[ad_1]

husayno

When Apple Inc. (NASDAQ:AAPL), analysts on Wall Road are slightly bullish about Apple, whereas analysts right here on Looking for Alpha are much less optimistic. I even have been slightly cautious about Apple up to now and in my earlier articles I rated the inventory as a “Maintain”. However clearly I used to be incorrect concerning the inventory and since my final article, Apple returned about 32% and outperformed the SP& 500 (SPY), which elevated 25% in the identical timeframe.

Apple Analysts Score (Looking for Alpha)

Within the following article, we’re trying on the previous efficiency of Apple, the final reported outcomes and are additionally making an attempt to reply the query if the financial scenario in China and the USA might be a risk for Apple.

Nice Efficiency In The Previous

And though I used to be not so optimistic about Apple in my previous articles and all the time rated the inventory as a “Maintain” and was all the time cautious concerning the future efficiency, I have to admit that Apple carried out nice in the previous few years – and it does not actually matter what timeframe we take.

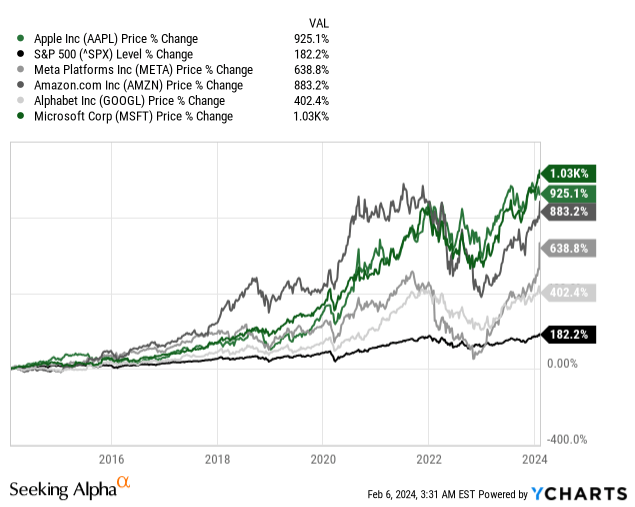

When searching for instance on the inventory within the final ten years, Apple’s inventory value elevated 925% and never solely can we see a transparent outperformance of the S&P 500 (which elevated 182% in the identical timeframe – an already nice efficiency), however Apple was truly performing higher than a lot of its giant cap expertise friends. Solely Microsoft (MSFT) carried out higher among the many main info expertise shares. When trying on the Magnificent 7, Tesla (TSLA) would have additionally carried out higher than Apple, however until the corporate from Cupertino will lastly introduce its personal automobile, they don’t seem to be actually rivals.

Apple

Amazon.com (AMZN)

Alphabet (GOOG)

Meta Platforms (META)

Microsoft

Income 10-year CAGR

8.41%

22.68%

17.78%

32.86%

10.53%

Income 5-year CAGR

7.61%

19.80%

17.57%

19.29%

13.94%

Working Revenue 10-year CAGR

8.84%

47.72%

19.69%

32.50%

12.71%

Working Revenue 5-year CAGR

10.02%

24.30%

21.84%

13.42%

20.35%

EPS 10-year CAGR

15.75%

58.22%

19.79%

37.85%

14.14%

EPS 5-year CAGR

15.54%

23.56%

21.56%

14.46%

35.36%

Click on to enlarge

And when elementary metrics, Apple is lagging a lot of its friends, however the reported progress charges are nonetheless nice, and plenty of corporations will not have the ability to obtain related progress charges.

