[ad_1]

Up to date on November twenty second, 2023 by Nikolaos Sismanis

To put money into nice companies, it’s important to discover them first. Carl Icahn is an professional at this, with an fairness funding portfolio value greater than $12 billion, as of the tip of the 2023 third quarter.

Carl Icahn’s portfolio is crammed with high quality shares. You may ‘cheat’ from Carl Icahn shares to seek out picks to your portfolio. That’s as a result of institutional traders are required to periodically present their holdings in a 13F submitting.

You may see all 13 Carl Icahn shares (together with related monetary metrics like dividend yields and price-to-earnings ratios) by clicking on the hyperlink under:

Notes: 13F submitting efficiency is completely different than fund efficiency. See how we calculate 13F submitting efficiency right here.

This text analyzes Carl Icahn’s 13 shares based mostly on the knowledge disclosed in his Q3 2023 13F submitting.

Desk of Contents

You may skip to a particular part with the desk of contents under. Shares are listed by share of the full portfolio, from highest to lowest.

Carl Icahn & Dividend Shares

Carl Icahn has grown his wealth by investing in and buying companies with robust aggressive benefits buying and selling at honest or higher costs.

Most traders know Carl Icahn seems to be for engaging shares, however few know the diploma to which he invests in dividend shares:

10 out of the 13 Carl Icahn shares pay dividends

His high 5 holdings have a mean dividend yield of seven.6% (and make up 94% of his portfolio)

His funding agency, Icahn Enterprises, is structured as an MLP and pays its traders a large double-digit yield.

Maintain studying this text to see Carl Icahn’s 13 inventory choices analyzed in better element.

#1: Icahn Enterprises L.P. (IEP)

Dividend Yield: 24.2percentP.c of Carl Icahn’s Portfolio: 61.8%

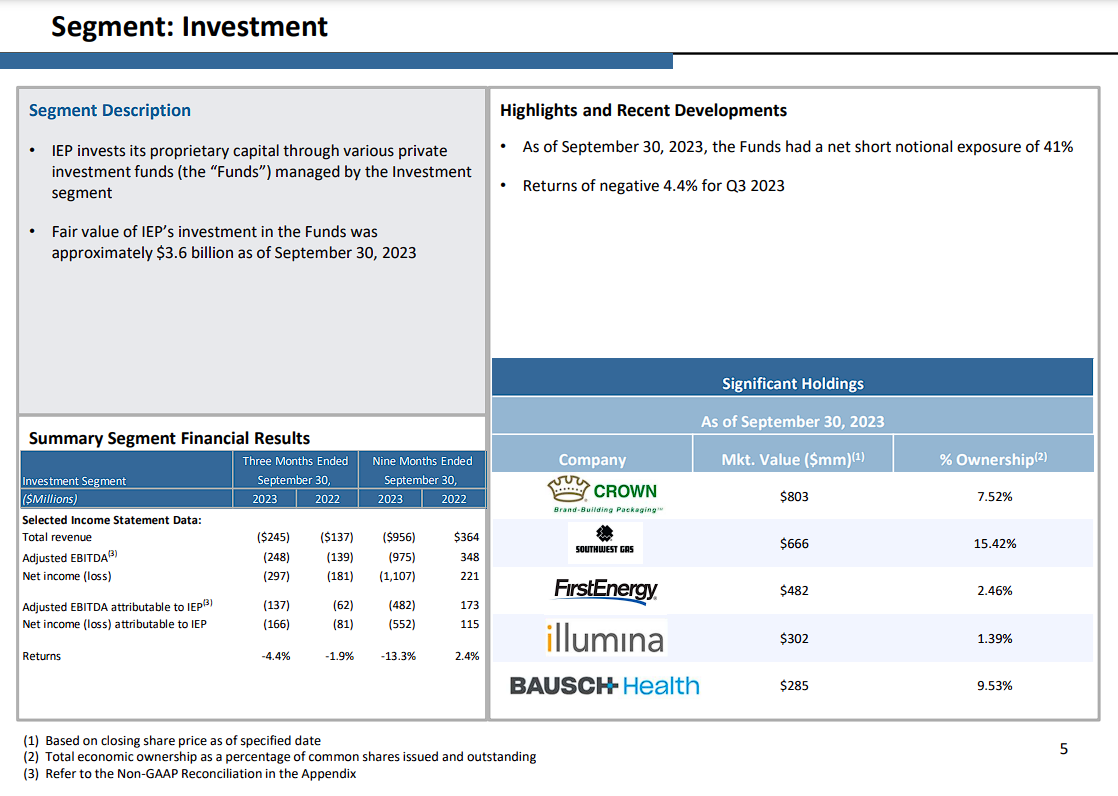

Icahn Enterprises L.P. operates in funding, vitality, automotive, meals packaging, metals, actual property, and residential vogue companies in the USA and Internationally. The corporate’s Funding phase focuses on discovering undervalued corporations to allocate capital via its numerous non-public funding funds.

