[ad_1]

Bitcoin not too long ago surged, overcoming short-term hurdles, with a deal with key resistance ranges at $46,675 and $47,150, paving the best way for a possible transfer in direction of $50,000.

The upcoming halving in April and different tailwinds contribute to the bullish sentiment, suggesting a possible acceleration in direction of $51,700.

With Fibonacci ranges and the Stochastic RSI signaling potential positive aspects, elevating the prospect of reaching $57,000 within the coming weeks.

In 2024, make investments like the large funds from the consolation of your private home with our AI-powered ProPicks inventory choice software. Be taught extra right here>>

costs have surged not too long ago, breaking free from the crypto’s sluggish begin to February.

With that, the losses incurred post-ETF approval have been primarily recuperated, with Bitcoin now revisiting the risky zone noticed through the ETF approval week.

The downturn witnessed throughout that interval was predominantly pushed by institutional promoting to capitalize on the ETF-induced demand surge.

Nevertheless, this week, patrons have regained momentum, pushing the value upwards after a short consolidation interval in early February.

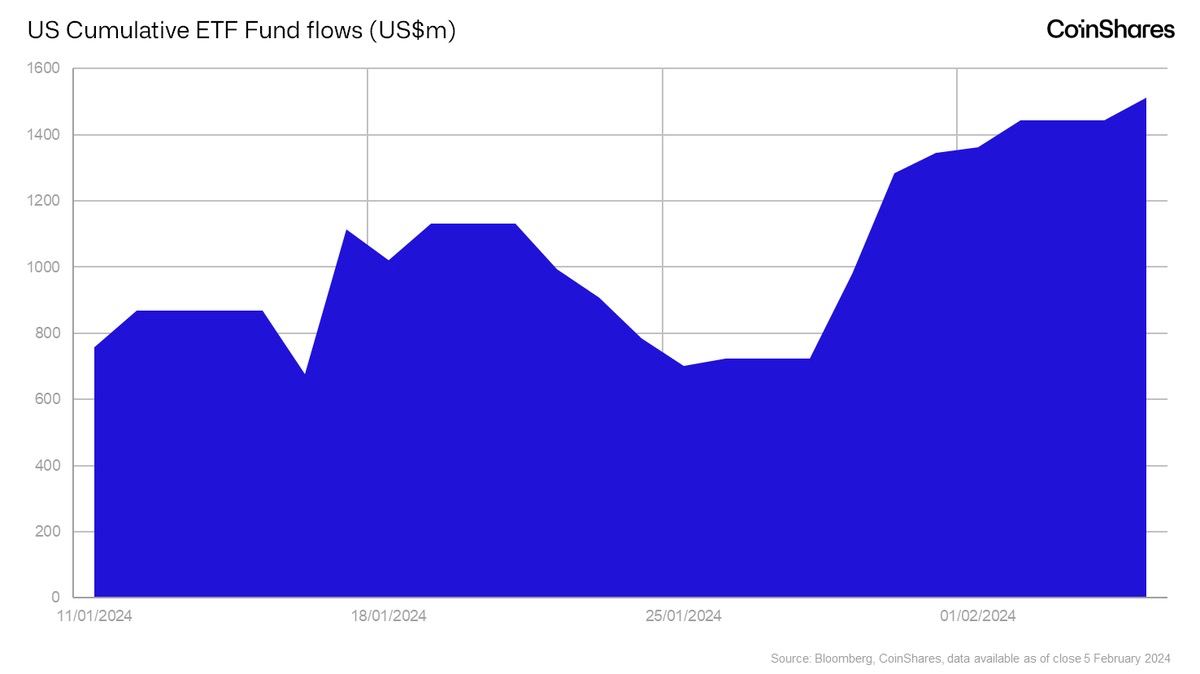

Notably, the bullish momentum in Bitcoin’s value aligns with the rise in fund flows in spot ETFs.

As GBTC redemptions decreased throughout this era, it positively influenced ETF internet fund flows and Bitcoin’s value.

In at the moment’s evaluation, we’ll study the important help and resistance ranges that play an important function in figuring out Bitcoin’s value motion in each the brief and medium time period.

