[ad_1]

Because the US magnificent 7 maintain rallying, some European giants have flown underneath the radar.

Whereas tech corporations dominate the magnificent 7, the European shares supply diversification to totally different sectors.

On this piece, we’ll check out the valuations and the monetary well being of those corporations.

In 2024, make investments like the large funds from the consolation of your property with our AI-powered ProPicks inventory choice device. Study extra right here>>

Goldman Sachs predicts that the tech sector will proceed to thrive in the long run, significantly the magnificent 7.

In distinction, Europe is anticipated to see optimistic returns by way of a mixture of sectors. On this piece, we’ll concentrate on European corporations with strong earnings development, low volatility, excessive and regular margins, robust steadiness sheets, and constant dividends.

Using Investing Professional’s Truthful Worth, which makes use of numerous established monetary fashions tailor-made to the distinctive attributes of those corporations, we carried out an in depth evaluation and got here up with the next knowledge:

Roche Holding (OTC:) – undervalued – up +37%.

ASML (NASDAQ:) ) – overvaluation – down by -17%

Nestle (OTC:) – undervaluation – up +12.5%

Novartis (NYSE:) ) – undervaluation – up +14.2%

Novo Nordisk (NYSE:) – overvaluation – down -17.8% decline

LVMH (OTC:) – overvaluation – down by -11.7%

Sanofi (NASDAQ:) – undervaluation – up +23.7%

Now, let’s check out every firm individually and analyze their prospects for the remainder of the yr.

Roche

Roche, a research-based healthcare firm, is undervalued by 37% in response to Investing Professional’s funding fashions. The chance profile exhibits monetary well being stage, with a rating of three out of 5.

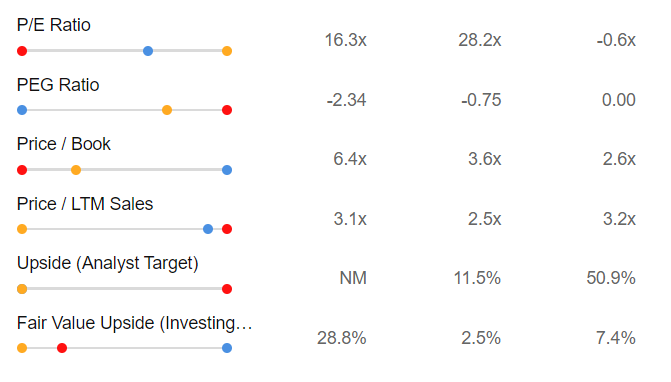

Supply: InvestingPro

Delving deeper, we will see the way it compares with the market and opponents, contemplating the best-known indicators, that Roche is now value 3.1x its revenues in comparison with the business’s 3.2x, and the Worth/Earnings ratio at which the inventory is buying and selling is greater than 16 instances in opposition to an business common of -0.6x, which stands to focus on its overvaluation.

ASML

ASML, a producer of chip-making tools, seems to be overvalued by 17% in response to Investing Professional’s funding fashions. Nevertheless, the corporate has an excellent monetary well being score of 4 out of 5.

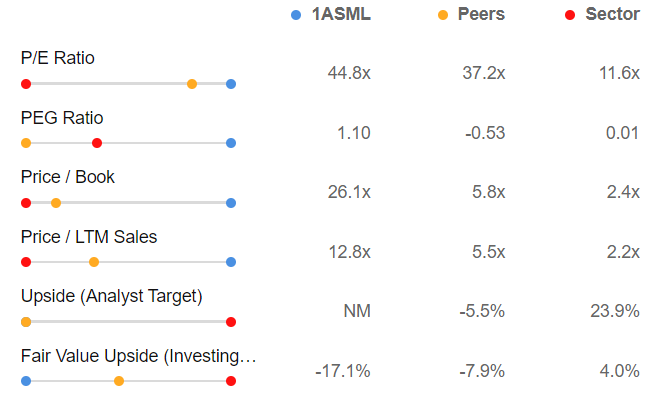

Supply: InvestingPro

Evaluating the inventory with the market and opponents, now we have the affirmation we anticipated, the inventory at present has a doubtlessly overvalued valuation.

Immediately it’s value greater than 12 instances its income in comparison with 2.2x within the business, and the Worth/Earnings ratio at which the inventory is buying and selling is 44.8X in opposition to an business common of 11.6x.

Nestle

Nestlé, a meals, well being, and wellness firm, seems to be undervalued by 12.5% in response to Investing Professional’s funding fashions. However the threat profile exhibits first rate monetary well being, scoring 2 out of 5.

