[ad_1]

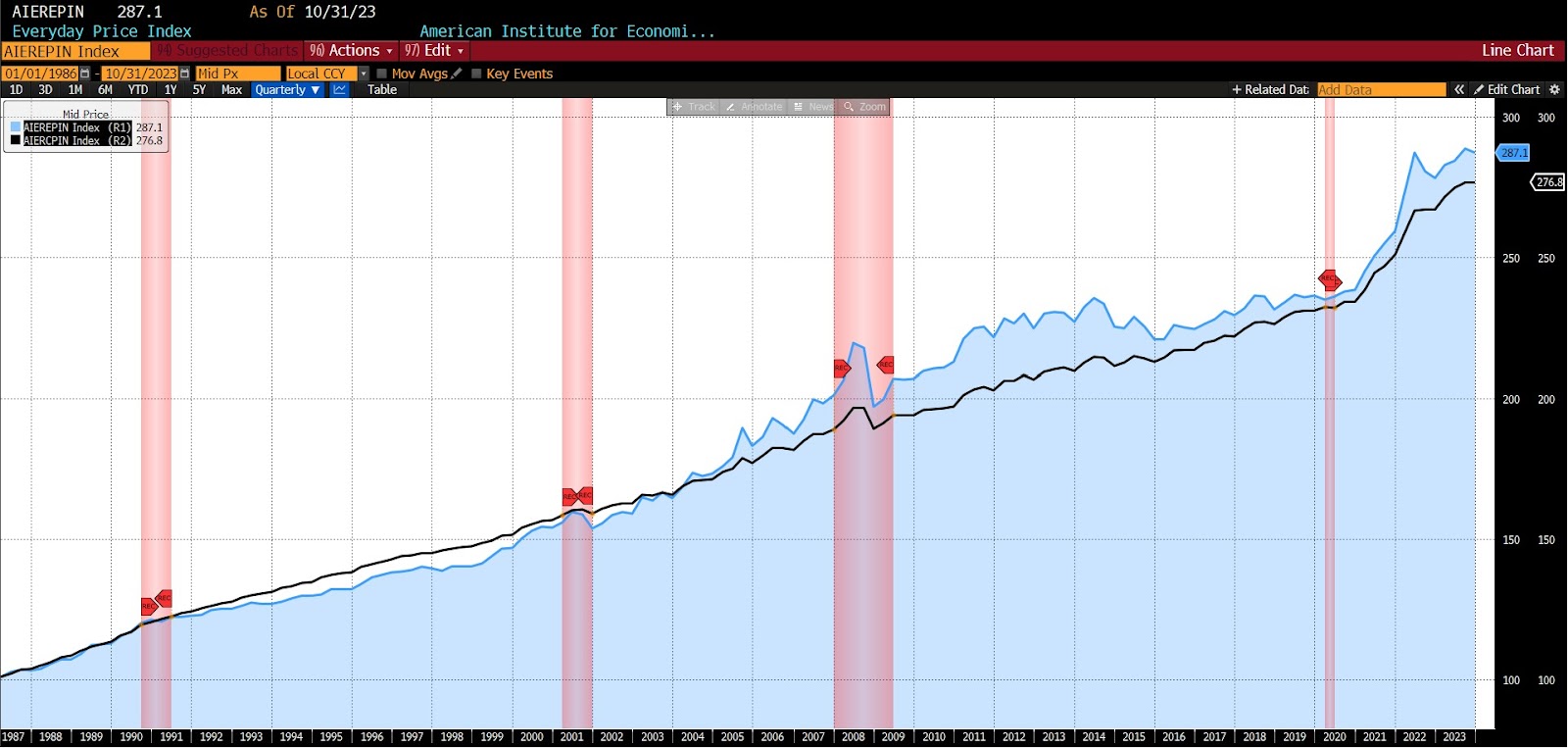

In October 2023 the AIER On a regular basis Value Index (EPI) fell 0.49 p.c to 287.1. That is the second month-to-month lower in 2023 (the primary got here in Might 2023), and the biggest pullback because the over 1 p.c index decline in December 2022.

AIER On a regular basis Value Index vs. US Client Value Index (NSA, 1987 = 100)

Throughout the EPI the biggest month-to-month will increase amongst constituents got here in meals at residence, meals away from residence, tobacco and smoking merchandise, and prescribed drugs. Value declines had been seen in motor gasoline, housing fuels and utilities, satellite tv for pc and stay TV streaming, and web providers. Between September and October 2023, the costs of fifteen EPI elements rose, one was unchanged, and 6 fell.

