[ad_1]

ClaudineVM/iStock by way of Getty Photographs

Expensive readers/followers,

On this article, I am going to offer you my first article on the AES Company (NYSE:AES). The corporate is a US-based utility with a doubtlessly pretty respectable upside. Like most of the utilities across the globe presently, the corporate is pretty closely weighted in the direction of changing into a champion renewable participant. The corporate is headquartered in Arlington, and the abbreviation AES stands for Utilized Power Companies – which additionally was the corporate’s title till the 12 months 2000, with a founding 43 years in the past again within the early 80s.

The corporate manages revenues of over $12B and a internet revenue of a few quarter-billion on top-line gross sales. Now, AES is a world participant. The corporate sells energy in 15 nations, employs over 10,000 individuals and can also be a member of the Fortune 500.

It isn’t a yield monster, or perhaps a excessive yielder, sadly. At the moment, it yields 3.77%, which is definitely lower than my very own financial savings account, which does not precisely make for a robust funding argument presently.

Let us take a look at what AES truly has going for it, and why chances are you’ll wish to embrace this in your conservative dividend portfolio.

AES Company – A lot to love, however solely on the proper value

So, AES has a number of downsides. A kind of downsides is definitely that the corporate, in contrast to different utilities I spend money on, does not have all that nice of a credit standing. The corporate has BBB- which in comparison with the BBB+ and the A-rated firms I usually spend money on makes for a little bit of a pause for me.

To ensure that this firm to essentially change into enticing, I’d then want a far greater mixed upside to this enterprise – and one of many issues I wish to take a look at when I’m taking a look at AES is that if the corporate truly has or can justify this.

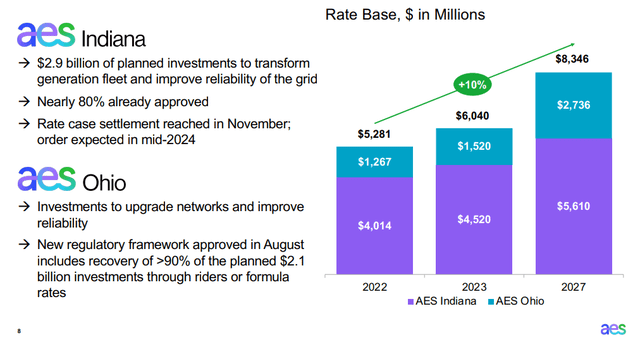

AES argues that it is a core enabler and participant within the renewable sector, with a rising 25-30 GW portfolio of solar energy till 2027, and a rising anticipated 10% annualized base price development, which is among the many highest within the US utility sector. So reasonably, as with most utilities which deal with greater revenue and stability, AES factors to development right here. (Supply: AES IR)

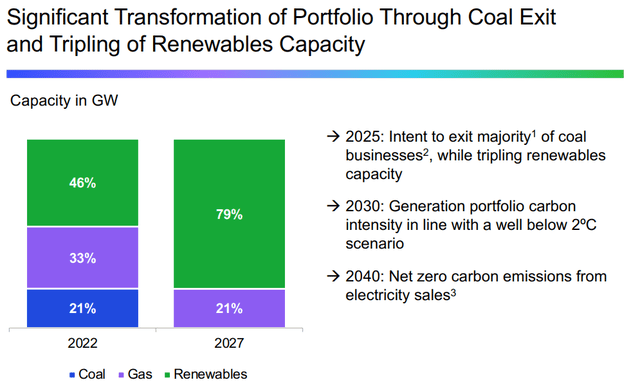

The corporate can also be decreasing its portfolio in thermal whereas rising the renewables just about completely. AES targets a coal exit in 2025E, lower than 2 full years.

Wanting on the firm’s filings and materials, we additionally discover that the corporate has long-term USD-denominated contracts with multi-year partnerships on each the shopper and the monetary/provide aspect. The corporate has excessive confidence within the projected returns due to what’s described as strong hedging of long-term monetary prices and secured gear pricing, in addition to total development prices. (Supply: AES IR)

AES is on observe to carry one other 3.5 GW to the market in 2023-2024, which is a doubling of the 2022 quantity – and it moreover has a backlog of over 13 GW of tasks with signed contracts that aren’t but on-line, which does lend credence to the corporate’s claimed visibility of ahead development.

