[ad_1]

Bitcoin not too long ago broke above its buying and selling channel, surging to $44,000 and finally discovering help at $43,100 after a partial retracement.

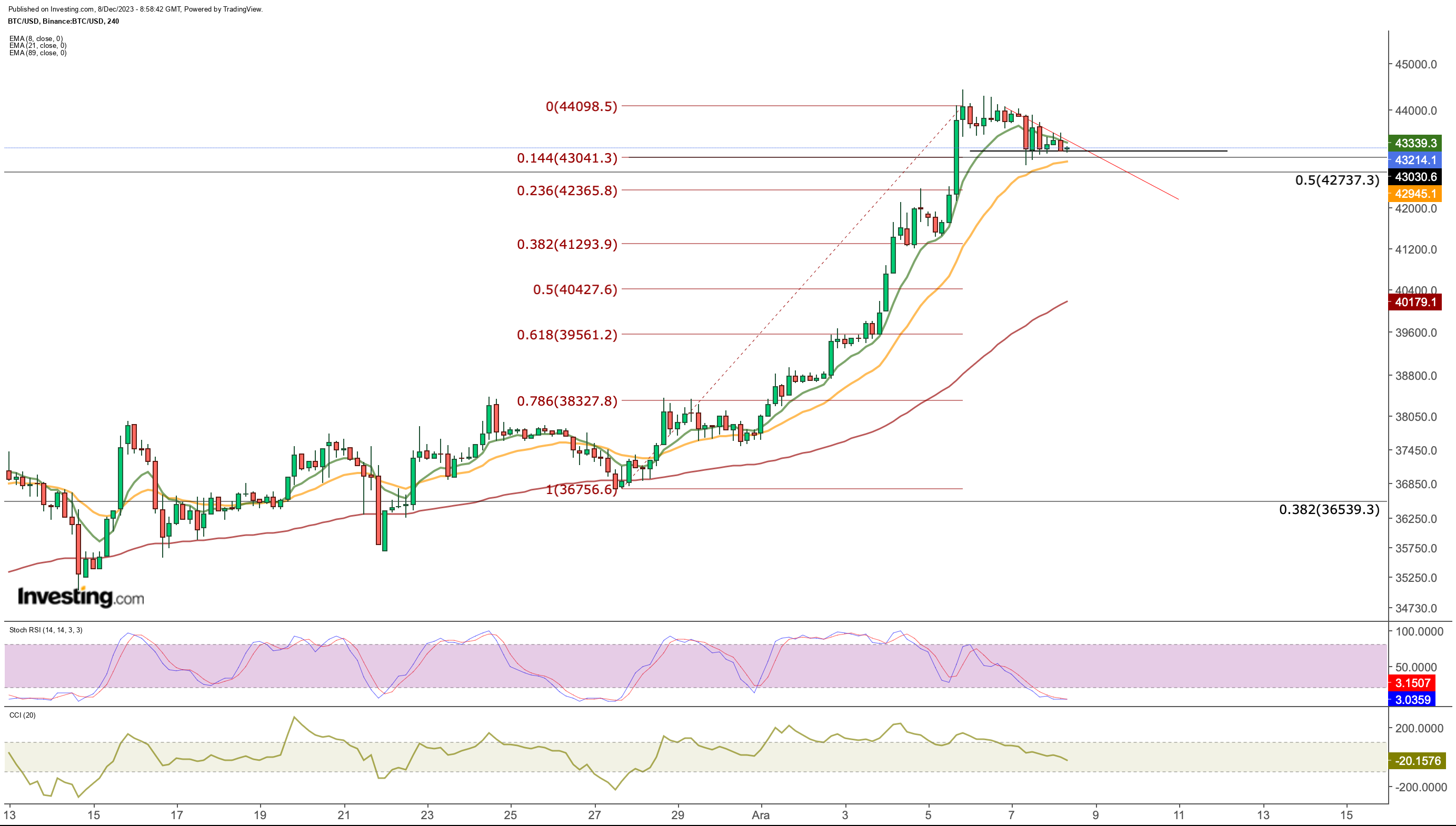

The 4-hour chart’s Stochastic RSI suggests doubtlessly oversold situations, indicating a potential take a look at of the $42,700 help line.

