[ad_1]

ozgurdonmaz

In our earlier evaluation of Apple Inc. (NASDAQ:AAPL), we analyzed the smartphone market, projecting a -2.8% development attributable to sluggish penetration charges and a world lower in substitute charges. Regardless of this, we believed Apple was strategically positioned to thrive within the high-growth premium smartphone market. We recognized the corporate’s aggressive benefits in branding, product options, and breadth, main us to challenge a mean 4.1% development in iPhone revenues.

On this evaluation, we revisit the corporate publish its FY2023 full-year outcomes, revealing a 2.8% contraction in income development, barely beneath our full-year forecast of -0.7%. We look at the corporate to find out whether or not its income development might decide up in FY2024 by reviewing its segments and outlook. Furthermore, we look at whether or not the corporate’s margins might proceed to extend with an expense evaluation as analysts’ consensus projected increased EPS development than income development. Moreover, we look at whether or not its EPS development could possibly be supported by inventory buybacks by analyzing its FCFs.

Progress To Rebound however Decrease Than Our Expectations

On this level, we examined whether or not Apple might obtain our earlier expectations of a rebound in its complete development (12.64% in FY2024) following its poor efficiency final 12 months.

Apple Income Segments ($ bln)

Precise (2023)

Our Earlier Forecast (2024F)

iPhone

200.6

208.8

Progress %

-2.39%

4.10%

Mac

29.4

40.3

Progress %

-26.94%

37.30%

iPad

28.3

32.7

Progress %

-3.38%

15.70%

Wearables, residence and equipment

39.8

45.3

Progress %

-3.36%

13.60%

Companies

85.2

104.6

Progress %

9.05%

22.80%

Complete

383.3

431.7

Complete Progress %

-2.80%

12.64%

Click on to enlarge

Supply: Firm Information, Khaveen Investments.

In FY2023, the corporate’s income contracted by 2.8% as all of its segments had unfavorable development apart from Companies. We look at every phase’s efficiency in additional element beneath.

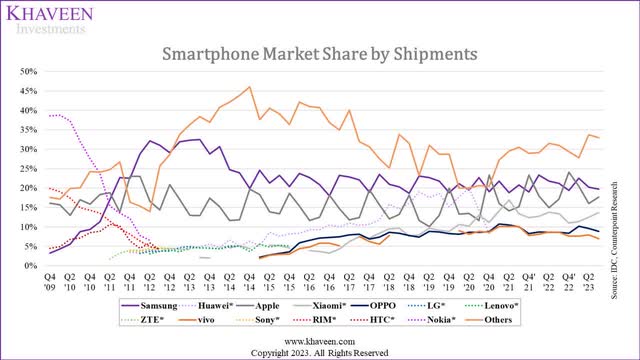

iPhone

In FY2023, Apple’s iPhone income dropped by 2.4% YoY as its complete shipments declined by 5.4% based mostly on IDC knowledge, though its ASPs grew by 3.1%. As highlighted beforehand, the smartphone market demand waned attributable to weak client confidence, notably in China. Going ahead, we anticipate the smartphone market development in complete to stay difficult with a forecasted common development of -2.7% because the smartphone market matures with growing improve cycles. Nevertheless, we forecasted the premium smartphone market to be increased than the general market at 2.5% in 2024 pushed by increased spending. We anticipate Apple to capitalize on this attributable to its robust place within the premium market phase with a 75% share in 2022.

Just lately, Apple launched the iPhone 15 product lineup and highlighted in its briefing that it continues “to see extraordinarily excessive ranges of buyer satisfaction which 451 Analysis lately measured at 98% within the U.S.” Moreover, Apple’s market share elevated to 17.7% in Q3 2023 following the launch of its iPhone 15 in comparison with 17% in the identical interval final 12 months, indicating its robust recognition.

The all-new iPhone 15 and iPhone 15 Plus characteristic a stunning design, highly effective cameras and the intuitive Dynamic Island. Powered by the industry-leading A17 Professional, our iPhone15 Professional lineup has a stupendous robust and sturdy titanium design and the very best iPhone digital camera system ever, together with a 5X Telephoto lens on the iPhone 15 Professional Max. – Tim Cook dinner, CEO.

Nevertheless, Apple could possibly be confronted with robust competitors from key gamers, particularly Samsung Electronics Co., Ltd. (OTCPK:SSNLF) (16%) and Huawei (3%) who path behind Apple when it comes to market share within the premium phase. Notably, as we talked about beforehand, Huawei’s new Mate mannequin which has 5G capabilities has seen robust demand in China and was attributed to its rise in market share in China to 13% in Q3 2023 (9% a 12 months in the past), indicating robust client curiosity in its newest mannequin. Furthermore, Samsung is predicted to announce its subsequent flagship Samsung Galaxy mannequin in early 2024.

IDC, Counterpoint Analysis, Khaveen Investments

General, for the iPhone phase, we proceed to base our projections on a cargo development forecast of two.8% pushed by premium smartphone market development as we coated beforehand and ASP development of three.5% based mostly on its 5-year common.

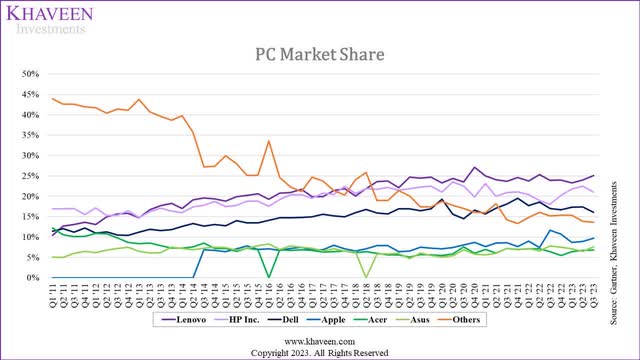

Mac

In FY2023, Apple’s Mac revenues declined by 27% within the full 12 months as its complete shipments declined by 12% YoY amid the weak PC market shipments development, which we beforehand forecasted to say no by 11.7% for the complete 12 months attributable to extra shipments following the pandemic interval. Nevertheless, we anticipated the PC market to get better strongly in 2024 at 18.7% as we modeled extra shipments to be totally absorbed. Moreover, one more reason for the decline in Apple Mac revenues is because of ASP declines of 17%. It is because Apple had lower costs for a few of its new MacBook fashions resembling its MacBook Air by $100, which is a decline of 8.3% from the unique value of $1,199.