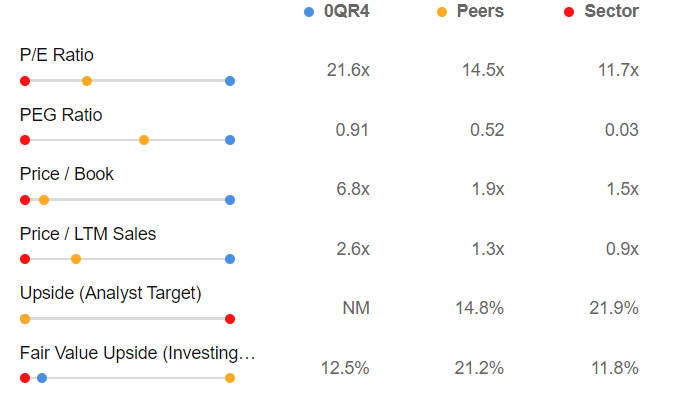

Supply: InvestingPro

Comparability with the market and opponents sees the inventory at a doubtlessly overvalued valuation.

It’s value greater than 2.5 instances its income in comparison with 0.9x for the business, and the Worth/Earnings ratio at which the inventory is buying and selling is 21.6X in opposition to an business common of 11.7x.

Novartis

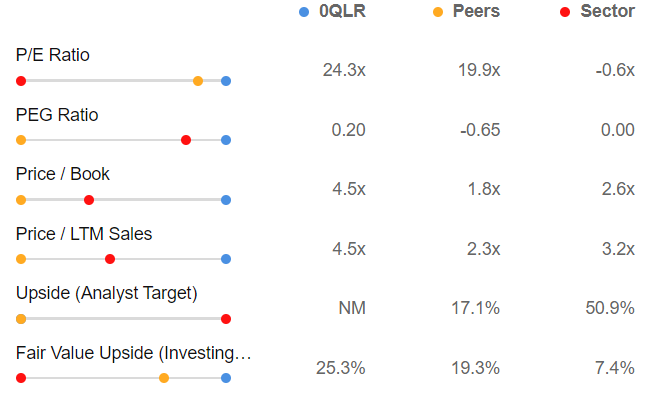

Novartis, which specializes within the analysis, growth, manufacturing, and advertising and marketing of a variety of pharmaceutical merchandise, is undervalued in response to Investing Professional’s funding fashions by 14.2% and the low threat profile is optimistic, has wonderful monetary well being, with a rating of 4 out of 5.

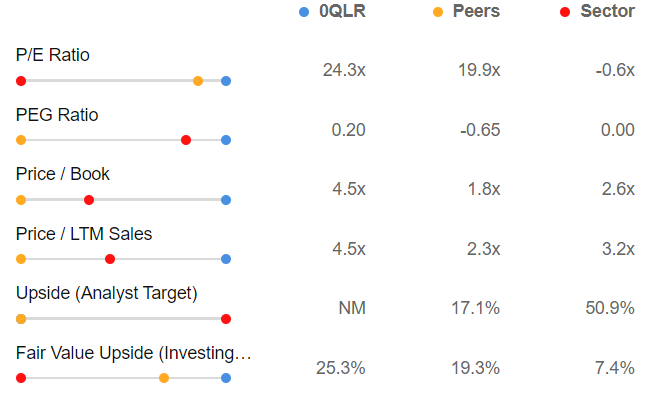

Supply: InvestingPro

Delving deeper, we will see the way it compares with the market and opponents, contemplating the best-known indicators, that Novartis is value 4.5 instances its revenues in comparison with greater than 3 instances within the business, and the Worth/Earnings ratio at which the inventory is buying and selling is 24.3x in opposition to an business common of -0.6x, which stands for a potential overvaluation.

Novo Nordisk

Novo Nordisk, an organization concerned within the discovery, growth, manufacturing, and advertising and marketing of prescribed drugs, is discovered to be overvalued in response to Investing Professional’s funding fashions by 17.8%. However it has an excellent monetary well being score of 4 out of 5.

Supply: InvestingPro

If we once more take a look at the best-known indicators, we will see that Novo Nordisk is now value greater than 16 instances its revenues in comparison with 3.2x within the business, and the Worth/Earnings ratio at which the inventory is buying and selling is 45.4X in opposition to an business common of -0.6x, which stands to focus on its excessive overvaluation.

