[ad_1]

A girl fills a glass with faucet water. dusanpetkovic/iStock through Getty Pictures

When many buyers consider Dividend Aristocrats and Dividend Kings, they most likely consider the preferred first: These embody Procter & Gamble (PG), Johnson & Johnson (JNJ), and Coca-Cola (KO).

Nevertheless, some equally spectacular firms fly beneath the radar. There may very well be quite a lot of causes behind this truth, however it most likely has so much to do with the truth that the aforementioned firms are consumer-facing with international presences.

Serving California and varied U.S. army base installations, American States Water (NYSE:AWR) is not a family identify to most buyers. Whereas I do not personal the corporate, it’s one which I’d at the very least think about proudly owning. For the primary time in two months, let’s revisit the corporate’s working fundamentals and valuation to study why I prefer it.

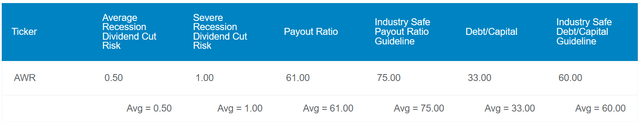

DK Zen Analysis Terminal

Though its 2.1% dividend yield is not excessive relative to different utilities, AWR does present extra beginning earnings than the 1.5% yield of the S&P 500 (SP500). This seems to be comparatively safe as nicely. AWR’s 61% EPS payout ratio is nicely beneath the 75% EPS payout ratio that ranking businesses favor from water utilities in accordance with Dividend Kings.

The water utility additionally has a fantastic stability sheet, with a 33% debt-to-capital ratio. For extra coloration, that is simply over half of the 60% debt-to-capital ratio that ranking businesses wish to see from water utilities per Dividend Kings. That implies AWR is well-capitalized.

Contemplating these variables, Dividend Kings tasks that the danger of the corporate decreasing its payout within the subsequent garden-variety recession at 0.5%. Even in a extreme recession, the chance of a dividend minimize stands at simply 1%.

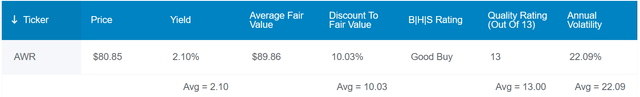

DK Zen Analysis Terminal

After years of being overvalued from my perspective, AWR appears to be like to have lastly grown into its valuation. That is supported by Dividend Kings’ $90 common honest worth estimate.

That honest worth determine additionally jives with the $86 honest worth that I get from utilizing the next inputs within the dividend low cost mannequin: A $1.72 annualized dividend per share, a ten% low cost fee, and an 8% annual dividend development fee.

Averaging these two honest values collectively, I get an $88 honest worth. Relative to its present $80 share value, AWR is buying and selling at a 9% low cost to honest worth.

If the corporate returns to this honest worth and matches development expectations, listed below are the whole returns that it may produce by means of 2033:

2.1% yield + a 6% annual earnings development fee + 0.9% annual valuation a number of enlargement = 9% annual whole return potential or a cumulative 10-year 137% whole return versus the 9% annual whole return potential of the S&P 500 or a 137% cumulative whole return

A Basically Sound Third Quarter

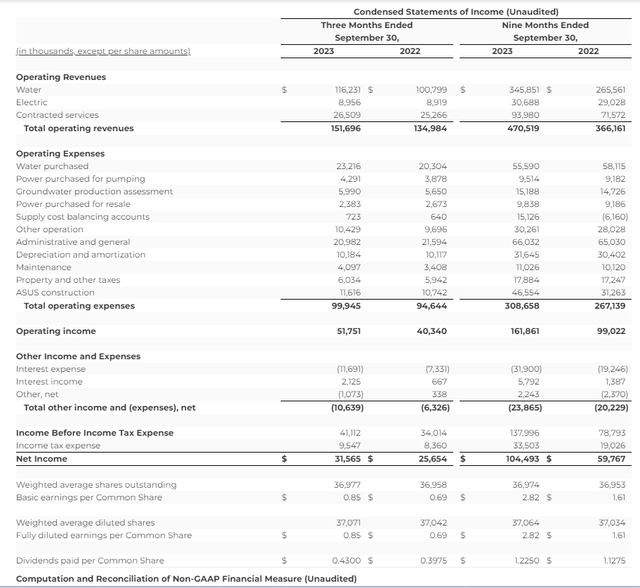

AWR Q3 2023 Earnings Press Launch

AWR posted respectable outcomes for the third quarter. The corporate’s $151.7 million in working income through the interval was up 12.4% over the year-ago interval. This narrowly missed the analyst estimate of $152 million within the quarter. What contributed to AWR’s double-digit topline development?