Gartner, Khaveen Investments

In 2023, Apple launched new M3 chips and with efficiency enchancment in comparison with its successors highlighted beneath by Digital Developments.

On the CPU facet, Apple elevated the velocity of its efficiency cores by 15% and its effectivity cores by 30% over the M2. General, Apple is promising a 20% to 25% enchancment in efficiency. On the GPU facet, Dynamic Caching is one expertise that hurries up quite a lot of GPU processes, whereas players will profit from mesh shading and hardware-accelerated ray tracing. – Digital Developments.

Firm

Pocket book

Desktop

Common PassMark CPU Rating

Intel Company (INTC)

33,585

38,862

36,224

Superior Micro Units, Inc. (AMD)

21,466

45,367

33,417

Apple Inc.

29,397

29,397

29,397

Click on to enlarge

Supply: PassMark, Khaveen Investments.

Nevertheless, evaluating the typical CPU benchmark rating for Apple’s M3 with our earlier evaluation of AMD and Intel 2022 gen CPU scores, we see Apple’s Pocket book common rating increased than AMD however decrease than Intel. Nevertheless, its Desktop scores are nicely beneath Intel and AMD. Thus, we imagine Apple continues to lack a stable efficiency benefit as we decided beforehand and limits its ASP development. Nonetheless, Apple highlighted that it continues “to see robust upgraded exercise to Apple silicon” and excessive “buyer satisfaction at 96% for Mac.” For the Mac phase, we replace our forecast of its cargo development based mostly on our PC market projections which present a robust restoration in 2024 by 18.7% attributable to we estimate the market extra shipments totally absorbed as defined in our Intel evaluation, in addition to ASP development based mostly on its 5-year common of -1%, as we see its pricing energy restricted attributable to a scarcity of a stable efficiency benefit regardless of its new M3 chips.

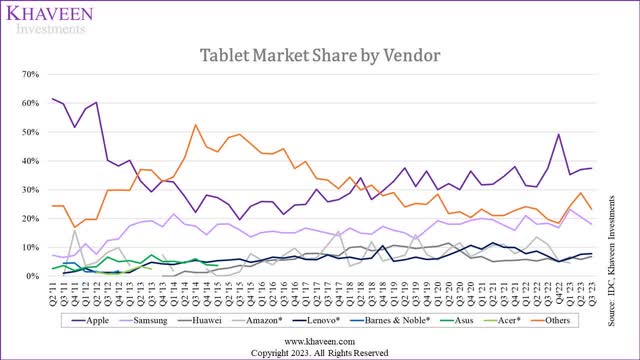

iPad

For its iPad phase, its revenues declined by 3.4% as its shipments declined by 0.7%. In line with administration, iPad income challenges have been attributed to difficult market situations, together with provide disruptions (manufacturing unit shutdowns throughout the earlier 12 months’s June quarter) and troublesome compares from the earlier 12 months. Although, Apple’s market share was pretty secure within the interval. Moreover, in accordance with the IDC, the pill market is forecasted to develop by 4.4% YoY in 2024 as demand improves and extra stock is predicted to ease.

IDC, Khaveen Investments

In Q1 2023, Apple launched new iPad and M2-iPad Professional fashions and highlighted the constructive buyer reception for versatility and design. The corporate additionally emphasised excessive buyer satisfaction “measured at 98% within the U.S. by 451 Analysis.” Moreover, Apple is predicted to be launching new iPad Air fashions in 2024 that are anticipated to supply new options and improved efficiency as highlighted by ZDNet.

The OLED show for the brand new Professional variations will undertake the Tandem design with LTPO (low-temperature polycrystalline oxide) backplanes, the identical backplanes used on the iPhone 15 Professional telephones. Meaning the brand new OLED tablets will outshine the prevailing LED and mini-LED fashions in each show efficiency and energy consumption. – ZDNet.

General, we forecast its cargo development based mostly on the pill market forecast CAGR of 0.3% and ASP development at a 3-year common of -4.2% as we see Apple persevering with to take care of its competitiveness and market place with extra engaging pricing.

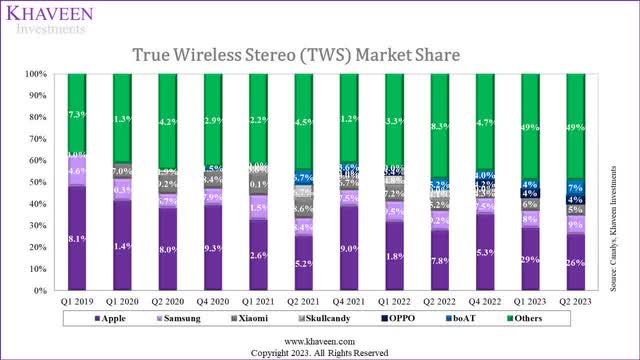

Wearables, Residence, and Equipment

Apple’s Wearables, Residence, and Equipment phase revenues declined by 3.4% YoY in 2023. The phase consists primarily of its AirPods and Apple Watch revenues, which signify round 43% of revenues every based mostly on our estimates in 2023.

Canalys, Khaveen Investments

In wi-fi headphones (AirPods), we estimate its shipments decline by 9.2% based mostly on its prorated Q1 and Q2 cargo development by Canalys. Furthermore, as seen by the chart above of TWS market share shipments, Apple has been on a declining pattern whereas the share of Others has been growing over the previous 5 years. This highlights competitors dangers for the corporate. In line with Canalys, “distributors are dealing with fierce competitors and are struggling to distinguish from their rivals.” Moreover, smaller new entrants are more and more changing into extra aggressive resembling boAT based mostly in India, having the most important inhabitants, and being the market chief there.

