[ad_1]

Bitcoin’s surge to the $52,000 vary was fueled by sturdy demand for the spot Bitcoin ETF.

This rally is at present exhibiting resilience at the same time as this week’s CPI information exceeded expectations.

Going through short-term resistance at $51,700, Bitcoin must surpass this stage and attain $53,000 for confirmed help, focusing on $55,000.

In 2024, make investments like the massive funds from the consolation of your private home with our AI-powered ProPicks inventory choice instrument. Be taught extra right here>>

() has been on a gradual uptrend because the begin of the month, pushed primarily by demand for the spot Bitcoin ETF.

Notably, the upward momentum remained sturdy even when this week’s information got here above expectations, briefly making a panic ambiance out there.

Nevertheless, a key level of consideration is the emergence of short-term resistance at this juncture.

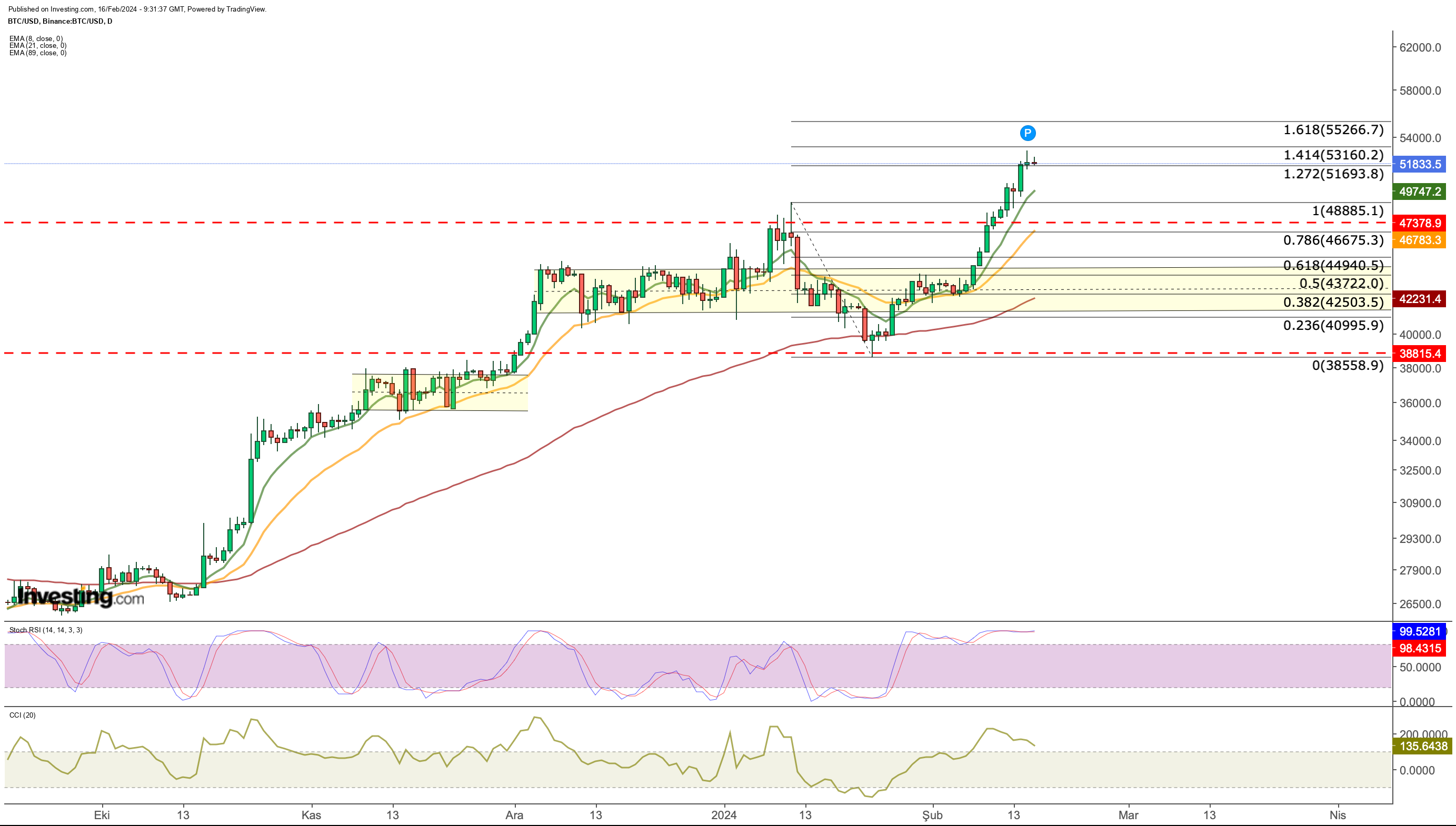

Bitcoin has encountered resistance on the $51,700 stage, which is the decrease boundary of the Fibonacci enlargement zone based mostly on the latest correction, after experiencing fluctuations between the January peak of $48,800 and the underside worth of $38,500.

The cryptocurrency must surpass this resistance and climb to $53,000 to ascertain it as a confirmed help stage. If profitable, the following potential goal is $55,000 (Fib 1.618).

As of yesterday, $51,700 serves because the pivotal level. A day by day closing under this worth might sign a retracement in the direction of a mean of $49,500.

A breach of this help may lengthen the correction, heading in the direction of the $46,000 area. Bitcoin has displayed overbought circumstances on the day by day chart, primarily pushed by ETF-backed purchases.

Buying and selling across the $51,700 mark seems essential, indicating a possible short-term correction based mostly on the present outlook.

Bitcoin Weekly Chart Evaluation

If we examine the final one-year development with the weekly Bitcoin chart, it reveals that the worth tried to breach the higher line of the ascending channel this week.

Bitcoin made a vital breakthrough this week by surpassing the $49,000 stage, aligned with the long-term Fib 0.618.

The importance of this transfer can’t be overstated. If consumers efficiently defend Bitcoin in opposition to potential gross sales within the $46,000 – $49,000 vary, contemplating its overbought circumstances within the quick time period, the following goal could possibly be Fib 0.786 at $57,700.