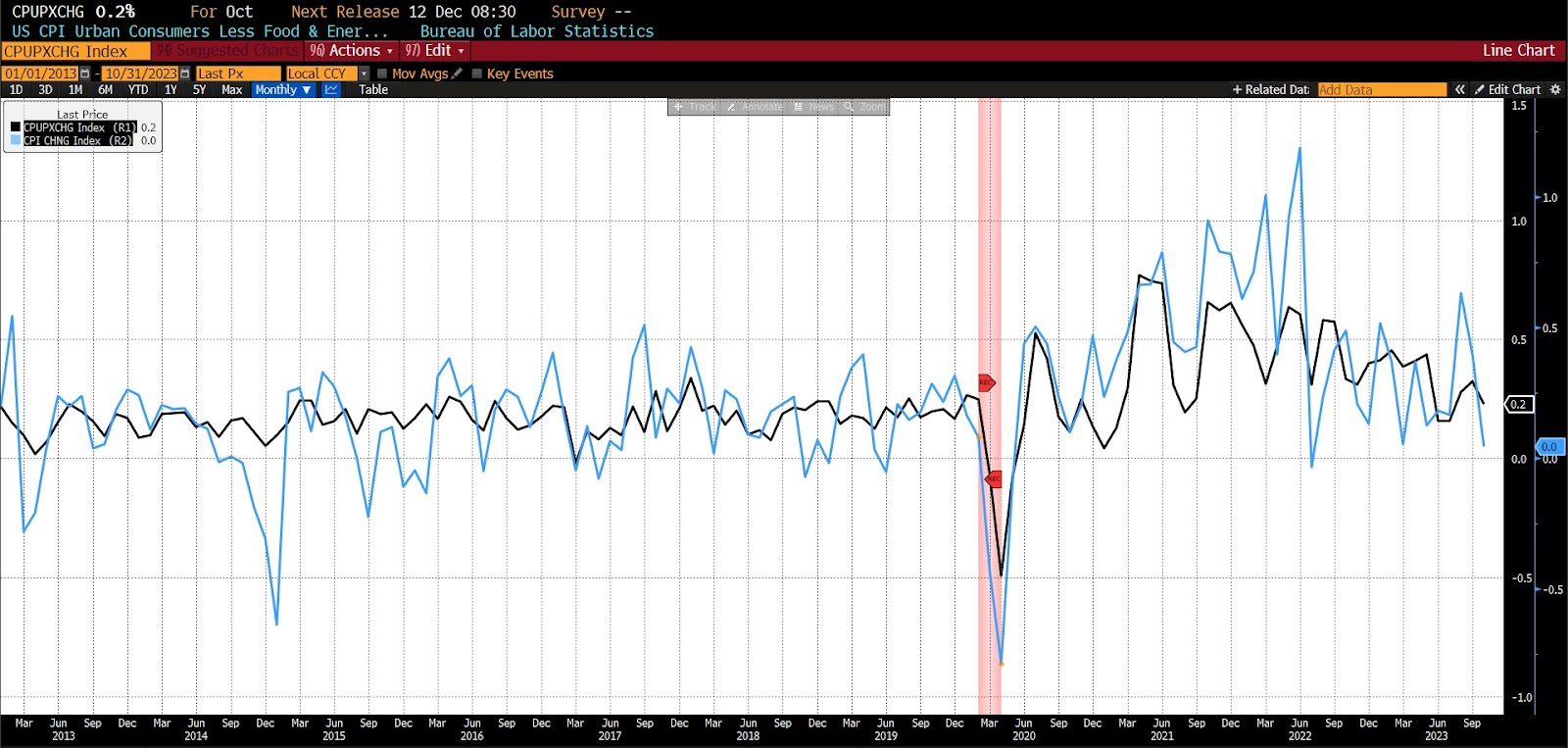

On November 14th the US Bureau of Labor Statistics (BLS) launched Client Value Index (CPI) information for October 2023. The month-to-month headline CPI quantity was flat, beating surveys anticipating an increase of 0.1 p.c. The core month-to-month CPI quantity rose 0.2 p.c, 0.1 lower than expectations.

October 2023 US CPI headline & core month-over-month (2013 – current)

Whereas gasoline costs fell in October, they had been offset by rising shelter costs. The most important contributors to the month-over-month core index had been lease, house owners’ equal lease, motorcar insurance coverage, and medical care. The most important declines from September to October 2023 had been lodging away from residence, used automobiles and vehicles, communication, and airline fares.