Supply: Investor Presentation

Carl Icahn owns 100% of Icahn Enterprises GP, the overall accomplice of Icahn Enterprises and Icahn Enterprises Holdings, and roughly 89% of Icahn Enterprises’ excellent shares.

On August 4th, 2023, Icahn Enterprises slashed its distribution by 50% to a quarterly charge of $1.00.

On November third, 2023, the partnership reported its Q3 outcomes for the interval ending September thirtieth, 2023. For the quarter, revenues got here in at $3.0 billion, 12% decrease year-over-year, whereas the loss per unit was $0.01, versus a loss per unit of $0.37 in Q3-2022. Decrease revenues had been because of Icahn’s investments recording weaker outcomes in comparison with final 12 months.

The corporate employs a fancy accounting technique by realizing revenues via its funding funds, not its subsidiaries’ precise gross sales. Consequently, the corporate posts internet losses in working actions and solely income from its “funding actions” phase of its money flows.

The corporate doesn’t particularly report funding revenue per share. The partnership’s distribution lower could have confirmed Hindenburg’s earlier brief report, which argued that the inventory is buying and selling at an “inflated” valuation in opposition to NAV, to be proper.

Click on right here to obtain our most up-to-date Certain Evaluation report on IEP (preview of web page 1 of three proven under):

#2: CVR Power Inc. (CVI)

Dividend Yield: 6.3percentP.c of Carl Icahn’s Portfolio: 19.4%

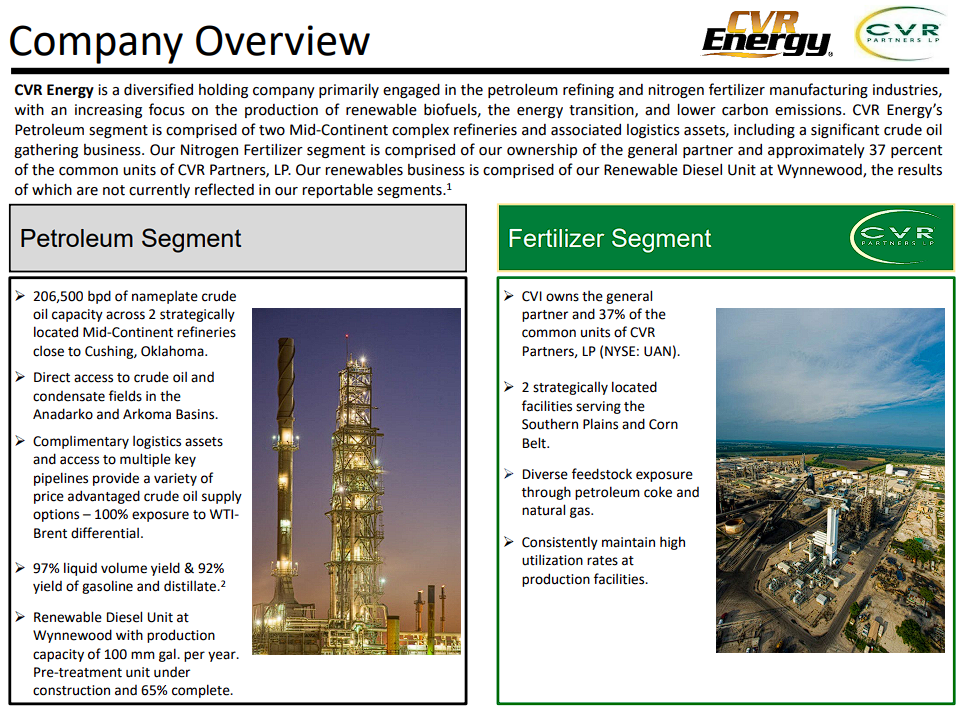

CVR Power is a diversified holding firm primarily engaged within the renewable fuels and petroleum refining and advertising companies, in addition to within the nitrogen fertilizer manufacturing enterprise via its curiosity in CVR Companions, LP. CVR Power subsidiaries function the overall accomplice and personal 37% of the frequent items of CVR Companions.

Supply: Investor Presentation

For Q3, the corporate reported internet revenue of $353 million, or $3.51 per diluted share, on internet gross sales of $2.5 billion for the third quarter of 2023, in comparison with internet revenue of $93 million, or 92 cents per diluted share, on internet gross sales of $2.7 billion for the third quarter of 2022.

Adjusted earnings for the third quarter of 2023 had been $1.89 per diluted share in comparison with adjusted earnings of $1.90 per diluted share within the third quarter of 2022.

hird quarter 2023 EBITDA was $530 million, in comparison with the third quarter 2022 EBITDA of $181 million. Adjusted EBITDA for the third quarter of 2023 was $313 million, secure year-over-year.

