ResMed Inc. inventory value, the shares are buying and selling above two buy-rated analyst value targets and up in opposition to close to the third one which was issued after first quarter information hit the wires. The inventory additionally trades at 24 instances FY2024E earnings and 5.5 instances revenues. The shares additionally pay a 1.1% dividend yield.

Not outlandish valuations given ResMed’s development prospects, however hardly compelling, both. Subsequently, I’ve no funding suggestion round RMD at present buying and selling ranges.

Those that are able to tyranny are able to perjury to maintain it.”― Lysander Spooner.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please pay attention to the dangers related to these shares.

[ad_2]

Source link

Add comment