[ad_1]

miss_j/iStock by way of Getty Photographs

Funding Technique For Giant-Cap Shares

We lined each large-cap and small-cap shares. Our article about large-cap shares gives worth propositions for buyers who’re occupied with exploring the nuances of adjusting expectations for inventory valuations.

Our funding philosophy on the subject of large-cap shares is that buyers ought to totally make investments the funds they’ve allotted to giant caps on a periodic foundation. Our article gives steering to buyers on shifting their allocations between particular large-cap shares whereas adhering to the general philosophy of periodic shopping for.

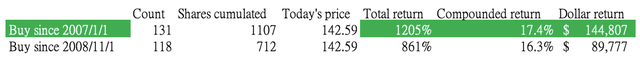

Case Examine: Amazon’s Inventory Efficiency

Right here is an instance as an instance how not totally investing is doing extra hurt than good for buyers. Should you periodically make investments $100 in Amazon.com, Inc. (NASDAQ:AMZN) inventory, the compounded annual return distinction between shopping for earlier than the monetary disaster in January 2007 and shopping for the dip since November 2008 is 17.4% versus 16.3%. Nonetheless, in greenback quantity and whole return, there’s a big distinction. You’ll make $144,807 or 1205% versus $89,777 or 861% for those who purchase on the excessive proper earlier than the monetary disaster.

Yahoo Finance, LEL

If this consequence conflicts together with your instinct, right here is the reason: the distinction within the returns is just because for those who purchased earlier than the monetary disaster, you’ll have already purchased 131 instances since then. Whereas for those who determine to attend and purchase the dip, you solely purchase 118 instances. The concern of shopping for on the prime precipitated you to make lower than $55,030 on a complete $131,000 funds. It’s since you had $1,300 on the aspect and this cash missed the compounding alternative over the subsequent 16 years.

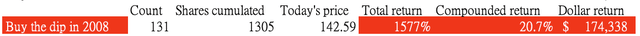

After all, there shall be extra advantages for those who time the market proper. Beneath reveals that for those who occur to allocate the $1,300 set-aside cash to purchase the dip in 2008, you’ll make a 1577% return in whole and enhance the compounded annual return to twenty.7%. However, typically talking, timing the market is tougher than full funding.

Yahoo Finance, LEL

Actually, this investing technique applies to most large-cap shares or index funds. The compounding return impact makes setting cash on the aspect the least favorable funding resolution.

So, sooner or later, our funding article on large-cap shares ought to give attention to a dialogue of the over/equal/underweight of a specific inventory.

In mixture quantities, we suggest buyers all the time periodically and constantly make investments all their cash inside their large-cap allocation funds. More often than not, buyers solely must test whether or not the large-cap corporations nonetheless preserve their management place earlier than making periodic buys.

On this article, we talk about the explanations that buyers ought to allocate an equal weight on Amazon’s inventory.

The Sum Of The Elements Valuation Replace

We wrote an article about Amazon in June and tried to worth Amazon’s inventory by the sum of the elements methodology. We assumed retail can be rising within the mid-single digits and Amazon Internet Companies (“AWS”) would preserve excessive double-digit development as a result of retail is comparatively mature and AWS continues to profit from elevated penetration of IT spending within the cloud.

Within the following part, we are going to talk about what we noticed within the Q3 earnings and its influence on our assumptions and Amazon’s sum of the elements valuation.

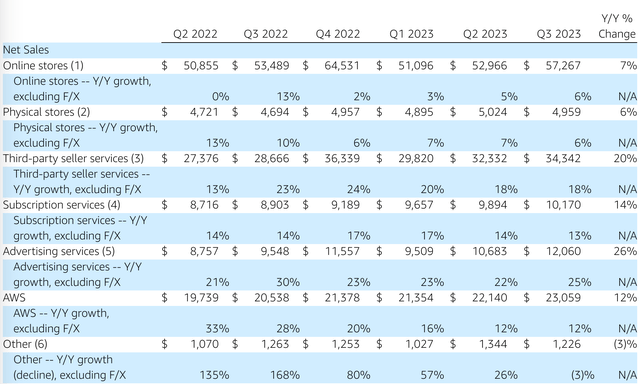

AWS

AWS grew by 12% in Q3, an analogous cadence as Q2. Therefore, after checking these information factors, we’re comfy with our AWS assumptions.

This development momentum is useful to maintain the thesis of AWS persevering with to profit from the pattern of IT spending migrating from on-premises to the cloud, as talked about by administration within the earnings name.

then we now have a $92 billion income run fee enterprise the place 90% of the worldwide IT spend nonetheless resides on premises.

In Q3, Amazon was in a position to cease the margin compression pattern in AWS by reducing bills. Therefore, its AWS working margin elevated to 30% from 24% in Q2 2023. This margin growth sustains our margin assumptions.

a query about AWS margins. So sure, the margin improved 600 foundation factors quarter-over-quarter, a rise of revenue of $1.6 billion quarter-over-quarter for AWS, is pushed by — primarily by our headcount reductions in Q2 and in addition continued slowness in hiring, rehiring open positions.

Retail

Now, let’s check out its retail enterprise.