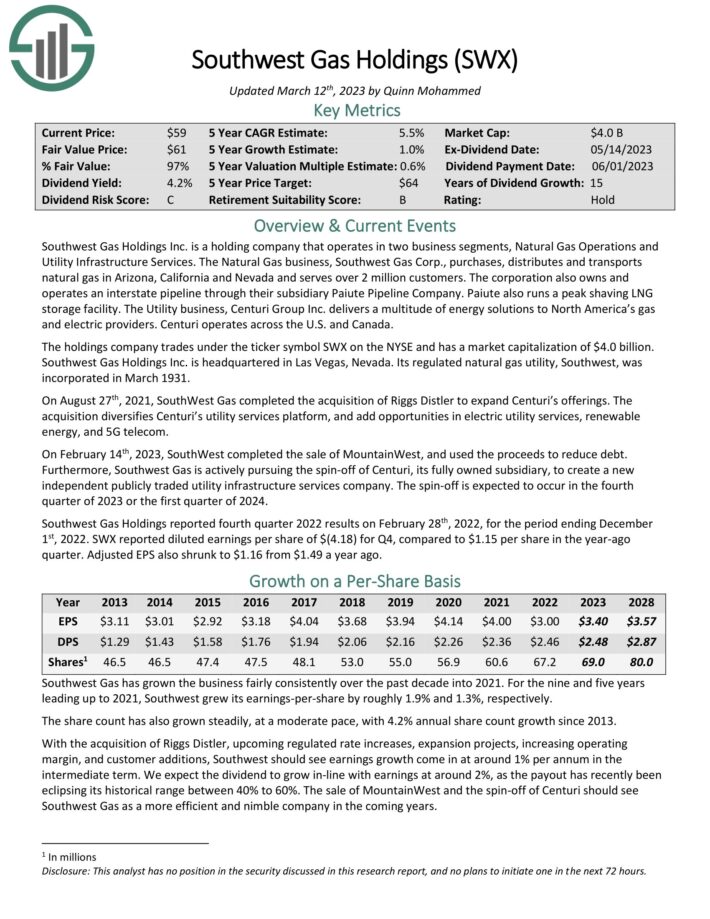

#3: Southwest Gasoline Holdings (SWX)

Dividend Yield: 4.2percentP.c of Carl Icahn’s Portfolio: 6.1%

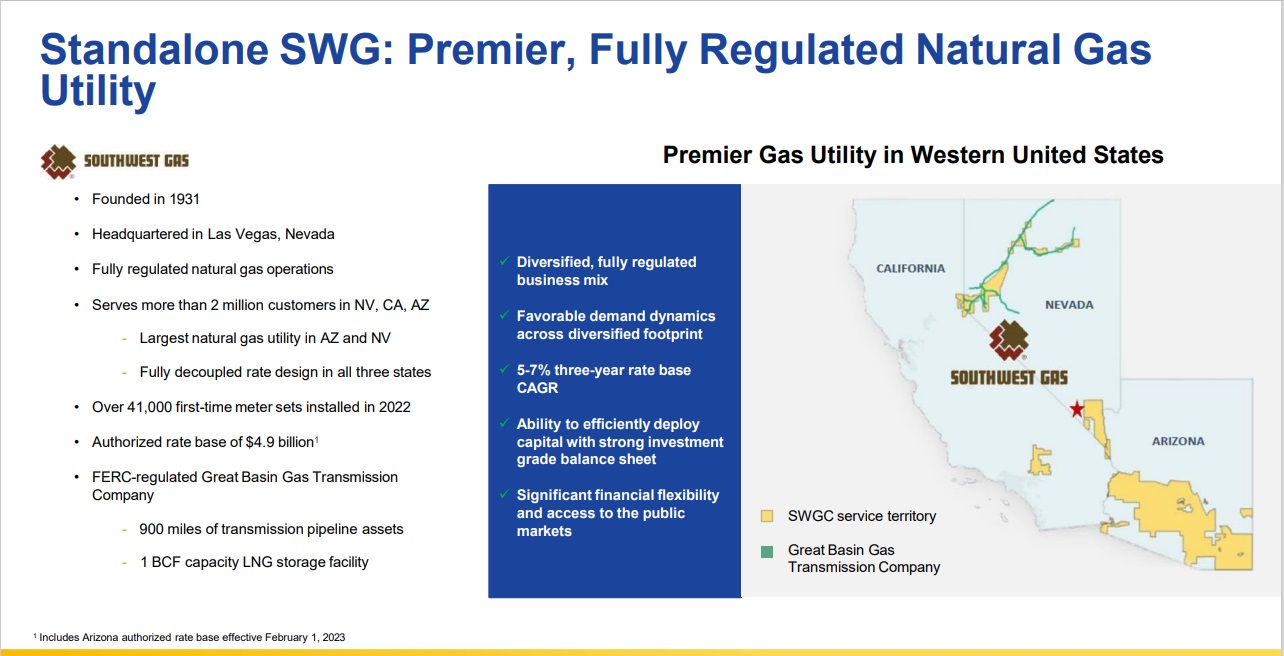

Southwest Gasoline Holdings Inc. is a holding firm that operates in two enterprise segments: Pure Gasoline Operations and Utility Infrastructure Companies. The Pure Gasoline enterprise, Southwest Gasoline Corp., purchases, distributes, and transports pure fuel in Arizona, California, and Nevada and serves over 2 million clients.

