[ad_1]

Airbnb is about to unveil its This autumn 2023 monetary outcomes, following a robust efficiency within the earlier quarter that noticed an 18% development in revenues, reaching almost $3.4 billion.

Anticipation surrounds Airbnb’s This autumn report, with expectations of $2.16 billion in income and $0.7 EPS, signaling a possible 14% enhance in income in comparison with the identical interval final 12 months.

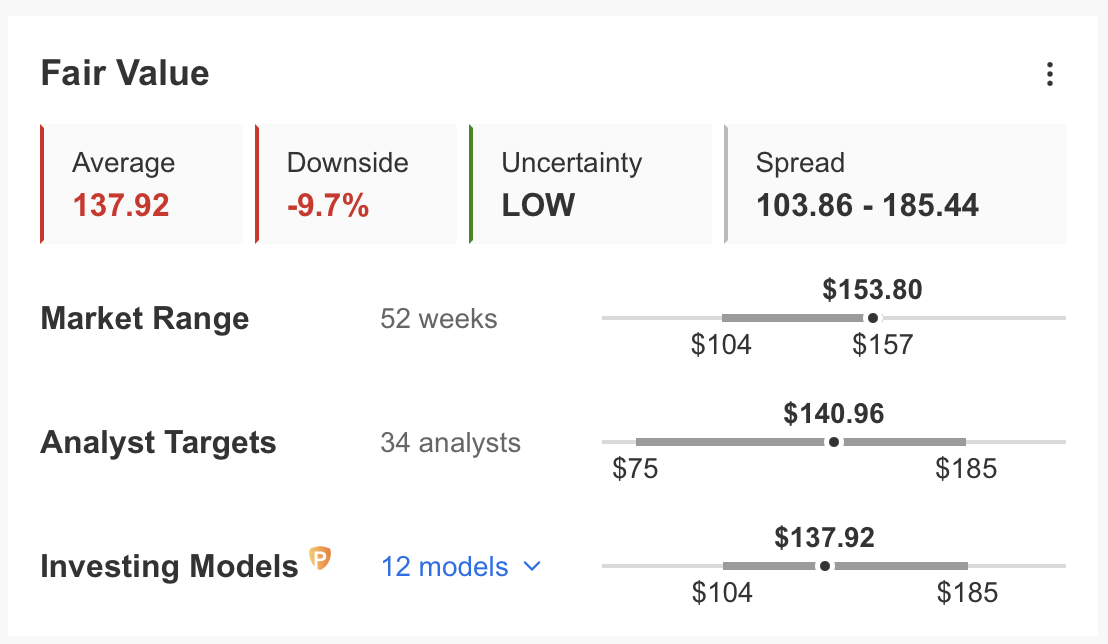

Regardless of a strong monetary well being rating of 4 factors, the InvestingPro truthful worth evaluation suggests a potential correction of near 10%.

In 2024, make investments like the large funds from the consolation of your own home with our AI-powered ProPicks inventory choice instrument. Study extra right here>>

Airbnb will launch its This autumn 2023 monetary outcomes after the market closes at this time.