Wanting forward, the ETF commerce that fueled Bitcoin’s ascent may face headwinds this week, pending courtroom approval for Genesis to promote its GBTC shares.

The timeframe for this sale stays unsure, however with Genesis holding $1.3 billion price of GBTC, it introduces a component of stress. Moreover, revenue gross sales from the present area might exert short-term downward stress on the worth.

Conversely, the extension of the rate of interest reduce expectation into the second half of the 12 months dampens enthusiasm in threat markets.

Whereas the maintains bullish power, Bitcoin’s appreciation amid a sustained uptrend in DXY underscores the resilience of the rally.

The upcoming halving occasion in April, decreasing Bitcoin provide within the face of excessive demand, acts as an extra catalyst for its rise.

Consequently, the present outlook suggests a uneven development till the second quarter, with the uptrend probably gaining power in June because the Fed initiates the curiosity easing course of.

That is contingent on a rise in threat urge for food. Nevertheless, traders ought to stay ready for rising dangers throughout this era.

***

Take your investing recreation to the following stage in 2024 with ProPicks

Establishments and billionaire traders worldwide are already nicely forward of the sport on the subject of AI-powered investing, extensively utilizing, customizing, and creating it to bulk up their returns and reduce losses.

Now, InvestingPro customers can just do the identical from the consolation of their very own properties with our new flagship AI-powered stock-picking instrument: ProPicks.

With our six methods, together with the flagship “Tech Titans,” which outperformed the market by a lofty 1,427.8% over the past decade, traders have one of the best choice of shares out there on the tip of their fingers each month.

Subscribe right here and by no means miss a bull market once more!

Subscribe At present!

Do not forget your free present! Use coupon code INVPROGA24 at checkout for a ten% low cost on all InvestingPro plans.

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, or suggestion to take a position as such it’s not supposed to incentivize the acquisition of belongings in any method. I want to remind you that any kind of asset, is evaluated from a number of factors of view and is very dangerous and subsequently, any funding resolution and the related threat stays with the investor.

[ad_2]

Source link