[ad_1]

We Are

Funding Thesis

Amazon (NASDAQ:AMZN) continues to excel each by way of income development and price management. The agency’s most up-to-date Q3 outcomes noticed the agency generate large YoY development in income, working revenue, and general margins.

I nonetheless consider the agency is nicely poised to learn within the long-term from their large financial moat with a number of new enterprise ventures corresponding to Amazon Pharmacy and Clinic and their expanded generative AI options set to additional enhance the scale and breadth of their moat.

Provided that shares look like someplace between pretty valued and an 18% undervaluation mixed with development prospects of excessive teenagers for the approaching ten years, I proceed to consider Amazon will earn nice returns for affected person, long-term traders.

Upgraded Robust Purchase ranking issued.

Firm Background

Amazon is an American e-commerce and cloud/internet service supplier that dominates virtually each market through which it operates. Their financial and social affect is realized throughout the globe via numerous enterprise segments which give the corporate important breadth and financial moat.

The majority of Amazon’s revenues come up from their e-commerce gross sales with Amazon Internet Providers (AWS) being their second major supply of gross sales. Important revenues are additionally realized via their Prime subscription service and thru their providing of digital promoting options.

The immense scale on which Amazon operates has allowed the corporate to develop an ingrained presence within the lives of most Individuals and Europeans. The breadth of companies provided by the agency makes it virtually not possible for the typical individual to dwell their life with out benefitting from Amazon-related services or products in a method or one other.

Financial Moat – Q3 FY23 Replace

Amazon harbors a real mega-moat standing as its breadth of companies and product choices create important long-term worth alternatives for the corporate.

I performed a full in-depth evaluation of Amazon’s financial moat again in January 2023 which I nonetheless consider to be principally legitimate, you’ll be able to test it out right here: “Amazon: Deep Dive Evaluation Reveals Wonderful Lengthy-Time period Worth”. To learn my most up-to-date early summer season replace, click on right here.

On this replace article, I wish to focus on the event of Amazon’s new “Clinic” enterprise, AWS, and their number of AI integrations into their service

Q3 noticed Amazon considerably develop its Amazon Clinic platform, a digital healthcare market that gives care options for over 35 totally different circumstances together with the chance to purchase inexpensive pharmaceutical merchandise via Amazon Pharmacy.

I consider the fast enlargement of Amazon Clinic is making the platform extra of a severe contender and market disruptor when in comparison with conventional pharmacies and care strategies.

The chance for each underserved clients and people who need fast care to entry an internet physician in minutes presents a really enticing healthcare answer that I believe will probably be significantly standard among the many youthful generations of shoppers.

Moreover, Amazon is partnering with Blue Protect of California to supply a first-of-its-kind mannequin to supply extra inexpensive pharmacy care to its members the place Amazon Pharmacy will supply quick, free dwelling supply of prescription drugs to greater than 4.8 million Blue Protect of California members, beginning in 2025.

The agency can also be testing 60-minute drone supply utilizing Prime drones in just a few cities with wider-scale rollouts anticipated additional sooner or later.

General, I consider this extra severe endeavor into the prescription drugs and care enterprise can generate large moatiness for the agency. Amazon has the ability to forge highly effective strategic partnerships with key established gamers throughout the business which may enable their Amazon Pharmacy and Clinic to develop quickly.

Their distinctive set of pre-existing supply, warehouse, and on-line infrastructure would make it tough for a competitor to launch the same service with an equal set of companies. Subsequently, I assign this enterprise at current a slender financial moat and await extra monetary information to assign kind of moatiness to the brand new enterprise phase.

AWS continues to develop at a strong tempo with new AI enhancements resulting in important additional development potential. The agency has partnered with Anthropic to construct their AI fashions which the agency plans to combine each into AWS companies and into their core consumer-oriented companies.

AWS noticed many buyer corporations combine the platform companies extra tightly into their operations buildings with the likes of BMW Group (OTCPK:BMWYY), NatWest Group (NWG), PwC, Occidental Petroleum (OXY), and DS Smith (OTCPK:DITHF) undertake new AWS companies into their enterprise operations.

A key driver behind this development got here from the advantages many of those corporations can take pleasure in from an operational effectivity perspective because of the superior generative AI instruments offered to them by the now Anthropic-enhanced AWS platform.

Amazon has additionally applied many generative AI instruments into their core e-commerce and Prime service choices primarily with the main focus of bettering the usability of the companies for patrons.