Amazon elevated its retail working margin to 4.9% in Q3, which helps assist our thesis that it could actually obtain mid-single-digit free money circulation margins long-term. Retail income development additionally accelerated, suggesting Amazon’s development initiatives like Amazon Clinic are gaining traction. We consider increasing its retail platform past simply e-commerce gross sales can drive continued development. The stable margin and income development this previous quarter point out these efforts to leverage Amazon’s buyer base in new methods are working. We are going to hold monitoring the influence of those initiatives on long-term prospects.

On this quarter, Amazon expanded its partnership with Blue Defend to supply service for 4.8 million members. That is simply an instance of Amazon’s initiatives to leverage its retail buyer base to extend income streams exterior of its on-line retail enterprise.

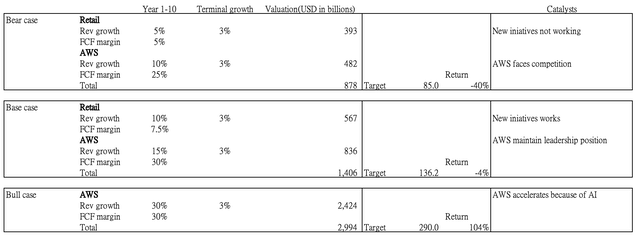

Therefore, based mostly on the above observations, we replace our sum of the elements mannequin as follows:

We used a WACC of 10% and long-term terminal development of three% in our assumptions. Its internet debt was -$3 billion in Q3.

LEL

Base Case

The corporate’s retail new initiatives will maintain its income development fee at a CAGR of 10% over the subsequent 10 years and a long-term free money circulation margin of seven.5%. It will result in a $567 billion retail fairness valuation.

AWS will proceed to keep up income development at a CAGR of 15% over the subsequent 10 years and a long-term free money circulation margin of 30%. It will result in an $836 billion AWS fairness valuation.

For the bottom case, our goal worth shall be $136 per share, a 4% draw back.

Bull Case

The corporate’s retail performs the identical because the assumptions within the base case.

Due to AI boosting cloud demand as talked about in our earlier article, AWS accelerates to 30% CAGR for the subsequent 10 years and a long-term free money circulation margin of 30%. This led to an AWS valuation of $2.4 trillion.

For the bull case, our goal worth shall be $290 per share, a 104% upside.

Bear Case

The retail’s new initiatives don’t work properly, and its income development within the subsequent 10 years is barely 5%. The long-term free money circulation margin is barely 5%. This results in a $393 billion retail fairness valuation.

AWS additionally slowed to 10% income development on account of additional competitors and the long-term free money circulation margin decreased to 25%. This led to an AWS valuation of $482 billion.

For the bear case, our goal worth shall be $85 per share, a 40% draw back.

Given AWS’s development is barely 12%, its steering for This fall, and administration’s feedback on its buyer patterns, we really feel that the AI explosive development case just isn’t taking place within the close to time period. Therefore, the bull case likelihood is low now.

so prospects are experimenting with a number of various kinds of fashions after which completely different mannequin sizes to get the associated fee and latency traits that they want for various use circumstances.

The bottom case is prone to play out close to time period as its third-party vendor companies and promoting companies nonetheless have robust momentum and have grown at excessive double digits.

Its subscription companies grew by 13% however was decrease than its Prime worth hike of 17%. Therefore, there may be some weak point within the client depend development. Thus, we envision on-line and bodily retail ought to keep in single-digit development forward.

AMZN

Draw back Danger

Two dangers that may set off a draw back danger valuation of $85 per share embody additional competitors within the cloud house and an absence of development in new initiatives.

We’re much less involved about its retail enterprise as the corporate continues to innovate new merchandise. For instance, Amazon was the primary to launch its AI-powered speaker and Hearth TV. In addition they enhance its on-line retailer purchasing expertise and provide extra vendor instruments with AI options.

Launched product evaluate highlights, a brand new generative AI–powered characteristic that lets buyers in Amazon’s U.S. retailer rapidly decide what different prospects are saying a couple of product earlier than studying by way of evaluations…

Launched generative AI capabilities to assist sellers create product listings as a part of quite a few improvements…

Previewed a wiser and extra conversational Alexa, powered by generative AI and an LLM custom-built for voice interactions…

Introduced updates to the Hearth TV expertise, together with an enhanced AI-powered Hearth TV voice search..

Throughout the earnings name, administration cited metrics to justify their value management place. Though we all know its friends are aggressively innovating new merchandise. Therefore, we shall be monitoring the aggressive panorama going ahead.

..for those who have a look at the expansion of shoppers utilizing EC2 cases which are Graviton based mostly which is our {custom} chip that we constructed for generalized CPUs, the variety of individuals and the share of cases launched their Graviton base versus Intel or AMD base may be very considerably greater than it was earlier than. And one of many issues that prospects love about Graviton is that it gives 40% higher worth efficiency than the opposite main x86 processors.

Conclusion

We predict buyers ought to totally allocate funds periodically to large-cap shares. The good thing about full allocation is healthier than setting cash apart. Though there may be additionally a profit to market timing, we suggest buyers rebalance or shift funds inside their large-cap portfolio however preserve full allocation.

We don’t see explosive spending from the emergence of AI in AWS within the close to time period, as enterprise customers are nonetheless exploring the house in the meanwhile. Though retail appears to be supported by robust momentum in promoting and third-party vendor companies, the market appears to have already priced this in. Amazon.com, Inc. inventory appears to be pretty valued in our opinion based mostly on our base case valuation. Therefore, we’re revising our ranking to equal weight for the inventory.

[ad_2]

Source link