So, total, I’d say that AES does present tendencies for development charges which can be greater than the everyday utility enterprise, and it will not be shocking to see that double-digit base price development materialize, which might then have an affect on firm earnings. (Supply: AES IR)

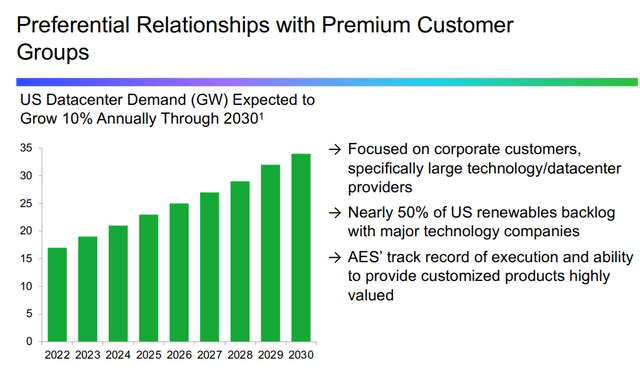

The corporate additionally has good relationships with some main buyer teams.

AES IR (AES IR)

And in contrast to some utilities, the corporate’s publicity to rising rates of interest is low – as a result of all long-term debt the corporate has is at fastened charges. There’s additionally a complete hedging program for refis over the following few years. The general construction of the corporate’s funds signifies that a 100 bps motion in rates of interest is lower than a cent both approach in 2024E, and fewer than 5 cents in 2025E (Supply: AES IR). That is clearly a constructive, and never a small one.

Additionally, the corporate’s development charges are pretty confirmed.

AES IR (AES IR)

The corporate’s transfer from fossil fuels, on this case coal, which represented over 20% of the combination in 2022, to renewables is among the quickest I’ve ever seen on this complete sector. If the corporate manages to do that, it will likely be one of the crucial spectacular turnarounds on this sector. Nearly too spectacular – it leads me to ask questions on simply what the “value” of this total transfer is for the corporate, and what dangers we’re taking a look at – as a result of these days, many renewable companies, particularly associated to onshore/offshore wind, haven’t precisely been doing properly.

AES IR (AES IR)

Development via transformation – that is the corporate’s mantra right here. I do not contemplate this a “dangerous” goal total, and it is utterly in keeping with how the corporate has been allocating capital. The corporate’s guardian funding capital has been nearly completely allotted in the direction of the renewables sector in 2023 and can proceed to take action till 2027 – with round 80% anticipated to be within the US as properly. (Supply: AES IR)

The corporate has averaged spectacular near-double-digit development charges in adjusted EPS, FCF, and a 6% dividend development right here. So whereas it is not a formidable dividend, it is spectacular development for an organization that usually doesn’t present development if we take a look at the sector.

For the newest 12 months, the corporate’s positives are plentiful. AES managed to exceed the entire strategic or monetary goals, signing over 5.5 GW of latest renewables in long-term PPAs, with the completion of three.5 GW value of development throughout the 12 months, whereas assembly the EBITDA goal midpoint at 2.8B+ USD for the total 12 months. The corporate additionally exceeded its EPS goal vary by one cent, ending at $1.76, and simply over $1B in free money circulation.

This has resulted in AES elevating the bar when it comes to its development goal, now to 5-7% from 3-5% – and albeit, if it solely anticipated 3-5%, then I’d as properly have invested in any of the opposite utilities with higher credit standing and higher dividend yield. (Supply: AES IR)

I like the corporate’s deal with the company sector. A deal with massive tech firms will imply that these are more likely to be much more demand-resilient than different clients. That is additionally a part of why the corporate is anticipating an rising price of return, now at 12-15% in comparison with 10-13% prior, because of sturdy challenge demand.

What makes AES totally different – no less than to the corporate’s personal estimates – is the development execution. Once they signal a PPA, the corporate locks in, on the time, all main gear, EPC, and all financing. This clearly signifies that, in contrast to different gamers, AES has an excellent challenge RoR visibility – one thing I count on different firms to undertake in the event that they have not already.

General, the 2023 returns have been strong.

What dangers I’d level to listed below are, as ordinary in the case of ESG-heavy utilities, the chance that these excessive returns do not prove in addition to anticipated. With regards to AES, I can even clearly state that the corporate has higher-than-typical leverage, coming to over 70% long-term debt to capital, which can also be very doubtless a purpose why the corporate’s credit standing is simply at BBB-. (Supply: AES IR)

What impresses me is the execution and the standard of the corporate’s tasks – in addition to its buyer base.

It leads me to have the ability to put a valuation on this enterprise and inform you whether or not I’d make investments right here or not.

Valuation for AES – It is enticing, and the upside right here is double-digit.

