[ad_1]

JHVEPhoto

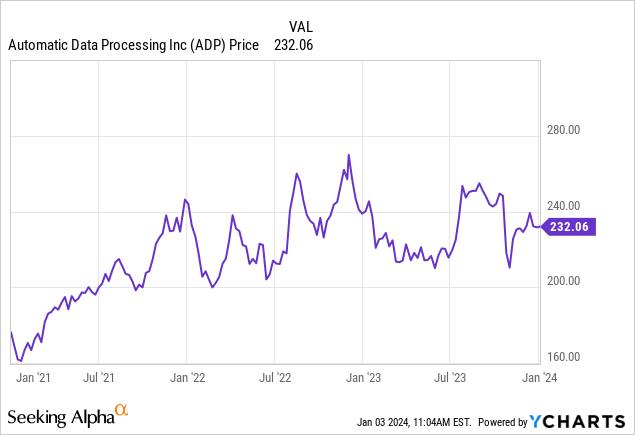

My goal with this thesis is to spotlight Computerized Knowledge Processing’s (NASDAQ:ADP) diversification technique along with its potential to persistently hike dividends as positives for the inventory going into 2024. On prime, it has AI potential too, and trades at round $232 which is beneath its December 2022 excessive of $269.9 by over $36 as per the chart beneath. The worth efficiency covers a three-year time horizon together with 2022, when the Federal Reserve hiked rates of interest at an unprecedentedly aggressive tempo, with the other anticipated for this 12 months, presumably with three cuts.

The inventory stays overvalued primarily based on metrics from the economic sector, however, a extra exact comparability of the monetary efficiency with Paycom (PAYC), one other cloud-based payroll service supplier helps to indicate ADP’s upside potential.

I begin by analyzing demand which now relies upon extra on cyclicality, along with the secular development of outsourcing versus do-it-yourself as firms focus on core operations whereas navigating by way of an more and more advanced company world.

A Nuanced Demand Atmosphere for HCM

First, cyclicality is expounded to the consequences of macroeconomic modifications on firms, and at present, the discuss is usually about high-interest charges and rising borrowing prices. This in flip makes monetary situations tougher for corporations with unhealthy stability sheets which face greater dangers of changing into bancrupt. On this case, in accordance with Danyal Hussein, talking throughout an investor convention on November 16, whereas demand is extra nuanced than it was previously a number of quarters, two key metrics, specifically chapter charges and new enterprise formations stay wholesome, auguring effectively for ADP.

One other reasonably supporting issue is the comparatively excessive wage inflation which reduces the recruitment urge for food of ADP’s prospects thereby making them extra prone to depend on the outsourced payroll companies. Nonetheless, ADP’s monetary efficiency stays related to GDP development, and with the U.S. economic system anticipated to decelerate this 12 months in comparison with 2023, demand is predicted to development softer and can be conditional to a tender touchdown which is an financial state of affairs the place a recession is prevented.

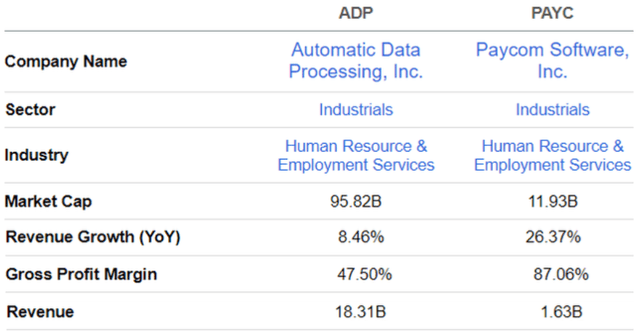

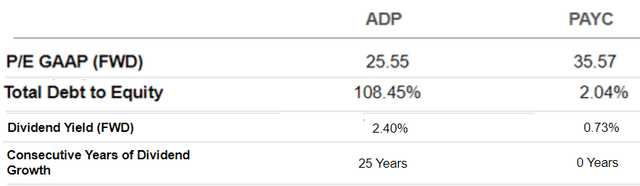

Specializing in the HCM (Human Capital Market), it may be envisioned as consisting of three tiers, the excessive, mid, and low finish the place there may be competitors each from personal suppliers and publicly listed ones like Paycom. Right here, its superior gross margins in comparison with ADP as proven within the desk beneath, have a tendency to point that almost all of its purchasers are comparatively “bigger manufacturers”, a reality confirmed by a USA At the moment report. These are inclined to generate extra earnings for Paycom due to extra cross-selling alternatives throughout the identical buyer base. Additionally, its greater income development signifies that it has leveraged on extra commoditized merchandise, such because the “Beti do-it-yourself payroll” for purchasers whose personal workers carry out payroll.

www.seekingalpha.com

However, ADP’s decrease margins have a tendency to indicate that it has “broadened its publicity” through the years to incorporate extra small to midsize corporations. Thus, its advertising and marketing staff has to work tougher to drive gross sales from a comparatively bigger variety of corporations, leading to decrease gross sales per buyer and profitability, however that is altering as I additional elaborate upon later. As for ADP’s decrease development, that is principally defined by its incumbent place and a income degree that’s already over ten occasions its peer as proven above.

