[ad_1]

Comezora/Second by way of Getty Pictures

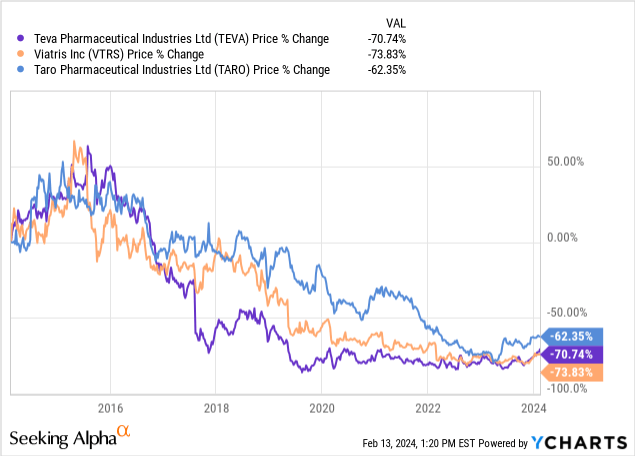

I used to be lately reviewing Teva Pharmaceutical (NYSE:TEVA) to see if they’ve turned any type of nook. They, together with most generic drug makers, have struggled for mainly the final decade. Here’s a have a look at a Teva and a number of of their rivals like Viatris (VTRS) and Taro (TARO) over the past decade:

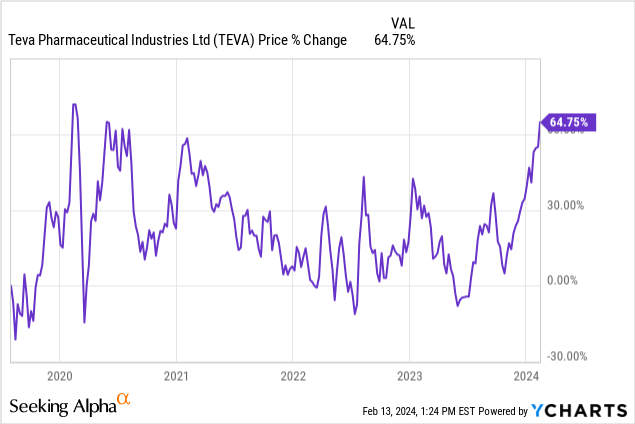

As you’ll be able to see, all the trade skilled fairly the downturn for a number of years beginning round 2016. Teva had mainly hit their lows close to the top of 2019 and has since treaded water till the previous few months after they have recovered significantly.

So the query becomes- was this rally for Teva over the previous few months grounded in fundamentals or had been they simply going increased with many of the market? To reply this query, I believe we must always first have a look at what introduced Teva decrease over the past decade within the first place.

The Lengthy Decline

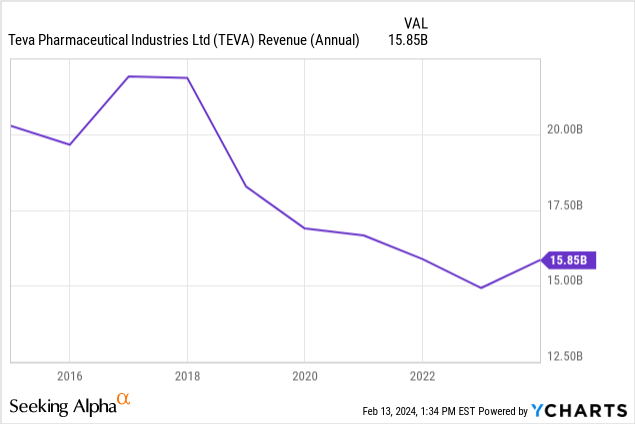

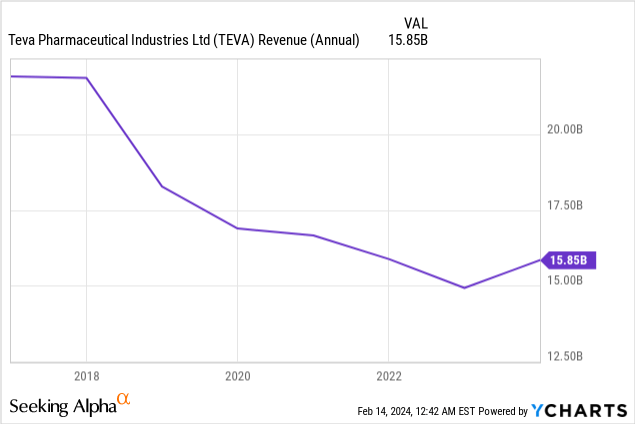

One factor I observed whereas trying over Teva is that they’ve been shedding revenues for a few years. This affected each the highest and backside traces at first, however after a number of years, income declines slowed and working revenue mainly held regular. I take this as an indication that administration initially did their job poorly and didn’t put together properly for losses within the trade, nor with their massive acquisition in 2016, which I am going to get to extra. Nonetheless, I believe they ultimately righted the ship and located methods to chop obligatory prices as income declines hit all the trade.

