[ad_1]

Hawaiian Airways Airbus A330

mixmotive

Whereas the highlight within the airline business is on the mixture of JetBlue (JBLU) and Spirit Airways (SAVE), Alaska Air Group (NYSE:ALK) is stealing a number of the thunder because it introduced an settlement with Hawaiian Holdings (NASDAQ:HA) to mix. On this report, I can be discussing the small print of the transaction and I can be specializing in in what approach these airways are suitable or not.

Price Strain Gas Merger and Acquisition Momentum In The Airline Trade

Following some lean years within the airline business, it shouldn’t come as a shock that airways are more and more mergers and acquisitions to bolster their enterprise. In some sense, the momentum within the M&An area has been considerably delayed as a result of governments have saved airways afloat through the pandemic, and as lockdowns eased demand for air journey surged, however as we’re seeing a really difficult backdrop that I beforehand mentioned M&A turns into increasingly more simple regardless of the advanced setting to realize regulatory approval. We’re at the moment seeing softening in unit revenues whereas labor prices are rising and gas costs have additionally headed greater.

In its most up-to-date earnings report, Alaska Airways noticed yield drop 10% and income per out there seat mile drop 12% whereas capability elevated 14%. Wages elevated 17% on a 4% development fee in FTEs reflecting greater pay within the business. Gas prices within the third quarter had been 11% decrease however will not be offering a practical projection base.

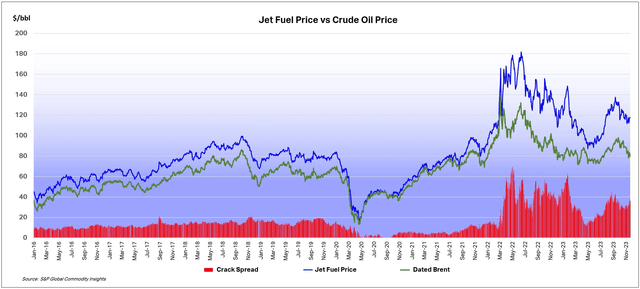

S&P International Commodity Insights

It is fairly evident that since Might 2023, gas costs have began to go greater and that implies that whereas Q3 supplied greater labor prices however a decrease gas invoice, This autumn possible will embody greater labor prices and a decrease constructive impression from oil worth fluctuations. If we mix that with weakening unit revenues, it is fairly evident that there is a margin stress that can not be offset by growing fares which is what airways have been capable of do for a while since Q2 2022. Once I mentioned the JETS ETF, I identified that some price rationalization and administration are required and a technique to try this is to trim capability growth to stabilize unit revenues with the price stability. Mergers and acquisitions are one strategy to obtain that in addition to a much bigger airline permits for price to be amortized extra effectively.

Alaska Airways Buys Hawaiian Airways

Alaska Airways is aiming to accumulate Hawaiian Airways for $18.00 per share in an all-cash deal, placing the fairness worth of the deal at $1.0 billion with assumption of $0.9 billion in debt, which might put the enterprise worth at $1.9 billion with $235 million in run-rate synergies inside two years after closing of the deal.

How Will Alaska Airways Finance The Merger With Hawaiian Airways?

In the course of the convention name discussing the merger particulars scheduled for Dec. 3, 2023, at 3:00 p.m. Hawaii Commonplace Time, we’ll possible hear how the deal can be financed. Alaska Airways at the moment has money and money equivalents of $647 million and marketable securities of $1.8 billion placing the full money and marketable securities at $2.45 billion. So, the corporate could possibly be financing the deal from its personal pocket. However on condition that Alaska Airways retains round $2.5 billion in money and marketable securities which covers their debt I might anticipate that the deal can be financed with a mix of each, and this was later additionally confirmed by a slide deck that was uploaded by Alaska Airways.

When Is The Alaska Airways and Hawaiian Airways Merger Set To Shut?

Alaska Airways expects that the deal could possibly be closed in 12-18 months pending regulatory approval and approval of Hawaiian Holdings shareholders which the corporate expects to be sought by the primary quarter of 2024.

Are Hawaiian Airways Shareholders Getting A Good Deal?