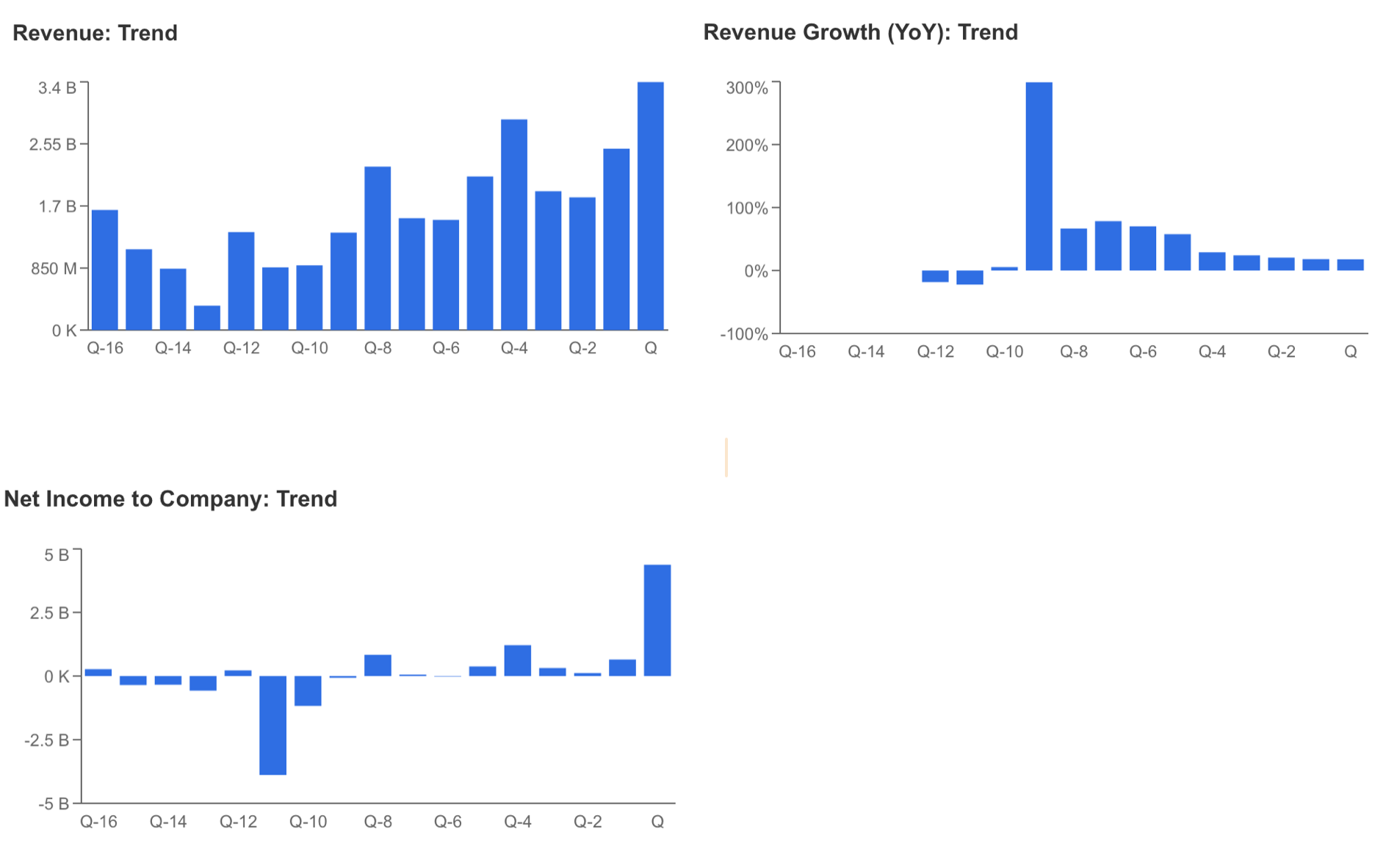

Within the earlier quarter, the lodging supplier revenues of almost $3.4 billion, reflecting an 18% development in comparison with the identical interval final 12 months.

Following the Q3 outcomes that surpassed income expectations, the corporate additionally disclosed a web revenue of $4.37 billion.

This marks a big 260% enhance in comparison with the identical interval the earlier 12 months, with a noteworthy portion of the web earnings development—$2.7 billion—attributed to a one-time tax benefit

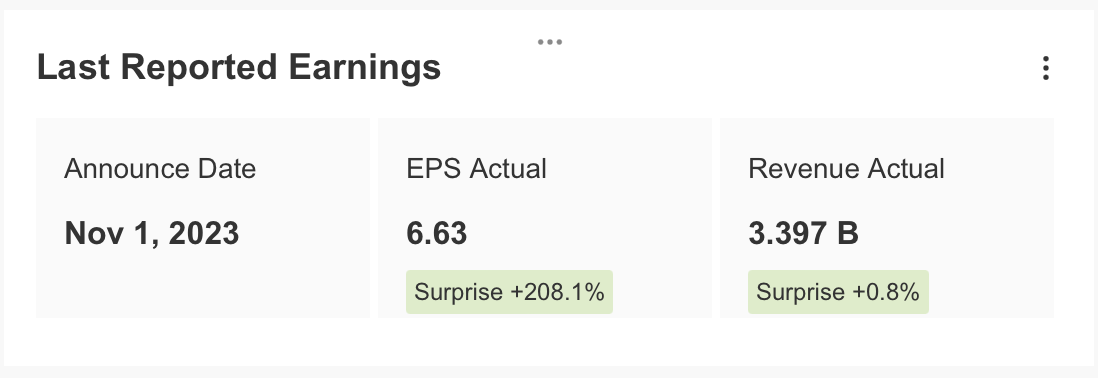

Supply: InvestingPro

Consequently, Airbnb achieved earnings per share of $6.63 in Q3, surpassing InvestingPro expectations by a powerful 208%.

