[ad_1]

Yves right here. Anti-trust enforcement and authorized restrictions on extra market energy is a very goal wealthy setting. This put up describes how Apple’s new apps retailer plan is designed to avoid the EU’s Digital Markets Act, which comes into impact right this moment. As an app retailer avoider (I see them each the apps and the shops as adware vectors), I’m woefully ignorant as to how awful they’re. Captive audiences permit Retailer house owners to serve their very own want and never care a lot about customers. So there’s a sturdy case for extra suppliers. However can the authorities leash and collar Apple and Google sufficiently for that to occur?

By Jacques Crémer, Professor Toulouse Faculty Of Economics; Paul Heidhues, Professor of Behavioral and Competitors Economics Heinrich-Heine-College Düsseldorf; Monika Schnitzer, Full Professor within the Division of Economics Ludwig-Maximilians College of Munich (LMU); and Fiona Scott Morton, Theodore Nierenberg Professor of Economics Yale College. Initially printed at VoxEU

Article 6(4) of the Digital Markets Act (DMA), which comes into full pressure within the European Union on 7 March, requires Apple to allow third-party app shops to distribute apps on its iOS gadgets. This column evaluations Apple’s scheme to adjust to this requirement and argues that the proposed phrases will block entry and innovation in app shops somewhat than rising contestability because the legislation requires.

The Digital Markets Act (DMA) comes into full pressure within the European Union on 7 March. Article 6(4) requires Apple to allow third-party app shops to distribute apps on its iOS gadgets. After explaining why this requirement is vital, we present that there are good causes to consider that Apple’s proposed method to compliance is not going to meet the targets of the DMA, and likely impede entry by rival shops in addition to stifle innovation.

The Significance of App Retailer Selection

The DMA’s requirement that Apple provide its customers the selection of utilizing various app shops displays the significance of such shops for driving high quality and innovation. In recent times, the variety of apps that customers have been putting in on their handsets has declined. That is the case regardless of the rising variety of functions of all types that make a handset extra helpful. Among the many causes for this decline could possibly be the low high quality of the invention course of and the shortage of innovation in distribution. All apps are distributed by means of one giant monopoly retailer that has restricted performance; discovering an app includes looking by means of hundreds of thousands of apps utilizing the shop’s search perform, the ensuing suggestions are themselves distorted by promoting; and the shop isn’t tailor-made to the wants of explicit apps or customers.

This example isn’t good for both app builders or shoppers. Innovation and retailer selection are wanted. Rival app shops may enhance the consumer expertise in curation and search by carrying solely a subset of apps and providing customers a distinct worth proposition. Rival shops could possibly be run by a big company with a selected enterprise mannequin, reminiscent of Disney in curation of apps for kids, Pinterest in curation of apps for creativity, or American Specific in distribution of apps for frequent travellers. New fashions of shops may spring up – as an illustration, a retailer which might provide a reduction for subscription to a number of on-line newspapers, or a retailer run by a authorities with useful apps for its residents. Rival shops may additionally merely compete by charging decrease charges to builders.

Customers would possibly need to make one such retailer their default whereas multihoming throughout others, or they may even need to single-home on a rival retailer somewhat than use the cluttered legacy retailer run by the gatekeeper. Mother and father could want to give their youngsters quick access to solely a child-centred retailer, as an illustration.

All of those choices characterize innovation, which is a core objective of the DMA, and one which the European Parliament feared was being harmed by incumbent gatekeepers. Enabling efficient entry to third-party shops is designed to extend contestability on the platform with ensuing enhancements in value, high quality, and innovation that may profit finish customers as effectively.