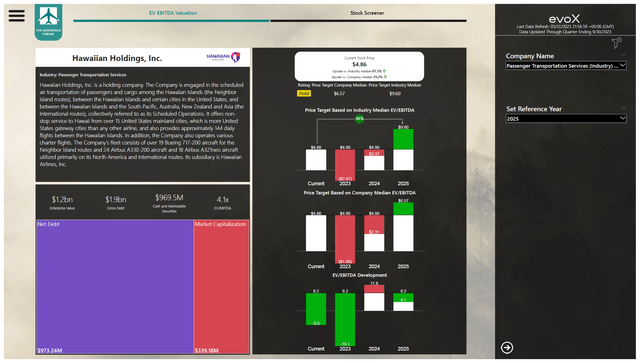

The brief reply is “sure.” The present share worth is $4.86 and shareholders can be getting $18 per share which gives a 2.7x premium. Usually, it is fairly troublesome to determine a justified premium.

I seemed up the premium paid for the acquisition of a number of passenger airways within the US and located the next:

Take over goal

Acquired by/To be acquired by

Premium

Spirit Airways

JetBlue

57%

Southwest Airways

Air Tran

69%

Alaska Airways

Virgin America

90%

Click on to enlarge

Word: The mixture of American Airways (AAL) and US Airways has not been listed as opposite to the opposite mergers and acquisitions it was an all-stock deal.

The Aerospace Discussion board

Valuing Hawaiian Holdings is definitely not a straightforward process with damaging EBITDA anticipated for the yr rendering an EV/EBITDA valuation for 2023 ineffective. The money and marketable securities are valued at $22 per share, so the corporate being valued at 0.8x money out there, which I feel shouldn’t be a foul factor given that there is additionally debt excellent. Actually, I don’t imagine that we needs to be present yr figures and needs to be 2025 figures as a substitute when Hawaiian Holdings needs to be additional forward within the restoration trajectory which is sort of distinctive to its feeder perform for Hawaii. With 2025 earnings in thoughts and a 90% premium, we might get to a $18.24 worth per share which is 1.3% decrease than what Alaska Airways has supplied. So, I might say the bidding worth of $18 per share is truthful and I feel the 90% premium in opposition to 2025 earnings additionally might be justified given the distinctive positioning of Hawaiian Airways.

Acquisition Value Displays Struggles Hawaiian Airways Faces

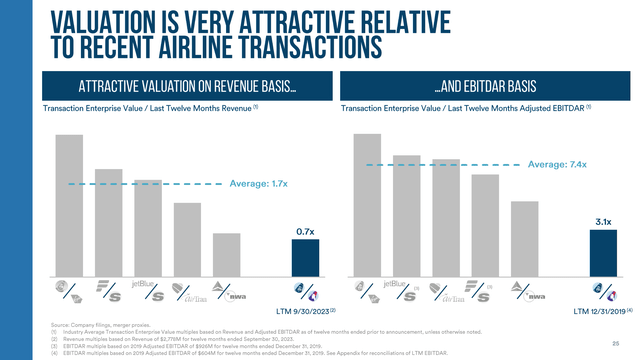

Alaska Airways

Usually, I view the transaction worth as a good worth for Hawaiian however that’s not a lot pushed by EV/income or EV/EBITDAR figures as Alaska is getting the higher deal right here with an EV/income transaction worth of 0.7x in comparison with 1.7x on common and a median of seven.4x EV/EBITDAR in comparison with 3.1x supplied. Why do I feel the value remains to be a good one? The reason being the operational challenges Hawaiian confronted this yr. The fires in Maui resulted in $25 million misplaced income and weak spot in unit revenues as demand will progressively rebuild. Aside from that the corporate has had some challenges reviving its enterprise as journey from Japan took longer to revive and there are issues with the Pratt & Whitney PW1100G turbofans retaining two to 4 out of 18 A321neo airplanes grounded and the introduction of the Boeing 787-9 has additionally been delayed into subsequent yr.

All of that gives a fairly strong base to barter a below-average acquisition worth for Hawaiian Airways and I nonetheless assume that is a great deal because it displays a premium to 2025 EV/EBITDA valuation. On a 12-18 month approval trajectory, because of this shareholders have to attend and see however are paid an 87.5% premium for that.

Assessing Fleet Compatibility: A Very Odd Fleet Mixture

In Service

Orders

Boeing 737-700

11

0

Boeing 737-800

59

0

Boeing 737-900

12

0

Boeing 737-900ER

79

0

Boeing 737 MAX 8

0

15

Boeing 737 MAX 9

63

17

Boeing 737 MAX 10

0

102

Alaska Airways Complete

224

134

Airbus A321neo

18

0

Airbus A330-200

24

0

Boeing 717-200

19

0

Boeing 787-9

0

12

Hawaiian Airways

61

12

Professional-forma mixed

285

146

Click on to enlarge

From a fleet perspective, I can say nothing else aside from this being a extremely fascinating mixture that doesn’t straight make sense to me. Alaska Airways is an all-Boeing operator on its mainline fleet and it spent the previous years changing into an all-Boeing operator once more because it absorbed Airbus A320 household airplanes from the acquisition of Virgin America.