ADP Affords A Extra Diversified Method and Dividend Development

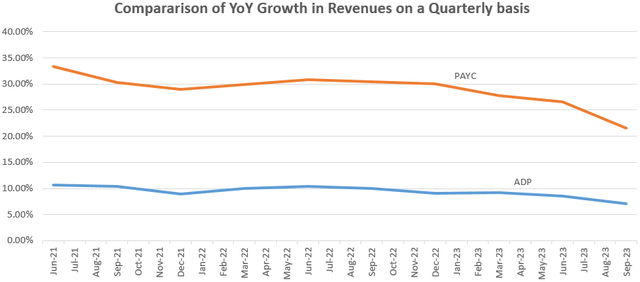

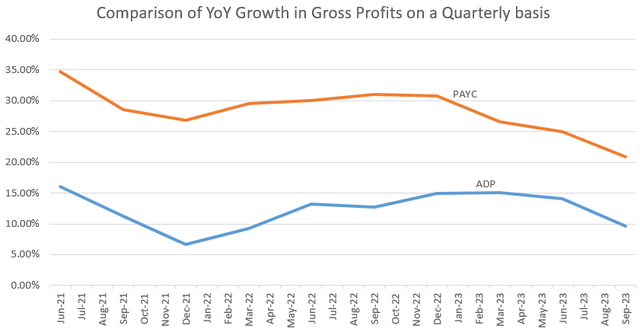

Now, it’s exactly this broader publicity or extra diversified strategy that has helped it to mitigate the consequences of uncertainty as seen by its comparatively flatter YoY income decline from June 2021 to September 2023 as pictured within the blue chart beneath. In distinction, Paycom has suffered from a steep decline in YoY quarterly income development as proven in orange.

Charts Constructed utilizing information from (seekingalpha.com)

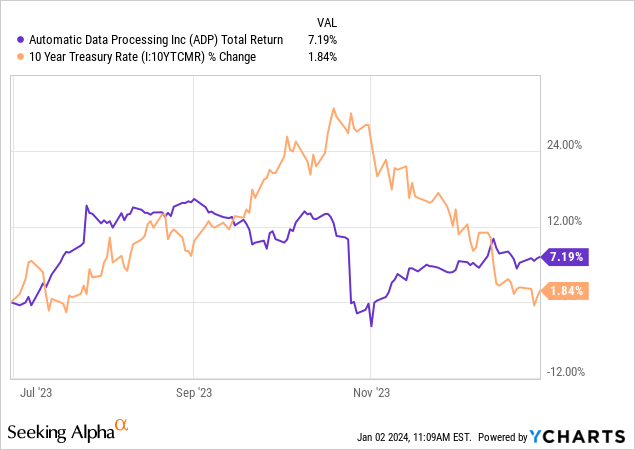

Trying additional, along with purely monetary metrics like income or profitability traders are inclined to worth a inventory like ADP additionally due to its dividends. On this respect, its ahead yield of two.4% is effectively beneath the risk-free yield of the U.S. 10-year treasury bond yield which pays above 3.75%. Nonetheless, the distributions shareholders obtain have persistently elevated over the past consecutive 25 years which qualifies it as a dividend aristocrat. In distinction, for the 10-year, yields have been on a downtrend because the finish of October as proven within the orange chart beneath as a result of Federal Reserve switching to “pause mode” after aggressively mountaineering charges since March 2022.