First Quarter Outcomes

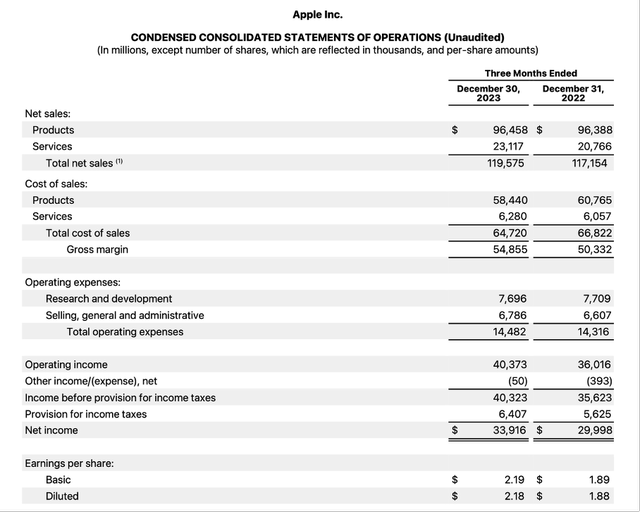

Final week, Apple reported first quarter outcomes for fiscal 2024 and the corporate may beat analysts’ expectations for the highest and backside line. Whereas income exceeded expectations by $1.34 billion, the corporate may beat earnings per share by $0.07.

Apple Q1/24 Earnings Launch

And when trying on the outcomes, they had been actually not dangerous however not nice both. Whole gross sales elevated barely from $117,154 million in Q1/23 to $119,575 million in Q1/24 – leading to 2.1% year-over-year progress. Working revenue, however, elevated 12.1% year-over-year from $36,016 million in the identical quarter final 12 months to $40,373 million on this quarter. And eventually, diluted earnings per share elevated 16.0% YoY from $1.88 in Q1/23 to $2.18 in Q1/24.

Shifting In the direction of Providers

Below Tim Cook dinner, Apple is continuous to shift increasingly in the direction of service gross sales. In an article revealed about two years in the past, I already defined how Apple is widening its moat attributable to specializing in service gross sales.

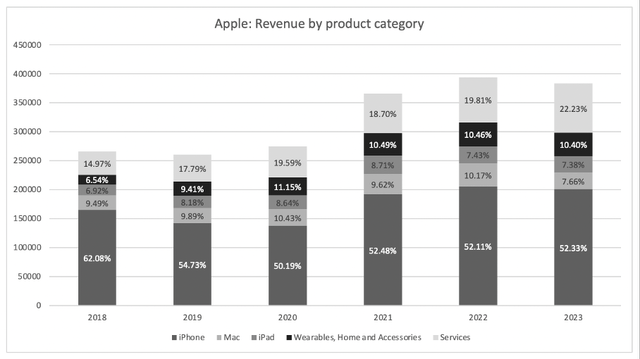

Within the final quarter, service gross sales accounted for $23,117 million and in comparison with a complete income of $119,575 it’s accounting for 19.3% of whole income. In comparison with the earlier quarter, service gross sales elevated 11.3% year-over-year and was one of the best performing class for Apple (forward of iPhone gross sales). And whereas service gross sales had been accounting just for 19.3% within the final quarter, they made up 22.2% of whole gross sales in fiscal 2023 and Apple was continually in a position to enhance service gross sales through the years and they’re taking part in a increasingly necessary position for total income.

Creator’s work

In my earlier article I additionally defined why service gross sales are slightly resulting in an financial moat – in comparison with {hardware} gross sales:

Service gross sales are together with income from the app retailer, Apple music, Apple Pay or Apple TV+ and these gross sales might be seen as extra constant than iPhone gross sales as we’re coping with subscription fashions, and that is resulting in extra constant income streams. And it may additionally assist iPhone gross sales to be extra constant. If I’ve paid for a number of apps, possibly use Apple Music (though there are a lot of different related suppliers to which I can swap) and have saved my knowledge in Apple’s cloud, the inducement is far larger to purchase an iPhone once more to have the ability to use the providers in the same means.

And I additionally describe the ensuing switching prices which can be arising and are contributing to the widening moat:

These switching prices are additionally growing as Apple is promoting increasingly further {hardware} units. Gross sales from “Wearables, Dwelling and Equipment” elevated from 6.54% of whole gross sales in 2018 to 10.49%. And prospects who personal not solely an iPhone, but in addition a Mac and Apple Watch or Apple TVs are much less prone to swap away from the Apple ecosystem. And the Apple ecosystem can be the important thing to its (large) financial moat. The higher the ecosystem, the upper the incentives to remain throughout the ecosystem. Switching prices are getting larger and better when a number of providers and merchandise are embedded in such a means, that I can use them solely in an inexpensive means after I maintain all these merchandise.