Canalys, Counterpoint Analysis, Khaveen Investments

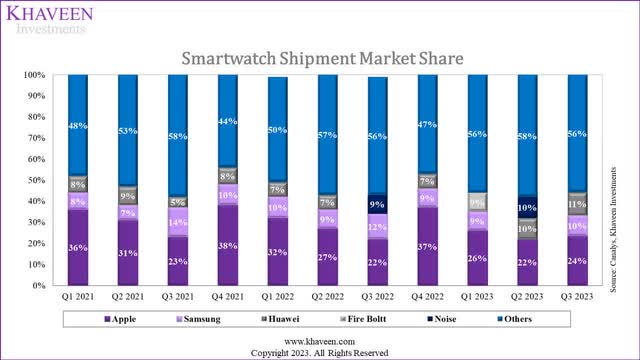

Equally, Apple’s market share of smartwatches has been reducing over the previous 3 years and we estimated its shipments to say no by 2% in 2023 based mostly on its market share development and smartwatch market cargo development of 11% YoY. Counterpoint Analysis highlighted that Apple’s decline is attributable to its “higher-priced Apple Watches” amid the weak client atmosphere. For instance, whereas Apple’s market share decreased, competitor Fireplace Bolt noticed its share achieve over the interval with a less expensive value vary of round $20 to 45 for its smartwatches in comparison with a mean of $396 for Apple. Although, Apple lately launched a number of new Apple Watch fashions with improved options and highlighted its strongest lineup ever for its smartwatches. Additionally, Apple highlighted that almost all of its consumers are new at “2/3 of each purchaser of Apple Watch.”

Apple Watch has turn out to be important in our lives and that is our greatest Apple Watch lineup ever. With the Apple Watch Collection 9 and Apple Watch Extremely 2, we’re giving individuals much more instruments to remain protected and dwell wholesome, energetic lives. With the brand new double faucet gesture, customers can simply management the Apple Watch Collection 9 and Apple Watch Extremely 2 utilizing only one hand and with out touching the show. – Tim Cook dinner, CEO.

In complete, for its Wearables, residence and equipment phase, we forecast its development based mostly on the smartwatch, TWS and sensible speaker market forecast CAGR, however accounted for additional market share losses, at a weighted common of 10.2%.

Companies

Lastly, Companies income additionally slowed down in 2023 at a 9% YoY development. In line with its earnings briefings, administration highlighted the difficult “macroeconomic atmosphere” which impacted the phase development. We up to date our derived breakdown of the Companies phase beneath and projections.

Apple Companies Forecast ($ mln)

2021

2022

2023

2024F

2025F

2026F

Our Earlier Forecast Common

Our New Forecast Common

App Retailer

19,148

19,530

20,025

22,995

26,410

30,337

Progress %

2.0%

2.5%

14.8%

14.9%

14.9%

23.4%

14.9%

Apple Music

8,488

9,337

11,646

13,023

14,566

16,294

Progress %

10.0%

24.7%

11.8%

11.8%

11.9%

44.1%

11.8%

Apple TV

1,497

2,339

4,422

5,574

6,747

7,956

Progress %

56.3%

89.1%

26.0%

21.0%

17.9%

27.5%

21.7%

Apple Information+

1,424

1,319

1,470

1,638

1,826

2,036

Progress %

-7.4%

11.4%

11.5%

11.5%

11.5%

18.3%

11.5%

Different Companies Income

37,870

45,605

47,637

52,344

57,524

63,228

Progress %

20.4%

4.5%

9.9%

9.9%

9.9%

8.7%

9.9%

Complete Service Income

68,427

78,130

85,200

95,574

107,074

119,851

Progress %

14.2%

9.0%

12.2%

12.0%

11.9%

22.9%

12.0%

Our Earlier Forecast

22.8%

22.7%

23.0%

Click on to enlarge

Supply: Firm Information, Enterprise of Apps, Khaveen Investments.

In 2023, its Companies income development is decrease throughout Apple TV and Different Companies income which include merchandise resembling Apple Licensing, Apple Care and iCloud. Nevertheless, Apple had raised pricing for a few of its Companies merchandise resembling Apple Music and Apple TV by 8.7% and 40.1% respectively in 2023 which supported its development. We up to date our earlier forecasts for its Companies phase. In complete, we derived a ahead common of 12%, decrease than the excessive development of twenty-two.9% beforehand. This is because of:

For its App Retailer income, we forecast it to be decrease (14.9% vs 23.4% beforehand) on common based mostly on its 5-year common App income per consumer development (4.5% vs 13.6% beforehand) multiplied with our Apple put in base development projections of 9.9% for a complete of 14.9%. In line with BusinessofApps, App Retailer revenues had stagnated prior to now 2 years as income from Gaming apps had plateaued prior to now 2 years with a development fee of -4.3% amid the gaming market slowdown. Gaming is the most important app class within the App Retailer accounting for 58% of complete app income in 2022. Furthermore, for its Apple Music income, we replace our projections with a ahead common of 11.8% in comparison with 44.1% as its subscriber development had slowed down over the previous 3 years and we forecast its new subscriber development at 11.8% (44% beforehand), which is extra consistent with its previous 3-year subscriber development at a mean of 12%. Moreover, for its Apple Information income, we up to date our forecast for its subscriber development with a mean of 11.5%, in comparison with our earlier forecast of a mean of 18% as its subscriber development had moderated prior to now 3 years (4% common). Although, for its Apple TV phase, our forecast is consistent with our earlier projections as its subscriber development remained robust in 2022 at 56%. For Different Companies income, we up to date it based mostly on our revised projections of its put in base at 9.9%, which is consistent with our earlier projection of 8.7% on common.

Outlook

Apple Income Projections ($ mln)

2023

2024F

2025F

2026F

Our Earlier Forecast (2024F)

iPhone

200.6

213.38

227.00

241.48

208.8

Progress %

-2.4%

6.4%

6.4%

6.4%

4.10%

Mac

29.4

34.50

36.69

37.06

40.3

Progress %

-26.9%

17.5%

6.3%

1.0%

37.30%

iPad

28.3

27.20

26.14

25.13

32.7

Progress %

-3.4%

-3.9%

-3.9%

-3.9%

15.70%

Wearables, residence and equipment

39.8

44.03

48.50

53.25

45.3

Progress %

-3.4%

10.5%

10.2%

9.8%

13.60%

Companies

85.2

95.57

107.07

119.85

104.6

Progress %

9.0%

12.2%

12.0%

11.9%

22.80%

Complete

383.3

414.7

445.4

476.8

431.7

Complete Progress %

-2.8%

8.2%

7.4%

7.0%

12.64%

Click on to enlarge

Supply: Firm Information, Khaveen Investments.