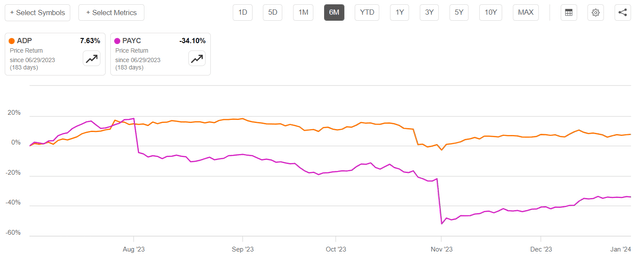

Conversely, the Fed’s pause has benefited ADP’s inventory as per the blue chart above, and, this after the inventory suffered from volatility after lacking topline expectations on October 25. As for Paycom, because it pays yields of solely 0.73%, the draw back suffered by its inventory after posting combined third-quarter outcomes on October 31 has not been attenuated as for ADP because it doesn’t current any fee sensitivity attribute. Thus, Paycom’s inventory which tumbled by greater than 25% following outcomes nonetheless bears the marks of acute volatility as illustrated within the purple chart beneath.

seekingalpha.com

Valuing ADP Contemplating Alternatives and Dangers

Due to this fact, with the corporate’s broader publicity making it comparatively extra proof against the consequences of cyclicality, and the Federal Reserve extensively anticipated to chop charges in 2024, the inventory ought to development greater. For this goal, in accordance with the US Bureau of Labor Statistics, the variety of job openings on the final enterprise day of November stood at 8.8 million, which is lower than the 8.85 million openings within the earlier month. This suggests that the economic system is slowing and reduces the likelihood of a fee hike.

To supply an estimate of a possible upside as to ADP’s inventory, I contemplate that its ahead GAAP value to earnings of 25.55x is buying and selling at a reduction of 28% ((25.55-35.57)/35.57)) relative to Paycom. Assuming an upside of simply 10% or a P/E of 28.1x (25.55 x 1.1), which remains to be beneath the five-year common of 29.1x, I obtained a goal of $255 (232 x 1.1).

seekingalpha.com

This can be a conservative determine provided that we aren’t but out of the woods regarding inflation which is at present at barely above 3% and stays effectively above the Fed’s goal of two%. Thus, the U.S. Central Financial institution might need to preserve financial coverage tighter for longer which might partially offset the ADP fee sensitivity benefit. In such a state of affairs, a debt-to-equity ratio of above 100% as tabled above might deter risk-averse traders on the lookout for a rock-solid stability sheet.

Nonetheless, for others specializing in its A+ profitability grade, a comparability of the YoY development in gross earnings within the chart beneath exhibits that, whereas Paycom has seen a profitability decline by practically 15% from June 2021 to September 2023, issues have been extra nuanced for ADP which has seen its figures lower by solely about 5%. This can be on account of its broader market presence lowering the probability of going through a copycat competitor probably consuming into its market share and having to supply reductions to take care of gross sales targets.

Charts Constructed utilizing information from (seekingalpha.com)

Due to this fact, for ADP, it’s about being appropriately positioned to mitigate the consequences of cyclicality on the one hand whereas persevering with to profit from the secular digital transformation on the opposite. This will increase the probability of the corporate attaining topline development expectations of 6.26% for FY-2024 which ends in June.

This digitalization development which was accelerated by the pandemic, might this time obtain an impetus by the drive to automate enterprise operations utilizing synthetic intelligence after the fast popularization of ChatGPT with its user-friendly Chatbot.

Concluding with the AI Narrative

Thus, in accordance with a research by McKinsey on Generative AI, billions of {dollars} of productiveness positive factors are attainable in areas starting from gross sales and advertising and marketing to buyer operations, with out forgetting software program improvement. Now to translate this chance to actuality, corporations have been investing both to construct their infrastructure or lease them for public cloud suppliers within the type of AI-as-a-Service.

On this respect, one of many benefits for smaller companies to stay with ADP is that they don’t must spend money on expensive clever innovation however can as an alternative profit from Generative AI being immediately embedded into product choices as of the primary quarter of 2023 which lasted from June to September 2023. In consequence, because the product isn’t monetized individually, present customers simply must log in to the payroll service supplier’s platform.

Due to this fact, greater than earlier than, as an alternative of attempting to handle HR on their very own, each on account of compliance necessities with native and federal rules, and from a technological complexity perspective, it makes extra sense for corporations to make use of ADP’s platform. Consequently, they will free themselves concentrate on their core enterprise, and get extra productive. On this respect, as per Gartner, world spending on software program and IT companies ought to whole $2.6 trillion in 2024 in comparison with final 12 months and must be led partly by the necessity for extra effectivity and automation. Consequently, there are further gross sales alternatives for ADP because it leverages Gen AI to signal further subscription plans or retain prospects with its potential to supply AI-embedded merchandise throughout the whole consumer life cycle.

Lastly, relying on the execution of Gen AI which I’ve not factored within the valuations, the inventory has room for additional upside than the $255 goal I supplied. As such, given its fee sensitivity, it might once more rise to the $269-$270 degree following a fee minimize.

[ad_2]

Source link