{Hardware} Gross sales

And whereas Apple is seeing its service gross sales growing with a stable tempo in the previous few years (providers gross sales elevated with a CAGR of 16.5% within the final 5 years), {hardware} gross sales weren’t nice within the first quarter of fiscal 2024 in addition to in 2023. And as {hardware} gross sales are nonetheless liable for the largest a part of income this may be problematic.

In 2023, all 4 {hardware} classes needed to report declining gross sales with iPhone gross sales declining solely 2.4% YoY and gross sales for Mac declining 26.8% YoY. Within the first quarter of fiscal 2024 the image was a bit completely different. Whereas iPhone gross sales elevated 6.0% year-over-year and Mac gross sales elevated 0.6% YoY, gross sales for iPad and Wearables declined. In whole gross sales for merchandise had been secure year-over-year.

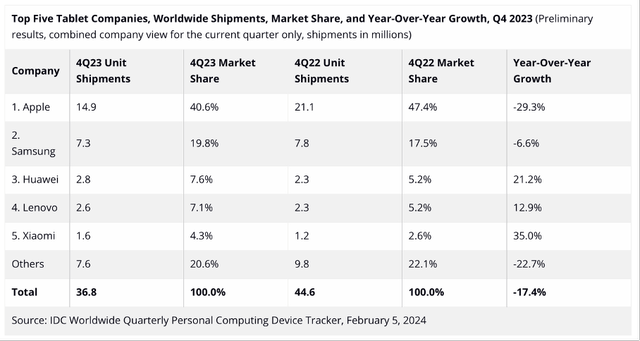

And whereas Tim Cook dinner led the corporate in the direction of larger providers gross sales and due to this fact widening Apple’s moat (that was slightly slim earlier than), he’s typically criticized for Apple being much less revolutionary than underneath Steve Jobs. When contemplating that incontrovertible fact that 2023 was the primary 12 months with none new iPads since 2010, we will perceive the criticism. The final refresh for the iPad and iPad Professional was introduced in October 2022 and never surprisingly, Apple noticed enormous declines for iPads shipped within the fourth quarter. The corporate continues to be clear market chief with about 40% market share however year-over-year the corporate from Cupertino misplaced market shares to its rivals.

IDC

When trying on the full 12 months shipments, nevertheless, Apple’s market share is remaining flat round 38% and shipments for tablets declined about 20% for Apple – in step with the general market.

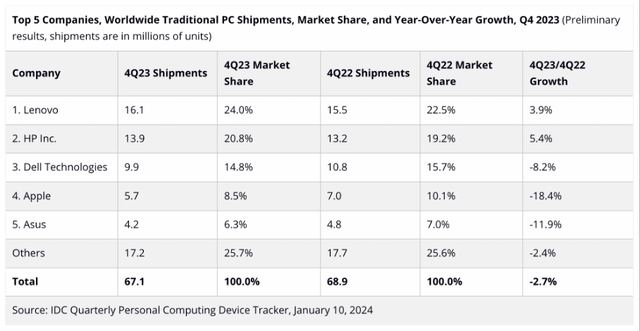

When PC shipments within the final 12 months, Apple additionally underperformed the market. For the total 12 months shipments declined from about 27.9 million in 2022 to 21.7 million in 2023 leading to a decline of twenty-two.4% whereas total shipments declined solely 13.9%. And particularly within the fourth quarter (vacation season) the issue turned apparent. Whereas the general shipments declined solely 2.7%, Apple noticed its shipments decline 18.4% and was the worst performing among the many high 5 corporations.

IDC

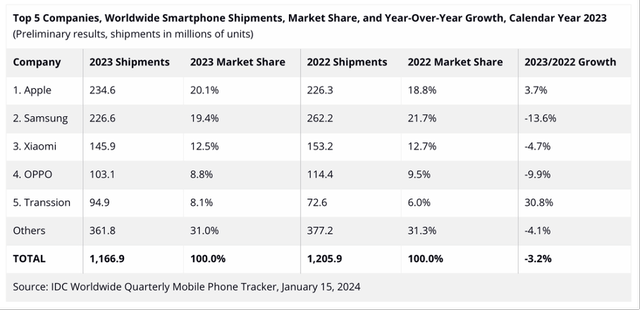

And so long as we’re speaking about {hardware}, we also needs to point out that Apple pushed Samsung from the smartphone throne and offered probably the most smartphones worldwide in 2023. This was largely as a result of underperformance of Samsung in 2023 and never a lot as a result of outperformance of Apple. However, Apple may enhance the variety of shipped smartphones 3.7% year-over-year whereas the general market reported a decline of three.2%.

