[ad_1]

aapsky

Abstract

Following my protection of Amadeus IT Group (OTCPK:AMADF), for which I beneficial a purchase score as a result of sturdy development tailwind from air journey and pricing energy seen within the distribution phase (as a result of product’s stickiness), this put up is to supply an replace on my ideas on the enterprise and inventory. I reiterate my purchase score for AMADF. I imagine the chance of direct connection disintermediating AMADF from the worth chain is overestimated. My view is that AMADF will stay an vital a part of the worth chain, and it’ll proceed to learn from the long-term secular tailwind of air passenger development. Whereas the EBITDA margin goes to flatten in FY24, it ought to resume enlargement as the price of migrating to the cloud tapers.

Funding thesis

AMADF reported 4Q23 revenues of EUR1.355 billion and EBITDA of EUR469 million. In Air Distribution, 4Q23 air bookings have been nonetheless down 23.4% in opposition to 2019 ranges, whereas in Air IT, passengers boarded have been 0.5% above 2019 ranges. Nevertheless, reserving efficiency might have been higher if not for the cancellations associated to the battle within the Center East and a selected buyer state of affairs in North America. Excluding these results, reserving development would have been 12.7%, which might have put bookings at 19% beneath 2019 ranges. The main debate for the AMADF fairness story is that direct join within the US goes to proceed stress quantity development. For these that aren’t acquainted, direct join is when journey brokers, principally OTAs (on-line journey companies), entry airline stock instantly and bypass the GDS (world distribution system) (AMADF on this case). And the 4Q23 efficiency kind of feeds into this narrative as AMADF noticed quantity headwind in North America. Resulting in buyers questioning the disintermediation danger over the long run.

My perception is that, sure, there’s positively going to be an impression on AMADF and different GDS gamers like Sabre. Nevertheless, I don’t imagine AMADF will likely be solely disintermediated by all airways. Do not forget that direct connections usually are not new and have been round for a few years, however they’ve typically been restricted in scope. There’s a motive why it has not taken off in any main kind to this point. Firstly, consider how complicated it could be for the airways to construct, preserve, and function. If you happen to take a look at how a GDS works, it mainly connects tens of 1000’s of items of stock from airways throughout the globe into numerous distribution channels (OTAs, journey brokers, company journey administration, and so forth.) day by day on a reside foundation. AMADF is a system that works and has labored very nicely over the a long time. Reliability is vital as a result of any cancellation will simply frustrate customers, irrespective of the rationale. You may merely take a look at the scandal at Qantas to see how dangerous the state of affairs can get. The situations the place I feel it is smart to attach instantly are when it’s a very concentrated airline market, the place a number of massive airways are connecting to some massive OTAs. This is smart as a result of the complexity is quite a bit much less, and enormous airways have the mandatory monetary and technical capability to take action. This isn’t the case for a price range airline that mainly competes on providing low-cost flights (doubtless no spare sources to construct its personal tech group and rent folks to handle such a posh operation) and wishes a whole lot of quantity (they should depend on all attainable buyer acquisition channels, so the complexity shoots by means of the roof). Therefore, I feel AMADF will nonetheless be an unimaginable and vital a part of the worth chain, and the market appears to be over-discounting the inventory valuation due to this.

A couple of days in the past, it was additionally introduced that AMADF can be buying Voxel, a distinguished provider of B2B funds and digital bill options to resorts, journey brokers, and different journey business contributors. Incorporating Voxel into Amadeus’s present funds enterprise, Outpayce, enhances the product suite for journey sellers and opens up new alternatives within the hospitality business. In my view, this acquisition will strengthen Amadeus’s product line and pave the best way for the corporate to supply an automatic funds system that’s constant all through the journey ecosystem. This could solidify AMADF’s place as a key participant within the worth chain, making disintermediation all of the tougher.