The company additionally owns and operates an interstate pipeline via its subsidiary, Paiute Pipeline Firm. Paiute additionally runs a peak-shaving LNG storage facility. The Utility enterprise, Centuri Group Inc., delivers a large number of vitality options to North America’s fuel and electrical suppliers. Centuri operates throughout the U.S. and Canada.

Supply: Investor Presentation

On February 14th, 2023, SouthWest accomplished the sale of MountainWest and used the proceeds to cut back debt. Moreover, Southwest Gasoline is actively pursuing the spin-off of Centuri, its totally owned subsidiary, to create a brand new unbiased publicly traded utility infrastructure providers firm. The spin-off is anticipated to happen within the fourth quarter of 2023 or the primary quarter of 2024.

Southwest Gasoline Holdings reported third quarter 2023 outcomes on November eighth, 2023, for the interval ending September thirtieth, 2023. SWX reported diluted earnings per share of $0.04 for Q3 in comparison with ($0.18) per share within the year-ago quarter. Adjusted EPS soared to $0.10 from a lack of ($0.05) a 12 months in the past.

Click on right here to obtain our most up-to-date Certain Evaluation report on SWX (preview of web page 1 of three proven under):

#4: FirstEnergy Corp. (FE)

Dividend Yield: 4.42percentP.c of Carl Icahn’s Portfolio: 4.7%

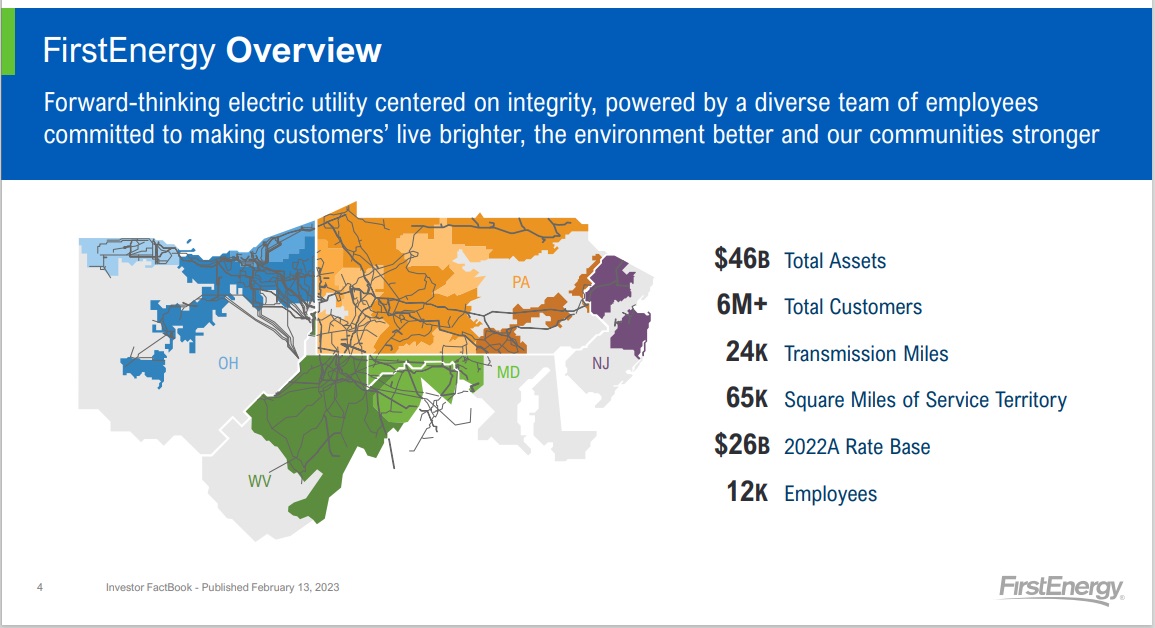

FirstEnergy Corp, via its subsidiaries, generates, transmits, and distributes electrical energy in the USA. The corporate operates via Regulated Distribution and Regulated Transmission segments. It owns and manages hydroelectric, coal-fired, nuclear, and pure fuel, in addition to renewable energy producing amenities.