IDC

Apple additionally took the highest spot within the Chinese language smartphone marketplace for the primary time – regardless of challenges within the area.

China Constantly Difficult

One of many issues Apple is going through proper now are the declining gross sales in China. However that is actually not an issue solely Apple is going through. And this wrestle in China is just not a lot the issue of Apple as it’s slightly an issue in China. In Q1/24, gross sales in China declined to $20,819 million from $23,905 million in the identical quarter final 12 months – leading to 12.9% year-over-year decline.

And though the weak outcomes are in all probability nothing Apple is liable for, it’s nonetheless an issue Apple should take care of as China is liable for about 20% of Apple’s whole income and therefore an necessary market. China is clearly in a bear market and in an financial hunch (to keep away from the time period recession) and after the collapse of Evergrande with $300 billion in debt ripple results all through the economic system are doubtless. Whereas I feel the Chinese language inventory market is likely to be near its backside, the economic system may proceed to endure a bit longer (because the inventory market is all the time a number one indicator).

When knowledge from the IMF, China’s actual property sector is clearly in a downturn. Since 2020, actual property gross sales and actual property begins each declined about 50%. The IMF is writing:

With the property downturn in its third 12 months, progress in downsizing the sector has been fast in some respects. Housing begins have fallen by greater than 60 % relative to pre-pandemic ranges, a traditionally fast tempo solely seen within the largest housing busts in cross-country expertise within the final three a long time. Gross sales have fallen amid homebuyer issues that builders lack ample financing to finish initiatives and that costs will decline sooner or later.

And the IMF can be projecting it would take for much longer earlier than we will see a restoration and it would take a very long time earlier than the actual property market will attain pre-crisis ranges once more. The mixture of individuals shedding cash within the inventory market, bought actual property property being value much less, (youth) unemployment being larger and the temper being slightly pessimistic is main individuals to buy much less client discretionary items and Apple is without doubt one of the corporations experiencing the detrimental results.

One other fascinating query is what’s going to occur if Trump is elected once more in November 2024: Will the commerce warfare with China return? I do not actually know what’s going to occur, however these are situations we must always take into consideration.

China At the moment, United States Tomorrow?

Whereas the USA are nonetheless in good situation from an financial perspective, we additionally should take into consideration what may come. As I’ve defined in several articles, we ought to be ready for a state of affairs that appears unlikely however may occur within the foreseeable future – the USA (and different nations around the globe) sliding right into a recession. We aren’t solely having a number of indicators pointing in the direction of the top of the short-term debt cycle (additionally known as enterprise cycle), however we’re near the top of a long-term debt cycle. In one other article explaining why gold is likely to be a very good funding within the coming decade, I wrote:

When trying on the idea, Ray Dalio introduced in his guide Rules for coping with the altering world order there are three “cycles” that appear to come back to an finish which is slightly spelling doom for the globe. Not solely does the long-term debt cycle appear near completion, however the world is slightly shifting from its inside and exterior order in the direction of dysfunction on each stage.

If my prediction is appropriate, we’ll enter a decade of declining asset costs (the so-called “misplaced decade”), a decade of deleveraging and all of the detrimental penalties related to that course of (individuals spending much less for instance). Moreover, we’ll see larger unemployment charges and possibly declining wages.

And it does not actually matter if the subsequent financial downturn can be a despair or “simply” a recession. Apple as an organization promoting largely non-essential gadgets (or gadgets the place a purchase order can simply be postponed just a few quarters) will really feel the results. I would want a brand new smartphone as my iPhone is already two, three or 5 years outdated – however as the chance for me shedding my job is rising in a despair (or recession) and I already should make excessive curiosity funds on my mortgage (attributable to larger rates of interest) and my belongings are value much less, I’ll postpone shopping for a brand new iPhone (or may selected the smartphone of a less expensive competitor).