Apple’s Proposed Method to Compliance

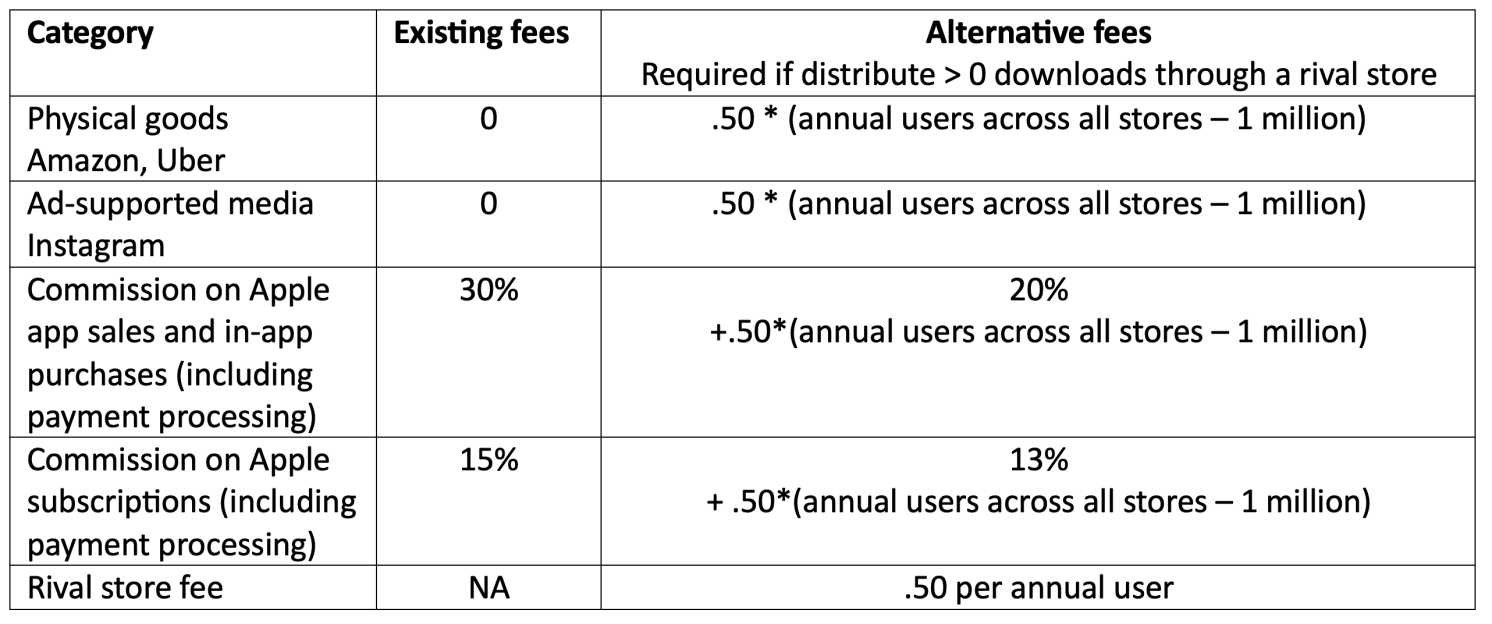

As a part of its normal DMA compliance measures, Apple is certainly opening up its gadgets to entry by third-party app shops at a technical degree. Nevertheless, it has proposed accompanying measures that may considerably hamper the probability and effectiveness of such entry. (We summarise the brand new charges for apps and app shops in Desk 1.)

To grasp the next, you will need to take into accout an vital function of the brand new scheme proposed by Apple. It is going to be doable for app builders to proceed to learn from the identical phrases which are presently supplied by Apple. At first sight, this appears uncontroversial and a great way to make sure that there are not any losers from the introduction of the brand new tariffs. Nevertheless, the previous phrases will solely be out there for apps distributed solely by means of the Apple app retailer. For any app wishing to make use of another app retailer, the brand new tariffs apply. These embrace a minimal payment of, successfully, €0.50 per consumer per yr. As we are going to see, it will usually act to stifle the event of engaging various app shops.

Apple’s phrases may even hinder competitors from ‘proprietary’ app shops: app shops that specialise within the apps produced by one or a small variety of builders. Total, our evaluation signifies that the principle class of app shops that will probably be efficiently created are these which distribute apps that Apple has determined to not carry: playing, pornography, and a few types of unsavoury courting. These entrants could set up a foul popularity for all various app shops within the minds of customers. By blocking the entry of extra optimistic retailer classes, the Apple guidelines severely constrain the trail of innovation, to the detriment of each enterprise customers and finish customers.

Desk 1 Abstract of Apple’s annual charges for big business builders(As we perceive them. Simplified for simpler comprehension.)