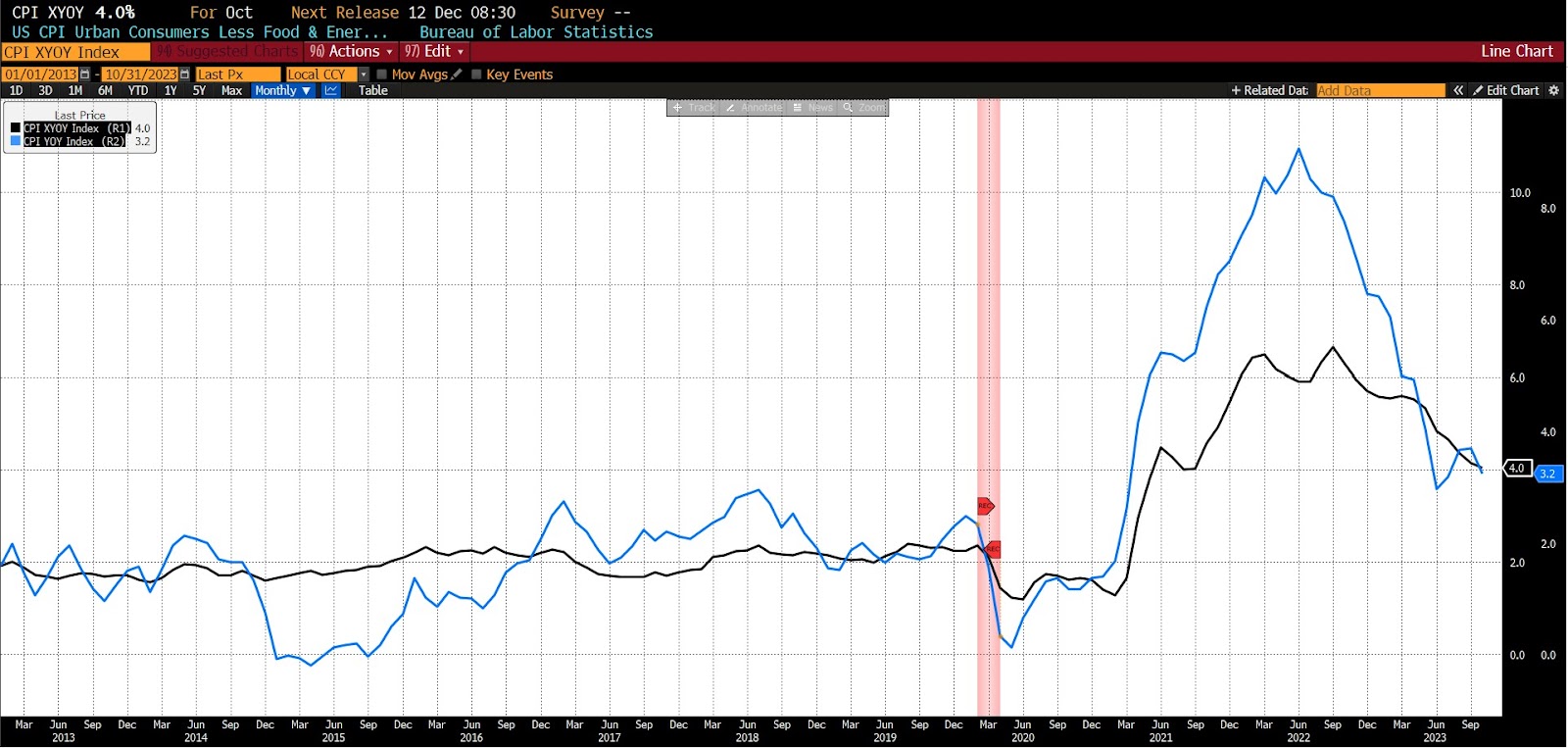

On the year-over-year aspect, headline CPI rose 3.2 p.c versus an anticipated 3.3 p.c. Core CPI (once more, year-over-year) rose 4.0 p.c versus an anticipated 4.1 p.c. The most important contributors to the year-over-year October 2022 to October 2023 adjustments had been shelter (which accounted for 70 p.c of that improve), motorcar insurance coverage, and recreation. Declining considerably on a year-over-year foundation had been costs of family furnishings and new automobiles.

October 2023 US CPI headline & core year-over-year (2013 – current)

The October CPI numbers had been the primary in a while to ship a shock on the draw back. Annualized core CPI is working at 2.8 p.c on a one month foundation, 3.4 p.c on a 3 month foundation, and three.2 p.c on a six month foundation, down from September readings of three.9 p.c, 3.1 p.c, and three.6 p.c respectively.

Broad moderation in inflation measures to ranges usually per the Fed’s goals resulted in a fast repricing of Fed Fund futures early within the session. The market implied likelihood of one other Fed hike earlier than the tip of 2023 dropped to lower than 10 p.c. Moreover cited as optimistic within the October report was the rising diffusion of disinflation amongst CPI constituents, with the p.c of core spending objects exhibiting declining costs rising to 41 p.c from 33 p.c in September. Moreover, the share of core costs for which annualized costs rose at a charge of above 4 p.c fell from 44 p.c in September to 38 p.c in October.

The October inflation launch supplies a welcome respite from resurgent worth will increase over the previous few months. Past the patron perspective, the suggestion that coverage charges could also be at their peak is undoubtedly excellent news for upcoming finances negotiations, a central focus of which has been surging US Treasury yields and consequently more and more unsustainable debt service prices. However: whereas the newest CPI (and EPI) information relay a optimistic state of affairs within the resumption of the disinflationary development, it’s important to emphasise that challenges and uncertainties persist.

[ad_2]

Source link