Dividend and Share Buybacks

Apple declared a dividend of $0.24 within the earlier quarter and after 4 quarters of the identical dividend in a row we will count on the subsequent dividend enhance within the coming quarter. However the dividend might be not the explanation for anybody to spend money on Apple because the dividend yield is barely 0.52% and Apple grew its dividend solely 6.15% within the final 5 years (and is due to this fact neither a very good dividend progress funding).

Apple was slightly specializing in share buybacks in the previous few years. Whereas Apple was spending about $14 billion to $15 billion yearly on dividend funds within the final 5 years, the corporate spent between $69 billion and $95 billion yearly on share buybacks within the final 5 years.

2019

2020

2021

2022

2023

Free money circulate

$58,896

$73,365

$92,953

$111,443

$99,584

Dividend

$14,119

$14,081

$14,467

$14,841

$15,025

Share Buybacks

$69,714

$75,992

$92,527

$95,625

$82,981

Click on to enlarge

Within the final 5 years, Apple spent more cash on dividends in addition to share buybacks than it generated in free money circulate. Within the final 5 years, Apple spent 112% of the generated free money circulate or to place it a bit bit otherwise, Apple spent about $53 billion extra on dividends and share buybacks than it generated in free money circulate.

However at this level, Apple nonetheless has $40,760 million in money and money equivalents on its stability sheet in addition to $32,340 million in marketable securities and for my part, administration can use a much bigger a part of these very liquid belongings for share buybacks – at the least in idea. Administration ought to nonetheless take into consideration how it’s utilizing the free money circulate it’s producing handiest and share buybacks ought to solely come into play when the inventory is just not overvalued.

Intrinsic Worth Calculation

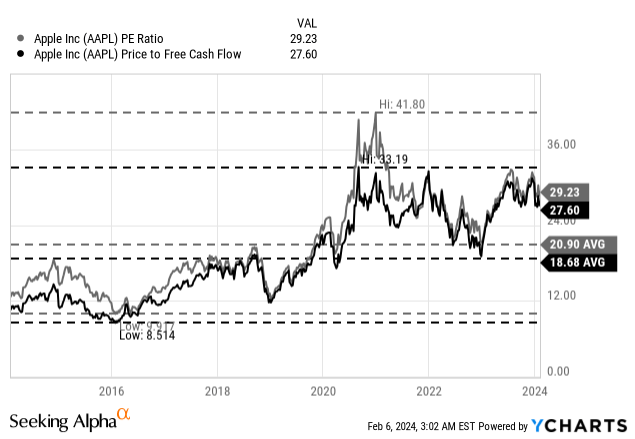

On the time of writing, Apple is buying and selling for 29.2 occasions earnings in addition to 27.6 occasions free money circulate. And at the least when trying on the final ten years this is without doubt one of the larger valuation multiples the inventory has been buying and selling for. And it additionally trades clearly above the 10-year averages (which had been 18.68 for P/FCF and 20.90 for P/E).

When making an attempt to calculate an intrinsic worth through the use of a reduction money circulate calculation, we use a ten% low cost charge and are calculating with 15,577 million diluted excellent shares. As foundation for such a calculation, we will use the free money circulate of the final 4 quarters (which was $106,869 million). When calculating with these assumptions, Apple should develop its free money circulate barely above 7% yearly for the subsequent ten years adopted by 6% progress.

How practical are these progress assumptions? At this level, I might argue that Apple is pretty valued. And naturally, Apple struggled in 2023 however when the previous few years, we will assume Apple to develop its free money circulate 7% yearly. We should always not neglect that Apple is producing about $100 billion in free money circulate it will probably in idea use for share buybacks. With a market capitalization of $2.87 trillion, this is sufficient to repurchase about 3.5% of excellent shares and the corporate will develop simply through the use of share buybacks about 3.5% yearly.

Conclusion

However regardless of me arguing that Apple might be pretty valued, I nonetheless could be cautious about an funding as I may also see a state of affairs of Apple’s gross sales stagnating or declining in the USA as effectively. And we actually mustn’t take a look at the final recession for comparisons as Apple was in a part of explosive progress at that cut-off date.

[ad_2]

Source link