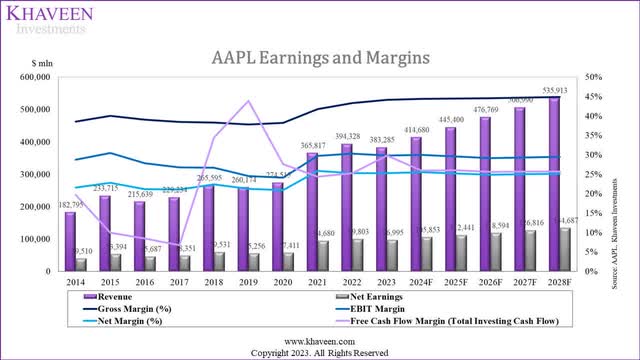

In abstract, we adjusted our income projections and introduced a summarized overview within the desk above. In complete, we see the corporate’s development barely decrease at 8.2% in 2024 (vs 12.6% beforehand). One of many main components is as a result of decrease projections for its Companies phase, it is second largest phase (22% of complete income), which we beforehand forecasted to develop by a decrease development fee of 12.2% (vs 22.8% beforehand) attributable to decrease development throughout App Retailer which had been impacted by decrease spending on Gaming apps, decrease Apple Music subscriber development projections because it had slowed down prior to now 3 years indicating it could possibly be approaching a more experienced development cycle. Furthermore, our decrease and tapered-down Mac and iPad projections additionally weigh on our complete development forecast of Apple as we highlighted its restricted pricing energy attributable to a scarcity of a stable efficiency benefit regardless of its new chips and fierce competitors within the pill market, leading to aggressive pricing cuts by Apple.

Secure and Flattish Margin Outlook

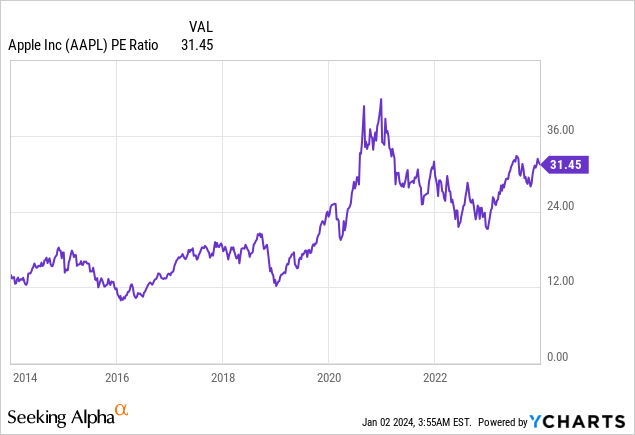

Within the subsequent level, we centered on Apple’s profitability and margin development outlook. As seen within the chart beneath, its P/E ratio has been on an growing pattern over the previous 10 years.

YCharts

SeekingAlpha

SeekingAlpha

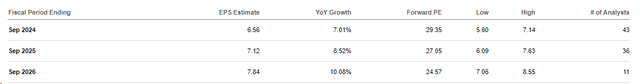

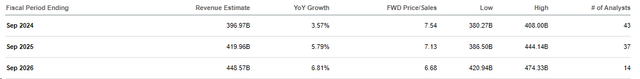

One of many components for its rising P/E pattern could possibly be marginal development expectations. The consensus amongst analysts signifies an anticipated increased development within the firm’s EPS in comparison with its income. Thus, we examined whether or not the corporate’s revenue margins might rise going ahead.

Firm Information, Khaveen Investments

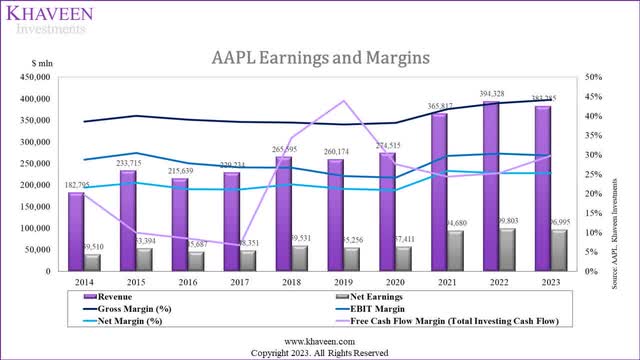

Over the previous 10 years, the corporate’s web margins have elevated, with a notable rise in 2021 as its gross margins rose. Nevertheless, its web margins have been flat. We look at the corporate’s key bills pattern as a % of income with an expense evaluation beneath.

Firm Information, Khaveen Investments

Expense Evaluation (% of Income)

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

Common

COGS (excluding D&A)

57.1%

55.1%

56.1%

57.1%

57.6%

57.4%

57.7%

55.1%

53.9%

52.9%

56.0%

Depreciation & Amortization

4.3%

4.8%

4.9%

4.4%

4.1%

4.8%

4.0%

3.1%

2.8%

3.0%

4.0%

Gross Revenue

38.6%

40.1%

39.1%

38.5%

38.3%

37.8%

38.2%

41.8%

43.3%

44.1%

40.0%

Analysis and growth

3.3%

3.5%

4.7%

5.1%

5.4%

6.2%

6.8%

6.0%

6.7%

7.8%

5.5%

Promoting, basic and administrative

6.6%

6.1%

6.6%

6.7%

6.3%

7.0%

7.3%

6.0%

6.4%

6.5%

6.5%

Different Bills (Earnings)

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

Earnings Earlier than Curiosity & Taxes (EBIT)

28.7%

30.5%

27.8%

26.8%

26.7%

24.6%

24.1%

29.8%

30.3%

29.8%

27.9%

Curiosity

-0.8%

-0.9%

-1.2%

-1.3%

-0.9%

-0.5%

-0.3%

-0.1%

0.03%

0.05%

-0.6%

Different non-operating bills (earnings)

0.2%

0.4%

0.6%

0.1%

0.2%

-0.2%

0.0%

0.0%

0.1%

0.1%

0.1%

Earnings Earlier than Tax

29.3%

31.0%

28.5%

28.0%

27.4%

25.3%

24.4%

29.9%

30.2%

29.7%

28.4%

Tax

7.6%

8.2%

7.3%

6.9%

5.0%

4.0%

3.5%

4.0%

4.9%

4.4%

5.6%

Internet Earnings

21.6%

22.8%

21.2%

21.1%

22.4%

21.2%

20.9%

25.9%

25.3%

25.3%

22.8%

Click on to enlarge

Supply: Firm Information, Khaveen Investments.

