[ad_1]

The absence of a Santa Claus rally has traditionally preceded disappointing years for the S&P 500.

However, nevertheless, analyzing previous annual returns reveals that sturdy good points are sometimes adopted by common constructive years.

Whereas the Tech sector hits new highs, the market’s development stays bullish, however a reversal might be signaled by a collapse in Nasdaq and Russell 2000.

Seeking to beat the market in 2024? Let our AI-powered ProPicks do the leg give you the results you want, and by no means miss one other bull market once more. Be taught Extra »

Santa Claus did not make it on time final yr because the market did not rally within the closing week of the yr. Traditionally, this precedes the start of a disappointing yr for the .

So, we’d surprise: What occurs after a yr of constructive efficiency?

What lately occurred in 2022, following the constructive efficiency of 2021 (+28%), was a damaging yr (-18%). In truth, as in life, we do not often suppose that one thing damaging will occur after a greater than constructive interval.

However sturdy good points do not final lengthy; each investor ought to contemplate the danger of downturns when markets are doing effectively and proceed to rise an excessive amount of.

Can S&P 500 Register Consecutive Constructive Years?

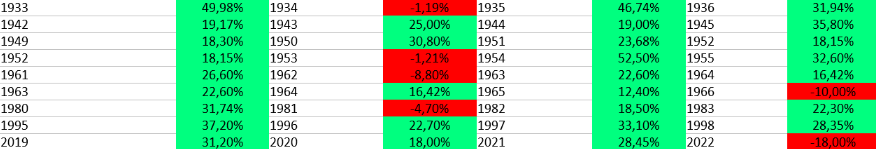

Wanting on the previous annual returns of the S&P 500, I’ve recognized the occasions when the market recorded double-digit good points and the efficiency of the subsequent three years.

As may be glimpsed from the chart, it typically occurs that glorious efficiency is adopted by as many common constructive years.

The intervals recognized, spanning 40 years of inventory efficiency, signify 35% of the occasions when a double-digit constructive yr was adopted by a mean constructive three-year interval, apart from just a few.

However there isn’t a must go too far again; the inventory market has had consecutive good years lately. The five-year interval from 2019 to 2023 has seen returns of +31%, +18%, +28%, -18% and +26%.

So what we will infer from this information is that 60% of the time the nice years are adopted by an equally good yr, 30% of the time it’s adopted by a double-digit constructive three-year interval, and 40% of the time the next yr closed with a mean lack of 4%.

That is decisive if we give attention to the brief time period, the place new traits may be born or current ones strengthened, making equities each exhilarating and unstable on the identical time. Most of the time, long-term returns are the one ones that matter.

In the intervening time, the Tech sector (NYSE:), which accounts for nearly 1/3 of your complete S&P 500, has reached new highs.

A damaging sign that might arouse bearish suspicions can be the breaking of earlier highs (across the 175 space), the restriction of the 50 and 200 shifting averages, and the breaking after which closing beneath the previous (50).

However in the meanwhile, from a medium-term perspective, we must always spend extra time on the lookout for Purchase shares, not on the lookout for Quick going in opposition to the development.

Is the Market Pattern Nonetheless Bullish?

A market reversal can be signaled by the collapse of and , adopted by the outperformance of client items (NYSE:) relative to the S&P 500.

If client items go on to recuperate the lows of 2021 after which past, this might point out a potential rotation towards extra defensive shares and a much less aggressive atmosphere.

Additionally, a probably stronger greenback would trigger shares to return underneath growing promoting stress.

A restoration of the greenback above 102, and a return above the 50 common, would possible verify a extra defensive investor bias. A rally to the 105 space might be the strongest sign that may give a bearish outlook to equities.

The development in the meanwhile stays bullish and our methods are primarily based on an objectively constructive atmosphere whereas a bearish view would most likely fare higher within the state of affairs assumed above.

It is very important be certain that to determine all of the solutions within the coming weeks.

***

In 2024, let laborious selections turn out to be straightforward with our AI-powered stock-picking software.

Have you ever ever discovered your self confronted with the query: which inventory ought to I purchase subsequent?

Fortunately, this sense is lengthy gone for ProPicks customers. Utilizing state-of-the-art AI expertise, ProPicks supplies six market-beating stock-picking methods, together with the flagship “Tech Titans,” which outperformed the market by 670% during the last decade.

Be a part of now for as much as 50% off on our Professional and Professional+ subscription plans and by no means miss one other bull market by not figuring out which shares to purchase!

Declare Your Low cost Immediately!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, counsel or suggestion to take a position as such it isn’t supposed to incentivize the acquisition of property in any method. I want to remind you that any sort of asset, is evaluated from a number of factors of view and is extremely dangerous and due to this fact, any funding determination and the related threat stays with the investor.

[ad_2]

Source link