Its ten electrical distribution corporations type one of many nation’s largest investor-owned electrical methods, serving clients in Ohio, Pennsylvania, New Jersey, West Virginia, Maryland, and New York. The $21.4 billion firm serves roughly six million clients.

Supply: Investor Presentation

On September twenty sixth, FirstEnergy resumed its dividend development, elevating its dividend by 5.1% to a quarterly charge of $0.41.

On October twenty sixth, 2023, FirstEnergy introduced its Q3 outcomes for the interval ending September thirtieth, 2023. For the quarter, revenues got here in at $3.50 billion, flat year-over-year, whereas adjusted EPS totaled $0.88, in comparison with $0.79 final 12 months.

Revenues benefited from increased weather-adjusted gross sales to residential and business clients of two.3% and 1.2%, respectively. The corporate additionally reported charge base will increase of greater than 8% in its regulated transmission enterprise. Nonetheless, these will increase had been offset by regular distribution deliveries falling by 1.7%.

Administration narrowed its FY2023 outlook, which initiatives adjusted EPS between $2.49 and $2.59.

Click on right here to obtain our most up-to-date Certain Evaluation report on FE (preview of web page 1 of three proven under):

#5: Bausch Well being Firms (BHC)

Dividend Yield: N/A (Bausch Well being doesn’t presently pay a quarterly dividend)P.c of Carl Icahn’s Portfolio: 2.1%

Bausch Well being Firms was previously generally known as Valeant Prescription drugs and altered its title to Bausch Well being Firms Inc. in July 2018. Bausch Well being manufactures and markets a variety of pharmaceutical, medical gadget, and over-the-counter (OTC) merchandise, primarily within the therapeutic areas of eye well being, gastroenterology, and dermatology.

The corporate operates via 5 segments: Salix, Worldwide, Solta Medical, Diversified Merchandise, and Bausch + Lomb. The Salix phase offers gastroenterology merchandise within the U.S., whereas the Worldwide phase presents Solta merchandise, branded and generic pharmaceutical merchandise, OTC merchandise, medical gadget merchandise, and Bausch + Lomb merchandise in Canada, Europe, Asia, Latin America, Africa, and the Center East.

The Solta Medical phase presents medical units. The Diversified Merchandise phase presents pharmaceutical merchandise within the areas of neurology and different therapeutic courses, in addition to generic, dermatological, and dentistry merchandise in the USA.

Lastly, the Bausch + Lomb phase presents merchandise with a give attention to imaginative and prescient care and surgical and ophthalmic pharmaceutical merchandise.

#6: Dana Inc. (DAN)

Dividend Yield: 3.1percentP.c of Carl Icahn’s Portfolio: 1.7%

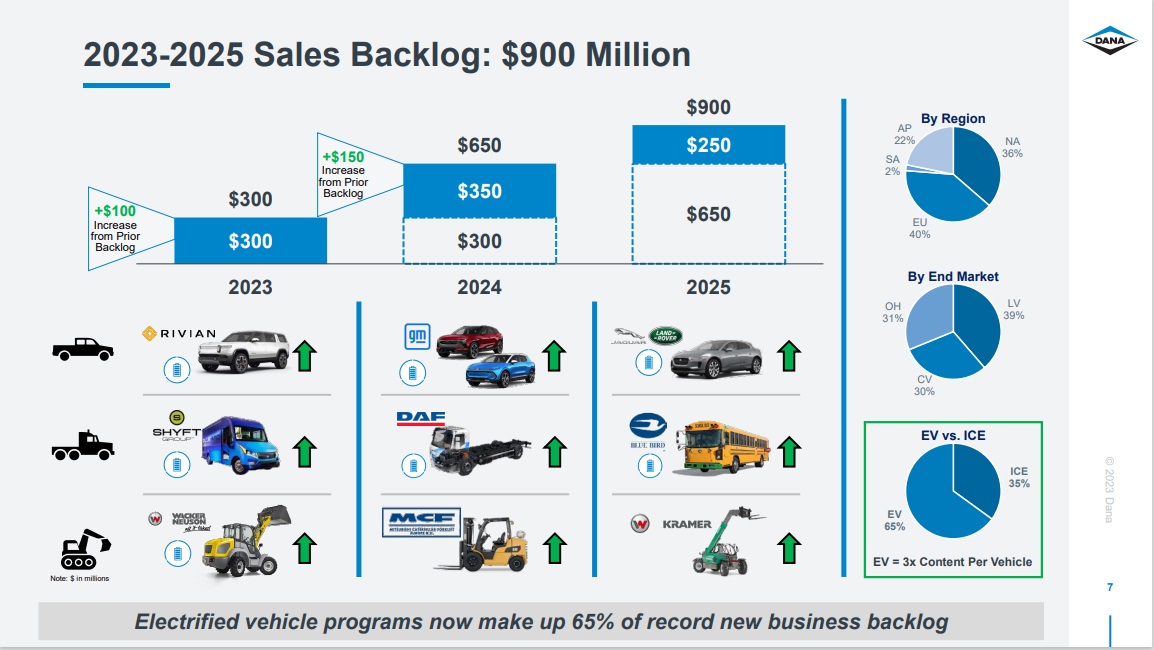

Dana Integrated offers power-conveyance and energy-management options for automobiles and equipment in North America, Europe, South America, and the Asia Pacific. It operates in 4 segments: Mild Car Drive Programs, Industrial Car Drive and Movement Programs, Off-Freeway Drive and Movement Programs, and Energy Applied sciences.