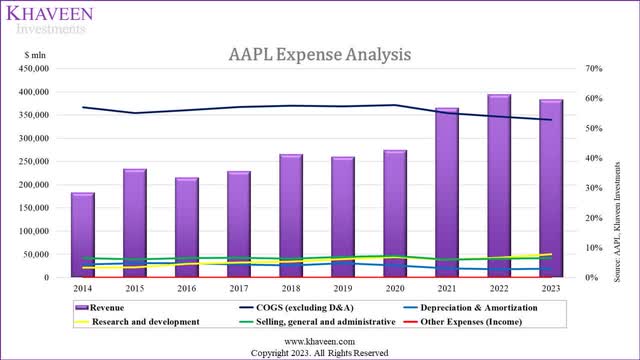

COGS: COGS % of income had been growing from 2014 as much as 2020. Nevertheless, after 2020, it has been declining yearly, from 57.7% to 52.9%. D&A: Earlier than 2020, its D&A % of income had remained secure persistently at a mean of 4.5%. Its D&A % of income after 2020 declined to three% with a previous 3 years common of three%. R&D: There was an upward pattern in R&D over the previous ten years, growing from 3.3% in 2014 to 7.8% in 2023. Notably, 2023 can also be the 12 months with the very best R&D on this interval. SG&A: Its SG&A % of income has been very secure with a previous 10-year common of 6.5%. Curiosity: Its curiosity expense % of income was unfavorable till 2021 as its curiosity earnings was increased than its curiosity bills. Nevertheless, from 2022 onwards, its curiosity expense % of income elevated however solely represented a minor portion or 0.05% of income. Different non-operating expense (earnings): Its Different non-operating expense additionally contributed a minor portion to its bills at solely 0.1% in 2023 with a 10-year common of 0.1% Tax: Its tax bills % of income had regularly declined as a % of income however had stabilized prior to now 5 years with a mean of 4.2%.

We mentioned the 2 main bills together with COGS, which is its largest expense merchandise, in addition to R&D which elevated to its highest prior to now 10 years.

COGS

Beforehand, we forecasted its COGS by first forecasting its complete gross margins, which have been based mostly on our projections for its Merchandise and Companies segments.

For its Merchandise phase, we forecasted its margin to extend based mostly on its 5-year common improve of 0.1% Companies phase, we forecasted it by estimating its prices (value per put in base multiplied by put in base forecasts), subtracted from our Companies income forecasts.

Based mostly on our complete weighted common gross margins, we subtracted our forecasted depreciation to derive our COGS estimates and divided it with our income projections to estimate its COGS % of income. In complete, we forecasted its COGS % of income to say no from 53.1% to 46.7% by 2026 as we beforehand defined attributable to its Companies phase that has increased development and margins than Merchandise.

Apple Gross Margins by Section

2017

2018

2019

2020

2021

2022

2023

Common

Product Income ($ bln)

199.3

227.1

213.9

220.8

297.4

316.2

298.1

Product COGS Estimate ($ bln)

119.3

139.7

134.7

142.3

183.3

192.5

180.6

Product Depreciation Estimate ($ bln)

8.8

9.3

10.3

8.9

9.2

8.9

9.0

Product Gross Margin

35.7%

34.4%

32.2%

31.5%

35.3%

36.3%

36.4%

34.5%

Product Income % of Complete

86.9%

85.5%

82.2%

80.4%

81.3%

80.2%

77.8%

Companies Income ($ bln)

30.0

38.5

46.3

53.8

68.4

78.1

85.2

Companies COGS Estimate ($ bln)

12.2

13.5

14.6

16.1

18.6

19.9

22.0

Companies Depreciation Estimate ($ bln)

1.3

1.6

2.2

2.2

2.1

2.2

2.6

Companies Gross Margin

55.0%

60.8%

63.7%

66.0%

69.7%

71.7%

71.2%

65.4%

Companies Income % of Complete

13.1%

14.5%

17.8%

19.6%

18.7%

19.8%

22.2%

Complete Income ($ bln)

229.2

265.6

260.2

274.5

365.8

394.3

383.3

Complete COGS ($ bln)

130.9

152.9

149.2

158.5

201.7

212.4

202.6

Complete D&A ($ bln)

10.2

10.9

12.5

11.1

11.3

11.1

11.5

Complete Gross Margin

38.5%

38.3%

37.8%

38.2%

41.8%

43.3%

44.1%

40.3%

Click on to enlarge

Supply: Firm Information, Khaveen Investments.

As seen by the gross margin breakdown above, its Merchandise gross margin decreased till 2020 and began rising in 2021. In 2023, its Product margins elevated to the very best within the interval. Furthermore, the corporate’s Service gross margin had elevated till 2022 and was 71.2% in 2023.

Based mostly on the corporate’s annual report, the lower in gross margins for its Companies phase in 2022 was as a result of weakening of foreign currency relative to the US greenback. All of its reportable geographic segments skilled weaker foreign currency in comparison with the US greenback in 2023. The corporate highlighted the chance of selecting to not elevate its worldwide pricing within the occasion of weakening foreign currency for aggressive causes which will have an effect on its gross margins.

Going ahead, we forecast the corporate’s COGS % of income by forecasting its COGS by Merchandise and Companies segments. For Merchandise, we forecast its complete COGS based mostly on our projections of its complete Merchandise cargo development of smartphones, PCs, tablets and wearables and common value per cargo development. Whereas for its Companies phase, we forecast its complete COGS based mostly on our projections of its put in base and price per put in base development.