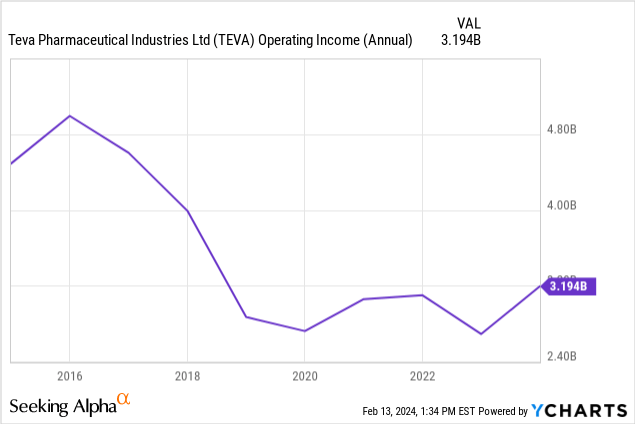

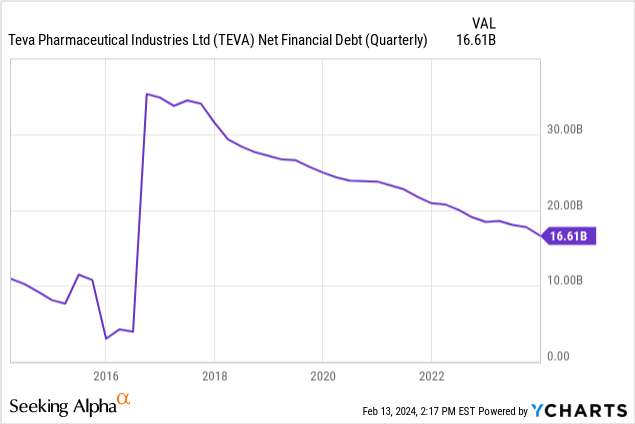

Working revenue dipped under $3B in 2018 and 2019, however Teva managed to get it again above $3B for a pair years till it dipped and rebounded once more. In brief, they’ve stabilized round $3B in working revenue for round 5 years now. That sounds fairly nice for a corporation below a $15B market cap, however debt after all is the actual factor holding again Teva from unlocking extra worth for shareholders. When together with Teva’s debt load and money, they’ve an enterprise worth of about $32B. A lot of the debt load was picked up after they acquired Allergan’s Generic enterprise for $40.5B again in 2016.

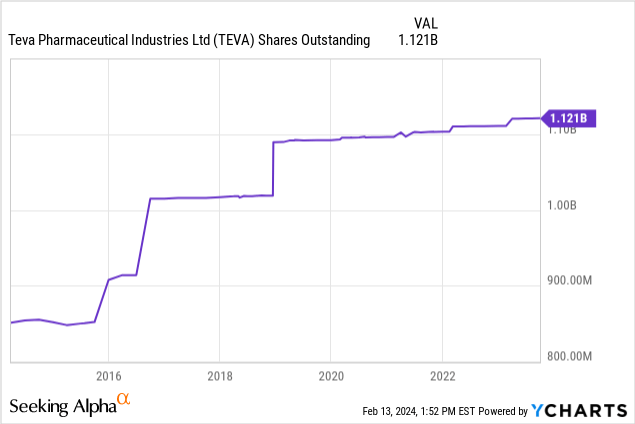

This debt load has been strangling the enterprise ever since these income declines began. Teva final paid a dividend in 2017 and have been web issuers of shares yearly regardless of the shares buying and selling at very low P/E multiples and other people clamoring that they’ve been a robust purchase for years. To me, it all the time speaks volumes when the board cannot even justify shopping for again any significant quantity of shares, regardless of the supposedly, rock-bottom costs:

The rationale administration couldn’t justify a dividend or buybacks was that it had that vast debt quantity they needed to cope with first. The excellent news is that Teva has executed main work getting this debt down ever since they made that acquisition from Allergan:

