[ad_1]

KikoStock/iStock by way of Getty Pictures

Introduction

Aris Mining (NYSE:ARMN)(TSX:ARIS:CA) is a quickly rising mid-tier gold producer with operations primarily targeted in South America. The corporate operates the Segovia and Marmato gold mines in Colombia. It additionally owns the Toroparu growth undertaking in Guyana. Moreover, Aris holds a 20% curiosity (with an possibility to extend possession to 50%) within the world-class Soto Norte undertaking, additionally situated in Colombia.

The corporate has a market capitalization of $450 million and simply over $350 million in debt. It additionally has $200 million in money. The enterprise worth is due to this fact round $600 million. Contemplating that Aris generated $75.4 million in free money movement in 2023, from the manufacturing of 202,940 ounces at an AISC (all-in sustaining price) of $1,173/oz, the corporate seems to be undervalued.

Rising manufacturing profile

Aris seems even cheaper when one takes into consideration its progress potential. Actually, the overwhelming majority of the free money movement generated in 2023 was allotted in the direction of funding the assorted progress initiatives pursued by the corporate, totaling $84.2 million.

There are two main ongoing initiatives geared toward attaining an bold objective of reaching an annual manufacturing of 500,000 ounces by 2026, greater than double the present steering for 2024.

The primary initiative is the Marmato Decrease Mine growth. Aris is already working the Marmato Higher Mine. Each are situated within the Marmato gold district in Colombia’s Caldas division. This mountainous area has a wealthy historical past of gold mining relationship again to pre-Colonial occasions. Actually, the gold from the Marmato area mines was used as collateral by Simon Bolivar to safe funding from British banks through the conflict of independence within the 1800s.

The Marmato Higher Mine, in operation since 1993, is a historic mine that sadly has change into comparatively small and expensive. With an annual manufacturing of round 25,000 ounces, its mineralization is restricted to slim veins, leading to excessive manufacturing prices attributable to its small-scale and labor-intensive nature.

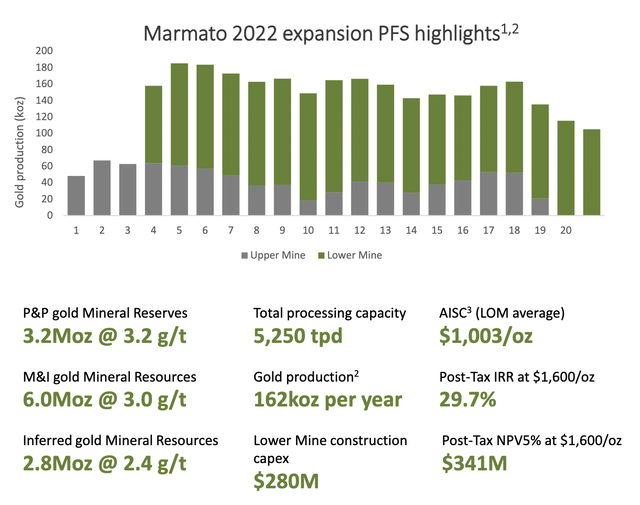

Nonetheless, the brand new Decrease Mine will faucet into wider porphyry mineralization and is predicted to considerably enhance complete manufacturing to 162,000 ounces per 12 months, with a projected mine lifetime of 20 years. All permits for the Decrease Mine had been obtained in July 2023, and engineering work commenced in Q3 2023.

Firm’s Presentation

The event of the Marmato Decrease Mine comes with a big price ticket, estimated at $280 million, which incorporates the development of a brand new 4,000 tonnes per day processing facility. To cowl a portion of those prices, Aris Mining has entered right into a stream financing settlement with Wheaton for $122 million, whereas the remaining funding will likely be sourced from internally generated money movement.

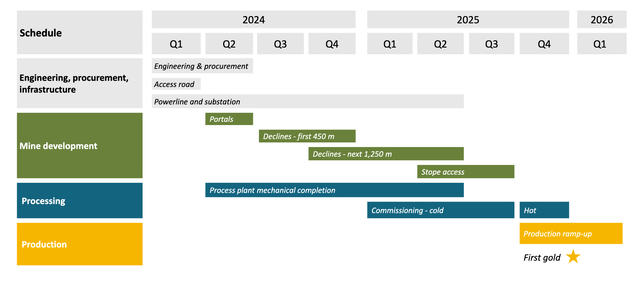

Regardless of the bills, the potential advantages are substantial. In response to the November 2022 Technical Report, the all-in sustaining price (AISC) is projected to be round $1,000/oz. Nonetheless, contemplating the price will increase skilled by many gold miners since then, together with the strengthening of the Colombian peso in opposition to the greenback, it’s prudent to regulate this determine for inflation and overseas trade actions. Taking these elements into consideration, a extra real looking estimate could be roughly $1,200/oz. Nonetheless, given the present sturdy gold costs, the Marmato undertaking has the potential to generate a powerful $125-$150 million in annual free money movement. First gold manufacturing is anticipated in This autumn 2025.

Firm’s Presentation

The second progress initiative, whereas smaller in scale and value, remains to be vital. It includes increasing the Segovia processing plant by 50%, from 2,000 tpd to three,000 tpd. The remaining capital expenditure for this growth is barely $11 million, and it’s anticipated to be accomplished in early 2025. The ramp-up course of will happen within the second half of 2025, enabling a rise in annual manufacturing at Segovia from roughly 200,000 ounces to 300,000 ounces.