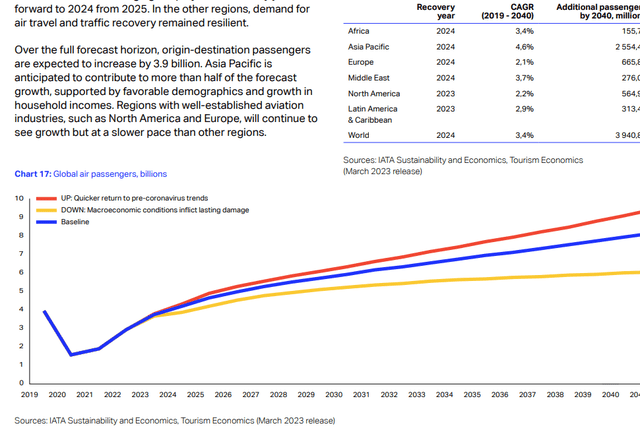

Additionally do not forget that the general pie (air journey addressable market) remains to be increasing, and the expansion runway is robust. Traditionally, air site visitors volumes grew at 1.5x GDP development, and I don’t see any motive for this to not be the case within the coming years. Based mostly on the IATA forecast, passenger journey is anticipated to develop at ~2 to 4% for the approaching 2 a long time, implying ~4 billion incremental passengers within the subsequent 2 a long time, which represents an enormous alternative for AMADF to seize. Within the close to time period, I count on AMADF to learn from enterprise journey development because the work-from-home tradition continues to die down. Provided that company journey remains to be ~ 75–80% of 2019 ranges, it means there’s extra potential for outsized development within the close to time period as restoration takes place.

IATA

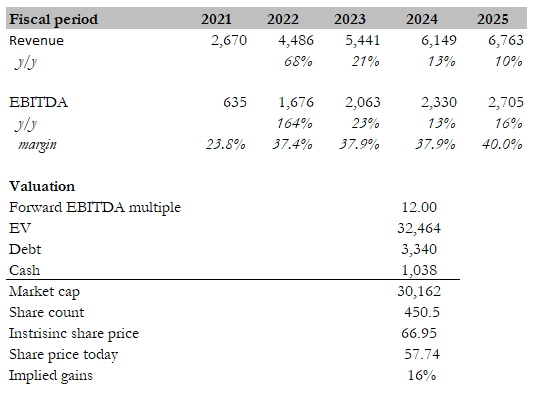

Valuation

Personal calculation

My goal value for AMADF, based mostly on my mannequin, is ~EUR69. My mannequin assumptions are that development will comply with administration steerage for low-teen development within the close to time period (I assume 13%). That mentioned, I’m nonetheless sticking to my 10% development expectation in FY25 because the restoration development profit begins to taper. I’ve additionally tapered my expectation for EBITDA margin. Administration has guided to flat EBITDA margins in 2024. A serious a part of the dearth of leverage on the EBITDA margin degree this 12 months is the continued value of the cloud migration mission. Nevertheless, shifting forward, I count on AMADF to renew working leverage as these prices taper away. A big income scale additionally offers AMADF with extra fixed-cost protection. Since June final 12 months, the AMADF valuation has traded down from 14x ahead EBITDA to 12x EBITDA. The fantastic thing about investing at this valuation degree is that we don’t want multiples to go as much as make a horny return. Though I feel that direct join will not be as huge of a problem, I feel this narrative will take maintain for the near-term, pressuring valuation at this degree, till AMADF reveals a optimistic inflection in reserving development. Assuming a 12x ahead EBITDA a number of, we are able to nonetheless see 16% upside.

Threat

If a rising variety of airways are prepared to bear the ache of connecting instantly, whatever the monetary value and operational complexity, it might actually develop into an enormous drawback for AMADF as reserving development continues to say no, placing much more stress on valuation.

Conclusion

In conclusion, my score for AMADF is a purchase score. Though there are considerations about direct join disintermediating AMADF, I imagine it isn’t as dangerous because it appears. Moreover, the general air journey market is on monitor for important development, providing AMADF ample alternative to seize new passengers. The current acquisition of Voxel strengthens AMADF’s product portfolio and positions them to be a key participant in your entire worth chain. Whereas the inventory valuation has been impacted by disintermediation fears, AMADF’s present value represents a horny entry level with first rate upside.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please pay attention to the dangers related to these shares.

[ad_2]

Source link