Margins

2018

2019

2020

2021

2022

2023

2024F

2025F

2026F

Product Section

Income

227.1

213.9

220.8

297.4

316.2

298.1

319.1

338.3

356.9

Progress %

14.0%

-5.8%

3.2%

34.7%

6.3%

-5.7%

7.1%

6.0%

5.5%

Gross Revenue

78.1

68.9

69.5

105.0

114.8

108.6

116.6

124.0

131.3

Gross Margin %

34.4%

32.2%

31.5%

35.3%

36.3%

36.4%

36.54%

36.66%

36.78%

COGS

149.0

145.0

151.2

192.4

201.4

189.5

202.98

216.37

230.06

iPhone Cargo (mln)

217.7

185.2

189.8

239.9

237.1

223.6

229.9

236.3

242.9

iPad Shipments (mln)

43.6

45.1

50.1

59.3

56.7

56.3

56.5

56.6

56.8

Mac Cargo (mln)

18.3

18.4

20.8

26.9

27.4

23.4

27.8

29.8

30.4

Wearables (mln)

61.7

96.6

166.9

145.9

149.5

139.8

154.7

170.8

188.3

Complete shipments (mln)

341.3

345.2

427.6

472.0

470.7

443.1

468.8

493.6

518.4

Common value per product

436.56

420.05

353.62

407.68

427.96

427.76

433.03

438.36

443.75

Progress %

3.8%

-3.8%

-15.8%

15.3%

5.0%

0.0%

1.23%

1.23%

1.23%

Companies Section

Income

38.5

46.3

53.8

68.4

78.1

85.2

95.6

107.1

119.9

Progress %

28.3%

20.4%

16.2%

27.2%

14.2%

9.0%

12.2%

12.0%

11.9%

Gross Revenue

23.4

29.5

35.5

47.7

56.0

60.3

68.0

76.4

85.8

Gross Margin %

60.8%

63.7%

66.0%

69.7%

71.7%

70.8%

71.1%

71.3%

71.6%

COGS ($ mln)

15.1

16.8

18.3

20.7

22.1

24.9

27.6

30.7

34.1

Complete put in base (bln)

1.4

1.5

1.7

1.8

2.0

2.2

2.4

2.7

2.9

Value per put in base

0.011

0.011

0.011

0.012

0.011

0.011

0.011

0.012

0.012

Progress %

3.8%

4.0%

-1.1%

3.9%

-4.0%

2.4%

1.05%

1.05%

1.05%

Product COGS

149.0

145.0

151.2

192.4

201.4

189.5

203.0

216.4

230.1

Companies COGS

15.1

16.8

18.3

20.7

22.1

24.9

27.6

30.7

34.1

COGS (Complete)

164.1

161.8

169.5

213.2

223.5

214.4

230.6

247.0

264.1

Depreciation

10.9

12.5

11.1

11.3

11.1

11.5

11.8

11.8

11.8

COGS (Excluding D&A)

153.2

149.3

158.4

201.9

212.4

202.9

218.8

235.2

252.4

COGS % of income

57.7%

57.4%

57.7%

55.2%

53.9%

52.9%

52.8%

52.8%

52.9%

Click on to enlarge

Supply: Firm Information, Khaveen Investments.

As seen above, for its Merchandise phase, its common value per product had decreased considerably in 2020 as its Wearables shipments elevated as a result of launch of its new AirPods and elevated following the surge in iPhone shipments within the following 12 months of 2021. We forecast its common value per cargo based mostly on its 6-year common excluding each these years. Moreover, for its Companies phase, we up to date our earlier forecast of its COGS based mostly on our put in base development projections for the corporate and common value per put in base based mostly on a 6-year common development. Then, we summed our complete COGS estimates for each segments and subtracted our depreciation forecasts to derive our COGS % income estimates which present it pretty secure with a slight improve to 53.5% by 2026.

R&D

By way of R&D, we beforehand projected based mostly on its 2022 % of the income of 6.7% because it has reached the very best prior to now 10 years. In line with administration, the rise in R&D spending is pushed by components resembling Imaginative and prescient Professional, AI and ML, Apple Silicon and Mac transition. Moreover, the corporate said that some R&D investments contribute to gross margin growth. Moreover, administration said that it plans continued funding in R&D with a give attention to innovation and product growth. In line with MacRumors, there are a number of anticipated product launches in 2024 such because the M3 Mac, Apple Imaginative and prescient Professional, OLED show Mac fashions and new AirPods Professional. Past that, one of many future product developments is the Apple Automobile referred to as “Undertaking Titan” which is predicted to be launched between 2023 and 2025.

Outlook

General, we up to date our forecast for the corporate’s margins with our assumptions for its bills resembling:

COGS: We estimated it to be pretty secure with an estimated % of income of 53.5% by 2026 based mostly on our estimates of its COGS by Merchandise and Companies excluding D&A as defined above. D&A: We beforehand forecasted this based mostly on its 5-year common depreciation & amortization % of mounted property of 5.7%. We continued to forecast it with a 5-year common of 5.7% because it was secure within the interval. R&D: We anticipate its R&D % of income to proceed rising because it focuses on upcoming product developments resembling its Apple Silicon, new product fashions and future product growth resembling Apple Automobile and forecasted to extend by 0.5% per 12 months. SG&A: We beforehand projected it based mostly on its previous 5-year common of 6.6%. In our earlier evaluation, we highlighted the corporate’s branding energy as the highest amongst all smartphone rivals. Thus, we proceed to base our assumption on the identical methodology. Thus, we anticipate it to proceed remaining secure and forecast a 5-year common of 6.63%. Curiosity: We beforehand projected it based mostly on a 5-year common curiosity expense as % of income 0.17% and maintained our forecast because it has been secure within the interval. Different non-operating expense (earnings): We beforehand didn’t account for this in our forecast and now forecast it with a 5-year common of 0.002%. Tax: We beforehand forecasted based mostly on its 5-year common tax bills as % of EBT of 15.2% and proceed to forecast on this approach because it has been secure.

Firm Information, Khaveen Investments

Our Earlier Forecasts

2024F

2025F

2026F

Product Gross Margin

36.42%

36.54%

36.66%

Companies Gross Margin

70.69%

73.57%

76.23%

Gross Margin

45.20%

47.07%

49.20%

EBIT Margin

31.91%

33.79%

35.92%

Internet Margin

27.11%

28.69%

30.49%

Our New Forecasts

2024F

2025F

2026F

Product Gross Margin

36.54%

36.66%

36.78%

Companies Gross Margin

71.10%

71.35%

71.57%

Firm Gross Margin

44.39%

44.53%

44.60%

EBIT Margin

29.96%

29.60%

29.17%

Internet Margin

25.53%

25.24%

24.87%

Click on to enlarge

Supply: Firm Information, Khaveen Investments.