Supply: InvestingPro

On this article, we’ll take a deep dive into the San Francisco, California-based big’s fundamentals to raised perceive had been the corporate stands going into earnings.

Elementary View: Macro, Geopolitical Points to Adversely Have an effect on Journey Demand?

With the information indicating that bookings elevated in November and December, there’s the thought that there could also be geopolitical issues and macroeconomic information that will negatively have an effect on journey demand available in the market for the present interval.

On this unsure setting, the corporate’s final quarter report is eagerly awaited.

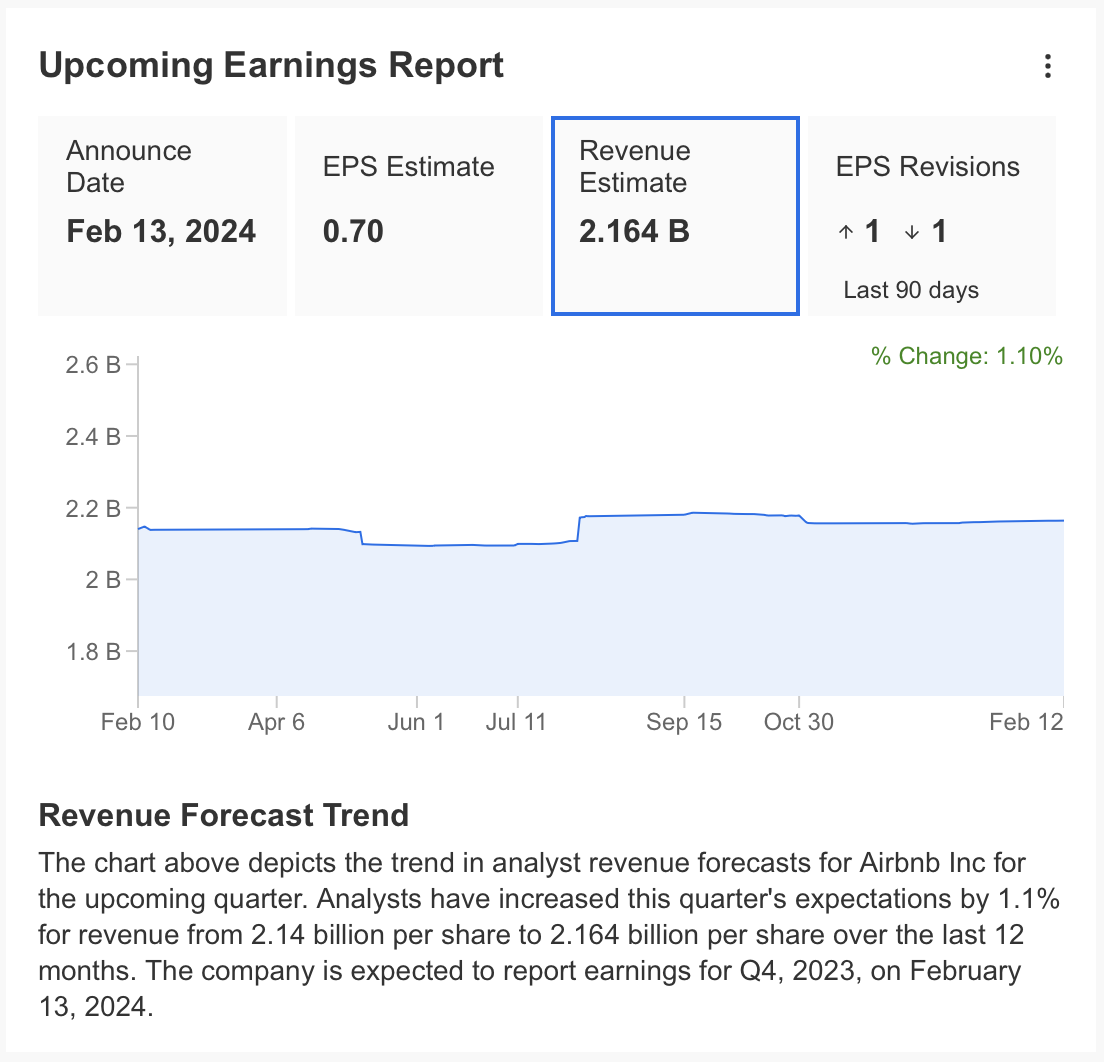

Once we check out the This autumn expectations through InvestingPro, we see that there’s an expectation of $2.16 billion in income and $0.7 EPS.