Whereas the Anthropic deal will enable Amazon to quickly scale and develop its personal in-house generative AI instruments, I consider the agency will initially lag behind rivals like Microsoft with regard to absolutely the talents of their AI fashions.

Nevertheless, this strategic partnership locations Amazon in an amazing place to turn into a long-term chief in generative AI, significantly from e-commerce, IaaS, and streaming perspective. The event of AI is usually labeled as a “race” and I firmly consider it needs to be considered as a marathon somewhat than a dash.

The partnership with Anthropic additionally represents some conscientious cost-control from administration with the collaboration presenting a way more cost-effective and fewer resource-intensive method to enter into the AI area.

In the end, I consider Amazon has tangibly expanded its financial moat all through Q3 because of quite a lot of strategic, important, and influential developments throughout its enterprise operations. Moreover, many of those enhancements take months if not years to develop which illustrates simply how progressive and obsessive Amazon continues to be relating to bettering the purchasers’ expertise.

I consider Amazon completely nonetheless has an enormous financial moat that actually could be thought of as a mega moat. The breadth, depth, and affect held by their numerous enterprise operations proceed to be primarily unmatched throughout the market environments through which they function.

Monetary State of affairs – Q3 FY23 Replace

On the entire, Amazon’s fiscal scenario stays principally unchanged with the agency persevering with to be an absolute income, cashflow and profitability powerhouse. Amazon’s most up-to-date FY23 Q3 10-Q report continues to assist this speculation with sturdy development and nice margins being earned.

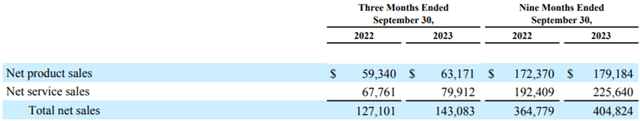

AMZN FY23 Q3 10-Q

Q3 noticed Amazon develop its internet product and repair gross sales massively with complete internet gross sales rising 13% YoY totaling over $143.1B. This was largely achieved because of sturdy 12% development from the AWS phase together with resilience in each North American and worldwide markets.

The agency’s Prime subscription service additionally noticed sturdy 14% YoY development whereas Amazon’s digital promoting service grew at an enormous charge of 26% YoY. Fairly merely, Amazon is firing on all cylinders with the agency making large good points throughout its enterprise operations.

AMZN FY23 Q3 10Q

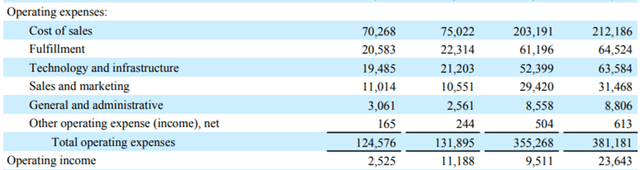

Virtually extra spectacular than their sturdy development and nice revenues is the price management achieved by Amazon. Final yr the agency launched into an enormous new initiative to chop large quantities of prices from their operations construction within the identify of reaching true operational excellence.

Contemplating that Amazon’s COGS solely elevated 7% in comparison with their enhance in internet gross sales of 13%, it’s clear that the agency has managed to barely enhance its gross margins.

Moreover, the agency truly noticed gross sales and advertising bills together with normal and administrative prices lower by round $500M every. When mixed with the really restricted rises in achievement and expertise and infrastructure spending, the agency has considerably expanded its gross margins YoY.

AMZN FY23 Q3 10Q

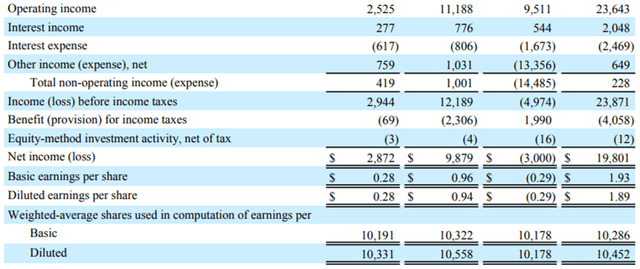

Working revenue was up a whopping 344% YoY with the earlier yr’s losses being remodeled into large incomes because of nice income development and strong value management.

Web revenue elevated to $9.9B with diluted EPS of $0.94.

FCF additionally elevated to $21.4B for the TTM with a YoY enchancment (contemplating a TTM determine from September 30, 2022) of 8.7%.