Gross sales for the third quarter of 2023 totaled $2.67 billion, in contrast with $2.54 billion in the identical interval of 2022, representing a $134 million enhance pushed by increased market demand, cost-recovery actions, and conversion of our gross sales backlog partially offset by the decrease demand because of the UAW strike at two of our key clients.

Supply: Investor Presentation

Adjusted EBITDA for the third quarter of 2023 was $242 million, in contrast with $192 million for a similar interval in 2022. The 150 foundation factors of margin enchancment within the third quarter of 2023 was primarily pushed by increased gross sales quantity and useful combine, internet buyer pricing and restoration actions, improved buyer order patterns driving increased manufacturing effectivity, and decrease internet commodity prices.

These enhancements had been partially offset by continued inflationary value pressures.

#7: Conduent Inc. (CNDT)

Dividend Yield: N/A (Conduent doesn’t presently pay a quarterly dividend)P.c of Carl Icahn’s Portfolio: 0.9%

Conduent delivers technology-led enterprise course of options for companies and governments globally. Conduent’s options and providers digitally remodel its shoppers’ operations, together with delivering 43% of diet help funds within the U.S., enabling 1.3 billion customer support interactions yearly.

Income for Q3 2023 was $932 million as in comparison with $977 million in Q3 2022, down 12.4% year-over-year or 6.7% in fixed foreign money. This was because of a robust quarter within the firm’s authorities phase, offset by milestone timing and transportation.

Adjusted EBITDA was $92 million for the quarter as in comparison with $105 million in Q3, 2022, and the adjusted EBITDA margin of 9.9% was down 80 foundation factors year-over-year as in comparison with Q3, 2022. This was consistent with administration’s expectations.

#8: Crown Holdings, Inc. (CCK)

Dividend Yield: 1.2percentP.c of Carl Icahn’s Portfolio: 0.8%

Crown Holdings, Inc., along with its subsidiaries, provides inflexible packaging merchandise in Pennsylvania and internationally. It operates via Americas Beverage, European Beverage, Asia Pacific, and Transit Packaging segments.

Web gross sales within the third quarter had been $3,069 million in comparison with $3,259 million within the third quarter of 2022, reflecting increased beverage can volumes in North America and favorable overseas foreign money translation of $60 million, offset by decrease volumes throughout most different companies and the pass-through of $187 million in decrease materials prices.

Revenue from operations was $374 million within the third quarter in comparison with $297 million within the third quarter of 2022. Phase revenue within the third quarter of 2023 was $430 million in comparison with $336 million within the prior 12 months’s third quarter.

The expansion in Revenue from Operations displays the advantages from increased beverage can volumes in North America, the contractual restoration of prior years’ inflationary value will increase in Europe, and the profitable implementation of value discount applications in Transit Packaging.

#9: Sandridge Power Inc. (SD)

Dividend Yield: 2.7percentP.c of Carl Icahn’s Portfolio: 0.7%

SandRidge Power, Inc. engages within the acquisition, growth, and manufacturing of oil and pure fuel, primarily in the USA Mid-Continent. As of its newest filings, it had an curiosity in 1,471 gross-producing wells.

On July 11, 2023, the Firm closed an acquisition that elevated the Firm’s working curiosity in twenty-six wells operated by SandRidge inside the Northwest Stack play for about $11.3 million, with an efficient date of April 1, 2023. The typical internet manufacturing related to the acquired pursuits for the primary quarter of 2023 was roughly 500 barrels of oil equal per day (~30% oil)

Supply: Investor Presentation

Sandridge generated roughly $ 63.6 million in free money move in the course of the first six months of 2023, which represents a conversion charge of roughly 85% relative to adjusted EBITDA.

#10: Bausch & Lomb Company (BLCO)

Dividend Yield: N/APercent of Carl Icahn’s Portfolio: 0.5%

Bausch + Lomb Company operates as a watch well being firm worldwide. It operates via three segments: Imaginative and prescient Care, Ophthalmic Prescription drugs, and Surgical. The Imaginative and prescient Care phase offers contact lenses and get in touch with lens care merchandise.