This can imply a 14% enhance in income in comparison with the identical interval final 12 months and can present that the lack of momentum in income development continues.

EPS is anticipated to extend by 46% in comparison with $0.48 within the final quarter of final 12 months.

Supply: InvestingPro

Airbnb strives to undertake an strategy that reduces the price of lodging for vacationers.

Though the present pricing coverage results in a lack of momentum in income development, it appears to have a optimistic affect on the corporate’s web earnings.

Though there are fluctuations in quarterly intervals, it has began to generate steady web earnings for the reason that second half of 2022.

Supply: InvestingPro

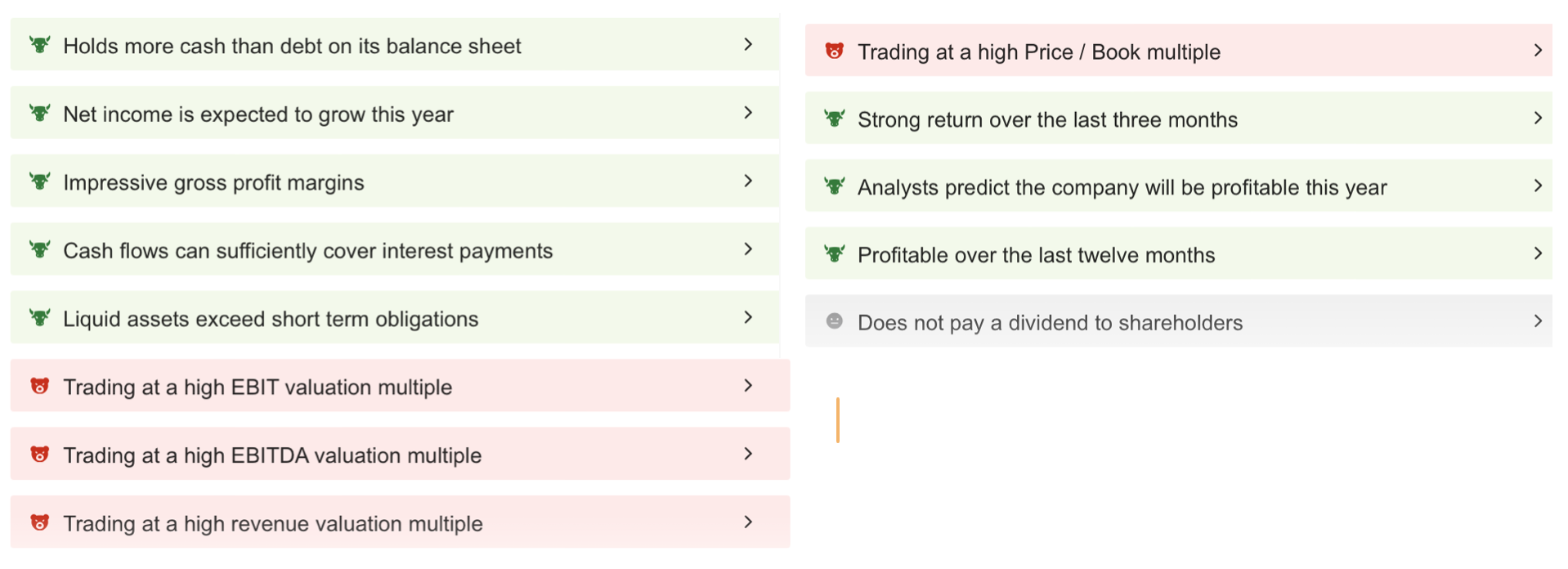

With the ProTips report ready for Airbnb through InvestingPro, we are able to make an essential inference in regards to the firm’s monetary well being by its strengths and weaknesses.