Compared with our earlier forecasts, we modeled decrease margins for the corporate. We modeled its gross margins to solely improve to 44.6% by 2026 (vs 49.2% beforehand). That is as a result of increased COGS % of income of 52.9% in comparison with 46.7% beforehand. One of many essential causes for this is because of our decrease forecasts of its higher-margin Companies phase as we modeled its Companies phase margin to solely improve to 71.6% (vs 76.23% beforehand) primarily as a result of slowdown in development for the phase.

In our earlier evaluation, we believed the sturdy development of its Companies phase with increased margins primarily affected Apple’s total margin development, nonetheless, our revised projections now point out slower development for Companies, impacting our outlook on Apple’s complete margin development. Moreover, we imagine Apple’s pipeline of future modern tasks might additional have an effect on its profitability as we forecast its R&D spending % of income for the corporate by 0.5% per 12 months, impacting its web margins. Thus, we now anticipate Apple’s web margins to stay pretty secure and flattish going ahead, fairly than growing barely in our earlier evaluation.

Enormous Money Pile Helps Inventory Buybacks

Furthermore, we examined the corporate’s FCF technology talents, by analyzing its enterprise mannequin and capex necessities, and the way it might additional help its inventory repurchases going ahead.

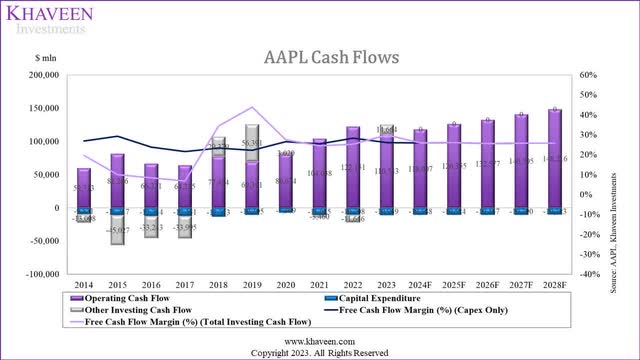

Firm Information, Khaveen Investments

Based mostly on the chart, the corporate’s FCF margins secure (based mostly on capex solely excluding different investing money circulate) have been very with a mean of 25.3% as compared with its FCF margins based mostly on complete investing money flows with a mean of 23.04%. Its FCF margins based mostly on complete investing money flows are extra unstable as a result of firm’s investments in marketable securities. For instance, in 2023, it had a constructive different investing money circulate as its proceeds from marketable securities have been increased than its complete spent. To look at Apple’s FCF technology energy, we examined its capex within the desk beneath.

Capex

Apple Investing Money Stream Evaluation

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

Common

Capex

9,571

11,247

12,734

12,451

13,313

10,495

7,309

11,085

10,708

10,959

Capex % of Income

5.2%

4.8%

5.9%

5.4%

5.0%

4.0%

2.7%

3.0%

2.7%

2.9%

4.2%

Capex % Mounted Property

5.9%

5.6%

5.9%

5.0%

5.7%

6.0%

4.1%

5.1%

4.9%

5.2%

5%

Different Investing Money Stream

13,008

45,027

33,243

33,995

-29,379

-56,391

-3,020

3,460

11,646

-14,664

Different Investing Money Stream % of Income

7.1%

19.3%

15.4%

14.8%

-11.1%

-21.7%

-1.1%

0.9%

3.0%

-3.8%

2.3%

Free Money Stream Margin (%) (Capex Solely)

26.82%

29.22%

23.88%

21.59%

23.41%

22.22%

26.47%

25.37%

28.28%

26.02%

25.3%

Free Money Stream Margin (%) (Complete Investing Money Stream)

19.70%

9.95%

8.46%

6.76%

34.48%

43.89%

27.57%

24.42%

25.33%

29.85%

23.0%

Click on to enlarge

Supply: Firm Information, Khaveen Investments.

As seen above, the corporate’s complete capex % of income is low with a mean of solely 4.2%. Furthermore, the corporate’s capex % of income had declined barely, particularly in 2020 and stabilized with a mean of two.8% of income. Moreover, when it comes to the capex % of mounted property, additionally it is very secure with a mean of 5% within the interval. We imagine the explanation for the corporate’s low capex is that in accordance with its annual report, its manufacturing is carried out by outsourcing companions globally, notably in Asia. In line with BCG, “Apple grew to become asset-light within the late Nineteen Nineties when Tim Cook dinner, then the chief working officer, outsourced virtually all manufacturing.” For instance, Foxconn is Apple’s “essential contractor for the manufacturing of a variety of merchandise, together with iPhones and MacBooks.” Foxconn is the market chief in EMS with a share of 41%. Compared, different Foxconn prospects inside the Tech {Hardware} {industry} even have low capex resembling HP Inc. (HPQ) (1% of income), Dell Applied sciences Inc. (DELL) (2.9%) and Sony Group Company (SONY) (5%). Subsequently, we based mostly our assumptions for its FCF based mostly on its 5-year common % of mounted property of 5%. Moreover, we assumed its days receivable and stock based mostly on its 5-year common and payables based mostly on its 3-year common because it had been secure within the interval.

Inventory Buybacks

Apple Inventory Repurchases

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

Common

Apple Inventory Repurchases ($ mln)

46,158

36,752

31,292

34,774

75,265

69,714

75,992

92,527

95,625

82,981

64,108

Apple Common Inventory Value

20.48

27.10

24.10

35.34

45.06

50.42

93.40

139.03

153.53

170.66

75.91

Common Shares Excellent (mln)

24,491

23,172

22,001

21,007

20,000

18,596

17,528

16,865

16,326

15,813

19,580

Common Market Cap ($ bln)

502

628

530

742

901

938

1,637

2,345

2,506

2,699

1,486

Inventory Repurchase % of Market Cap

9.2%

5.9%

5.9%

4.7%

8.4%

7.4%

4.6%

3.9%

3.8%

3.1%

4.3%

Click on to enlarge

Supply: Firm Information, Khaveen Investments.