Actually, the corporate didn’t retire the final A321neo till just lately as famous through the Q3 2023 earnings name:

As Ben talked about, we crossed a big milestone to finish the third quarter as we retired our final Airbus from service. And in wrapping up our Airbus period, we introduced this morning that we reached an settlement to promote the ten A321s to our associate, American Airways, and anticipate deliveries to happen over the subsequent two quarters.

That effort is now in a roundabout way struggling a setback and one can wonder if Alaska Airways is occupied with sustaining a comparatively small fleet of Airbus airplanes. Within the single-aisle fleet, Airbus would have a 7% share, and within the wide-body passenger fleet, the present fleet can be all-Airbus although Boeing 787 deliveries are anticipated within the years to return. So will probably be extremely fascinating to see what the corporate will do with the Airbus fleet. I might not be stunned if Alaska Airways can be seeking to do away with the Airbus fleet, which I imagine shouldn’t be a serious difficulty given market demand for next-generation single-aisle airplanes. The Airbus A330s would possibly pose a much bigger downside as they don’t seem to be excessive in demand and one can marvel what the mixture of Hawaiian and Alaska Airways means for the contract Amazon (AMZN) has with Hawaiian.

Community: Distinctive Entry Energy And Worldwide Publicity

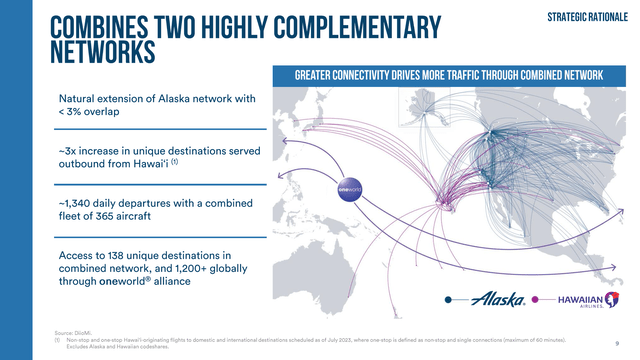

Alaska Airways

If we have a look at the Hawaiian Airways community, we see it has most of its publicity to the US West Coast however with some US East Coast locations in addition to worldwide locations in Japan, Australia, South Korea, and New Zealand.

As a mixed entity, Alaska Airways and Hawaiian Airways may have a firmer grip on the US West Coast though it stays to be seen what the regulatory necessities can be for West Coast connections to Hawaii. The Alaska-Hawaiian mixture has extra US East and West Coast locations which could possibly be useful to feed passengers into Hawaii. The Hawaiian community will add Asia-Pacific, New Zealand, and Australia to the community which might doubtlessly be useful in feeding vacationers to mainland US.

What Are The Dangers For The Alaska Airways and Hawaiian Airways Merger?

For the merger, I am seeing two foremost dangers. The primary one is sort of apparent and that’s the anti-consolidation stance on the Division of Transportation and Division of Justice in addition to opposition from lawmakers. Though, I feel the present price and demand atmosphere does push airways within the course of M&A. The second – prices associated to integration and synergies. Hawaiian and Alaska will each proceed operations as separate manufacturers offering companies to totally different audiences with totally different merchandise however via an upsized community, so maybe there received’t be a variety of prices on the combination aspect, however it stays to be seen whether or not the synergies of $235 million might be achieved. When mergers and acquisitions are introduced, we regularly see synergies touted as nice worth drivers. And whereas I might not wish to say these synergies tend to not materialize, realizing the synergies is a serious problem.

Conclusion: Alaska Airways Has A Nice Deal, However So Do Hawaiian Holdings Shareholders

I feel that general the low inventory worth for Hawaiian pushed by the challenges the airline faces has opened a really robust place for Alaska Airways to scoop up Hawaiian Airways and its distinctive enterprise as a feeder for Hawaii and neighboring islands at a worth that is considerably under business averages. So, Alaska Airways is getting a terrific deal that also needs to assist the corporate going ahead with a broader community and alternatives for helpful price amortization whereas shareholders are paid a premium on implied 2025 EV/EBITDA valuation. The Alaska-Hawaiian route community does add power to each carriers, however by way of fleet compatibility, the mixture is considerably odd.

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please pay attention to the dangers related to these shares.

[ad_2]

Source link