Supply: InvestingPro

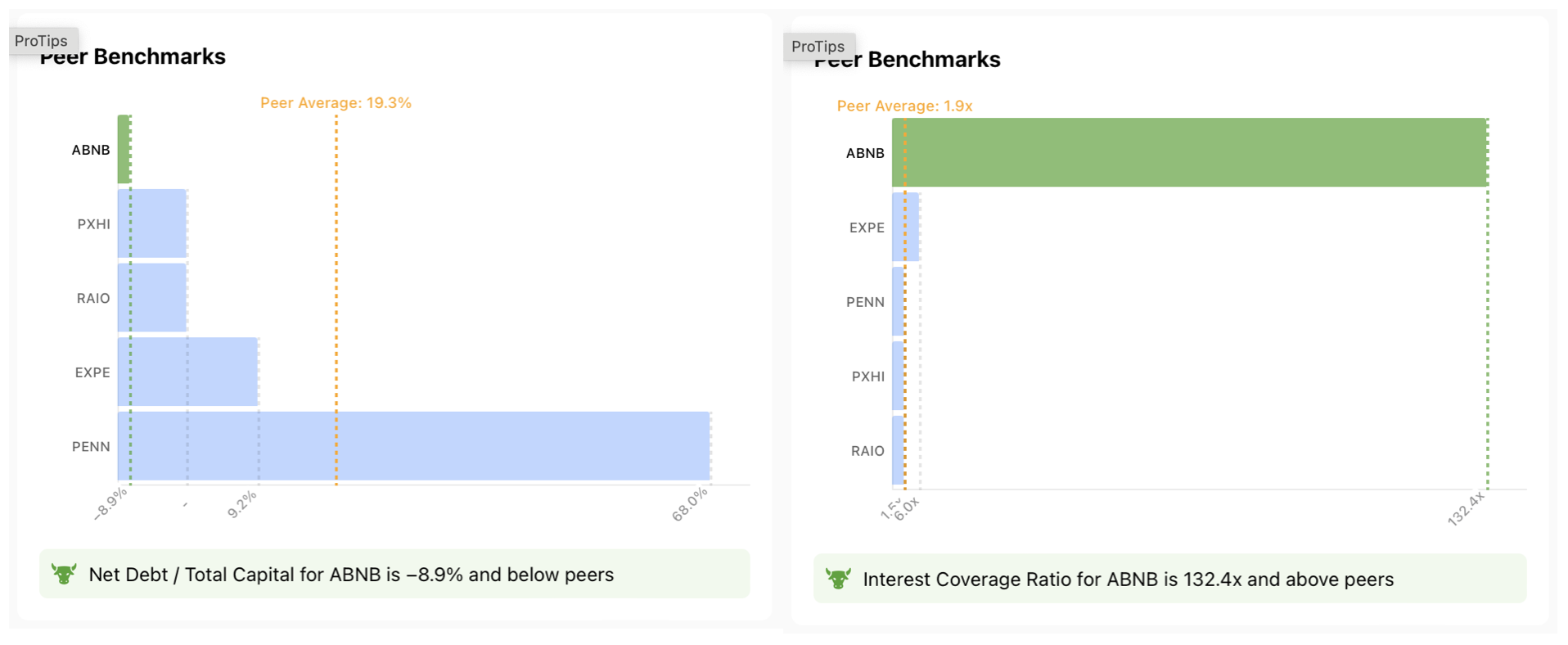

The truth that the amount of money on the corporate’s stability sheet exceeds its debt may be interpreted as a robust indicator of its monetary well being.

Airbnb has a a lot better Web Debt to Whole capital ratio than peer firms, which offers benefits resembling the corporate’s potential to withstand recessionary intervals and its excessive potential to grab development alternatives.

However, the corporate’s money circulate is adequate to cowl curiosity bills. Airbnb is at the moment in a really advantageous place in comparison with its opponents with an curiosity protection ratio of 132.4X.

