[ad_1]

Apple’s inventory had a powerful 2023 however confronted challenges within the new 12 months with a 3.58% drop triggered by Barclays’ downgrade and patent disputes affecting Apple Watch gross sales.

Regardless of underwhelming iPhone gross sales, Apple maintains a stable basic place, with efficient useful resource utilization.

Technical evaluation suggests a important help degree at $180 and resistance at $195-$200. A break under the previous degree can set off a transfer towards $165.

Seeking to beat the market in 2024? Let our AI-powered ProPicks do the leg be just right for you, and by no means miss one other bull market once more. Study Extra »

In 2023, Apple (NASDAQ:) inventory had a powerful efficiency, ending the 12 months at $192.53, marking a big 48% achieve from 2022.

Nevertheless, it is necessary to notice that this increase in inventory worth wasn’t fully backed by the corporate’s monetary efficiency all year long.

Now, as different extra punctual issues come along with the Cupertino-California large’s efficiency, the query preying on buyers’ minds is: Can the corporate hold outperforming in 2024?

Let’s take a deep dive into its financials to higher perceive the place we stand.

New 12 months Brings New Troubles for Apple

The onset of the brand new 12 months introduced a decline in AAPL share worth, spurred by unfavorable feedback concerning the firm. On the primary buying and selling day of the 12 months, Apple inventory skilled a 3.58% drop, triggered by Barclays’ pessimistic remarks.

Barclays downgraded the corporate, expressing issues about decelerating iPhone 15 gross sales in China and forecasting additional weakening gross sales with minimal developments anticipated within the upcoming iPhone 16 launch.

Including to Apple’s challenges, a patent dispute emerged, questioning whether or not the blood oxygen sensor in Apple’s Apple Watch infringed on Masimo’s (NASDAQ:) patented expertise.

The Worldwide Commerce Fee, in a latest growth, advocated for a ban on importing the watches, resulting in the elimination of the merchandise from cabinets.

Nevertheless, the Federal Court docket of Appeals considerably alleviated the disaster by allowing Apple to proceed promoting the watches.

Returning to issues relating to iPhone gross sales, latest quarterly outcomes point out that the iPhone constitutes 49% of Apple’s total gross sales.

With lackluster iPhone gross sales in 2023 and pessimistic expectations for 2024, apprehensions concerning the firm going through a difficult 12 months forward have began to mount.

Elementary View

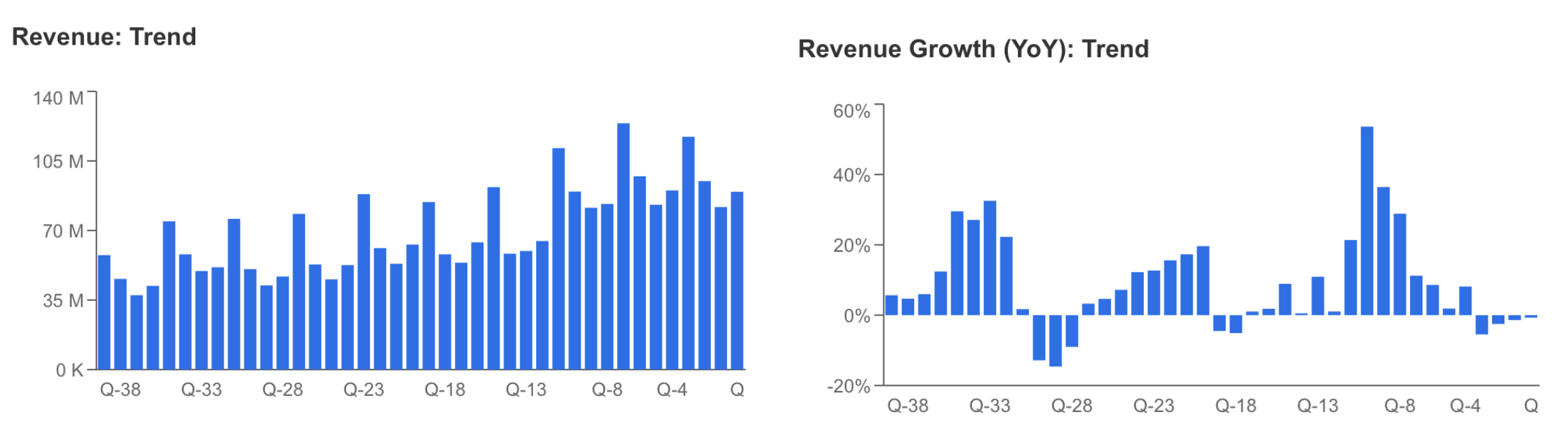

The underperformance of Apple’s iPhone in assembly gross sales expectations all through 2023 harm income, leading to a decline throughout the quarters of the 12 months.