Halving Set to Impression Value

Taking a look at Bitcoin’s short-term actions by means of the 4-hour chart, we observe a surge to $48,885 following the spot ETF approval on January eleventh, swiftly adopted by a steep decline to the $38,500 vary over the subsequent 12 days.

Moreover to the aforementioned elements, the market’s deal with the upcoming halving scheduled for April has begun to influence Bitcoin demand positively.

Analyzing the previous month, we observe that the $46,675 degree (Fib 0.786) serves because the preliminary resistance level when contemplating the highs and lows.

This resistance line could stretch as much as $47,150, contemplating the latest market exercise. Surpassing this hurdle, the heightened threat urge for food may propel Bitcoin in direction of the $50,000 vary.

Moreover, the $50,000 mark, seen as a psychological degree, possibly surpassed swiftly, initiating a speedy acceleration in direction of $51,700 primarily based on Fibonacci growth ranges.

If we verify the help zones within the short-term outlook; The primary level to be thought of in a attainable retreat appears to be at $ 45,500.

This value degree can work as an vital help line once more on the level the place the breakthrough occurred final month.

Due to this fact, it could make sense to cease losses for each day closes under the $45,000 – $45,500 vary in shopping for positions. This means a threat premium of three – 3.5% from present ranges.

After we take a look at Bitcoin from a broader perspective with the weekly chart, the continuation of the present pattern with upward strain appears to be the primary noticeable state of affairs.

Bitcoin value, which has not damaged on the higher band of the upward channel, is shifting in direction of $ 48,900, which corresponds to Fib 0.618 in accordance with Fibonacci ranges measured primarily based on each the higher band and the bear season.

This degree was examined briefly throughout final month’s bounce. On the identical time, the present value space is extraordinarily vital as the value vary the place the reactionary purchases initially of the bear market had been made.

One other bullish signal on the weekly chart is the Stochastic RSI indicator, which is trending upwards.

This indicator hints that Bitcoin may speed up rapidly above the resistance line.

Primarily based on final 12 months’s value motion, the Stoch RSI has solely moved up from the present zones twice, and in each cycles, it pointed to cost positive aspects of round 80%.

A repeat of this cycle by breaking by means of the present resistances would indicate an increase in direction of the $80,000 space inside 6 months on common.

However, the correction that adopted the primary optimistic cycle in 2023 was longer lasting.

Within the second cycle, the Stochastic RSI approached the oversold zone in a shorter interval and this time the correction was rather more restricted as demand remained brisk within the decrease space.

This may be thought of as an extra sign that the uptrend could proceed strongly.

If we summarize the short-term targets; Whereas the vary of $ 46,675 – 47,150 is vital within the 4-hour view, the weekly chart emphasizes the significance of the $ 48,900 degree above this space.

Above this resistance line, $ 51,700 might be thought of as the primary value goal. If the pattern continues, it could be attainable to see an increase in direction of the $ 57,000 space within the coming weeks.

***

Take your investing recreation to the subsequent degree in 2024 with ProPicks

Establishments and billionaire traders worldwide are already effectively forward of the sport relating to AI-powered investing, extensively utilizing, customizing, and creating it to bulk up their returns and decrease losses.

Now, InvestingPro customers can do exactly the identical from the consolation of their very own houses with our new flagship AI-powered stock-picking software: ProPicks.

With our six methods, together with the flagship “Tech Titans,” which outperformed the market by a lofty 1,183% over the past decade, traders have one of the best choice of shares available in the market on the tip of their fingers each month.

Subscribe right here and by no means miss a bull market once more!

Subscribe At present!

Remember your free present! Use coupon code OAPRO1 at checkout for a ten% low cost on the Professional yearly plan, and OAPRO2 for an additional 10% low cost on the by-yearly plan.

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, or advice to take a position as such it’s not meant to incentivize the acquisition of property in any method. I wish to remind you that any kind of asset, is evaluated from a number of factors of view and is extremely dangerous and due to this fact, any funding resolution and the related threat stays with the investor.

[ad_2]

Source link