The Ophthalmic Prescription drugs phase presents proprietary and generic pharmaceutical merchandise for post-operative therapies, in addition to for the remedy of eye situations corresponding to glaucoma and retinal ailments.

The Surgical phase offers medical gadget tools, consumables, and applied sciences. Bausch + Lomb Company was spun off from Bausch Well being Firms.

#11: Worldwide Flavors & Fragrances (IFF)

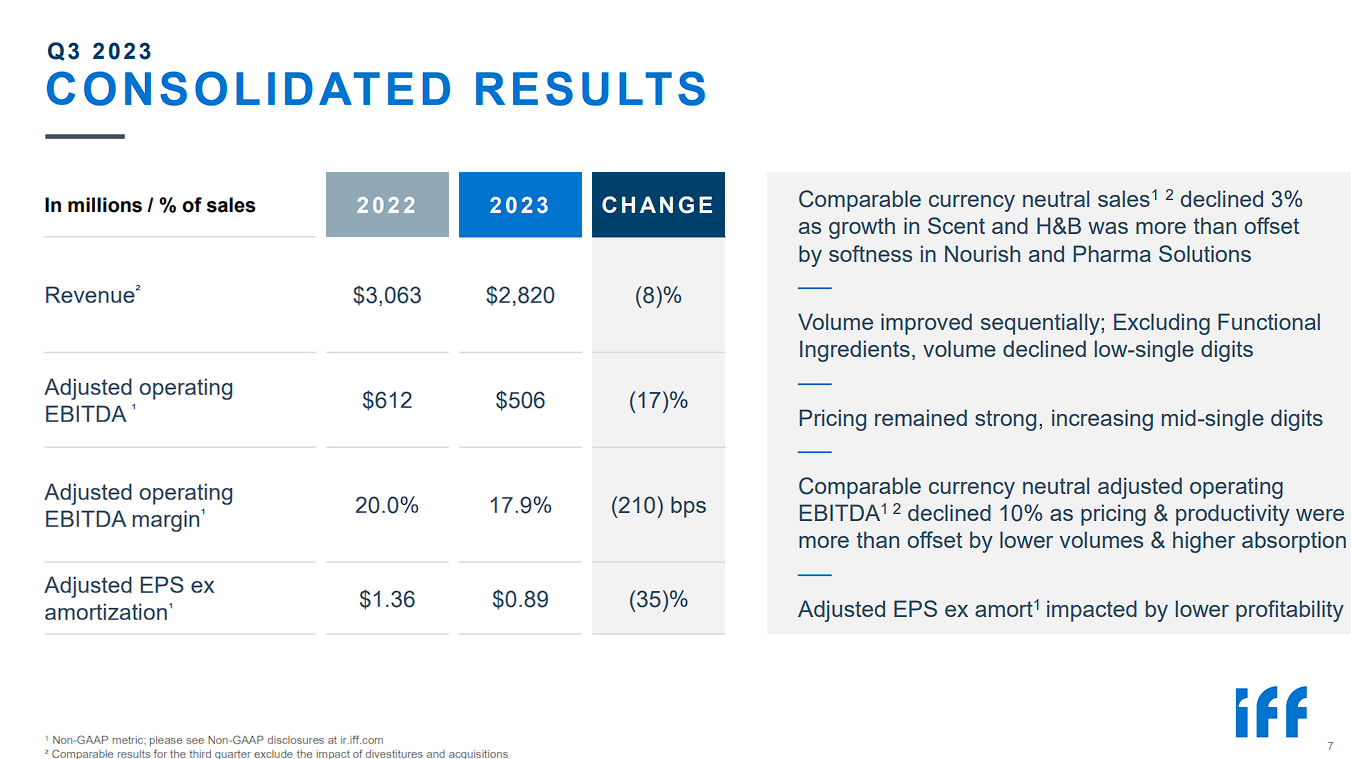

Dividend Yield: 4.4percentP.c of Carl Icahn’s Portfolio: 0.4%

Worldwide Flavors & Fragrances Inc. is a worldwide producer and vendor of flavors and fragrances. The corporate has made two massive acquisitions, Frutarom (2018) and DuPont Diet and Biosciences, in a brief interval. IFF now stories 4 segments: Nourish (~53% of income), Well being & Biosciences (~17% of income), Scent (~23% of income), and Pharma Options (~7% of income).

The corporate sells flavors, scents, fragrances, enzymes & cultures, and binders & polymers globally for cosmetics, detergents, soaps, perfumes, ready meals, drinks, dairy, prescription drugs, confectioners, and extra. In 2022, income was $12.4B professional forma.

Supply: Investor Presentation

IFF reported Q2 2023 outcomes on August seventh, 2023. Companywide internet gross sales had been down (-11%) to $2,929M from $3,307M and adjusted diluted earnings per share decreased to $0.86 from $1.54 on a year-over-year foundation, impacted by divestitures, overseas trade headwinds, decrease volumes due to destocking, and decrease margins, offset by value will increase. Diluted GAAP earnings per share declined to $0.11 from $0.43 due to decrease gross sales and margins.

