[ad_1]

The AIER On a regular basis Value Index noticed its third largest enhance in over a 12 months in March 2024, taking pictures up 0.82 %. That rise brings our proprietary inflation index to a brand new document excessive of 289.2, surpassing the earlier excessive of 288.60 reached in September 2023.

AIER On a regular basis Value Index vs. US Client Value Index (NSA, 1987 = 100)

The biggest worth will increase among the many constituents of the On a regular basis Value Index in March 2024 had been seen in motor gasoline, meals away from residence, and web companies/digital info suppliers. The biggest declines occurred in housekeeping provides, residential phone companies, and meals at residence. Among the many twenty-four index elements, sixteen rose in worth whereas eight declined.

The US Bureau of Labor Statistics (BLS) launched Client Value Index (CPI) knowledge for March 2024 on April 10, 2024. All 4 of the first launch metrics, core and headline each month-over-month and year-over-year, had been increased than forecast by 0.1 %. Each the headline and core month-to-month CPI numbers rose 0.4 % versus an anticipated 0.3 %.

Amongst headline classes, in March 2024 the meals index noticed a slight enhance of 0.1 %, with meals at residence remaining unchanged, although three out of six main grocery retailer meals group indexes decreased whereas the remaining three skilled worth advances. Different meals at residence decreased by 0.5 %, primarily resulting from a major 5.0 % decline in butter costs, whereas cereals and bakery merchandise noticed the biggest one-month seasonally adjusted lower ever reported. Meats, poultry, fish, and eggs rose by 0.9 %, pushed by a 4.6 % enhance in egg costs, whereas nonalcoholic drinks elevated by 0.3 %, and vegetables and fruit by 0.1 %. The meals away from residence index rose by 0.3 % in March, following a 0.1 % enhance in February, with restricted service meals rising by 0.3 % and full-service meals by 0.2 %.

The vitality index elevated by 1.1 % in March 2024, pushed by a 1.7 % rise in gasoline costs (which noticed a 6.4 % enhance earlier than seasonal adjustment), whereas electrical energy costs rose by 0.9 % and pure gasoline remained unchanged. Nevertheless, the gasoline oil index skilled a lower of 1.3 % in March.

Amid core classes on a month-over-month foundation, motorcar insurance coverage noticed a notable enhance of two.6 %, persevering with its upward development from February. Attire costs additionally rose by 0.7 %, alongside private care, schooling, and family furnishings and operations. Nevertheless, the medical care index noticed a modest rise of 0.5 %, whereas used automobiles and vans skilled a decline of 1.1 %, and numerous different classes resembling recreation, new automobiles, and airline fares additionally noticed decreases.

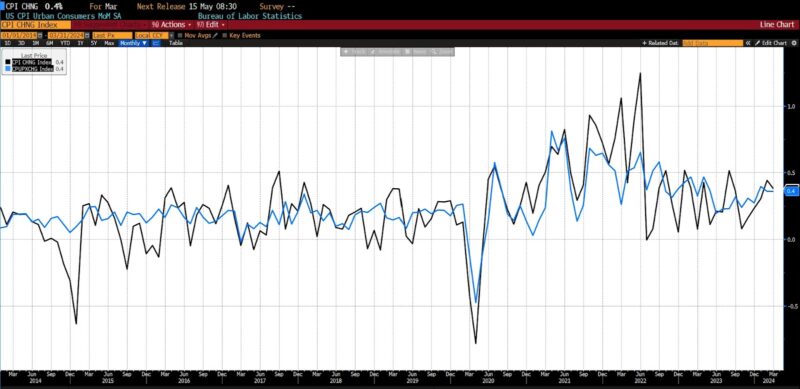

March 2024 US CPI headline & core month-over-month (2014 – current)

From March 2023 to March 2024, headline CPI rose 3.5 %, increased than the anticipated 3.4 %. 12 months-over-year core CPI rose 3.8 %, which was additionally increased than the survey prediction of three.7 %.

In meals classes over the previous 12 months, the meals at residence index rose by 1.2 %, with different meals at residence growing by 1.4 % and vegetables and fruit up by 2.0 %. Nonalcoholic drinks additionally noticed an increase of two.4 %, whereas meats, poultry, fish, and eggs elevated by 1.3 %, and cereals and bakery merchandise by %. Nevertheless, the dairy and associated merchandise index skilled a decline of 1.9 % over the 12 months. On the vitality entrance, the index elevated by 2.1 % over the identical interval, pushed by a 1.3 % rise in gasoline costs and a notable 5.0 % enhance in electrical energy costs. Conversely, pure gasoline and gasoline oil indexes decreased by 3.2 % and three.7 %, respectively, over the previous 12 months.

Over the previous 12 months, the index for all gadgets excluding meals and vitality elevated by 3.8 %, with shelter prices rising by 5.7 %, contributing considerably to the general enhance. Different notable will increase in indexes embrace motorcar insurance coverage (22.2 %), medical care (2.2 %), recreation (1.8 %), and private care (4.2 %).

March 2024 US CPI headline & core year-over-year (2014 – current)

Client inflation within the US continued its upward trajectory, as mirrored in latest authorities knowledge, dampening expectations for an early rate of interest minimize by the Federal Reserve, notably in a politically charged election 12 months.The inflationary pressures are evident throughout numerous important items and companies, with alarming charges recorded in sectors like automobile insurance coverage (22.2 %), transportation (10.7 %), and hospital companies (7.5 %), amongst others. Each core CPI and headline CPI figures have constantly surpassed forecasts for the previous 4 months, additional exacerbated by hovering oil costs nearing $90 per barrel, intensifying considerations about affordability and residing prices. Furthermore, the US has now endured over three years of inflation exceeding 3 %, marking the longest interval of sustained excessive inflation because the late Eighties and early Nineteen Nineties.

AIER’s On a regular basis Value Index, focusing intently because it does on a slim vary of extremely widespread services consumed by People, reveals the underestimation of upward worth pressures by the mainstream, authorities statistical businesses. In March 2024, our inflation metric elevated by greater than twice the quantity that the BLS core CPI did.

Swap contracts predicting the Fed’s choices adjusted to increased price ranges, indicating a decreased probability of price cuts, with expectations for the primary minimize pushed again to July from June. Choices merchants additionally shifted their bets, now speculating on only one price minimize this 12 months. Market reactions underscored the shifting expectations, with chances for a June price minimize dropping sharply and now favoring a price adjustment by September. The CME Group FedWatch instrument signifies a major lower within the probability of price cuts, with fewer than two cuts anticipated by the 12 months’s finish.

It’s more and more clear that the selection to cease price hikes on the 5.25 to five.50 coverage price vary was at greatest untimely and should in the end show inadequate. Ought to one other two or three months of inflation knowledge proceed on the present trajectory, the percentages of a 0.25 price hike is prone to materialize as an actual, if marginal, chance.

[ad_2]

Source link