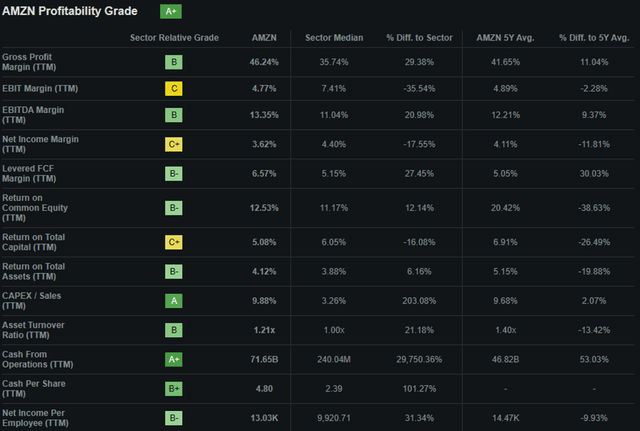

Looking for Alpha | AMZN | Profitability

Looking for Alpha’s Quant continues to derive an “A+” profitability ranking for Amazon which I consider completely represents the agency’s present and future earnings potential.

Amazon’s stability sheets proceed to be in nice form with the agency’s fast ratio of 0.70x and present ratio of 0.98x simply lined by their large FCF.

Fairly merely, the agency’s large unlevered free money flows ought to enable the agency to proceed protecting any and all maturing debentures with ease. When mixed with the huge value financial savings presently being pursued by Amazon, I don’t see any liquidity or stability issues for the agency.

It’s protected to say that from a long-term perspective, Amazon continues to have a wonderful fiscal place which ought to enable them to innovate and develop with ease.

A formidable Q3 from a income, revenue, and gross margin standpoint has not gone unnoticed by traders with shares rallying from late-October lows. Even in powerful macroeconomic circumstances, it seems Amazon is ready to produce large earnings from its numerous enterprise operations.

Valuation – Q3 FY23 Replace

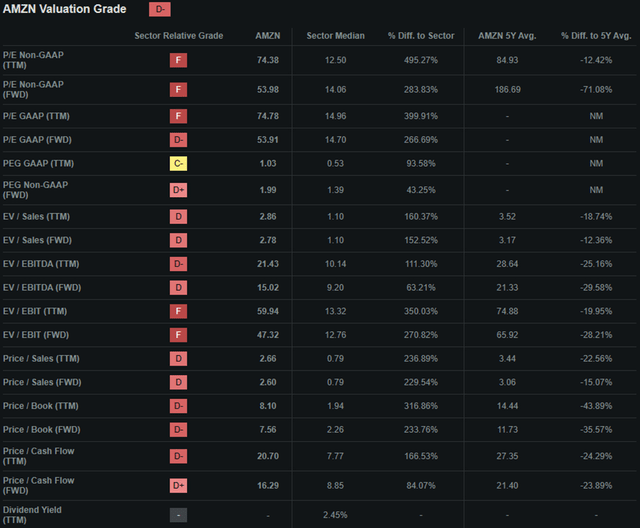

Looking for Alpha | AMZN | Valuation

Looking for Alpha’s Quant has assigned Amazon with a “D-” Valuation ranking. I’m inclined to disagree with this relative quant evaluation because it suggests the agency’s shares are materially overvalued, which I don’t consider to be the case.

The agency is presently buying and selling at a P/E GAAP FWD ratio of 53.91x and a P/CF ratio FWD of 16.29x. Their FWD Value/E-book ratio is 7.56x and the agency’s EV/Gross sales FWD is 2.78x. Whereas these metrics are definitely fairly elevated and never precisely indicative of a deep-value alternative, I consider they’re principally acceptable given the agency’s important development prospects.

Moreover, these letter grades and absolute figures should be taken with a pinch of salt. In the end, the grade given by Looking for Alpha’s quant is relative to business friends. Nevertheless, whereas Amazon’s numerous enterprise models could have comparative friends, I consider the agency is really incomparable as an entire.

Given the huge enlargement into new enterprise areas and industries, I consider Amazon will nonetheless have the ability to develop at a charge someplace within the excessive teenagers for no less than the following ten years subsequently simply warranting these elevated valuation multiples.

Looking for Alpha | AMZN | Superior Chart

From an absolute perspective, Amazon’s shares have proven sturdy efficiency all through 2023 with large YTD good points of round 70% returning 5Y common returns to above market ranges (as in comparison with the S&P 500 monitoring index (SPY)).