Supply: InvestingPro

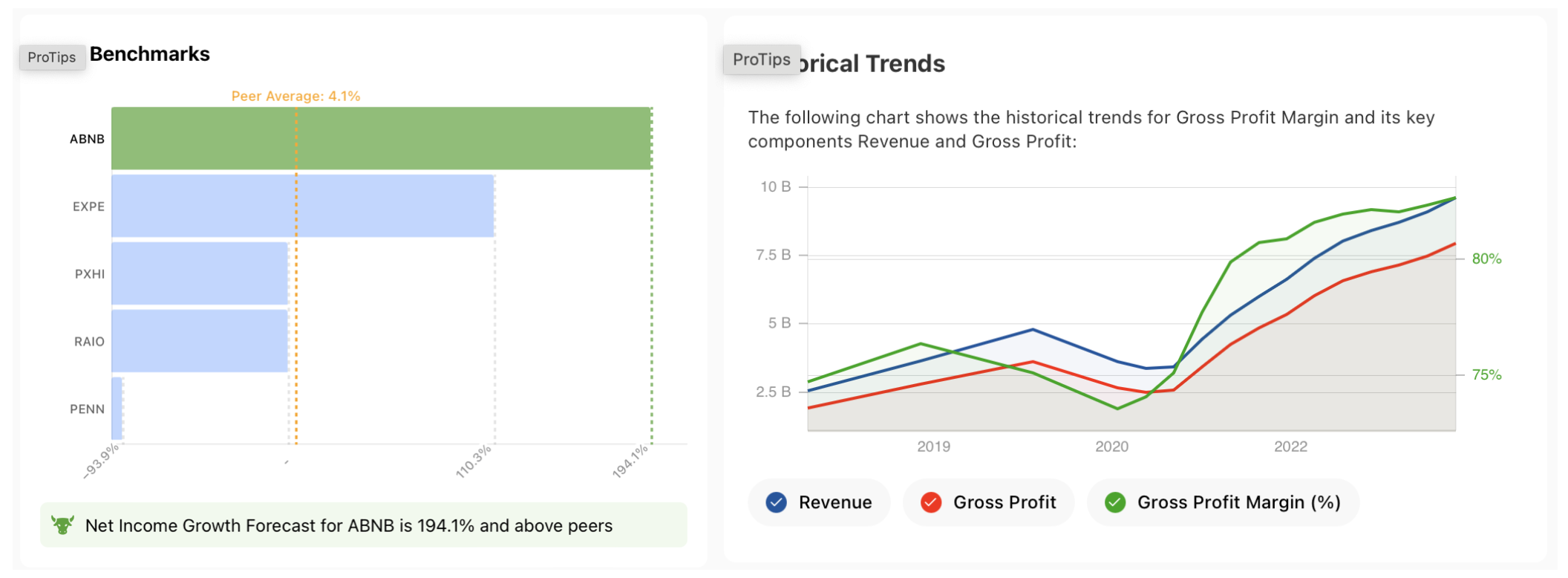

When it comes to profitability, the corporate is anticipated to considerably enhance its web revenue in 2023, whereas the expectation of an annual web revenue enhance of 194% in comparison with the peer common of 4.1% is a charge that may appeal to traders.

As well as, the corporate’s gross revenue margin can be at excessive ranges. With a median gross margin of 82.7%, Airbnb displays that its operations are environment friendly, it retains pricing energy, and has the potential to additional enhance its web revenue.

The corporate’s present ratio of 1.8X, with liquid belongings exceeding short-term liabilities, can be an essential signal that liquidity is getting used effectively.

As well as, ABNB inventory continues to carry out strongly, with a return of almost 30% within the final 3 months, effectively above the peer common of 1.5%.