The Influence of Apple’s Proposed Pricing Scheme on Builders

To analyse the financial impact of Apple’s pricing scheme, we first take a look at its affect on the incentives of well-liked ‘free’ apps: usually, apps that help off-handset actions or apps which are supported by promoting. Within the first class, we embrace apps which are utilized by corporations like banks, bodily shops, and so forth, to hook up with their clients in addition to apps that promote non-physical items and are due to this fact not topic to the present App retailer payment reminiscent of these of Amazon, Deliveroo, and Uber. Within the second class are content material apps supported by promoting reminiscent of social media and a few new apps reminiscent of Fb, Instagram, and Sky Information.

These apps have by no means paid, and presently don’t pay, any charges in anyway to achieve their finish customers by means of iOS. As mentioned above, it will likely be doable for such app builders to proceed to learn from the identical phrases. Nevertheless, in the event that they select to distribute by means of another retailer they need to select the brand new phrases of the Apple retailer, which in flip means they must pay €0.50 per consumer per yr. Furthermore, this payment is calculated on all installs whatever the app retailer through which the downloads happen. That’s, the app developer should now pay €0.50 for every of the Apple App Retailer customers it beforehand served totally free.

For instance, Deliveroo right this moment pays no charges to Apple to distribute its app on iOS. If Deliveroo solely distributes by means of the Apple App Retailer after 7 March, it may keep on the present tariff and proceed to pay nothing. Suppose, nevertheless, that Deliveroo needs to entry customers in a gaming retailer that has agreed to advertise the meals supply firm in an modern manner. In that case Deliveroo should transfer to the brand new Apple phrases. When Deliveroo presents its app on this rival retailer, the corporate must pay €0.50 for each consumer (after the primary million) that it serves by means of the Apple App Retailer in addition to for each consumer downloading the app by means of the choice gaming retailer. With this scheme Apple has positioned a brand new distribution cost on downloads by means of the Apple App Retailer – however provided that the developer patronises a rival of Apple’s retailer (Scott Morton and Abrahamson 2016).

The Apple pricing scheme successfully implies that any app developer with hundreds of thousands of present downloads will develop into accountable for a really substantial annual payment to Apple the second it decides to work with a rival app retailer. In financial phrases, due to this fact, Apple has ‘taxed’ its rivals’ entry. When a rival app retailer is nascent and has an unsure future, the developer will seemingly not achieve that a lot initially from distributing by means of the shop. Apple’s efficient tax on such well-liked apps utilizing a rival retailer is thus more likely to deter them from doing so.

Worse nonetheless, we perceive that the Apple guidelines stop the developer from returning to the earlier phrases (specifically, zero price of distribution within the Apple App Retailer). Due to this fact, the developer isn’t solely going through a considerably elevated price for its distribution by means of the Apple App Retailer, however one which it can’t reverse – regardless of the numerous threat. The principles due to this fact create a really substantial disincentive for apps which have a big put in base within the Apple App Retailer to even experiment with a brand new entrant.

The Influence of Apple’s Proposed Pricing Scheme on Shops

One can due to this fact predict that these well-liked apps is not going to want to distribute by means of rival app shops. However is that this such an issue? In any case, smaller apps with fewer than a million installs is not going to face the identical disincentive. Aren’t these sufficient these foster entry?

We consider this to be unlikely, and positively an absence of entry to well-liked apps will make entry by a brand new entrant app retailer very a lot more durable. New app shops ¬might want to provide some, and even a number of, of those present well-liked apps to construct credibility, develop, and start to develop their very own community results. We see this phenomenon of needing no less than a number of ‘huge names’ in retail settings the place explicit manufacturers or ‘anchor shops’ play an outsize position in attracting customers. Extra generalist shops will want well-liked apps to create an interesting worth proposition to finish customers, and this will likely even be true for specialist shops. With out the most important social media, finance, e-commerce, and transportation apps, any various app retailer specialising in that enviornment will probably be restricted to catering to very area of interest tastes. On this setting, rival app shops could have a tough time contesting Apple’s monopoly place.