Lengthy-term outlook means that Bitcoin might transfer towards essential help at $42,700 – $43,100, with eyes on the $48,000 goal.

Missed out on Black Friday? Safe your as much as 60% low cost on InvestingPro subscriptions with our prolonged Cyber Monday sale.

Getting into the $40,000 vary in its latest upward trajectory, surged to $44,000, surpassing the ascending channel established initially of 2023.

All through November, the cryptocurrency grappled with a pivotal resistance degree at $36,500, a problem it overcame as December unfolded. With a optimistic market sentiment, Bitcoin gained momentum, reaching above $42,700, recognized as the following resistance.

Regardless of attaining an annual peak of $44,400 midweek, the cryptocurrency skilled a partial retracement, discovering help at $43,100. Consequently, $43,100 emerged as the closest short-term help for BTC.

Within the final 48 hours, a retracement led Bitcoin to dip beneath the 8-day EMA worth, which had guided its ascent since December. Nonetheless, the cryptocurrency maintains bullish energy, hovering above its fast brief help at $42,950, with an untested, extra substantial long-term help at $42,700.

A better take a look at Bitcoin on the 4-hour chart reveals that the Stochastic RSI indicator has moved all the way down to the oversold zone within the partial pullback over the previous two days. This outlook means that the value could take a look at the help line extending to the $ 42,700 area.

The arrival of recent purchases at this help line will technically set off the development to proceed on its method. On this case, the Bitcoin value may be anticipated to shut above the 8-EMA worth, which is at the moment calculated at $ 43,300.

If we consider the latest upward momentum that began from the $ 36,000 area on November 27; In line with Fibonacci ranges, the $ 43,000 degree corresponds to Fib 0.144, as soon as once more emphasizing the significance of the carefully adopted $ 42,700 – $ 43,100 help space.

Beneath this zone, 42,300 after which 41,300 greenback ranges may be monitored because the 2nd and third help costs in a potential correction motion. Within the occasion of a retreat to those areas, a improvement which will improve promoting strain could trigger BTC to check the $ 39,500 – $ 40,000 vary.

Consequently, for the continuation of the upward motion within the short-term outlook, it has change into necessary for the week’s closing to happen above the $ 42,700 – $ 43,100 help space.

After we consider Bitcoin within the long-term outlook, the present state of affairs means that the following transfer is extra seemingly towards help ranges.

On the every day chart, the Stochastic RSI’s downward reversal with a partial decline within the final 48 hours may be adopted as a sign for a decline. If the indicator crosses beneath 80, it would present that there’s an impact which will speed up the correction momentum.

The help ranges I discussed above might be adopted by every day closes and a transparent every day candle formation may be anticipated above these values for a potential correction. Within the basic uptrend, the following goal zone stays the $ 48,000 band.

However, the US knowledge to be launched as we speak could improve volatility in cryptocurrency markets. Whereas employment within the US is predicted to extend by 180k in November, knowledge beneath this quantity could guarantee the danger urge for food stays intact.

Higher-than-expected knowledge could also be perceived negatively, because it might contribute to elevated inflationary pressures amid the sustained energy of the US financial system. This might doubtlessly set off promoting strain in riskier markets, together with cryptocurrencies.

***

With InvestingPro’s inventory screener, buyers can filter by an unlimited universe of shares based mostly on particular standards and parameters to establish low cost shares with sturdy potential upside.

You may simply decide whether or not an organization fits your threat profile by conducting an in depth basic evaluation on InvestingPro in accordance with your standards. This manner, you’re going to get extremely skilled assist in shaping your portfolio.

As well as, you possibly can join InvestingPro, one of the complete platforms available in the market for portfolio administration and basic evaluation, less expensive with the largest low cost of the 12 months (as much as 60%), by making the most of our prolonged Cyber Monday deal.

Declare Your Low cost As we speak!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, or advice to speculate as such it isn’t meant to incentivize the acquisition of property in any method. I wish to remind you that any kind of asset, is evaluated from a number of factors of view and is extremely dangerous and subsequently, any funding resolution and the related threat stays with the investor.

[ad_2]

Source link