The catalyst for the corporate’s working income development was primarily second-year fee will increase. AWR filed for these charges in June for its Golden State Water subsidiary, and the California Public Utilities Fee carried out them efficient on July 31. These larger charges changed the earlier charges that have been in place through the third quarter of 2022.

AWR’s adjusted diluted EPS surged 16.4% larger year-over-year to $0.85 for the third quarter. This sizable earnings development was fueled by the next working income base for one. Secondly, the 5.6% development fee within the working bills class trailed working income development. That is what helped the corporate to develop its non-GAAP revenue margin within the quarter. For these causes, adjusted diluted EPS grew sooner than working income through the quarter.

AWR additionally had some favorable developments within the quarter. First, the corporate was awarded two contracts by the U.S. authorities for its American States Utility Companies enterprise, in accordance with CEO Robert Sprowls’ opening remarks within the earnings name. The primary was a Navy contract for the Naval Air Station Patuxent River in Maryland, with an preliminary $349 million worth over 50 years. The opposite was a brand new 15-year contract at Joint Base Cape Cod in Massachusetts for $45 million over 15 years. This could hold the contracted providers section rising for the foreseeable future.

AWR additionally filed a brand new common fee case in August with CPUC, which is able to set new charges for the years 2025 by means of 2027. If in the end authorised, this might additionally hold strong development going for the Golden State Water subsidiary.

Lastly, AWR’s curiosity protection ratio was 6.3 within the 9 months ended September 30. Provided that regulated utilities are usually comparatively secure by way of earnings, it is a very sturdy curiosity protection ratio. That is most likely why S&P awards an A credit standing to AWR on a secure outlook.

Wholesome And Regular Dividend Development Can Be Maintained

AWR’s most up-to-date 8.2% dividend enhance introduced in August will probably be its 69th consecutive calendar yr of dividend development. I additionally anticipate that related dividend development needs to be the norm shifting ahead.

It is because AWR is predicted to generate $2.91 in adjusted diluted EPS in 2023. In comparison with the $1.655 in dividends per share that will probably be paid through the yr, it is a extremely sustainable 56.9% adjusted diluted EPS payout ratio.

Dangers To Contemplate

AWR has all of the indications of a well-run water utility, however it nonetheless has dangers that buyers should be tremendous with earlier than shopping for.

For the reason that firm’s most up-to-date 10-Q submitting mentions no new dangers since its earlier 10-Ok submitting, I’ll briefly some dangers famous in my prior article.

Except for its secondary ASUS enterprise, AWR is solely concentrated within the state of California. This focus particularly exposes the corporate to common dangers like wildfires and earthquakes, which may disrupt operations. It may additionally damage AWR financially if losses from such pure disasters are above and past its insurance coverage protection.

Moreover, there’s a regulatory danger that CPUC could not approve fee requests which can be favorable to AWR. This might materially hurt the funding thesis.

Lastly, AWR is seen by some buyers as a low-risk inventory. So long as rates of interest stay excessive, this might end in an absence of catalysts for the inventory near-term as buyers stick with higher-yielding choices.

Abstract: AWR Is An Undervalued And Underappreciated Enterprise

Because of its secure working fundamentals, wonderful stability sheet, and unmatched dividend development streak, AWR passes my high quality take a look at with flying colours.

The corporate’s discounted valuation additional seals the deal. That’s the reason I imagine it might probably at the very least match the S&P over the following decade. That is significantly enticing as a result of AWR can do this whereas additionally possessing the traits of one of many extra dependable companies within the funding universe. Thus, I fee shares of the inventory a purchase proper now.

[ad_2]

Source link

Add comment