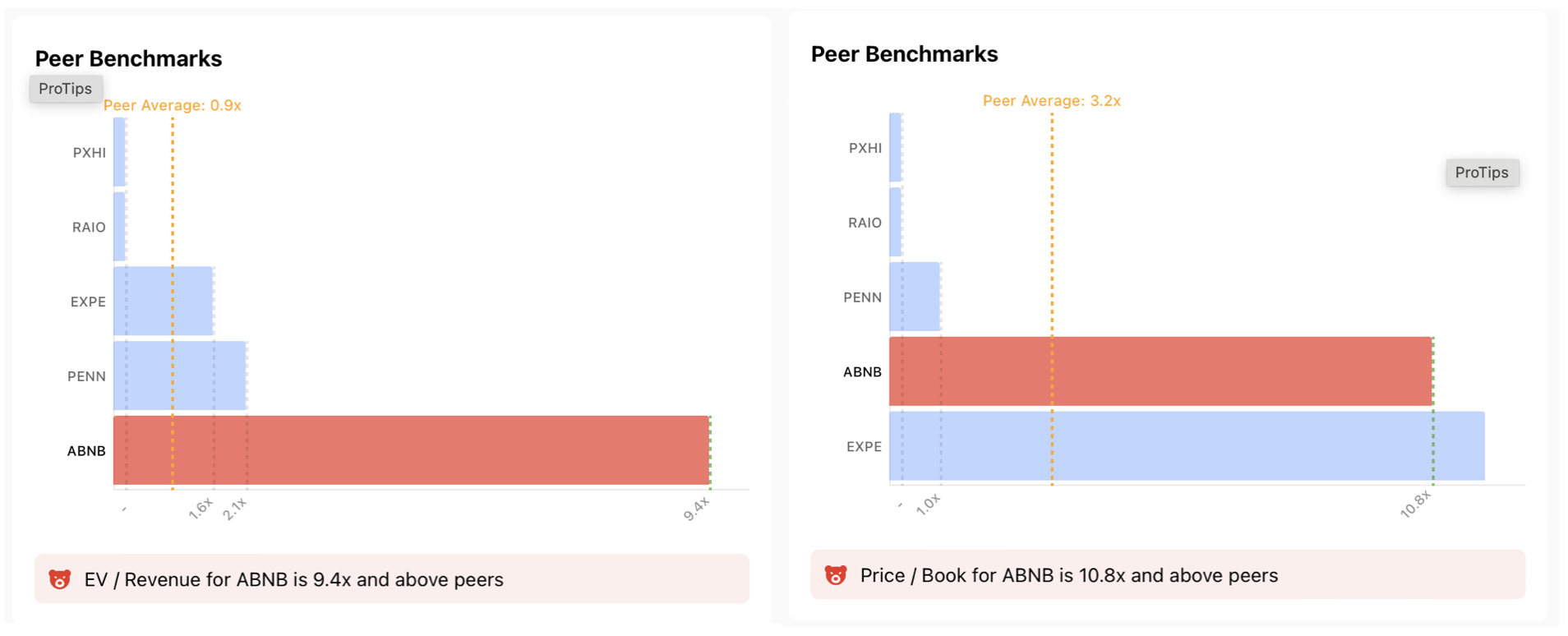

If we study the components which may be destructive for the corporate’s inventory; we are able to point out that there’s a threat of a correction as a result of continued overvaluation of the share value.

Though this example shouldn’t be all the time destructive, there could also be a threat issue resembling accelerating gross sales in case of a deterioration within the monetary state of affairs, which is at the moment thought-about fairly wholesome.

Supply: InvestingPro

At the moment, Airbnb’s enterprise value-to-revenue ratio of 9.4X is above the typical of 0.9X.

Equally, the P/B ratio of 10.8X in comparison with the typical of three.2X displays that the corporate’s inventory is overvalued.

As well as, the truth that the corporate doesn’t pay dividends may be seen as a destructive issue, particularly for long-term funding plans.