All through 2023, Apple’s service merchandise contributed to income, however not as a lot as anticipated as this section accounted for under 1 / 4 of complete income. So how did the almost 3% year-over-year decline in income have an effect on earnings?

The corporate managed to make the most of its assets successfully all year long whereas sustaining its gross margin. Accordingly, earnings per share have been $6.12 for the 12 months, in response to the most recent quarterly report.

Supply: InvestingPro

Thus, Apple managed to take care of the EPS quantity of $ 6.11 in 2022. However, there’s a threat that the dearth of income development in 2024 can even negatively have an effect on profitability.

A lot in order that the response to Barclays’ score will be thought of an necessary indicator of this.

Supply: InvestingPro

Imaginative and prescient Professional, iPhone 16 to Flip Issues Round?

Nevertheless, Apple, the world’s largest firm, could also be again on the offensive as a expertise large with the potential to reverse expectations in 2024.

This might begin with Imaginative and prescient Professional, which Apple plans to launch in February. If Imaginative and prescient Professional takes off, the corporate will probably be on the forefront of the following era of computing units.

Then again, the resurgence of iPhone gross sales can even have a big impression on Apple.

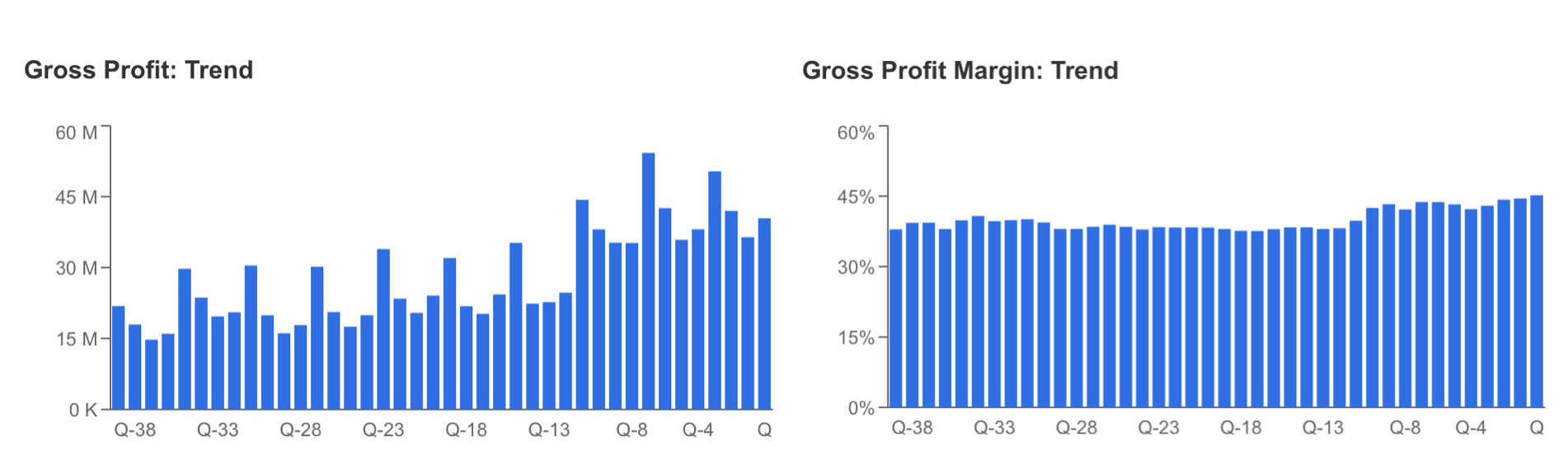

Earlier than the monetary earnings report anticipated to be introduced on January twenty fifth, it’s anticipated that EPS will probably be introduced as $ 2.1, down 6%, and quarterly income is predicted to be introduced as $ 118.2 billion, down 10% in comparison with final 12 months.

13 analysts revised their forecast for Apple downwards, whereas 12 analysts revised it upwards. This reveals that buyers have blended ideas about Apple.