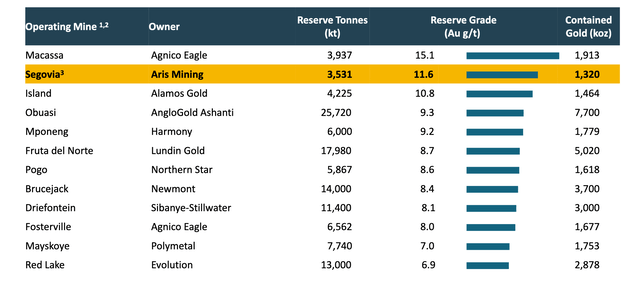

The choice to increase capability at Segovia was pushed by the substantial enhance in mineral assets and reserves, as introduced in November 2023. Aris Mining efficiently elevated the mineral reserves at Segovia by a powerful 75%, leading to a complete of 1.3 million ounces of gold with a mean grade of 11.63 grams per tonne. This positions Segovia as one of many world’s highest-grade gold operations. Based mostly on the present working profile, the up to date estimate has prolonged the mine life primarily based on reserves alone to almost seven years.

Firm’s Presentation

Causes to take a position: succesful administration, strong technique, distinctive belongings

There are a number of the reason why I discover Aris Mining interesting. Firstly, I’ve nice confidence within the administration crew. Aris Mining was fashioned by way of a merger between Aris Gold and GCM Mining. Though I had reservations about GCM Mining, the merger resulted within the firm adopting the identify and, extra importantly, the administration crew from Aris. This crew contains Ian Telfer because the Chair of the Board of Administrators and Neil Woodyer because the CEO. Ian Telfer beforehand served because the Chairman of Goldcorp (now Newmont), whereas Neil Woodyer was the founder and CEO of Endeavour Mining. This crew has a powerful monitor document of making worth for shareholders and are skilled mine builders. Moreover, insiders maintain a 6% stake within the firm, highlighting their alignment with shareholders.

Secondly, I’ve confidence within the firm’s strategic strategy. Contemplating their portfolio, it is sensible to make the most of internally generated money movement, together with a mix of financing choices, to drive aggressive manufacturing progress. The corporate’s medium-term goal of attaining 500,000 ounces could be completed by way of the event of the Marmato Decrease Mine and the Segovia growth. Trying additional forward, their long-term goal is to change into a number one producer of 1 million ounces. This may doubtless contain the pursuit of two further large-scale tasks.

Soto Norte: a high-grade, low-cost gold-copper undertaking

Aris Mining additionally holds a 20% curiosity within the Soto Norte gold-copper undertaking, with plans to increase this stake to 50% within the close to future. Soto Norte is an distinctive asset and ranks among the many largest undeveloped underground gold tasks globally. It boasts measured and indicated mineral assets of 8.5 million ounces at a grade of 5.5 grams per tonne. In response to the 2021 feasibility research, the undertaking has the potential to maintain an annual manufacturing of 450,000 ounces at an all-in sustaining price (AISC) of $471 per ounce.

Regrettably, the undertaking has confronted delays attributable to allowing points. Nonetheless, I stay optimistic that the required permits will ultimately be obtained, permitting the undertaking to maneuver ahead. One key benefit is the robust partnership with Mubadala Funding Firm, the sovereign wealth fund of the Emirate of Abu Dhabi, which holds the remaining curiosity within the undertaking.

Toroparu: greenfield undertaking in Guyana

Along with the Soto Norte undertaking, Aris Mining additionally possesses the Toroparu gold undertaking, situated in western Guyana. Toroparu holds measured and indicated mineral assets of 5.4 million ounces at a grade of 1.5 grams per tonne. Presently, the undertaking is within the early phases of growth, and the corporate is targeted on optimizing street entry routes and different website infrastructure.

Dangers

Whereas Aris Mining exhibits distinctive progress prospects within the close to and medium time period, you will need to think about among the related dangers.

Though Colombia is taken into account a comparatively mining-friendly jurisdiction in comparison with different South American nations, it doesn’t fall underneath the Tier 1 jurisdiction class for my part.

Aris Mining’s capital construction, partly inherited from GCM, is sort of complicated, and includes numerous lessons of warrants. An vital truth to bear in mind is that the present variety of issued shares in circulation is 138 million, with a further 51.6 million shares that could be issued upon the train of warrants and choices, leading to a completely diluted share rely of roughly 190 million.

Additionally it is price noting that 44% of the manufacturing at Segovia comes from ore sourced from companion operator miners, who’re artisanal and small-scale miners. These miners present the ore, which is then processed by Aris Mining in trade for a payment. This payment is calculated as a set share of the gold value per ounce in {dollars}.

Which means that, on one hand, the association permits Aris Mining to safe a set margin from these gross sales. However, it reduces their publicity to fluctuations in gold costs. As the value of gold will increase, the all-in sustaining price (AISC) may also rise proportionately.

Conclusions

The 12 months 2023 was a transition 12 months for Aris Mining. The corporate is on monitor to greater than double its manufacturing by 2026 to 500,000 ounces. Trying even additional forward, the objective is to realize a manufacturing stage of 1 million ounces by way of a strategic mixture of mergers and acquisitions, brownfield tasks, and greenfield alternatives.

2024 may also be in some ways a transition 12 months. Manufacturing is predicted to be between 200,000 and 220,000 ounces at an all-in sustaining price of between $1,122 to $1,325 per ounce at Segovia, and between 20,000 and 25,000 gold ounces at Marmato. Free money movement technology will likely be robust, however will likely be largely absorbed by the development of the Marmato Decrease Mine.

The growth at Segovia is anticipated to be accomplished by mid-2025, whereas Marmato is predicted to achieve its goal manufacturing price by early 2026. Consequently, it’s going to take roughly two years for Aris Mining to realize its goal of turning into a 500,000-ounce producer. This timeline permits buyers ample alternative to build up a place. Paying $600 million for a future 500,000 ounces low-cost producer actually seems like a cut price.

[ad_2]

Source link