Supply: InvestingPro

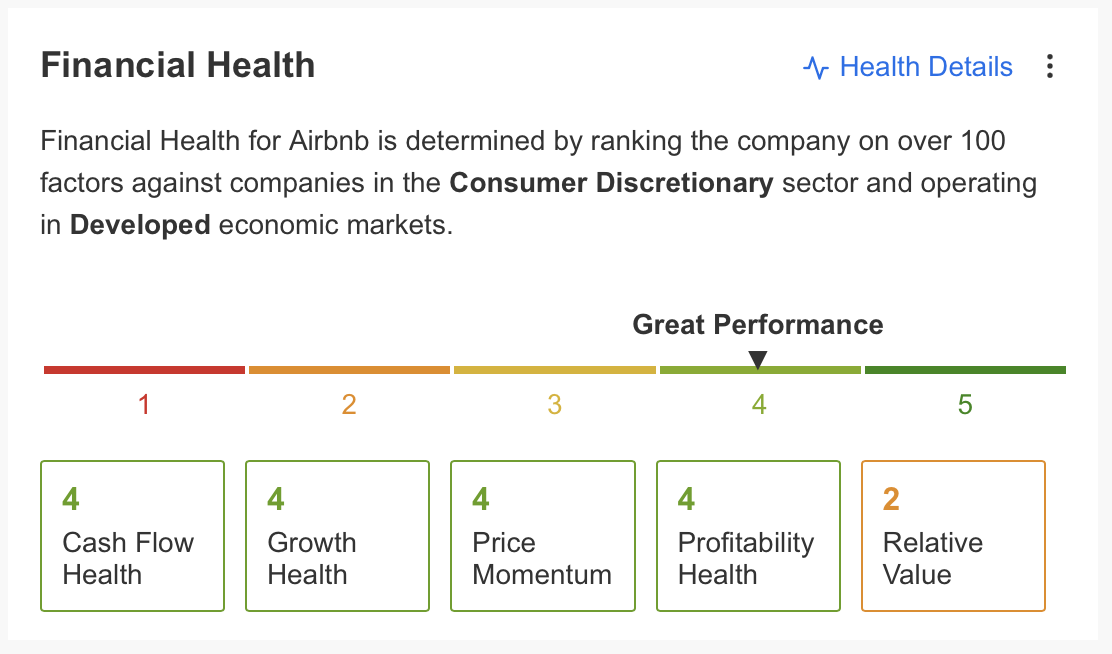

In abstract, the monetary well being chart from InvestingPro charges the corporate out of 5 in numerous standards resembling money circulate, development, value momentum, and profitability.

The corporate obtained a stable rating of 4 factors, indicating a strong monetary well being.

Supply: InvestingPro

The truthful worth evaluation, primarily based on 12 monetary fashions, exhibits that ABNB’s share might even see a correction of near 10% within the coming months and should fall as little as $138.

The consensus forecast of 34 analysts is that the inventory might fall as little as 140 {dollars}. Nevertheless, the ratios to be up to date in response to the earnings report back to be introduced at this time may result in a change within the truthful worth estimate.

Subsequently, utilizing InvestingPro usually will enable you keep alert to adjustments available in the market and present reviews.

Airbnb Technical View

This week, the share value surged 4% forward of the earnings report and began to check its peak in July final 12 months. Closing the week above $155 on common has grow to be essential for the upward swing to proceed all through 2023.

A optimistic earnings report might be the catalyst for ABNB’s share to realize momentum. On this case, we are able to see that the inventory might proceed in direction of the Fibonacci goal zone within the vary of $ 165 – 180 in the course of the 12 months.

However, if ABNB, which displays overbought circumstances, fails to exceed the $ 155 resistance, this can be seen as an excuse for merchants and it could be ordinary for the inventory to retreat in direction of the decrease band of the channel to the vary of $ 135 – $ 140.

***

Take your investing recreation to the following degree in 2024 with ProPicks

Establishments and billionaire traders worldwide are already effectively forward of the sport in relation to AI-powered investing, extensively utilizing, customizing, and growing it to bulk up their returns and reduce losses.

Now, InvestingPro customers can just do the identical from the consolation of their very own properties with our new flagship AI-powered stock-picking instrument: ProPicks.

With our six methods, together with the flagship “Tech Titans,” which outperformed the market by a lofty 1,427.8% over the past decade, traders have the perfect collection of shares available in the market on the tip of their fingers each month.

Subscribe right here and by no means miss a bull market once more!

Subscribe Right now!

Remember your free present! Use coupon code INVPROGA24 at checkout for a ten% low cost on all InvestingPro plans.

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, or advice to take a position as such it isn’t meant to incentivize the acquisition of belongings in any method. I want to remind you that any kind of asset, is evaluated from a number of factors of view and is very dangerous and due to this fact, any funding resolution and the related threat stays with the investor.

[ad_2]

Source link

Add comment