[ad_1]

Studio4/E+ by way of Getty Pictures

Again in July 2023, I wrote an article on Apple Hospitality REIT, Inc. (NYSE:APLE) labeling this Inventory as a purchase given the momentum within the underlying earnings and a ~30% low cost to different publicly traded resort REITs.

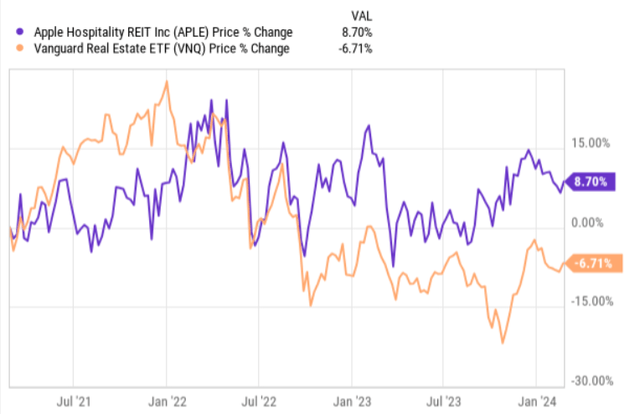

Since then, APLE has registered a complete return efficiency of ~10.5%, which is roughly 700 foundation factors above the broader REIT market. About 70% of this efficiency has stemmed from worth appreciation, thus implying that some a number of expansions have taken place.

Now, only recently the Firm issued its This autumn earnings deck, which together with the whole end result profile over 2023 and engaging outlook for the rest of this yr, has led me to purchase extra of APLE’s inventory.

Let me now clarify the important thing causes behind my bullish thesis right here.

Thesis

First, if we have a look at the 3-year historic worth ranges of APLE and the general REIT market – Vanguard Actual Property Index Fund ETF Shares (VNQ) – we will see that Apple Hospitality has received a bit forward of the index. Throughout this era, APLE has outperformed VNQ by ~15% (measured on a worth return stage).

Ycharts

There are two main causes behind this hole:

APLE’s continued restoration from the results of the pandemic. Downward strain on the index from the workplace sector, which has struggled loads these days.

Contemplating the above, one would possibly theoretically argue that at present, the entry level in APLE isn’t that favorable because the inventory worth has gone up, whereas the market has declined, changing into comparatively cheaper from a a number of perspective.

Nevertheless, I feel that this sort of pondering is wrong.

First, inventory worth appreciation of ~9% over a 3-year interval is nothing materials to substantiate a change in thesis. Second, from the P/FFO a number of perspective, APLE nonetheless trades at a pretty stage in each relative and absolute phrases: ~10% under the sector common if adjusted for extremes, and at P/FFO of simply 9.9x, respectively. Third, most significantly, the basics have improved loads, rendering the prevailing a number of low-cost in comparison with the underlying monetary dynamics.

Let’s now discover the essence in a bit extra element.

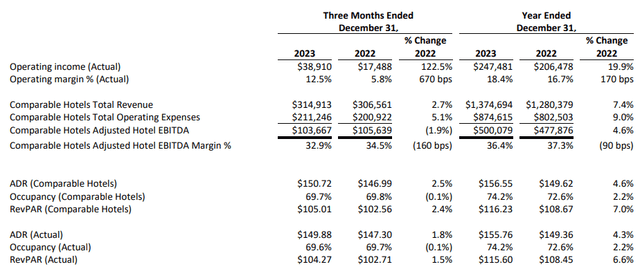

The current earnings bundle revealed constructive motion throughout the board. That is an achievement in itself given a really robust comparable base in 2022, which was supported by the pent-up demand and opening of economies that led to huge client spending ranges (together with journey & leisure)

Comparable resort gross sales landed at $315 million for the quarter and $1.4 billion for the yr that interprets to a 3% and seven% enhance in comparison with the identical interval of 2022, respectively.

Right here you will need to underscore that the uptick in gross sales and RevPAR was primarily pushed by a greater pricing combine since occupancy ranges remained roughly flat.