Supply: InvestingPro

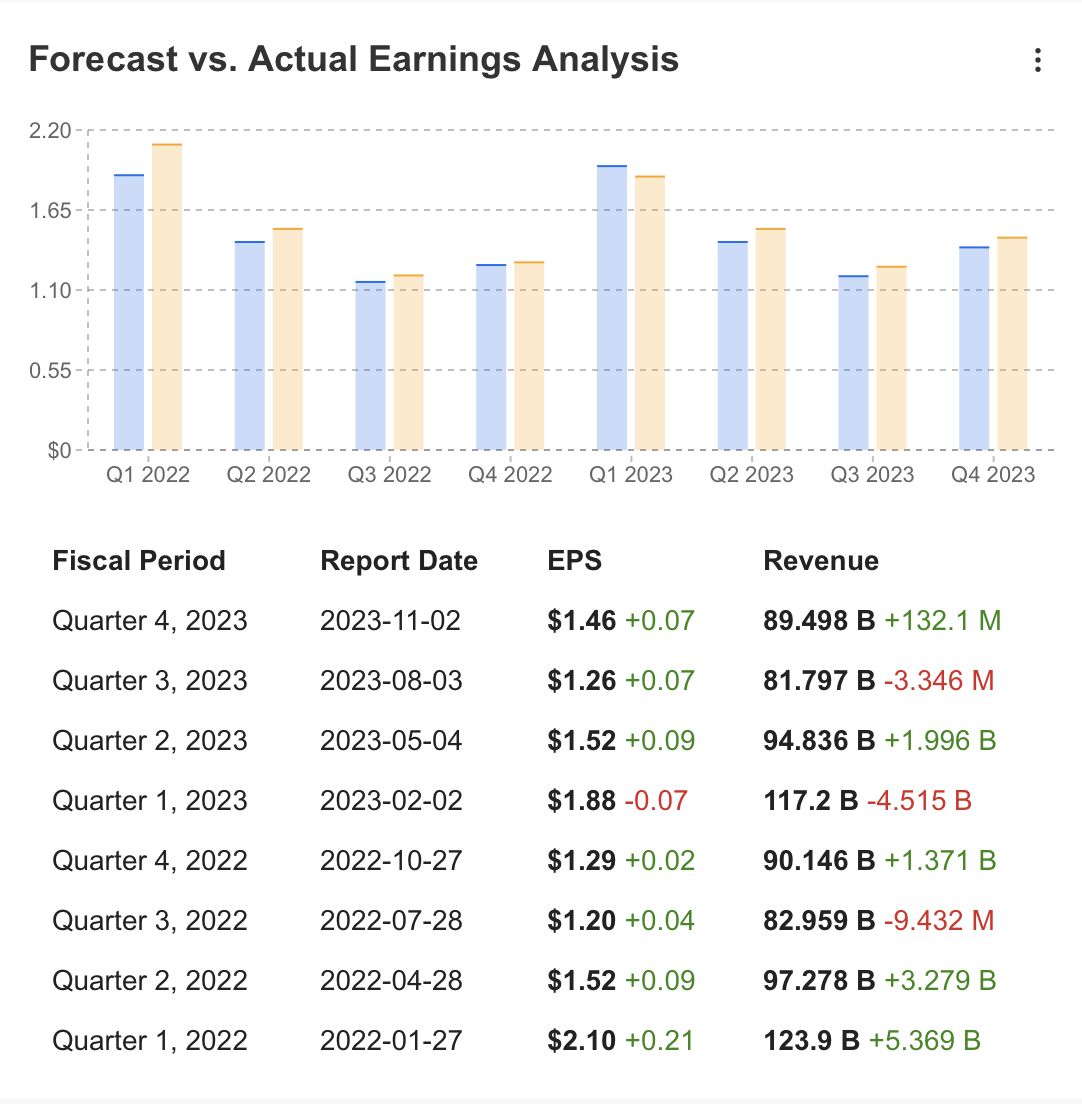

If we examine the truthful worth of AAPL inventory in response to the most recent monetary information, we will speak concerning the detrimental impression of monetary outcomes on the value forecast.

A lot in order that InvestingPro truthful worth evaluation reveals that AAPL might see a 16.4% correction through the 12 months, dropping as little as $154, in response to a calculation primarily based on 14 monetary fashions.

The consensus estimate of 44 analysts is that the inventory might attain a worth near $ 200.