So, AES is an effective/respectable firm. The 2 main downsides to this enterprise are the renewable focus, the place I preserve and level to sector averages and friends that there’s uncertainty within the forecasts for these returns.

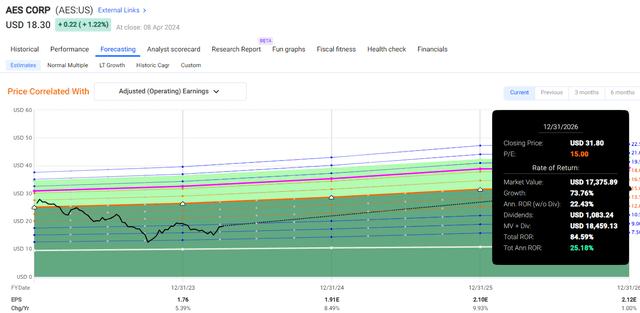

Nevertheless, the present firm valuation is a really enticing one. The corporate is buying and selling at lower than 10.5x P/E, which even on a peer common for utilities, and even with the BBB- thought-about continues to be enticing. The corporate usually trades round 13-14x P/E, so at a slight low cost.

In order that the corporate trades at a 10x P/E, that is a big low cost. On this case, it is also throughout a time when the corporate is definitely rising. Through the previous 9 or so years, the corporate has averaged a median earnings development price of virtually 8% on an annualized foundation (Supply: F.A.S.T Graphs/FactSet).

That signifies that we have now a really spectacular upside. Even on a 15x P/E foundation, the corporate has a reversal potential of 25% yearly for the following 3 years, which might be a market-outperforming form of return.

AES Upside (FAST Graphs)

So, you may see why I contemplate this firm as truly having a really important total upside.

In truth, even within the case of a full 20-year normalization to a P/E of 13.5x, the corporate has an annualized upside of 21%, which involves over 68% TSR in 3 years if this materializes.

As such, AES is by no means a “dangerous” potential funding. As a result of this can be a market-outperforming potential funding, we additionally want to have a look at what chance there may be for this firm to really outperform. One of the best indicator we have now there – as a result of we shouldn’t have a crystal ball – is historic developments. And in the case of AES, we have now the corporate hitting its targets over 90% of the time, which as I view it qualifies for a “excessive accuracy” when it comes to this firm’s reliability.

Now, some may say that previous efficiency isn’t any indicator of future efficiency. I’d wish to modify {that a} bit and say that “Previous efficiency shouldn’t be essentially an indicator of future efficiency” – a small adjustment, however a big one. As a result of I do consider, and most of the investments I spend money on again this up with information, that if an organization has outperformed 10/10 instances, the chances are greater for this firm to proceed to do that than for an organization that has failed to take action 10/10.

With that stated, I view AES as a “BUY” right here. I see many utilities as essentially enticing right here, and wouldn’t essentially over-invest in any of them, however I’m frequently placing cash to work and this is among the firms I’ll contemplate for funding going ahead.

Thesis

AES is a strong, investment-graded utility with an excellent portfolio and a really strong buyer base. The corporate is primarily uncovered to massive, company clients with a sexy demand profile. Whereas a considerably sub-standard yield, the corporate makes up for this with a sexy development profile. The corporate is, as I’d see it, valued no less than at a 15x P/E, and this 15x P/E, which is a big low cost to historic values, signifies that the corporate may generate 25% annualized upside presently. Due to this, I view the corporate as a “BUY” with a value goal of no less than $25/share presently, regardless of the low yield. I’d be comfy shopping for the corporate right here.

Bear in mind, I am all about:

1. Shopping for undervalued – even when that undervaluation is slight, and never mind-numbingly large – firms at a reduction, permitting them to normalize over time and harvesting capital good points and dividends within the meantime.

2. If the corporate goes properly past normalization and goes into overvaluation, I harvest good points and rotate my place into different undervalued shares, repeating #1.

3. If the corporate does not go into overvaluation, however hovers inside a good worth, or goes again all the way down to undervaluation, I purchase extra as time permits.

4. I reinvest proceeds from dividends, financial savings from work, or different money inflows as laid out in #1.

Listed here are my standards and the way the corporate fulfills them (italicized).

This firm is total qualitative. This firm is essentially secure/conservative & well-run. This firm pays a well-covered dividend. This firm is at present low cost. This firm has life like upside based mostly on earnings development or a number of enlargement/reversion.

Which means the corporate fulfills each single one in all my standards, making it comparatively clear why I view it as a “BUY” right here.

Thanks for studying.

[ad_2]

Source link