[ad_1]

by Rebecca Oi

February 9, 2024

In an period marked by fast technological evolution, the finance operate inside companies stands on the forefront of digital transformation within the Asia Pacific (APAC).

This shift just isn’t merely about adopting new applied sciences; it’s about reimagining the position of finance in driving future enterprise success.

As we delve into the vital position of digital transformation in finance, we draw on complete analysis of HSBC’s research performed by Toluna, which surveyed C-suite or enterprise decision-makers throughout key international markets, together with vital illustration from the Asia-Pacific area.

The indispensable position of digital transformation in finance

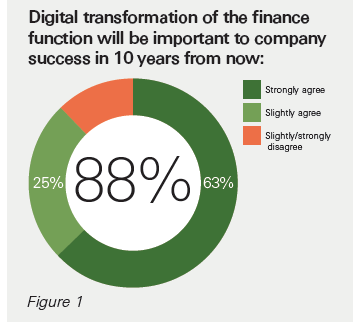

Current analysis performed by HSBC and Toluna titled ‘Digital Horizons,’ surveying 2,900 C-suite executives throughout numerous international markets, together with mainland China, Hong Kong, India and Singapore, reveals a consensus on the vital position of digital transformation in finance for future enterprise success.

These respondents, all key gamers in corporations with annual turnovers starting from US$2.5 to US$50 million and deeply concerned in finance-related decision-making, spotlight the digital crucial in right this moment’s enterprise panorama.

AI, Automation, and Blockchain

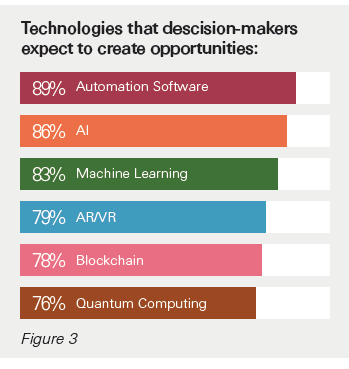

The arrival of AI and automation is about to revolutionise productiveness and effectivity. The HSBC report anticipates dramatic positive aspects in these areas as machines undertake more and more advanced duties.

For example, the fast adoption of OpenAI’s ChatGPT, reaching 100 million customers in simply two months, exemplifies how shortly digital instruments can turn out to be integral to enterprise operations.

Digital transformation in APAC

This digital acceleration suggests a future the place AI and automation streamline operations and unlock new avenues for innovation and development.

Singapore’s vital AI fintech funding, hovering to US$333.13 million within the second half of 2023, is an instance of how digital improvements allow extra environment friendly and inclusive monetary ecosystems on a worldwide scale.

Blockchain expertise additional exemplifies this pattern, providing safe, clear transaction mechanisms that may simplify cross-border monetary actions considerably.

The profitable execution of the world’s first reside repurchase transaction (repo) utilizing a digitally issued bond on a public blockchain by UBS, SBI, and DBS underneath MAS’ Challenge Guardian underscores the transformative potential of blockchain in mainstream monetary practices.

Cybersecurity issues within the digital transformation journey

Integrating applied sciences like AI and blockchain into enterprise processes and monetary transactions heightens the necessity for sturdy cybersecurity measures.

Generative AI (GenAI), whereas providing vital alternatives for innovation and effectivity, additionally presents potential knowledge privateness, safety, and moral use dangers.

The Financial Authority of Singapore’s (MAS) Cyber Safety Advisory Panel (CSAP) has particularly raised consciousness about the advantages and dangers of adopting GenAI within the monetary sector.

As well as, phishing campaigns and knowledge breaches continued to affect Singaporean companies, comparable to monetary providers chief OCBC, Starbucks, Shangri-La, and Carousell. The federal government recognises the rising variety of cyberattacks and is collaborating with the broader trade to boost consciousness.

This means a broader recognition of cybersecurity as a vital concern within the digital transformation journey.

World communication and transactions in a digital period

The survey underscores the rising significance of digital platforms in facilitating international enterprise operations.

Actual-time cost platforms, comparable to India’s Unified Funds Interface (UPI), revolutionise monetary transactions, enabling instantaneous funds and fostering monetary inclusion.

UPI’s success, with over 30 p.c of transactions in India performed by means of this platform, signifies a broader shift in the direction of frictionless, borderless monetary operations. By 2030, it’s predicted that this share will greater than double.

Equally, Brazil’s instantaneous cost platform, Pix, has surpassed conventional credit score and debit card transactions, showcasing the transformative potential of digital cost options.

Nevertheless, the transition in the direction of digital-first enterprise fashions additionally calls for a nuanced understanding of the worldwide regulatory and cultural panorama.

The HSBC research emphasises companies’ have to navigate these complexities, leveraging expertise to foster development whereas guaranteeing compliance and cultural adaptability.

A human-centric method amid technological developments

Regardless of the march in the direction of digitisation, the survey emphasises the irreplaceable worth of human ingenuity.

As companies undertake AI, automation, and blockchain, there stays an unequivocal want for a workforce able to innovation, vital considering, and empathy — qualities that expertise alone can’t replicate.

The survey’s findings additional substantiate this human-centric method: whereas 88 p.c of decision-makers recognise the significance of digital transformation in finance, there’s a urgent want for companies to spend money on upskilling initiatives.

Solely 60 p.c of respondents imagine their corporations are well-prepared for the emergence of latest applied sciences, indicating a big hole in readiness that should be addressed by means of complete coaching and growth applications.

The technological transformation additionally necessitates a sturdy give attention to coaching and upskilling, with the fast evolution of expertise demanding that the workforce not solely adapts however thrives.

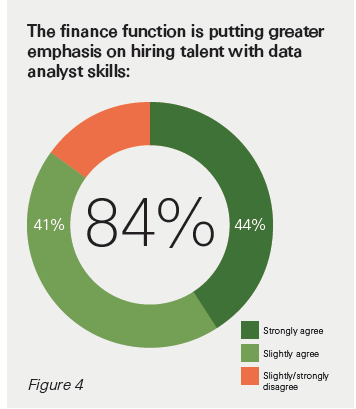

The survey reveals a proactive stance amongst companies, with 84 p.c emphasising the rising significance of knowledge analyst abilities inside finance roles, pointing in the direction of a strategic shift in expertise growth to fulfill future calls for.

Digital transformation in APAC

The trail towards digital transformation just isn’t with out its challenges. The survey identifies key areas of concern for companies, together with knowledge safety dangers, the price of funding in new methods and platforms, and integrating new applied sciences into current workflows.

Moreover, the readiness hole poses a big problem, with a substantial proportion of companies feeling unprepared for the digital future.

Placing a steadiness for future success

The HSBC and Toluna survey paints a transparent image of the longer term: digital transformation in finance isn’t just a pattern however a basic shift in how companies function and compete.

Integrating AI, automation, and blockchain guarantees redefining operational effectivity, strategic decision-making, and aggressive benefit.

Nevertheless, this technological evolution doesn’t diminish the significance of human expertise. Quite the opposite, it amplifies the necessity for companies to foster an atmosphere the place expertise and human ingenuity coexist and complement one another.

By specializing in digital transformation whereas nurturing their workforce’s creativity, adaptability, and collaborative spirit, companies can navigate the challenges of the digital age, guaranteeing success and sustainability within the years to come back.

[ad_2]

Source link