With its robust FCFs, Apple capitalizes on it with inventory repurchases. As seen above, its common yearly spending on inventory repurchases is $64 bln. Its shares excellent have been reducing prior to now 10 years. Its common inventory repurchases as % of the market cap had been 4.3%. Administration additionally lately highlighted its “objective of changing into web cash-neutral over time stays unchanged” and had beforehand talked about in Q2 that they “proceed to imagine there may be nice worth” within the firm’s inventory.

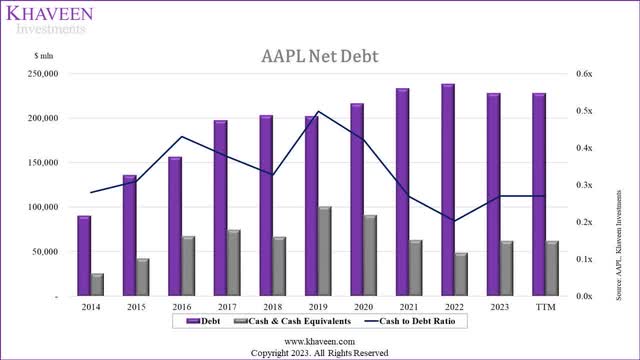

Firm Information, Khaveen Investments

As seen by the chart above of our calculated debt-to-cash (consists of all liabilities besides accounts payable) ratio, it stabilized prior to now 3 years with a mean of 0.2x following a interval of a declining pattern. Nevertheless, Apple highlighted it has web money of $51 bln as of the newest quarter, with complete money and marketable securities valued at $162 bln and complete debt (long-term and short-term borrowings solely) of $111 bln, thus indicating its huge money pile.

As well as, administration authorized one other $90 bln inventory repurchase program in Q2. The introduced inventory buyback licensed of $90 bln is consistent with final 12 months’s determine in 2022 however is 9.8% increased than its precise inventory repurchases of $82.98 bln in 2023.

Given the continued confidence we have now in our enterprise now and into the long run, right this moment our Board has licensed an extra $90 billion for share repurchases as we preserve our objective of attending to web money impartial over time. – Luca Maestri, Senior Vice President and Chief Monetary Officer.

Outlook

Going ahead, we imagine Apple’s asset-light manufacturing mannequin and low capital expenditures help its FCFs and we modeled the corporate’s FCF to stay robust at $107.5 bln and a 5-year ahead common FCF margin of 23.78%. We imagine this might allow the corporate to proceed its observe report of return cashing to shareholders, with a complete estimate of $158.5 bln together with its web money of $52 bln (together with marketable securities). Thus, we anticipate the corporate’s inventory buyback observe report, which has been at a mean % of market cap of 4.3% to proceed, boding nicely for the upside for the corporate and we accounted for this in our up to date valuation beneath.

Threat: Lengthening Smartphone Product Cycles

We proceed to imagine a serious danger for Apple is the smartphone market which accounts for almost all of its revenues (57% of revenues). In our final protection, we emphasised the prolonged lifespan of smartphones, pushed by diminished client upgrades and extended software program help. We projected a low development trajectory for the general smartphone market, with a ahead common of -2.7%. That stated, we imagine Apple’s stable positioning within the higher-growth premium smartphone market, holding a 75% market share might proceed to help its development. Nevertheless, stronger competitors from key gamers resembling Samsung and Huawei’s reentry into the 5G premium smartphone phase might pose a risk to Apple’s dominance.

Valuation

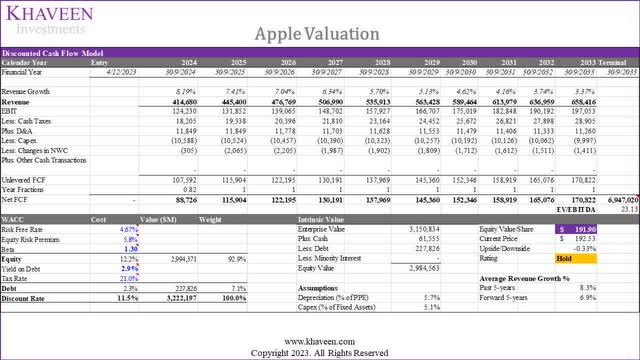

Khaveen Investments

Based mostly on a reduction fee of 11.5% (firm’s WACC) and an up to date weighted common EV/EBITDA of 23.13x, we derived an upside of -0.33%.

DCF Upside

-0.33%

Inventory Buyback Adjustment

4.3%

Complete Upside

3.99%

Value Goal

$200.20

Present Value

$192.53

Click on to enlarge

Supply: Khaveen Investments.

Moreover, we accounted for the inventory buyback in our valuation by including our discounted money circulate (“DCF”) upside of -0.33% with its 10-year common inventory buyback % of the market cap of 4.3% for a complete upside of 4%.

Verdict

In conclusion, we have now revised our income projections, anticipating a barely decrease firm development of 8.2% in 2024 (in comparison with 12.6% beforehand). Key components embrace diminished projections for the Companies phase, notably impacted by decrease App Retailer spending and slowed Apple Music subscriber development. We additionally spotlight constrained pricing energy in Mac and iPad attributable to market competitors. Our adjusted margin forecasts replicate a extra conservative outlook, with gross margins anticipated to achieve 44.6% by 2026 (vs 49.2% beforehand). The Companies phase’s margin is projected to extend to 71.6% (vs 76.23% beforehand) attributable to slowed development. We beforehand believed the Companies phase would considerably affect total margin development, however revised projections point out a extra tempered outlook. Moreover, we anticipate secure web margins as elevated R&D spending offsets potential profitability from modern tasks. Wanting forward, we imagine Apple’s asset-light manufacturing mannequin and low capital expenditures help robust free money flows, estimated at $107.5 bln in 2024 with a 5-year common FCF margin of 23.78%.

We imagine that this positions the corporate nicely to take care of its apply of returning money to shareholders, with an estimated complete of $158.5 bln, inclusive of $52 bln in web money. General, we imagine Apple’s inventory buyback observe report might proceed, averaging 4.3% of market cap, contributing to potential upside for the corporate, factored into our up to date valuation. With a calculated complete upside of solely 4% with an up to date value goal of $200.20 (in comparison with $194.78 beforehand), we downgrade Apple Inc. inventory as a Maintain, because it has reached our value goal following its robust 11.8% rise since our earlier protection.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please concentrate on the dangers related to these shares.

[ad_2]

Source link