In comparison with 2021 highs, Amazon shares proceed to be out there at an absolute low cost of round 40% relative to historic costs.

Whereas the relative valuation offered by easy metrics and ratios together with absolutely the comparability begins to create a baseline of understanding concerning the worth current in Amazon shares, a purely quantitative valuation methodology should be accomplished.

The Worth Nook

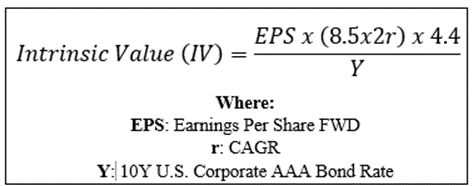

By using The Worth Nook’s specifically formulated Intrinsic Valuation Calculation, we will higher perceive what worth exists within the firm from a extra goal perspective.

Utilizing Amazon’s present share value of $145.80, an estimated 2025 EPS of $4.65, a sensible “r” worth of 0.18 (18%), and the present Moody’s Seasoned AAA Company Bond Yield ratio of 5.61x, I derive a base-case IV of $177.50. This represents an roughly 18% undervaluation in shares.

When utilizing a extra pessimistic CAGR worth for r of 0.15 (15%) to replicate a state of affairs the place Amazon struggles to earnings as a result of a recession impacting their core e-commerce enterprise, shares are nonetheless valued at round their present value of $153.50.

Contemplating the valuation metrics, absolute valuation, and intrinsic worth calculation, I consider Amazon continues to be buying and selling someplace between a good worth place and a modest undervaluation.

Within the quick time period (3-12 months), I discover it tough to say precisely what could occur to the inventory. Whereas the sturdy future development prospects are alluring, any short-term unfavourable catalyst may end in a sudden drop in share costs together with a panic-driven selloff.

An general souring in investor sentiments concerning the course the U.S. financial system is taking as an entire may additionally see Amazon shares lose worth. Given the combined macroeconomic indicators presently being generated by international economies, I consider making any short-term prediction on Amazon shares could be unreliable and excessively speculative.

In the long run (2-10 years), I see Amazon strengthening its place because the go-to firm relating to e-commerce, streaming, cloud computing, and AI.

The flexibility for Amazon to launch new service and product choices corresponding to Amazon Clinic and Pharmacy utilizing their pre-existing infrastructure provides the agency an enormous leg-up on new entrants relating to competing inside their respective market environments.

Dangers Dealing with Amazon – Q3 FY23 Replace

The first dangers dealing with Amazon stay largely unchanged in comparison with earlier evaluation. Nonetheless, for a extra in depth evaluation into the dangers dealing with the agency, I like to recommend studying my preliminary deep-dive evaluation right here.

In the end, Amazon nonetheless faces essentially the most danger from failed execution of future improvements and growth methods together with the potential for a recession in 2024 hurting the expansion in revenues of their core enterprise segments.

A recessionary macroeconomic surroundings would lead Amazon’s core shopper purchasers to really feel important stress on their incomes which might most certainly end in a cutback in spending on nonessential objects.

Whereas Amazon has considerably diversified its income streams even in comparison with simply two years in the past, the agency would nonetheless really feel an actual hit in revenues ought to such a recessionary surroundings materialize.

From an ESG perspective, no tangible change has occurred at Amazon with the danger of unionization nonetheless remaining the most important menace for the corporate to handle.

Abstract

Amazon has proven traders that its cost-cutting technique and need to realize operational excellence are paying off nicely. The sturdy development in revenues because of quite a few new service and product improvements has mixed with an general discount in prices leading to sturdy incomes and expanded margins.

I consider the agency is nicely set to realize important future development and because of its cheaper operational construction Amazon ought to have the ability to earn large outsized returns on its invested capital.

Whereas the short-term surroundings appears cloudier than ever because of a fancy macroeconomic surroundings, I see a affluent and growth-oriented future for Amazon with tangible aggressive benefits offering tailwinds for the agency for no less than the following 10 years.

When mixed with a possible for round an 18% undervaluation in shares, I nonetheless consider Amazon makes for maybe one of the vital compelling long-term funding alternatives available in the market. I believe this firm will reward affected person traders with nice multibagger returns.

I improve my ranking to a Robust Purchase.

[ad_2]

Source link

Add comment