[ad_1]

The Bitcoin value skilled an extra sell-off yesterday and fell by greater than 5% intraday to as little as $40,660. Because the year-to-date excessive of $49,000 on January 11, the BTC value has dropped by as a lot as 17%. Nonetheless, based on famend crypto analyst Jacob Canfield, this is probably not the top of the correction. In a current evaluation, Canfield warned that extra draw back could possibly be on the playing cards within the short-term.

The analyst, recognized for precisely predicting the native high of Bitcoin, addressed the prevailing uncertainty out there. “The query that everybody is asking now’s ‘the place can we go from right here?’” the analyst posed, acknowledging the group’s rising concern.

A major issue within the present market dynamics is the approval of a Bitcoin ETF, which has led to hypothesis about Grayscale Bitcoin Belief (GBTC) buyers promoting their holdings to evade the related charges. The narrative is compounded by revelations from court docket filings that the FTX chapter property holds a considerable variety of GBTC shares, roughly 22,280,720 (price $744 million), poised for liquidation.

Conversely, indicators of market optimism emerge with BlackRock’s ETF, IBIT, reportedly accumulating spot Bitcoin aggressively, including as much as 25,067 bitcoins in underneath per week. The analyst means that this shopping for momentum from BlackRock could ultimately counterbalance the promoting strain from GBTC, particularly when contemplating the impression of the upcoming Bitcoin halving, making a ‘delayed impression’ occasion probably tipping the dimensions in direction of demand over provide.

How Low Can Bitcoin Worth Drop?

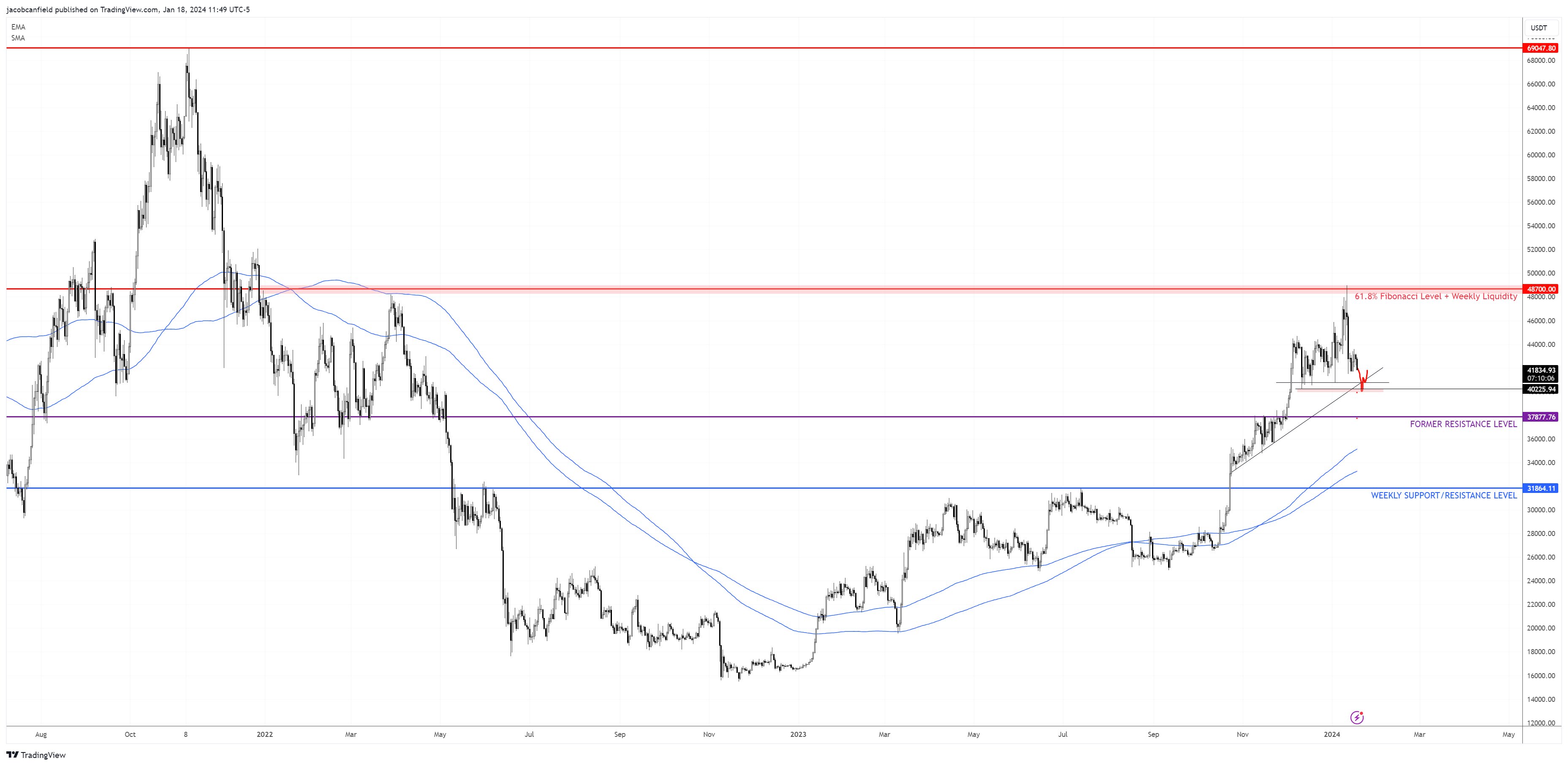

The chart evaluation supplies a extra quick and grim perspective. The Bitcoin 4-hour chart signifies a misplaced pattern that’s now appearing as resistance, traditionally a foreboding signal for brief to mid-term value actions.

“The 4 hour pattern on bitcoin has been misplaced and examined as resistance. This isn’t nice because the 4 hour pattern traditionally has been a very good indicator for brief time period/mid time period value actions, the analyst remarked.

Canfield additional factors out, “If I used to be searching for a degree for a brief time period bounce, it might most likely be at a sweep of the $40,000 liquidity,” hinting at potential downward strain on the worth.

The Bitcoin every day chart presents a slim path, with important ranges at $48.7k, marked by the 61.8% Fibonacci retracement and weekly resistance, and a notable assist degree at $38.7k. “As I’ve seen in former posts, after BTC faucets the 61.8, it tends to dump 18-22%, which might give us one other crack at that $38.7k degree as properly,” warns Canfield.

Moreover, the every day 200’s (EMA/MA) are at present trending upwards, having beforehand acted as assist, suggesting they could cushion an extra value fall.

The analyst concludes with a phrase of warning, emphasizing the necessity for vigilance within the present market characterised by low quantity and volatility, situations that always precede substantial market actions: “Greatest factor I can stress is that warning is required throughout low quantity/low volatility environments as an enormous transfer usually follows.”

At press time, BTC traded at $41,178.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use info offered on this web site totally at your personal threat.

[ad_2]

Source link