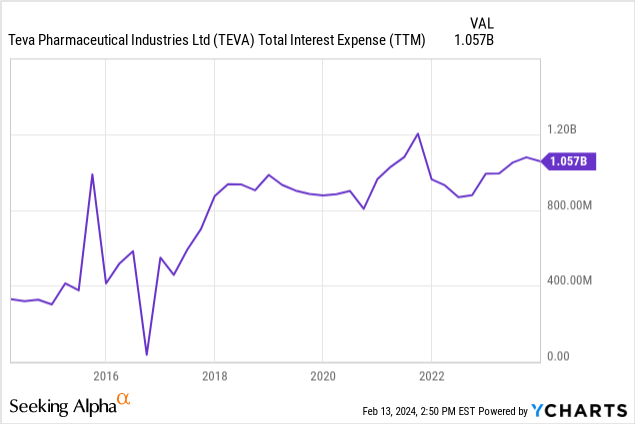

The dangerous information is that it has not resulted in decrease curiosity funds for Teva. Again after they points the debt for the acquisition, they did so with a lot better credit score and accordingly a a lot decrease value of capital. They’ve been downgraded a number of occasions over time (debt ranking of BBB+ by Fitch in 2015 versus their BB- ranking by Fitch that was affirmed final yr) by ranking firms because of their massive debt load, reducing revenues, and more durable generics setting. For these unfamiliar with Fitch’s ranking scale, that is 5 steps down and knocked them firmly from funding grade debt all the way down to junk grade.

Due to this and due to rising rates of interest, final yr Teva issued new, longer-term debt starting from 7.375% as much as 8.125% so as to repay debt coming due inside the subsequent few years starting from 2.8% as much as 7.125%. Right here is the chart exhibiting simply how a lot their curiosity bills have risen even whereas paying off a lot debt:

Is a Turnaround Virtually Right here?

One massive motive for hope is that Teva’s revenues had been lastly up in 2023 as in comparison with 2022. Administration began a ‘Pivot to Development’ technique in 2023 and it has been exhibiting indicators of creating a distinction within the topline. Two of the medication most liable for their progress in 2023 are Austedo and Ajovy. Uzedy additionally began rising in 2023, however it was simply authorized in April 2023, so it’s from a really small base. Right here is one other graph of Teva’s revenues over the previous few years, simply to point out how essential this time might be as an inflection level:

Again to the medication which might be not less than partially liable for this turnaround. Austedo XR is Teva’s drug to deal with each tardive dyskinesia and Huntington’s illness chorea. Its gross sales grew by 27% over the past yr, from ~$940M in 2022 as much as $1.2B in 2023. Administration has additionally already guided for $1.5B in 2024 for Austedo gross sales, which if they will hit their goal once more in 2024, could be good for an additional 20% enhance in gross sales.

Ajovy is a drug that’s used as a preventative therapy for migraines. It’s an injectable they usually ship it with an auto injector that can be utilized at residence or administered by a well being skilled. This to me reveals that its upside might be extra restricted than the most important blockbuster tablets as injectables usually will not have as excessive of an adoption price. It additionally should present the standard of their product although, as a result of regardless of that hurdle, they’ve grown gross sales very well the previous few years. It should present reduction from the debilitating situation that migraines are for a lot of. They elevated gross sales from $377M in 2022 as much as $435M in 2023, which was good for a 16% enhance. Teva is guiding for $500M in gross sales for Ajovy in 2024.

Lastly Uzedy is a a lot smaller piece of the pie at present, however might be nice for them for a few years to return. Uzedy is an injectable used to deal with schizophrenia they usually have guided for it to hit $80M in 2024. Who is aware of how a lot market share it should ultimately garner, however they level out that the market may be very massive at present at ~$4B and rising at 6%. Even a 1-2% market share would assist Teva out tremendously within the coming years and something greater than that’s gravy.

With the assistance of all these medication and an upfront cost of $500M from Sanofi in This fall 2023, Teva hit complete revenues of $15.8B in 2023 and has guided for a spread of income between $15.7B to $16.3B for 2024. To check apples to apples, I believe it is essential to take away that $500M upfront cost from Sanofi I discussed out of the 2023 numbers. This implies for progress to extra moderately be in contrast from $15.3B in 2023 to the vary of $15.7B to 16.3B given for 2024. Natural progress wasn’t fairly as nice because it appeared in 2023, however it additionally means the expansion could be fairly stable for 2024, if they will hit their targets.