APLE This autumn, 2023 earnings

But, wanting on the margins, we will discover that there was some minor contraction regardless of increased gross sales on a comparable resort foundation. Towards the backdrop of a extremely inflationary surroundings going into 2023 and protracted strain on wages in addition to utilities (two notable value gadgets for resorts), it is just logical that the margins have remained flattish or declined a bit.

On this case, I might not be that involved about APLE’s capability to safeguard the prevailing margin ranges (and even enhance this going ahead) because of the following causes:

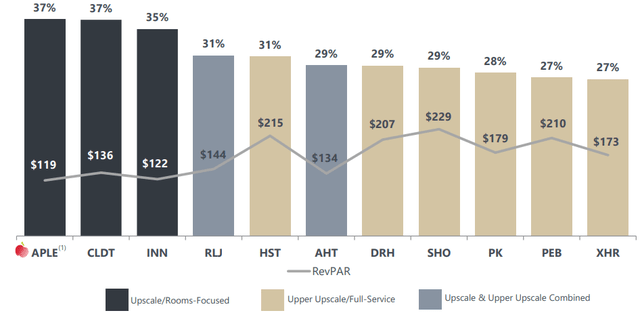

Inflation is clearly slowing down, which is confirmed by the truth that the Fed has stopped its mountain climbing cycle and as a substitute is more and more specializing in the timing and stage of rate of interest cuts. APLE’s enterprise mannequin is positioned in upscale/rooms-focused segments, which makes it simpler to cross by way of the inflationary results to the tip clients. 2023 has been clear proof of that, the place rising RevPAR managed to offset the majority of value inflation. Lastly, the chart under captures this story fairly properly: i.e., the place the deal with higher-end clients results in higher pricing alternatives.

APLE Investor Presentation

Apart from the sturdy top-line and the corporate’s pricing energy, you will need to have a sound steadiness sheet in place that acts as a protect towards deteriorating financial situations and helps to feed development in a sustainable method.

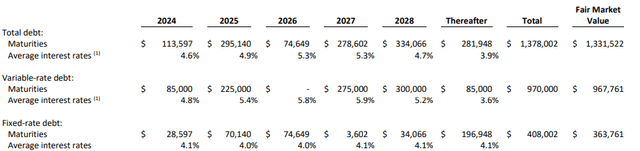

This side is among the key drivers why I’ve determined to load up on APLE’s inventory. Particularly, as of now, Apple Hospitality carries a debt ratio of 28%, which is roughly half the lodging sector common. The Firm has a internet debt to EBITDA of three.1x, the place the underlying debt proceeds are based mostly on a weighted common rate of interest of 4.3%.

Now, the desk under signifies an extra side, which makes the story of the fortress steadiness sheet much more engaging.

APLE This autumn, 2023 earnings

Roughly 80% of APLE’s debt is stipulated at mounted rates of interest, which in flip permits it to keep away from some headwinds from increased SOFR. Whereas there are some mounted fee debt maturities in 2024 and 2025, nearly all of them begin to fall due from 2027, which presents adequate time for APLE to keep away from incremental materials strain from increased financing prices till the rates of interest normalize.

Going ahead, APLE is well-positioned to accommodate natural development in an investor-friendly trend. In response to Justin Knight – CEO within the current earnings name, the Firm will proceed to amass further properties that ought to feed increased EBITDA technology.

Mixed with our super transaction expertise, our out there steadiness sheet capability, and our deep business relationships, we consider we proceed to be well-positioned relative to rivals within the present market surroundings and are optimistic that we’ll proceed to be internet acquirers within the coming months. We additionally actively search alternatives to refine our portfolio and optimize our capital reinvestment program by disposing of older property in lower-growth markets.

The underside line

APLE trades at a P/FFO that’s just under 10x and likewise ~10% under the resort REIT sector common. Within the context of bettering efficiency, a fortress steadiness sheet, and inherent aggressive energy to cross the inflationary pressures ahead to the tip clients, the prevailing valuations appear too low.

In my humble opinion, this hole will likely be ultimately closed by APLE’s continued investments in current resorts and M&A that might be accommodated by strong inner money technology (FFO payout of simply 66%) and a really sturdy steadiness sheet – all of which help development with out shareholder dilution.

For me, Apple Hospitality is a robust purchase.

[ad_2]

Source link