Supply: InvestingPro

This outcome will be interpreted because the preservation of the expectation that the corporate can take off once more in 2023 regardless of the below-expected efficiency.

In accordance with the most recent information of the corporate, we will additionally look at its monetary well being by means of InvestingPro.

Once we have a look at it, we will see that whereas profitability continues in excellent situation, development, and money circulation objects stay in good situation with the value momentum of the inventory.

Technical View

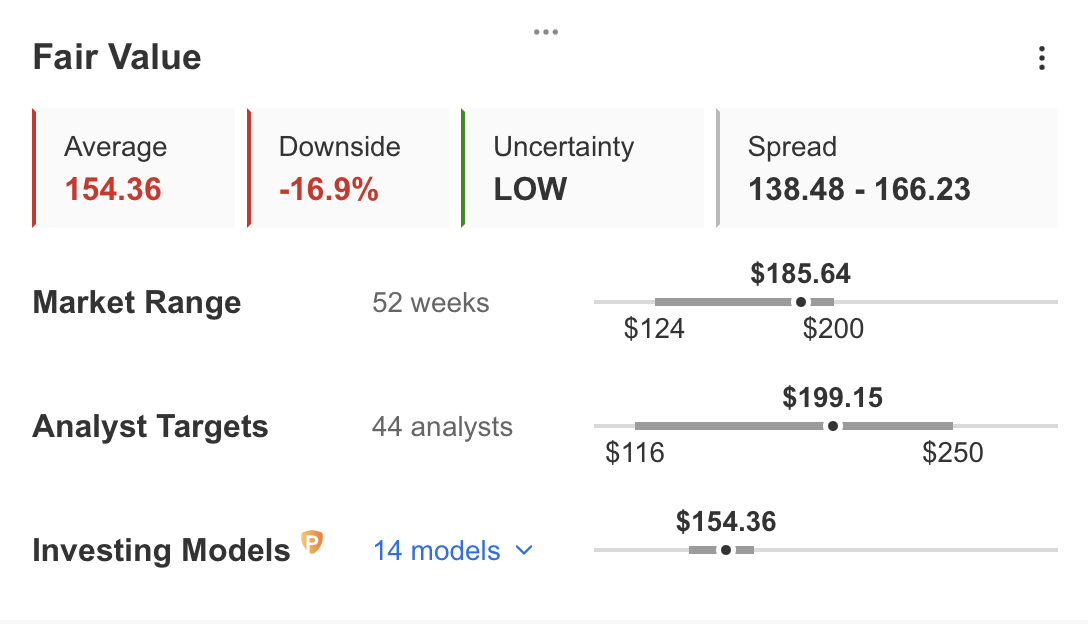

After gaining a big upward momentum within the first quarter of 2023, AAPL inventory adopted a unstable course within the second half of the 12 months.

Supply: InvestingPro

AAPL inventory skilled a correction within the July-October interval, retracing partially and establishing a technically bullish outlook for the long run, discovering help within the $160 vary.

Based mostly on the 2023 worth motion, over the last restoration, the inventory confronted resistance within the $190-$200 vary. With latest detrimental developments, a retest to the help zone within the $180-$185 vary ensued.

If the help zone holds this week, the resistance space of $195-$200 might resurface within the coming days.

A profitable breach would possibly propel AAPL in the direction of targets of $210-$220-$237 within the first half of the 12 months. Conversely, weekly closes under $180 might shift the outlook negatively, doubtlessly pulling the share worth again to the principle help level at $165.

Analyzing the weekly chart, the Stochastic RSI indicator is on the verge of producing a bearish sign, descending from the overbought zone. Due to this fact, sustaining the $180 help degree is essential to impede an acceleration within the decline.

***

In 2024, let arduous selections develop into simple with our AI-powered stock-picking device.

Have you ever ever discovered your self confronted with the query: which inventory ought to I purchase subsequent?

Fortunately, this sense is lengthy gone for ProPicks customers. Utilizing state-of-the-art AI expertise, ProPicks gives six market-beating stock-picking methods, together with the flagship “Tech Titans,” which outperformed the market by 670% over the past decade.

Be a part of now for as much as 50% off on our Professional and Professional+ subscription plans and by no means miss one other bull market by not figuring out which shares to purchase!

Declare Your Low cost At the moment!

Disclaimer: The writer doesn’t personal any of those shares. This content material, which is ready for purely instructional functions, can’t be thought of as funding recommendation.

[ad_2]

Source link