Different Future Development Alternatives

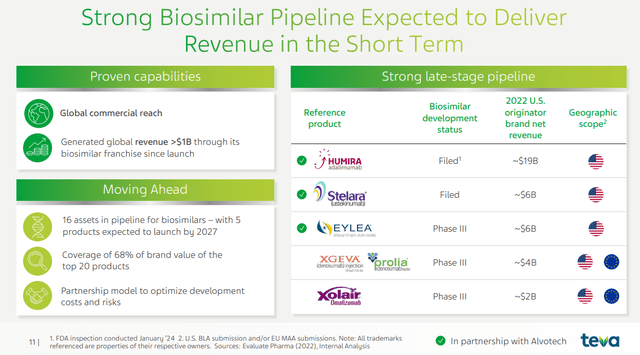

Outdoors of the medication which might be nonetheless exhibiting good progress, they’ve a portfolio of biosimilars developing, a few of that are within the regulatory approval/submitting course of with the FDA and others which might be nonetheless working trials. Here’s a listing of their largest upcoming biosimilars:

Biosimilar Pipeline (Teva Investor Relations)

Humira and Stelara each misplaced exclusivity in 2023. Nonetheless, it should take somewhat longer till Teva can begin competing to select up market share of each with their biosimilars, assuming they obtain approval. For Humira, administration said on their newest earnings name that they’re awaiting inspection by the FDA of their companion’s (Alvotech) facility in Eire. They want that inspection authorized by the FDA so as to transfer ahead. They’ve mentioned they hope for that to occur in 2024 and for revenues to begin this yr, however that if it takes some time and nonetheless will get authorized, then they do count on revenues to begin in 2025 and past.

Stelara, they’ve a extra clear timeline if it does get authorized. Teva administration said on their earnings name that they count on a call on FDA approval and a launch (if authorized) in Feb 2025. Whereas Stelara is not as massive of a pie to attempt to pull from, there aren’t almost as many rivals going after it as there are for Humira, so we’ll need to see which finally ends up being the bigger alternative.

I wish to warning buyers to keep in mind that whereas these numbers subsequent to Humira and Stelara are very massive numbers, there can be a number of competitors. Not solely will many need a piece of the pie, however the pie will possible get loads smaller as biosimilars compete with one another on pricing. Moreover, there’s a likelihood that just a few win massive, particularly with Humira. If there are too many rivals shifting in on Humira, it might be that just a few get acknowledged by payers. With Teva hitting the market with their biosimilar considerably late, I fear that they will not even be on the primary listing authorized by payers.

Again to Debt

The true story to me continues to be the debt for the following a number of years. Certain income progress is nice and can absolutely make it simpler to keep up or develop web revenue, however till Teva can get again to funding grade debt scores, I believe their share value may stall. Regardless of shifting a considerable amount of debt out additional in 2023, they nonetheless have round $3.5B in debt coming due in both 2024 or 2025. The rate of interest on this debt ranges from the extremely low 1% as much as 7%, so it is rather possible that if a few of it may’t be paid off and must be refinanced it should come at increased rates of interest.

In reality there are nonetheless some low rates of interest (1.6%-5%) coming due right through 2027, so I believe it may nonetheless be fairly a while till Teva lastly begins refinancing at decrease charges on the entire. Whereas I count on Teva to maintain making a dent within the debt over the following few years, it’s a little disheartening to know that the general curiosity paid could preserve going up for a short while. With federal rates of interest more likely to lastly decrease in 2024 and their debt attending to a sufficiently small complete quantity, maybe Teva can lastly begin seeing decrease total curiosity funds to associate with their decrease complete debt numbers.

Conclusion

There are promising indicators for Teva with a number of medication (specifically Austedo and Ajovy) resulting in income positive aspects in 2023, which marked a real inflection level from a income standpoint. In addition they have a portfolio of biosimilars of some fairly standard medication they hope to get approval for within the coming years. The debt has but to succeed in an inflection level, however I’m hopeful one might be reached within the subsequent couple years with decrease curiosity funds or debt ranking upgrades each constituting extra inflection factors.

I’m cautious of any income progress targets till I see these saved time and time once more. Preserve an in depth eye on these numbers as they arrive in all year long to know the way properly administration is executing or if another macro occasions weigh on revenues. Income progress is nice, however I count on the true inflection to return when debt will get low sufficient that Teva will get again to an funding grade ranking (or not less than begins heading in that path) and curiosity funds begin going decrease. At that time, I’d suppose administration may really contemplate returning cash to shareholders in the best way of buybacks or a dividend in addition to having extra choices to contemplate for additional progress.

[ad_2]

Source link