[ad_1]

A stockphoto/iStock by way of Getty Photos

Since my preliminary writeup of Asana (NYSE:ASAN) inventory, fundamentals stay challenged with intense competitors and the funding thesis is solely uncompelling.

To entertain the bull case, Asana is likely one of the class leaders within the work administration class, has repeatedly invested into product improvement for brand spanking new platform options (together with AI-driven options), and has created new pricing packages to drive income development. Moreover, Asana boasts its robust buyer adoption, its capability to upsell into greater pricing tiers, and naturally, its excessive internet retention charges. In October 2023, Asana supplies a 110 slide investor presentation that detailed the corporate’s platform, packaging choices, long-term outlook, monetary targets, and so forth. Total, the typical investor would conclude that Asana will beat the competitors and supply stable long-term returns. Nevertheless, I stay skeptical that would be the case right here.

Now onto the extra worrisome components in the Asana story. On slide 88, administration states that the whole addressable market (“TAM”) will improve from $45 billion in 2023 to $79 billion in 2027. Whereas development is central to the funding thesis, every time firms cite huge TAM figures, traders must put their skeptical hats on. Let’s have a look at how the “collaborative functions” complete addressable market is outlined. IDC’s collaborative functions is described to embody “staff collaboration functions, enterprise neighborhood functions, conferencing, digital occasions, and electronic mail functions.” To what extent does Asana present conferencing, digital occasions, and/or electronic mail options? Asana’s core focus is actually centered round staff collaboration functions, whereas the opposite classes appear to be much less of the target market. Put one other approach, are clients going to make use of Asana for video conferencing or electronic mail, like they might use Zoom, Microsoft groups, Microsoft Outlook, and so forth.? My guess might be not. In fact Asana can present integrations, however truly providing the core product to meet the enterprise want is a crucial distinction. So traders ought to take into account that when assessing TAM potential right here.

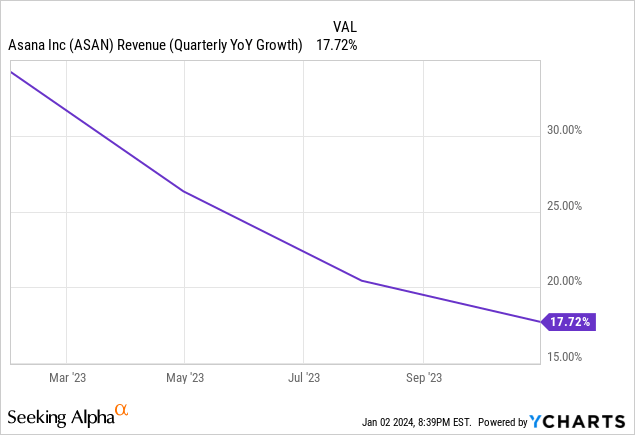

My second concern is that administration estimates the TAM is predicted to develop by 15% CAGR over the subsequent 4 years. That is an attention-grabbing determine as a result of Asana’s Q3 2023 earnings reported internet income development was 17.7%, which continues to be above market, however is quickly decelerating in comparison with prior quarters. So traders ought to be aware of ASAN’s quarterly income development and if it slips beneath that 15% threshold as a result of that is a possible indication it might be underperforming the typical development price of the trade.

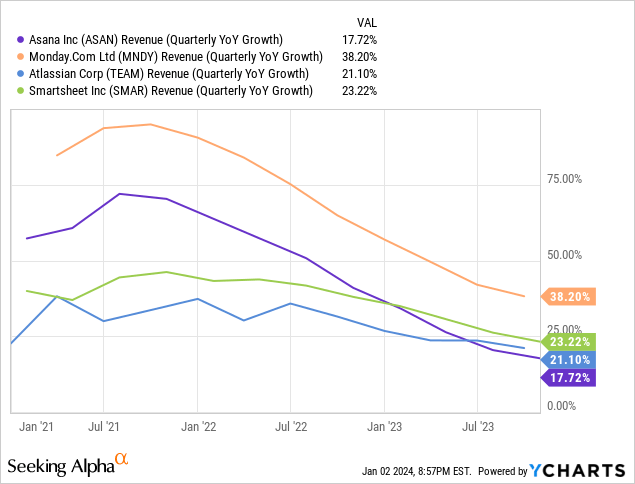

Furthermore, for an organization that has almost $700 million in annualized income, or 1.5% of its TAM, it is a bit of stunning to see such a fast deceleration in income development. One thing is occurring, and my take is that it is stiff competitors. 4 direct rivals, all have skilled a big drop off in income development over the past three years:

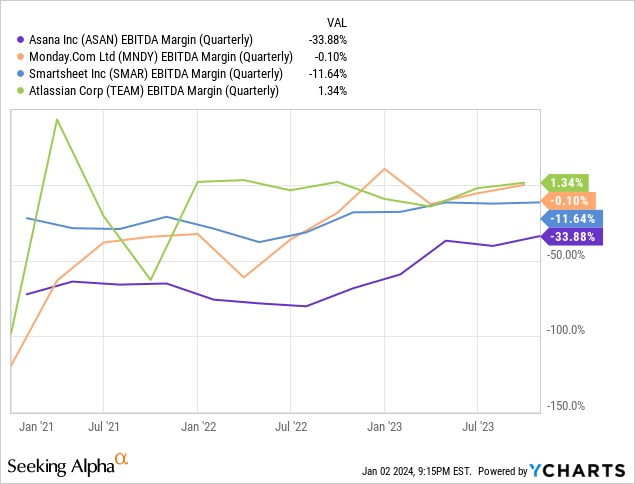

In fact, ASAN’s current buyer base plus incremental alternative mixed with their new pricing packages affords development runway, however the price of development is a priority relative to the estimated trade common. So both the aforementioned elements are sufficient to reinvigorate development, or the corporate might want to increase gross sales & advertising and marketing, and so forth. Clearly there are differentiators between work administration platforms as Asana has outlined (see slide 55), however Asana is the worst positioned among the many 4 listed above concerning its P&L. It has the smallest annualized income base, the weakest margins, and the worst free money stream profile. Put merely, ASAN goes to have the least capital sources accessible to push development relative to its bigger friends, and this comes at a time when Asana is making an attempt to be extra price disciplined.

Then turning to the Q3 2024 earnings name, analyst Pat Walravens of JMP Securities drew consideration to administration’s point out of development headwinds throughout the interval. CFO Tim Wan responded by describing strain of their internet growth charges and total weak spot being tied to the Americas:

I believe we’re nonetheless seeing strain on renewals. So, I believe there’s compression sort of in our internet growth charges, that is one. And I do assume we’ll lap these by the tip of Q1, primarily as a result of we do — like in case you sort of look again at layoffs in tech, there have been various massive firms that had been nonetheless doing layoffs originally of Q1. And I believe as soon as we sort of get by that interval, I believe we’ll have some extra tailwinds in our NRR.

The opposite piece, clearly, is I believe just like the areas that I spoke about which can be performing, EMEA and APAC, these have been good surprises, however I believe we nonetheless have extra work to do in Americas.”

There have been lingering know-how layoffs, which is legitimate. Nevertheless, Mr. Wan appears to counsel that with out that drag, then development ought to revert. Will probably be attention-grabbing to see if that performs out. Bear in mind, even with these software program improvement layoffs, total U.S. employment continues to be trending in any respect time highs and but all 4 firms reported decrease development. It is potential that this might be much less of a macroeconomic pattern and extra of an trade pattern. Regardless of the case is for the expansion weak spot, it occurred, ASAN’s income development pattern has been steadily deteriorating.

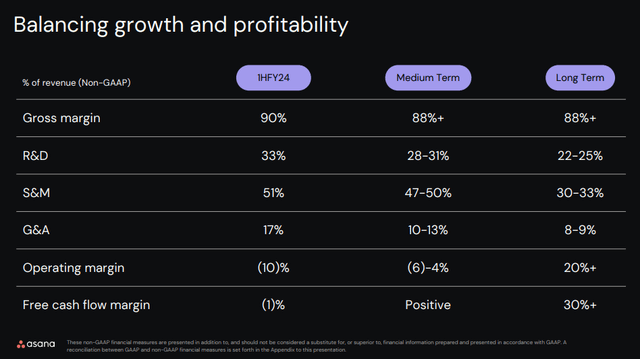

Final and most regarding of all, ASAN has said that it’s focusing on long-term working margins of 20%+ and free money stream margins of 30%+, as proven beneath. Fairly frankly, I do not even perceive how an organization can sustainably obtain free money stream margins in extra of its working margins when contemplating taxes. Extra importantly, ASAN has to work its approach up from a -38% working margin to twenty%, which is able to take a really very long time, if it is even achievable. For context, Apple Inc. (AAPL), among the many most worthwhile firms within the U.S., sports activities a TTM working margin of 30% and free money stream margin of 26%. So once more, for a software program platform, that is fairly the hurdle.

Asana Investor Day 2023 Slide 97 (Asana Investor Day 2023 Presentation)

Backside Line

Asana is experiencing development challenges pushed by intense competitors, which is rising quicker. Until the corporate’s development price stabilizes, administration can have problem enhancing margins with out implementing price reducing measures. Sadly, I imagine the bull thesis stays weak and traders ought to nonetheless keep away from ASAN shares. Thanks for studying and please remark beneath.

[ad_2]

Source link