Apple could declare that apps that pay zero in distribution charges to Apple right this moment is not going to be engaging to another app retailer anyway as a result of the charges they’ll cost will must be near zero – which can’t cowl the prices of the choice retailer. This, too, is over-simplistic. In fact, a rival generalist retailer must earn income indirectly. However we’ve got seen that these apps would seemingly convey advantages past any app retailer charges they pay. There can also be the potential for some app shops to enter as a part of a wider enterprise proposition of a much bigger model, and are due to this fact not supposed to be worthwhile in their very own proper. Furthermore, this isn’t Apple’s choice to make; it’s as much as the entrant to decide on its enterprise mannequin and worth proposition, and it ought to achieve this with out interference from the incumbent monopolist.

A part of the problem right here which Apple is exploiting is that the success of third-party app shops is determined by the unbiased decisions of a large group of app builders. In combination, they might achieve from a coordinated transfer to higher-quality and extra modern app shops, since this may permit these app shops to shortly construct their credibility with finish customers and profit from community results. However every developer, appearing alone, is not going to want to make that transfer till others do. And there’s no potential for the ‘winners’ on this course of to subsidise any ‘losers’. Thus, app builders face a coordination drawback. Apple’s pricing scheme exacerbates that coordination drawback, which can in flip favour its personal App retailer. Total, Apple’s guidelines could represent a violation underneath Article 8 of the DMA, as their impact is to avoid contestability in app shops on iOS (Salop and Scheffman 1983).

Lastly, you will need to recognise that underneath Apple’s new enterprise phrases, app builders that presently pay a 30% fee on gross sales of digital items will be capable to entry decrease charges (20%, see Desk 1), or transfer to third-party app shops that compete by providing decrease commissions. Nevertheless, these adjustments will nonetheless set off the €0.50 annual mounted payment per consumer, and thus many such apps could effectively nonetheless be worse off underneath the brand new phrases. That is more likely to embrace many well-liked ‘freemium’ apps which have a big put in base, and presently cowl their prices by upselling in app purchases to a small proportion of these customers. Underneath the brand new phrases, the brand new €0.50 payment per consumer could effectively outweigh the diminished upselling commissions.

Blocking Proprietary Shops

Along with its new pricing phrases, Apple has additionally imposed two direct necessities on the enterprise mannequin of different app shops for which we’re at a loss to discover a justification. Particularly, another app retailer should:

Conform to construct an app whose major function is discovery and distribution of apps, together with apps from different builders.

Agree to offer and publish phrases, together with these pertaining to content material and enterprise mannequin, for apps you’ll distribute, and settle for apps that meet these phrases.

The underlining right here is our personal. These phrases are extremely constraining. The primary requirement prevents the event of proprietary app shops that promote a single developer’s apps. The second prevents the event of rigorously curated app shops (except they’ll formalise all of their curation choices inside printed standards). Each of those classes of app retailer would appear to be helpful improvements that finish customers would seemingly worth. We see no cause why they need to be arbitrarily forbidden, nor can we perceive why it’s respectable for Apple to impose enterprise fashions on various app shops.

Implications for the DMA

Apple’s communications stress the truth that the brand new phrases will probably be beneficial to the overwhelming majority of app builders. It’s because the overwhelming majority of builders are small and pay no charges underneath both algorithm. The issue with the proposed Apple guidelines, as we’ve got proven, is that they’ll block entry and innovation in app shops somewhat than rising contestability because the legislation requires.

For well-liked apps that pay nothing to Apple right this moment, the exclusionary mechanism is simple: the payment construction creates a major new monetary price if these builders select to distribute by means of third-party app shops. With out well-liked apps of their shops, rival app shops can’t entice customers, develop, and supply contestability. The Apple scheme kills the community results of rival shops. By deterring profitable entry of third-party app shops, Apple protects its monopoly place in app shops on the iPhone, the ensuing monopoly earnings, and the management over the trail of innovation.

The DMA is a regulation with the precise targets of contestability and equity. Within the context of app shops, it’s clear that each targets require that third-party app shops can enter and be efficient rivals on gadgets. The tariff introduced by Apple the truth is achieves the precise reverse of the DMA targets by making entry of rival shops commercially unviable as a result of their incapability to draw well-liked apps.