Nourish gross sales decreased (9%) to $1,564M from $1,818 because of vital declines in Substances, regardless of increased costs. Well being and bioscience gross sales fell (3%) to $522M from $665M after accounting for divestitures with development in Cultures and meals Enzymes, Grain, and Dwelling and Private Care offset weak point in Well being.

Scent gross sales elevated +5% to $592M from $580M led by double-digit development in Client Fragrances and development in Effective Fragrances. Pharma Options gross sales elevated +3% to $251M from $244M led by development in Core Pharma.

IFF divested the Microbial Management, Meals Preparations, Savory Options, and Taste Specialty Substances companies. Nonetheless, the corporate is exploring additional strategic actions for the Beauty Substances and Lucas Meyer Cosmetics items.

IFF lowered income steering to $11.3B – $11.6B in 2023 and adjusted working EBITDA to $1.85B – $2.0B

Click on right here to obtain our most up-to-date Certain Evaluation report on IFF (preview of web page 1 of three proven under):

#12: Newell Manufacturers (NWL)

Dividend Yield: 3.7percentP.c of Carl Icahn’s Portfolio: 0.4%

Newell has reworked itself right into a client manufacturers powerhouse with massive acquisitions, corresponding to its merger with Jarden in addition to its buy of Sistema. The corporate’s annual income is over $8 billion, and it has a diversified product portfolio.

Supply: Investor Presentation

Newell posted third-quarter earnings on October twenty seventh, 2023, and outcomes had been considerably combined as soon as once more, as we’ve turn into accustomed to from the constantly-transitioning firm. Adjusted earnings-per-share got here to 39 cents, which was a powerful 16 cents higher than anticipated.

Income, nonetheless, was off 9.3% year-over-year to $2.04 billion and was $80 million gentle of estimates. Core gross sales declined 9.2%, and the corporate noticed a slight headwind from class exits, in addition to a small tailwind from foreign exchange trade.

Adjusted gross margin was 31.3% of income, up from 29.6% a 12 months in the past. The corporate noticed advantages from its cost-saving and productiveness program, in addition to increased realized promoting costs. That helped offset mounted value deleveraging, in addition to increased restructuring costs.

Adjusted working revenue was $167 million, or 8.2% of gross sales. This was decrease than $234 million, or 10.4% of income, a 12 months in the past. Newell continues to battle mightily relating to producing each income and margins, and projected earnings of simply 75 cents per share for this 12 months would be the lowest in additional than a decade for Newell.

Click on right here to obtain our most up-to-date Certain Evaluation report on Newell (preview of web page 1 of three proven under):

#13: Illumina, Inc. (ILMN)

Dividend Yield: N/A (Conduent doesn’t presently pay a quarterly dividend)P.c of Carl Icahn’s Portfolio: 0.4%

Illumina is an esteemed firm devoted to genetic sequencing and related applied sciences. Famend as a foremost supplier of cutting-edge DNA sequencing platforms and providers, Illumina holds a pivotal place within the realm of genomics and customized drugs.

By harnessing its distinctive sequencing methods, Illumina has performed a significant position in propelling genomics analysis to new heights. Their contributions span a variety of fields, together with genome-wide affiliation research, most cancers genomics, investigations into infectious ailments, and explorations of reproductive well being. Illumina’s revolutionary applied sciences haven’t solely enabled outstanding discoveries however have additionally deepened our comprehension of intricate organic processes.

In Q3, Illumina delivered income of roughly $1.12 billion, flat year-over-year, or up 1% on a relentless foreign money foundation. This was a disappointing end result. The macroeconomic atmosphere remained difficult for its trade and for its clients, with clients more and more cautious and constrained of their buying selections.

Regardless of a decrease gross margin year-over-year, tight administration of the corporate’s working bills allowed Illuminato to ship diluted non-GAAP EPS of $0.33, additionally roughly flat year-over-year.

For fiscal 2023, administration expects revenues to say no by about 2% to three$, and non-GAAP EPS to be between $0.60 and $0.70.

Supply: Investor Presentation

Ultimate Ideas

You may see extra high-quality dividend shares within the following Certain Dividend databases:

Alternatively, one other excellent place to search for high-quality enterprise is contained in the portfolios of different extremely profitable traders.

To that finish, Certain Dividend has created the next inventory databases:

You may also be seeking to create a extremely custom-made dividend revenue stream to pay for all times’s bills.

The next two lists present helpful info on excessive dividend shares and shares that pay month-to-month dividends:

Lastly, you possibly can see the articles under for evaluation on different main funding corporations/asset managers:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.

[ad_2]

Source link