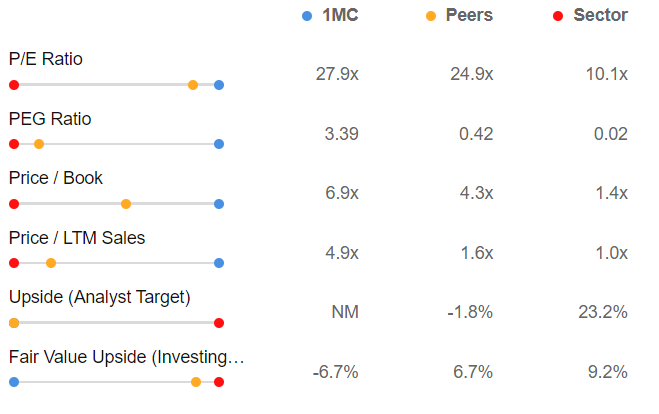

LVMH

LVMH is a luxurious group lively in six sectors: Wines and Spirits, Vogue and Leather-based Items, Perfumes and Cosmetics, Watches and Jewellery, Selective Retailing, and Different Companies. It’s discovered to be overvalued in response to Investing Professional’s funding fashions by 11.7 p.c however is reassuring in its threat profile, and has an excellent monetary well being score of 4 out of 5.

Supply: InvestingPro

Delving deeper, we will see the way it compares to the market and opponents, contemplating the best-known indicators, that LVMH is value 4.9 instances its income in comparison with the business’s 1.0x, and the Worth/Earnings ratio at which the inventory is buying and selling is 27.9x in opposition to an business common of 10.1x, which stands to substantiate its overvaluation.

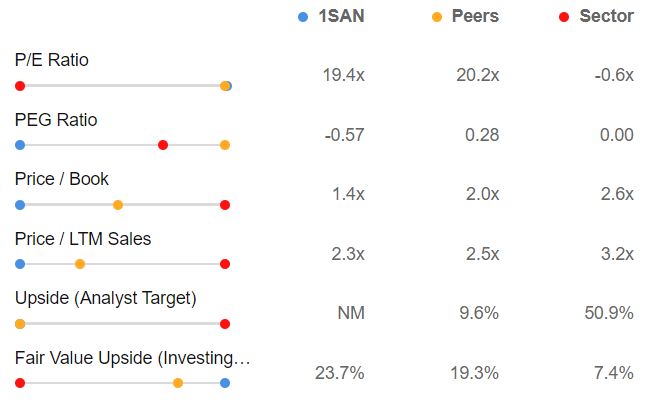

Sanofi

Sanofi, a healthcare firm engaged within the analysis, growth, manufacturing, and commercialization of therapeutic options, is discovered to be undervalued in response to Investing Professional’s funding fashions by 23.7 p.c and the low threat profile is reassuring, it has a superb stage of economic well being, scoring 4 out of 5.

Supply: InvestingPro

Delving deeper, we will see the way it compares with the market and opponents, contemplating the best-known indicators, that Sanofi is now value 2.3x its revenues in comparison with the business’s 3.2x, and the Worth/Earnings ratio at which the inventory is buying and selling is greater than 19 instances in opposition to an business common of -0.6x, which stands to substantiate the undervaluation.

Conclusion

In conclusion, Novartis and Sanofi boast numerous strengths, together with a good Truthful Worth, optimistic outlook, and powerful monetary well being. This implies that these shares might present passable returns.

Then again, Roche and Nestlé, regardless of having a bullish Truthful Worth in comparison with the present value, exhibit indicators of economic pressure, leading to double-digit unfavourable efficiency over the previous yr.

Shifting to ASML, Novo Nordisk, and LVMH, these corporations show strong monetary well being and distinct strengths, instilling confidence in buyers for the continuation of the present optimistic development.

Nevertheless, it is necessary to notice {that a} short-term correction may very well be possible, contemplating the substantial positive aspects of the primary two shares mentioned as they’ve seen will increase of +51.6% and +68.6% over the previous yr.

***

Take your investing sport to the following stage in 2024 with ProPicks

Establishments and billionaire buyers worldwide are already effectively forward of the sport in terms of AI-powered investing, extensively utilizing, customizing, and growing it to bulk up their returns and reduce losses.

Now, InvestingPro customers can just do the identical from the consolation of their very own houses with our new flagship AI-powered stock-picking device: ProPicks.

With our six methods, together with the flagship “Tech Titans,” which outperformed the market by a lofty 1,183% over the past decade, buyers have one of the best number of shares out there on the tip of their fingers each month.

Subscribe right here and by no means miss a bull market once more!

Subscribe Immediately!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, or advice to speculate as such it’s not meant to incentivize the acquisition of belongings in any approach. I wish to remind you that any kind of asset, is evaluated from a number of factors of view and is extremely dangerous and due to this fact, any funding choice and the related threat stays with the investor.

[ad_2]

Source link

Add comment