The adoption of this contract by a monopoly distributor in the mean time it’s confronted with entry from rivals seems like anticompetitive conduct. Furthermore, behaviour that dangers blocking the targets of the DMA poses a menace to the legitimacy of European legislation. The textual content of the DMA is obvious: it’s as much as Apple to indicate that its proposal will improve equity and contestability or else abandon the exclusionary parts of the scheme. Fee enforcers should ask the corporate to take action. If they don’t, we concern that the DMA enforcement course of is in danger.

Authors’ notice: Fiona Scott Morton frequently consults for presidency businesses and firms as an financial professional in antitrust and merger circumstances. She is retained for Dr Lovdhal-Gormsen’s opt-out client class motion towards Meta within the UK Competitors Enchantment Tribunal in addition to for Microsoft Company in multi-jurisdictional competitors issues. US purchasers presently embrace SiriusXM, a number of healthcare corporations, and nascent electrical auto makers.Paul Heidhues: Professor of Behavioral and Competitors Economics, Düsseldorf Institute for Competitors Economics (DICE), Heinrich-Heine College of Düsseldorf. Throughout the final three years – in collaboration with E.CA economics – he engaged in competitors consulting within the context of trucking and timber industries, and suggested E.CA on work carried out by E.CA for Apple within the context of a contest case.

References

Salop, S C and D T Scheffman (1983), “Elevating Rivals’ Prices”, The American Financial Evaluate 73(2): 267–71.

Scott Morton, F M and Z Abrahamson (2016), “A unifying analytical framework for loyalty rebates”, Antitrust Regulation Journal 81: 777.

Highlights of the present guidelines

Present payment construction: (https://appleinsider.com/articles/23/01/08/the-cost-of-doing-business-apples-app-store-fees-explained)

Commissions apply solely to digital items and providers that are purchases consumed inside the app. This excludes bodily items, reminiscent of ordering from a market, meals supply, and many others. Apple costs a payment of 30% of the value of apps and of in-app purchases for digital items and providers. For subscriptions, the payment is 30% within the first yr and 15% for subsequent years. The apps should use the Apple Cost system to course of the charges. Builders can apply for an “App Retailer Small Enterprise Program” if their revenues (put up fee) are much less that $1 million per yr, and qualify for a fee of 15%.

Builders pay an annual payment of $99 to take part within the Apple Developer programme, and $299 if the app is submitted for an enterprise or organizstion.

Highlights of the proposed adjustments in response to the DMA

App builders could have the selection between staying within the Apple App Retailer underneath the previous phrases, together with the usage of the Apple Cost System. If builders select this resolution, they don’t seem to be allowed to additionally distribute their apps by means of various shops.

If builders select to remain within the Apple App Retailer underneath new phrases:

The 30% payment is changed by a 17% payment and the 15% payment by a ten% payment, which don’t embrace the usage of the Apple Cost System. App builders will probably be free to make use of or to not use the Apple Cost System. In the event that they do, they are going to be charged a 3% additional cost.

Builders pays a €0.50 core know-how payment (CTF) “for every annual set up per yr over a 1 million threshold”. It must be understood that an improve will probably be thought-about an set up, so we anticipate that in follow apps with greater than one million customers pays €0.50 yearly per consumer over one million, with ‘consumer’ understood in a really huge sense: it’s sufficient that the app is put in on the cellphone, because the cost will apply even when the app is rarely used. Instructional establishments, authorities businesses, and non-profits is not going to pay the CTF.

The selection of the brand new phrases is irreversible.

If a developer chooses to distribute by means of another app retailer:

The app developer will probably be topic to the brand new phrases of the brand new app retailer (marketplaces)

The developer pays the CTF for all apps whatever the retailer by means of which they’re distributed.

Discover that the choice app shops are thought-about as apps and also will be topic to the CTF.

To calculate charges:

Price calculator for apps within the EU – Help – Apple Developer

Various app retailer guidelines:

Getting began in its place app market within the European Union – Help – Apple Developer

This entry was posted in Europe, Free markets and their discontents, Visitor Submit, Authorized, Politics, Rules and regulators, Expertise and innovation on March 7, 2024.

Submit navigation

[ad_2]

Source link

Add comment